Can KNX Challenge Resistance with Analyst Support?Trade Summary 📝

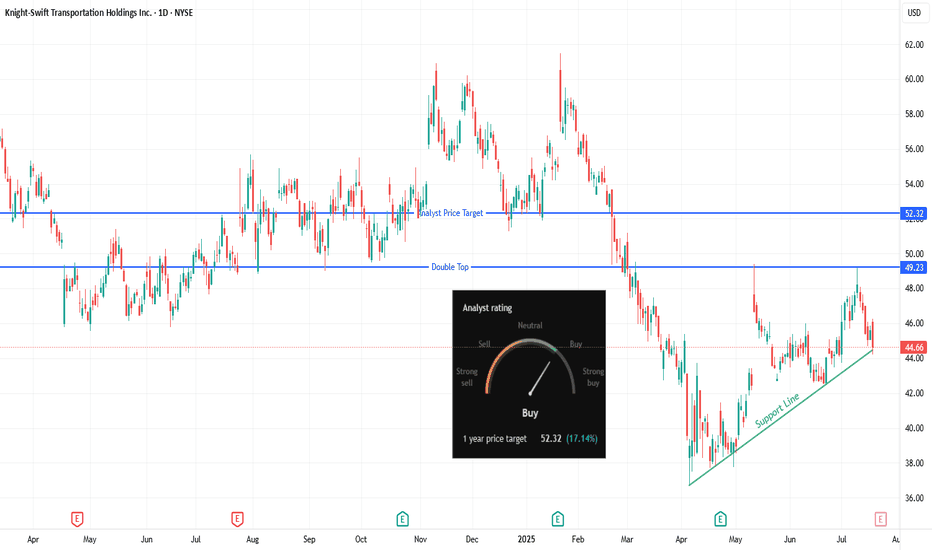

Setup: KNX building higher lows above rising support; testing multi-month resistance zone.

Entry: Watching for long entry on a break above $46.26.

Stop-loss: Below $44.20 (just under trendline support).

Targets: $49 (near double top resistance), $52.32 (analyst price target).

Risk/Reward: Attractive with defined risk and upside to multiple levels.

Technical Rationale 🔍

Rising trendline support shows bulls steadily defending higher.

Price compressing just below a prior pivot/high—breakout could spark new momentum.

Double top at $49 offers a logical first target; further room if bulls push to analyst target at $52.

Catalysts & Context 🚦

Analyst 1-year price target sits at $52.32 (+17%), with a “Buy” consensus rating.

Trucking/transport sector showing signs of rotation after long weakness.

Upcoming earnings and macro data could act as catalysts for a move.

Trade Management Plan 📈

Entry: On confirmed break and close above $46.26.

Stop-loss: Just below $44.20 support.

Scaling: Trim at $49 (double top area); hold runners for $52.32 if momentum continues.

What’s your move on KNX?

🔼 Bullish—Breakout incoming

🔽 Bearish—Resistance will hold

🔄 Waiting for confirmation

*** Follow us now to ensure you don't miss the next big setup ***

Disclaimer ⚠️: Not financial advice. Trade at your own risk and always use stops.

KNX trade ideas

KNIGHT SWIFT stock Chart Fibonacci Analysis 043025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 36.6/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Why Knight-Swift Transportation Stock Popped TodayKEY POINTS

a. Profits fell sharply but still beat estimates.

b. Knight-Swift seems likely to benefit from Convoy's bankruptcy.

c. The company is making profits with its integration of U.S. Xpress.

The diversified trucking company topped estimates and appears to be turning the corner in its U.S. Xpress acquisition.

Shares of Knight-Swift Transportation (KNX 11.75%) were moving higher today after the diversified transportation company topped analyst estimates in its third-quarter earnings report.

The competitive landscape is improving for Knight-Swift

Knight-Swift, which offers full-truckload, less-than-truckload (LTL), logistics, and intermodal services, posted solid revenue growth in its third quarter with the top line up 6.5% to $2.02 billion, ahead of estimates at $1.89 billion, helped in part by its acquisition of U.S. Xpress.

That growth was driven by its full truckload business, which saw revenue jump 22% to $1.17 billion, excluding its fuel surcharge.

However, profitability in that key segment fell due to an "extremely difficult environment," including ongoing soft demand, and an increase in fuel prices. Adjusted operating ratio, which is the inverse of operating margin and excludes the U.S. Xpress acquisition, jumped from 81.8% a year ago to 94.9% but improved slightly from the second quarter.

Profit margins also shrank in the logistics and intermodal segments, and overall adjusted earnings per share (EPS) fell from $1.27 to $0.41, ahead of the consensus at $0.36.

Comments on the earnings call seemed to give the stock a boost. As CEO Dave Jackson said, "It feels like the extreme aggressiveness that we have seen out of non-asset-based players has reached a level to where it's not only unsustainable but when you add how expensive financing is ... it blows up." Those remarks seemed to refer in part to the closure this week of digital freight broker Convoy.

Can Knight-Swift stock move higher?

Knight-Swift revised its full-year adjusted EPS guidance from $2.10-$2.30 to $2.10-$2.20, and management forecast that truckload rates would stabilize at current levels and says it expects solid growth in LTL revenue and shipments.

