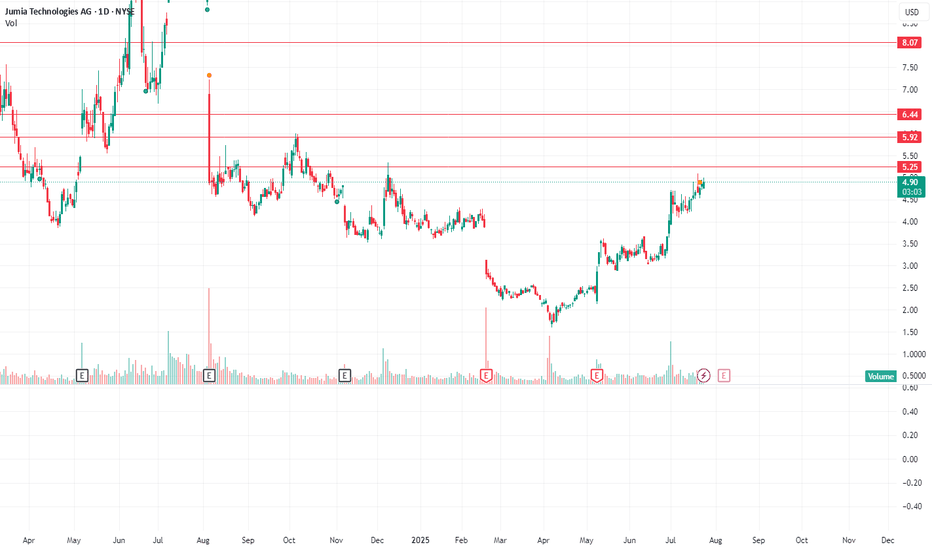

Jumia Technologies (JMIA) has formed a Golden Cross on the dailyNYSE:JMIA just printed a Golden Cross on the daily chart (50MA > 200MA) — often a signal of trend reversal.

✅ RSI ~62 = momentum building

✅ MACD flipped bullish

📊 Volume rising — breakout setup forming

🔼 Next resistance: $5.50 → $6.20

🛡️ Support: $4.50–$4.60 (MA zone)

Chart looks bullish — watch

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−99.09 M USD

167.49 M USD

122.03 M

About Jumia Technologies AG

Sector

Industry

CEO

Francis Dufay

Website

Headquarters

Berlin

Founded

2012

FIGI

BBG00NKZF9N8

Jumia Technologies AG engages in the provision of logistic services. It operates a pan-African e-commerce platform. It operates through the following geographical segments: West Africa, North Africa, East and South Africa, Europe, United Arab Emirates, and Others. The company was founded by Jeremy Hodara, Sacha Poignonnec, Peter Allerstorfer, Manuel Koser, Tunde Kehinde, and Raphael Afaedor in 2012 and is headquartered in Berlin, Germany.

Related stocks

JMIA wave 3 JUST started ATHs coming- LONG updating my previous idea IF November closes forming a SFP this week, this could be beginning of a huge wave 3 for JMIA, next potential target $27 usd where we could see a small pull back (wave 4) to then go to the ATHs in a final WAVE 5. The chart looking super bullish plus the partnership agreemen

JMIA best buy opportunity EVERfollowing ICT this chart is bullish, we created the perfect bottom, and we are in the best entry possible, the RRR is more than worth it to take a shot here, the Afrika emergent market plus the current deal with a huge credit card partner could be the begging for new ATH in the long term,

$JMIA * EWP TC FIB WEEKLY TF ANALYSISThe chart shared shows the historical weekly price action for Jumia Technologies AG ( NYSE:JMIA ) and includes several key Fibonacci retracement levels. Here are a few observations based on the chart:

1. IPO Price Reference: The chart marks Jumia’s IPO price on April 12, 2019, at $18.95, which has

$JMIA | First on the Scene, Aiming for 5x-10x BaggerNYSE:JMIA

Jumia, often referred to as the "Amazon of Africa," presents a unique opportunity for long-term investors to tap into the rapidly expanding e-commerce landscape in Africa. Our analyst, Shay Boloor, was one of the first analysts to recognize its potential, and while the company has faced

Jumia JMIA - The next Amazon?Not sure why Jumia has such strong technical while the fundamental are not so good. Is Jumia being given the same grace as Amazon that did not turn a profit for 13 or so years? Jumia is not turning a profit. But Jumia is like the Amazon of Africa. Do investors see the same future for Jumia? Do

Jumia (NYSE:$JMIA) Plummets 52% on Disappointing Q2 2024 ResultsShares of Jumia Technologies (NYSE: NYSE:JMIA ) experienced a sharp 52% drop following the release of its second-quarter 2024 financial results, underscoring significant challenges the e-commerce platform faces in maintaining its market position and financial health.

Key Financial Highlights

- Rev

JMIA - "African Amazon" - longterm playJumia Technologies AG is the pan-African e-commerce platform. The company's platform consists of a marketplace, which connects sellers with consumers. Its logistics service enables the shipment and delivery of packages from sellers to consumers, and the company's payment service facilitates transact

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.