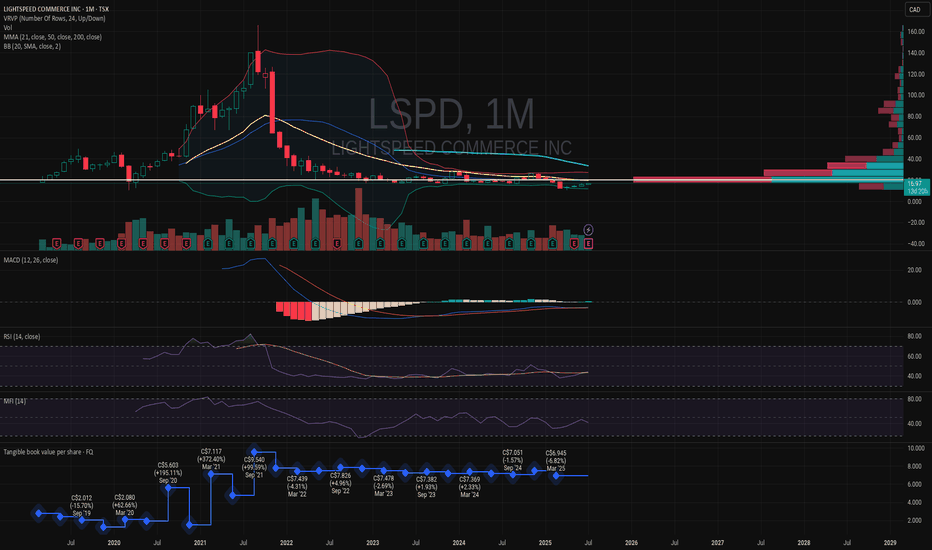

LSPD - Looks promising here. LONG. LSPD

If they can keep on keeping on, bring in cash, I think they have a good shot at carving out a market.

Of course I'm a newbie at all this and just giving my 0.00002 worth.

Same goes for all my charts. I don't profess to know a whole lot, but I'm trying.

If the last few years were tough for

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−4.72 USD

−644.83 M USD

1.04 B USD

122.44 M

About LIGHTSPEED COMMERCE INC

Sector

Industry

CEO

Dax Dasilva

Website

Headquarters

Montréal

Founded

2005

FIGI

BBG00PZ78ZM0

Lightspeed Commerce, Inc. engages in the provision of point-of-sale software for retailers and restaurants. It offers workflow analysis, training, configuration, networking, and business services. The company was founded by Dax Dasilva on March 21, 2005 and is headquartered in Montreal, Canada.

Related stocks

Accumulation complete, wealth distribution commenceVery typical pattern for profits here. Take a little portion of your portfolio to accumulate at this level before price goes parabolic. Price has consolidated at these levels for far too long and is now finally inching higher, after gathering immense demand. Expect price to visit all fresh supply zo

LSPD - Bullish ReversalLSPD (Lightspeed) appears to be oversold at the moment. The arrival of the new CEO is expected to significantly boost the stock. Additionally, there are signs of a potential reversal, particularly on the lower timeframe of 15 minutes, with an inverse head and shoulder formation indicating a possible

LSPD Lightspeed Canadian FinTech looking to breakoutLooking at LSPD chart, can see a breakout pattern emerging.

Can also see wyckoff accumulation pattern

Upside potential minimal 0.236 retracement if it's a wave 4, or if started brand new bullish leg as wave 1 (we'll only know once the wave 2 pullback successfully restests than current low, that can

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where LSPD is featured.

Frequently Asked Questions

The current price of LSPD is 12.03 USD — it has decreased by −0.50% in the past 24 hours. Watch Lightspeed Commerce Inc. Subordinate Voting Shares stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Lightspeed Commerce Inc. Subordinate Voting Shares stocks are traded under the ticker LSPD.

LSPD stock has fallen by −3.31% compared to the previous week, the month change is a 3.54% rise, over the last year Lightspeed Commerce Inc. Subordinate Voting Shares has showed a −4.07% decrease.

We've gathered analysts' opinions on Lightspeed Commerce Inc. Subordinate Voting Shares future price: according to them, LSPD price has a max estimate of 21.70 USD and a min estimate of 11.00 USD. Watch LSPD chart and read a more detailed Lightspeed Commerce Inc. Subordinate Voting Shares stock forecast: see what analysts think of Lightspeed Commerce Inc. Subordinate Voting Shares and suggest that you do with its stocks.

LSPD reached its all-time high on Sep 22, 2021 with the price of 130.02 USD, and its all-time low was 7.34 USD and was reached on Apr 7, 2025. View more price dynamics on LSPD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LSPD stock is 1.50% volatile and has beta coefficient of 2.44. Track Lightspeed Commerce Inc. Subordinate Voting Shares stock price on the chart and check out the list of the most volatile stocks — is Lightspeed Commerce Inc. Subordinate Voting Shares there?

Today Lightspeed Commerce Inc. Subordinate Voting Shares has the market capitalization of 1.62 B, it has decreased by −1.37% over the last week.

Yes, you can track Lightspeed Commerce Inc. Subordinate Voting Shares financials in yearly and quarterly reports right on TradingView.

Lightspeed Commerce Inc. Subordinate Voting Shares is going to release the next earnings report on Nov 6, 2025. Keep track of upcoming events with our Earnings Calendar.

LSPD earnings for the last quarter are 0.06 USD per share, whereas the estimation was 0.13 USD resulting in a −52.38% surprise. The estimated earnings for the next quarter are 0.12 USD per share. See more details about Lightspeed Commerce Inc. Subordinate Voting Shares earnings.

Lightspeed Commerce Inc. Subordinate Voting Shares revenue for the last quarter amounts to 304.94 M USD, despite the estimated figure of 287.25 M USD. In the next quarter, revenue is expected to reach 308.24 M USD.

LSPD net income for the last quarter is −50.38 M USD, while the quarter before that showed −574.20 M USD of net income which accounts for 91.23% change. Track more Lightspeed Commerce Inc. Subordinate Voting Shares financial stats to get the full picture.

No, LSPD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 12, 2025, the company has 3 K employees. See our rating of the largest employees — is Lightspeed Commerce Inc. Subordinate Voting Shares on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lightspeed Commerce Inc. Subordinate Voting Shares EBITDA is −17.93 M USD, and current EBITDA margin is −1.87%. See more stats in Lightspeed Commerce Inc. Subordinate Voting Shares financial statements.

Like other stocks, LSPD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lightspeed Commerce Inc. Subordinate Voting Shares stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Lightspeed Commerce Inc. Subordinate Voting Shares technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Lightspeed Commerce Inc. Subordinate Voting Shares stock shows the sell signal. See more of Lightspeed Commerce Inc. Subordinate Voting Shares technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.