LGF.A trade ideas

RiskMastery's Red Flag Stocks - LGF.A EditionWelcome to RiskMastery's Red Flag Stocks - Stocks with bearish potential.

In this edition, we'll be looking at NYSE:LGF.A ...

I believe this code is at a point of potential volatility.

If price can hold below $9.57 ... Bearish potential may be unlocked.

My key downside targets include:

- $8.43 (Conservative)

- $7.52 (Medium)

- $6.31 (Aggressive)

If however price breaks above $10.64 ... Bullish potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

Lionsgate Jumps 11% on Analyst Upgrade Ahead of Studio Spin-OffLionsgate ( NYSE:LGF.A ) experiences a remarkable 11% surge in its stock price following an analyst upgrade, signaling a promising trajectory ahead of the anticipated spin-off of its studios business from Starz.

Barrington Research analyst James Goss's decision to elevate Lionsgate's ( NYSE:LGF.A ) rating to outperform from market perform, coupled with a bullish $12 price target, underscores growing optimism surrounding the studio's future prospects. Goss highlights the forthcoming $4.6 billion SPAC deal with Screaming Eagle Acquisition Corp. as a pivotal catalyst, expected to commence in April. This strategic move is poised to create a publicly traded subset of the studio business, providing a focused platform for investors and reaffirming Lionsgate's value proposition.

The SPAC transaction, designed to raise approximately $350 million for strategic initiatives, signifies Lionsgate's commitment to fortifying its market position and unlocking shareholder value. Lionsgate Studio Corporation, poised to trade on the Nasdaq under the symbol LION, is projected to yield significant adjusted operating income, further bolstering investor confidence.

CEO Jon Feltheimer's acquisition of 100,000 shares further underscores leadership's unwavering belief in Lionsgate's growth potential. Feltheimer's strategic move, reflected in his purchase of Class A and Class B shares, serves as a vote of confidence in the company's strategic direction and future performance.

Despite the challenges posed by the pandemic and market volatility, Lionsgate's ( NYSE:LGF.A ) stock has demonstrated resilience, boasting a 20.9% increase over the last six months and an 11% uptick in the past year. While year-to-date performance has seen a modest decline, the company's proactive measures, including the SPAC deal and strategic acquisitions, position it for sustained growth and value creation in the long term.

As Lionsgate ( NYSE:LGF.A ) charts a course towards its studio spin-off and continues to innovate in the entertainment industry, investor sentiment remains buoyant. The company's unwavering commitment to enhancing shareholder value, coupled with a robust pipeline of content and strategic initiatives, bodes well for its future performance and market standing.

In conclusion, Lionsgate's ( NYSE:LGF.A ) recent stock surge and strategic moves underscore its resilience and potential for value creation. With a clear roadmap for growth and a strong leadership team at the helm, Lionsgate ( NYSE:LGF.A ) stands poised to navigate challenges and capitalize on emerging opportunities in the dynamic entertainment landscape.

What to look in LGFA.A Stock using Price Action StrategyHello Traders! LGFA.A is approaching the support key level and it will be a nice bounce in the upside after the appearance of a strong bullish candle.

The only candlestick pattern that I'm looking:

1.Engulfing Candlestick

2. Inside Bar

3. Pin Bar

4. Piercing line

Hope you enjoy the price action and hope you smash the like button :)

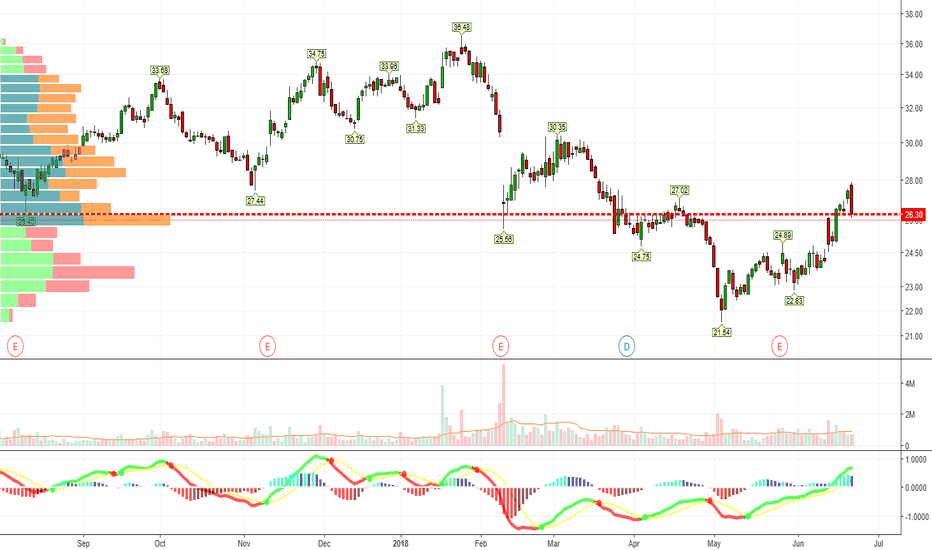

#LGFB Daily Stock AnalysisWe are using Capitulation Strategy on this counter.

What we can see from the charts, it has a row of 5 bearish candles that creating lower high + lower low and come along with a confirmation candle. This is a One White Soldier Pattern.

So there's is a high possibility for the price to snap back to the moving averages. Basically we are aiming 2R or further before touching the 50EMA, but in this case, it seems it there's possibility reaching 2R before the touching the moving averages.