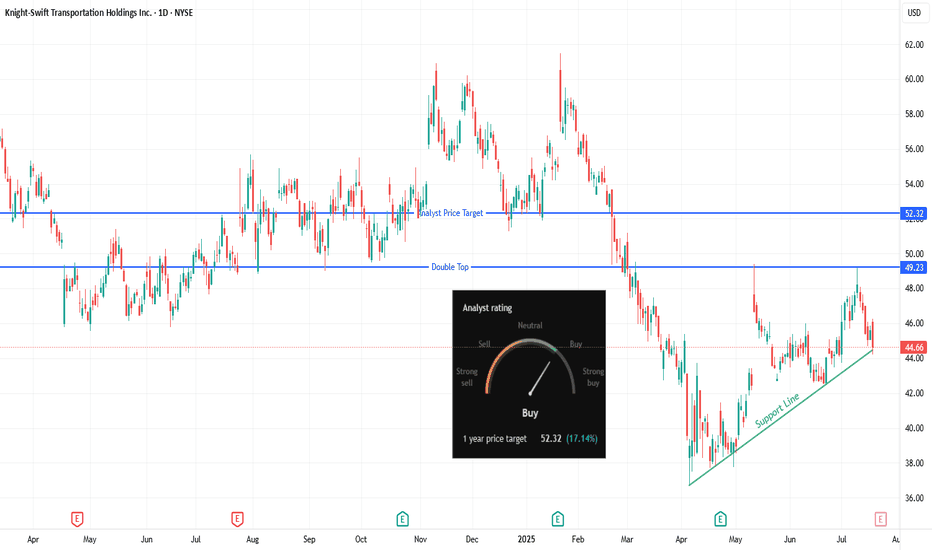

Can KNX Challenge Resistance with Analyst Support?Trade Summary 📝

Setup: KNX building higher lows above rising support; testing multi-month resistance zone.

Entry: Watching for long entry on a break above $46.26.

Stop-loss: Below $44.20 (just under trendline support).

Targets: $49 (near double top resistance), $52.32 (analyst price

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.02 USD

117.63 M USD

7.41 B USD

156.93 M

About Knight-Swift Transportation Holdings Inc.

Sector

Industry

CEO

Adam W. Miller

Website

Headquarters

Phoenix

Founded

1966

FIGI

BBG000BFC848

Knight-Swift Transportation Holdings, Inc. engages in the provision of multiple truckload transportation and logistics services. It operates through the following segments: Truckload, LTL, Logistics, Intermodal, and All Other. The Truckload segment includes irregular routes and dedicated, refrigerated, expedited, flatbed, and cross-border transportation of various products, goods, and materials. The LTL segment offers regional direct service and serves customers' national transportation needs by utilizing key partner carriers for coverage areas outside of network. The Logistics segment focuses on a multitude of shipping solutions, including additional sources of truckload capacity and alternative transportation modes, by utilizing a vast network of third-party capacity providers and rail providers, as well as certain logistics and freight management services. The Intermodal segment is involved in the regional operating model, while also allowing to better serve customers in longer haul lanes and reduces investment in fixed assets. The All Other segment refers to support services provided to customers and third-party carriers including equipment maintenance, equipment leasing, warehousing, trailer parts manufacturing, warranty services, and insurance for independent contractors. The company was founded in 1966 and is headquartered in Phoenix, AZ.

Related stocks

KNIGHT SWIFT stock Chart Fibonacci Analysis 043025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 36.6/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

Why Knight-Swift Transportation Stock Popped TodayKEY POINTS

a. Profits fell sharply but still beat estimates.

b. Knight-Swift seems likely to benefit from Convoy's bankruptcy.

c. The company is making profits with its integration of U.S. Xpress.

The diversified trucking company topped estimates and appears to be turning the corner in its U.S. Xpr

KNIGHT SWIFT Stock Chart Fibonacci Analysis 091323 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 53.2/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

KNIGHT SWIFT Stock Chart Fibonacci Analysis 062623 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 54.5/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where KNX is featured.

Frequently Asked Questions

The current price of KNX is 42.39 USD — it has increased by 0.07% in the past 24 hours. Watch Knight-Swift Transportation Holdings Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Knight-Swift Transportation Holdings Inc. stocks are traded under the ticker KNX.

KNX stock has fallen by −7.95% compared to the previous week, the month change is a −4.25% fall, over the last year Knight-Swift Transportation Holdings Inc. has showed a −21.50% decrease.

We've gathered analysts' opinions on Knight-Swift Transportation Holdings Inc. future price: according to them, KNX price has a max estimate of 68.00 USD and a min estimate of 42.00 USD. Watch KNX chart and read a more detailed Knight-Swift Transportation Holdings Inc. stock forecast: see what analysts think of Knight-Swift Transportation Holdings Inc. and suggest that you do with its stocks.

KNX stock is 2.27% volatile and has beta coefficient of 1.28. Track Knight-Swift Transportation Holdings Inc. stock price on the chart and check out the list of the most volatile stocks — is Knight-Swift Transportation Holdings Inc. there?

Today Knight-Swift Transportation Holdings Inc. has the market capitalization of 6.86 B, it has decreased by −6.53% over the last week.

Yes, you can track Knight-Swift Transportation Holdings Inc. financials in yearly and quarterly reports right on TradingView.

Knight-Swift Transportation Holdings Inc. is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

KNX earnings for the last quarter are 0.35 USD per share, whereas the estimation was 0.33 USD resulting in a 6.63% surprise. The estimated earnings for the next quarter are 0.39 USD per share. See more details about Knight-Swift Transportation Holdings Inc. earnings.

Knight-Swift Transportation Holdings Inc. revenue for the last quarter amounts to 1.86 B USD, despite the estimated figure of 1.87 B USD. In the next quarter, revenue is expected to reach 1.90 B USD.

KNX net income for the last quarter is 34.24 M USD, while the quarter before that showed 30.64 M USD of net income which accounts for 11.76% change. Track more Knight-Swift Transportation Holdings Inc. financial stats to get the full picture.

Yes, KNX dividends are paid quarterly. The last dividend per share was 0.18 USD. As of today, Dividend Yield (TTM)% is 1.61%. Tracking Knight-Swift Transportation Holdings Inc. dividends might help you take more informed decisions.

Knight-Swift Transportation Holdings Inc. dividend yield was 1.21% in 2024, and payout ratio reached 88.24%. The year before the numbers were 0.97% and 41.73% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 31, 2025, the company has 35.3 K employees. See our rating of the largest employees — is Knight-Swift Transportation Holdings Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Knight-Swift Transportation Holdings Inc. EBITDA is 1.07 B USD, and current EBITDA margin is 13.33%. See more stats in Knight-Swift Transportation Holdings Inc. financial statements.

Like other stocks, KNX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Knight-Swift Transportation Holdings Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Knight-Swift Transportation Holdings Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Knight-Swift Transportation Holdings Inc. stock shows the sell signal. See more of Knight-Swift Transportation Holdings Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.