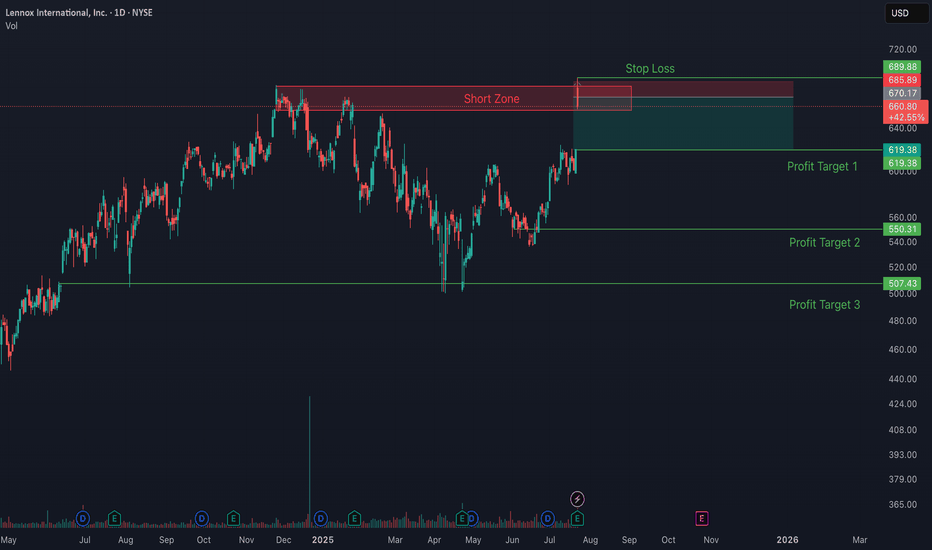

Lennox LII At Resistance, swept liquidity - Nice r/r for a shortLII is testing ATH resistance after failing a key level on the monthly. It just swept liquidity on earnings news. It may eventually go higher, but a gap fill is likely. Reward/risk is 3.23 on a short here with PT1 at the gap and a stop loss at ATH. It will be a quick in and out trade for me unless it breaks substantial levels below.

LII trade ideas

Lennox - Short term long playLittle ascending triangle attempting to form. It appears to have had 2 touches forming the top line and coming back to validate the support incline. I'd wait to see candles represent something bullish before entering here. If an entry here is taken, plan to close out your risk at the resistance line as a breakthrough is not likely on this run up in my opinion. This is given the strength of the sellers here. I think it has another push and rejection to go with the safer entry on the 3rd incline support validation. If entering on the 3rd test of the incline (safer play), the target would be the next weekly resistance area. Even safer, wait to enter if it breaks out and retests the resistance now turned support (safest play)...target is still the weekly resistance.

LII bull flags confirm break above $100LII is a low volume stock but one which is beginning to show signs of trending well since breaking above the 200ma in October 2014.

At that time there was major resistance ahead with price trading below the March 2014 pivot high ($94.69) and the $100 figure. The March high proved the more difficult to crack with price hanging around the $92-$97 zone for several months. Clearing $100 was more straightforward - although there were a number of indecision candles (doji in the main) just above this level.

There was no particular retest of either $95 or £100 so longer-term trend traders would have to wait for further confirmation that the uptrend had continued momentum. The two recent bull flags have given such a signal and a buy position could well provide good profits.

The one point of note here, however, is that in the previous bull trend (shown on the weekly) the pullbacks were pretty deep. So far the latest trend is proving to be more linear - but patience and wider stops may be needed to successfully trade this stock.