Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.42 USD

180.16 M USD

6.15 B USD

292.64 M

About Iron Mountain Incorporated (Delaware)

Sector

Industry

CEO

William Meaney

Website

Headquarters

Portsmouth

Founded

1951

FIGI

BBG000KCZPC3

Iron Mountain, Inc. engages in the provision of storage and information management solutions. It operates through the following business segments: Global Records & Information Management Business, Global Data Center Business and Corporate & Other Business. The Global Records & Information Management Business segment offers comprehensive solutions for storing, managing, digitizing, and securely disposing of records and information worldwide. The Global Data Center Business segment provides data center facilities to protect mission-critical assets and ensure the continued operation of its customers IT infrastructures, with secure and reliable colocation and wholesale options. The Corporate & Other Business segment consists of the storage, safeguarding and electronic or physical deliveries of physical media of all types and digital content repository systems to house, distribute, and archive key media assets, primarily for entertainment and media industry clients. The company was founded by Herman Knaust in 1951 and is headquartered in Portsmouth, NH.

Related stocks

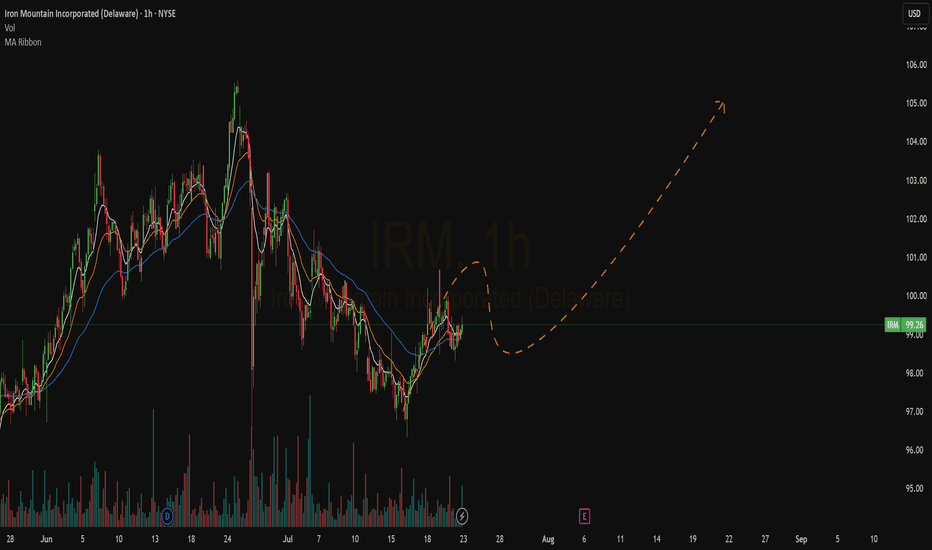

IRM Stock: Important Support Level Reached! Elliott WaveOn the IRM chart, I'm currently tracking a potential bullish impulse unfolding, represented by the white scenario. According to this white scenario, we're in a fourth wave pullback within a larger third wave. However, it's critical for the price to remain above the $80 level; otherwise, the pullback

Watchlist: IRM"A true friend is one who helps you overcome your failures, and celebrates your successes"

IRM came up on my stock scanner, so I'm adding it to my watchlist. I got a setup signal(1) and with above average volume(2). Looking to enter long near the close of the day if the stock can manage to close ab

IRM Long Trade Idea🔔 BUY Signal Alert! 🔔

🔗 Ticker: IRM

🌐 Market: US Equities

🔄 Side: Long

⏱️ Type: Swing Trade

🎯 Entry: 78.95

🛑 Stop Loss: 78.11

🥇 First Profit Target: 79.87

🏆 Final Profit Target: 80.73

The CHAMLEO EDGE model uses a proprietary algorithmic program at the pre-market auction to identify potential stoc

#IRM#Fundamental Analysis

Q2 2023 Performance:

The company witnessed a 5% revenue growth in Q2 2023, displaying solid operational performance.

Despite positive revenue growth, the stock experienced a decline on August 3, 2023. However, the overall earnings growth reported over the past year was favorable

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IRM5586236

Iron Mountain Incorporated 7.0% 15-FEB-2029Yield to maturity

6.02%

Maturity date

Feb 15, 2029

IRM5028386

Iron Mountain Incorporated 4.5% 15-FEB-2031Yield to maturity

5.93%

Maturity date

Feb 15, 2031

IRM5954448

Iron Mountain Incorporated 6.25% 15-JAN-2033Yield to maturity

5.77%

Maturity date

Jan 15, 2033

I

IRM5323750

Iron Mountain Information Management Services, Inc. 5.0% 15-JUL-2032Yield to maturity

5.75%

Maturity date

Jul 15, 2032

IRM5003236

Iron Mountain Incorporated 5.625% 15-JUL-2032Yield to maturity

5.64%

Maturity date

Jul 15, 2032

IRM4539229

Iron Mountain Incorporated 4.875% 15-SEP-2027Yield to maturity

5.62%

Maturity date

Sep 15, 2027

IRM5003234

Iron Mountain Incorporated 5.25% 15-JUL-2030Yield to maturity

5.61%

Maturity date

Jul 15, 2030

IRM4880634

Iron Mountain Incorporated 4.875% 15-SEP-2029Yield to maturity

5.55%

Maturity date

Sep 15, 2029

IRM5003232

Iron Mountain Incorporated 5.0% 15-JUL-2028Yield to maturity

5.21%

Maturity date

Jul 15, 2028

See all IRM bonds

Curated watchlists where IRM is featured.