It also sees the bottom-line impact from the U.S. Xpress acquisition improving, a sign that the company will return to profit growth in 2024.

KNIGHT SWIFT Stock Chart Fibonacci Analysis 091323 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 53.2/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

KNIGHT SWIFT Stock Chart Fibonacci Analysis 062623 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 54.5/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

KNXthere is a support area confluence with trend line and ema 200 and golden fibo zone if the price reaches to the support area then look for buy setup , volume , candlestick pattern.

the results of the company's financial information are acceptable :

market cap : 9.63 B

p/e : 15.23

p/s : 1.76

p/b : 1.51

peg : 0.82

Quick Ratio : 1.60

Current Ratio : 1.60

Please follow and like the idea for Support and More ideas like this and share your ideas and charts in Comments Section..!!

Thanks for Your Love :)

$KNX LONG to 65. EPS, Rev Beats & Raised FY guidance$KNX broke up today, got some selling, ended up coming all the way back to make a new high of day and all time high break.

2000+ 55c 11/19 traded - still only $1.25 - looking to get in tomorrow.

Headlines on TOS:

Knight-Swift Transportation Q3 Adjusted Earnings, Revenue Rise; Increases Full-Year 2021 Guidance.

Knight-Swift Crushes Q3 Expectations; All Segments' Revenue, Margins Up

$KNX: Another leg higher for this trucker post infrastructure?KNX is setting up here with a really nice long term base, cracked the 50 level last week. Was that the level it needed to make another move higher? Time will tell. Following IYT as well and the possibility of it bottoming, if it does, we should see significantly higher prices here

$KNX is on BUY point. Technical analysis:

The shares of $KNX have dropped around 10% after earnings miss.

As it is seen on the graph, $40.0 per share is acting as strong Support and the price can't break it down. Also, it is consolidating and moving sideways.

Fundamental analysis:

Knight-Swift Transporation (KNX) reported 4th Quarter December 2020 earnings of $0.94 per share on revenue of $1.3 billion. The consensus earnings estimate was $0.91 per share on revenue of $1.3 billion.

The company said in its earnings presentation it expects 2021 earnings of $3.20 to $3.40 per share. The current consensus earnings estimate is $3.34 per share for the year ending December 31, 2021.

As the company looking forward with positive date more and more investors will get in and buy the shares. So it has very nice BUY poin now.

Knight Transportation, Inc., is a provider of multiple truckload transportation services. Its services include dry van truckload, temperature-controlled truckload, truckload services, drayage, intermodal, and truckload freight brokerage services.

KNIGHT SWIFT TRANSN HLDGS Idea DailyHey traders, KNIGHT SWIFT TRANSN HLDGS is in an uptrend with stable buy volume and long legged turn. In the TIMEFRAME M1 we see a marubozu with a large volume of past purchase it goes back to its last precedent higher to then go to the top of the stabilization zone to test it. Great possibility of breaking out the price afterwards the zone to arrive in another and go to the next higher then excess (on TIMEFRAME H4). And an addition and four higher to yield before breakout the second stabilization zone (See TIMEFRAME H1). Not enough buying force to test the intermediate median of ANDREWS PITCHFORK.

Please LIKE & FOLLOW, thank you!

ABC BullishAll time high is 51.94 so perhaps R there

Guess what? They transport refrigerated stuff (o:

Fell from a bearish rising wedge at 44.95ish with a substantial pull back after the fall to 37ish

NV is highJust an observation

Knight-Swift Transportation Holdings Inc., together with its subsidiaries, provides truckload transportation services in the United States and Mexico. The company operates through three segments: Trucking, Logistics, and Intermodal. Its trucking services include irregular route, dedicated, refrigerated, flatbed, expedited, dry van, drayage, and cross-border transportation of various products, goods, and materials. The company also provides logistics and intermodal services, such as brokerage, intermodal, and certain logistics; freight management; and non-trucking services. In addition, it offers various support services, including repair and maintenance shop services, warranty, insurance, and equipment leasing; and trailer parts manufacturing services, as well as engages in the driving academy activities. The company operates a total of 18,877 tractors, which comprises 16,432 company-owned tractors and 2,445 independent contractor tractors, as well as 58,315 trailers; and 643 tractors and 9,862 intermodal containers. It serves retail, food and beverage, consumer products, paper products, transportation and logistics, housing and building, automotive, and manufacturing industries. Knight-Swift Transportation Holdings Inc. was founded in 1989 and is headquartered in Phoenix, Arizona.

Hide

Knight this Stock!What I see...

+ Bullish Engulfing

+ 10ma piercing through the mid-body of the bar

+ RSI turns bullish

+ MACD is in bullish territory

+ Healthy volume

- Bollinger is kind of side

- MACD is below the signal line

- Slight upper shadows in the past few days

What I setup...

+ Long entry above last Thursday's high

- Stop is that -1d low

+ Target is just under $50 - round dollar resistance

:: Duration - 3 to 10 sessions.

** Likes and Comments are appreciated; New subscribers are all Knighted! **