07-01-2022 | LEVI | GuidanceJournal Entry

Bias: Negative.

Sentiment: Pessimistic.

Emoji (emotion): Pumped 🏋️.

Null Hypothesis: Sell.

Alternative Hypothesis: Buy, Buy then Sell.

Signals: ...

Position: Swing trade.

Notes: I'm anticipating the market to sell the earnings surprise 07-07-2022 AMC: www.estimize.com

Barron's Company Overview: www.barrons.com

Other: ...

Tutorial: (Q/A) What exactly is the box labeled tolerance? The box labeled tolerance is a defined range of value & time that qualifies the right to exit the trade after a profit is made; as long as the security is inside the box and above the trade's entry one could say the profit is within tolerance, likewise if the security is outside the box either because of value or time one could say the profit is not within tolerance. It's a way to add parameters to the future outcome of the journal entry (as a means to grade the journal entry) while simultaneously providing leniency in the ability to achieve success with said journal entry.

About the Security: "Levi Strauss & Co. engages in the design, marketing, and sale of apparel products. The company offers jeans, casual and dress pants, tops, shorts, skirts, jackets, footwear, and related accessories. It operates through the following geographical segments: Americas, Europe, and Asia. The company was founded by Levi Strauss in 1853 and is headquartered in San Francisco, CA."

About the Author: I'm happy to hear from my readers/audience and I encourage constructive feedback; although I'm busy I will give my best effort to reply. I do strive to build an esteemed reputation with a prolific following as well as earn the titles of a Tradingview Wizard & Top Author; along those lines I'm a financial scientist and my contributions offered to the community are apart of my scientific journal or goodwill to mankind.

Disclaimer: My journal entry is not a complete prospectus, please consider it accordingly.

LEVI trade ideas

LEVI -SHORT TERM BEARISH SCENARIOOn Wednesday Levi Strauss & Co. released its 4Q results.

Sales rose 22% to $1.59 billion, also ahead of the $1.55 billion analysts expected and the adjusted earnings came in at 46 cents a share, above the 42-cent consensus estimate.

The company’s 2022 outlook remained intact, as Levi Strauss highlighted strong U.S. sales and ongoing demand in Europe.

Despite the good results, short-term bearish movement is expected into the price channel to the major support of $16.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

LEVI SHORT-TERM LONGMarket finished 1-5 Elliot wave, flat ABC correction and full 1-5 Elliot wave with XWY combination downwards, we were expecting it to bounce off of a demand zone, but it reversed earlier, R/R for this trade is way to low unless market retraces to our entry zone.

Entry: 16:76

Invalidation: 15.30

Target: 23 (50% fib zone)

Levi Strauss & Co (NYSE: $LEVI) Surges On Q1 Earning Beat! 👖Levi Strauss & Co. operates as an apparel company. It designs, markets, and sells jeans, casual and dress pants, tops, shorts, skirts, jackets, footwear, and related accessories for men, women, and children in the Americas, Europe, and Asia. The company sells its products under the Levi's, Dockers, Signature by Levi Strauss & Co., and Denizen brands; and also licenses its Levi's and Dockers trademarks for various product categories, including footwear, belts, wallets and bags, outerwear, sweaters, dress shirts, kids wear, sleepwear, and hosiery. The company sells its products through third-party retailers, such as department stores, specialty retailers, third-party e-commerce sites, and franchisees who operate brand-dedicated stores; and directly to consumers through various formats, including company-operated mainline and outlet stores, company-operated e-commerce sites, and select shop-in-shops located in department stores and other third-party retail locations. It operates approximately 3,100 brand-dedicated stores and shop-in-shops. The company was founded in 1853 and is headquartered in San Francisco, California.

Levi's going into earningsSupply chains woes have been negatively affected earnings for companies like this (Nike).

Levi's is at a rock and a hard place showing a Descending triangle pattern which is bearish 90% of the time but with earnings here you never know. Even though the pattern is bearish, all indicators (OBV,MACD,MFI,RSI) are bullish

This could go either way

Long over 26.50

Short below 24.25

From PJs to JeansWhy LEVI?

1. Solid earnings

2. Strong online sales - less dependency for box stores

3. W/Vaccine on the horizon it's going to be time to trade in the PJs (zoom meetings) for jeans and slacks (in person), hence increased sales

4. Management has held up the company through COVID and the stock is closing in our pre-covid prices.

Technical:

Cup & Handle formation seen on the chart

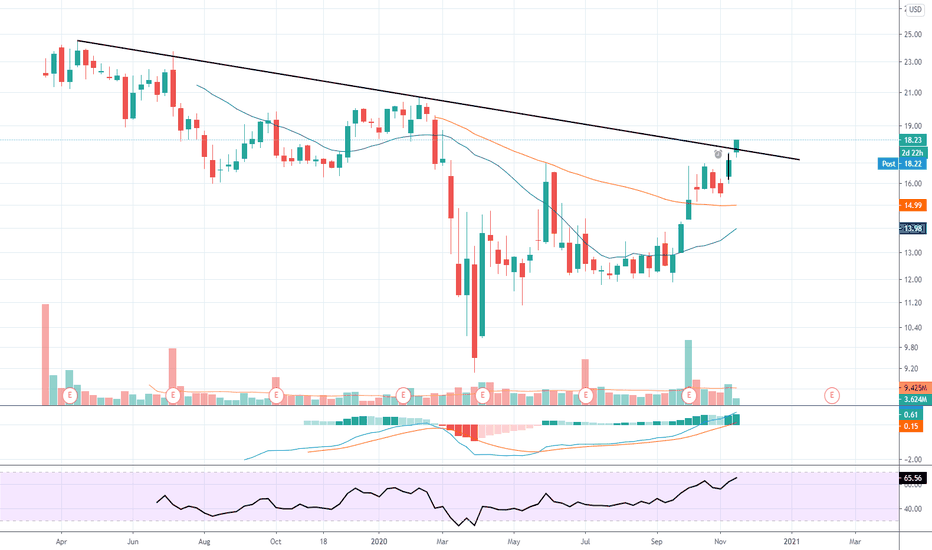

$LEVI Levis Strauss- Potential Major Trend break

Blow out earnings report resulted in a nice pop afterhours. The stock is

in a zone of huge price history so may find it difficult to break through unless

it gets interest from day traders and some short covering comes into play.

Alert set for break above downtrend and resistance @ $17.00

Upside targets $18.80 - $19.75.

Correction with respect!We're ranging between the 0.236-0.382 (local fib) with outliers at 0 & 0.618 possibly correcting before another strong move to the upside.

!!!DISCLAIMER!!! I'm new to analysis since November 2019 and this idea is only for the purpose of sharing ideas NOT investment advice, therefore any feedback from aspiring traders and experts are more than welcome.

Always remember to not go into a trade to soon and take profit along the way. Stay safe, stay profitable ^^

Correcting with respect!Are we ranging for another strong move to the upside? There seems to be a range between the local bottom and the 0.236 (of the local high). After a running flat correction we could enter the triangle correction until the first motive wave, stay tuned!

!!!DISCLAIMER!!! I'm new to analysis since November 2019 and this idea is only for the purpose of sharing ideas NOT investment advice, therefore any feedback from aspiring traders and experts are more than welcome.

Always remember to not go into a trade to soon and take profit along the way. Stay safe, stay profitable ^^