LVS trade ideas

$LVS Risky Gamble on Las Vegas Sands. Not exactly the most bullish of charts but this recent member of the S&P500 my just come up with a surprise in today's earnings report.

Estimates and expectations are very low but option traders have been quite bullish on the stock.

Yield 5.03% is considerable and given the upside potential on the price, it could be a very good long term hold, IF CHINA trade talks continue in a positive manner.

Indicators are bullish while volume is dominated by buyers it has been dwindling.

Analyst Carlo Santarelli Deutsche Bank upgraded the stock to buy from hold while raising the price target to $70 from $69.

"From a trading perspective, we believe LVS has largely priced in the primarily Macau based headwinds that have impacted the business. In 2019, which has experienced ebbs and flows in sentiment, Macau fundamentals, and geopolitical turmoil and rhetoric, shares have traded in a fairly wide range between $51 and $69," Santarelli said.

Las Vegas Sands (NYSE:LVS) is scheduled to announce Q3 earnings results on Wednesday, October 23rd, after market close.

The consensus EPS Estimate is $0.75 (-2.6% Y/Y) and the consensus Revenue Estimate is $3.3B (-2.1% Y/Y).

Over the last 2 years, lvs has beaten EPS estimates 50% of the time and has beaten revenue estimates 63% of the time.

Over the last 3 months, EPS estimates have seen 1 upward revision and 14 downward. Revenue estimates have seen 1 upward revision and 12 downward.

Source seeking alpha

Company profile

Las Vegas Sands Corp. engages in the development of destination properties. Its properties feature accommodations, gaming, entertainment and retail, convention and exhibition facilities, celebrity chef restaurants, and other amenities. It operates through the following geographic segments: Macao, Singapore, and United States. The Macao segments handles the operations of The Venetian Macao; Sands Cotai Central; The Parisian Macao; The Plaza Macao and Four Seasons Hotel Macao; and Sands Macao. The Singapore segment includes the Marina Bay Sands. The United States segment consists of Las Vegas Operating Properties and Sands Bethlehem. The company was founded by Sheldon G. Adelson in August 2004 and is headquartered in Las Vegas, NV.

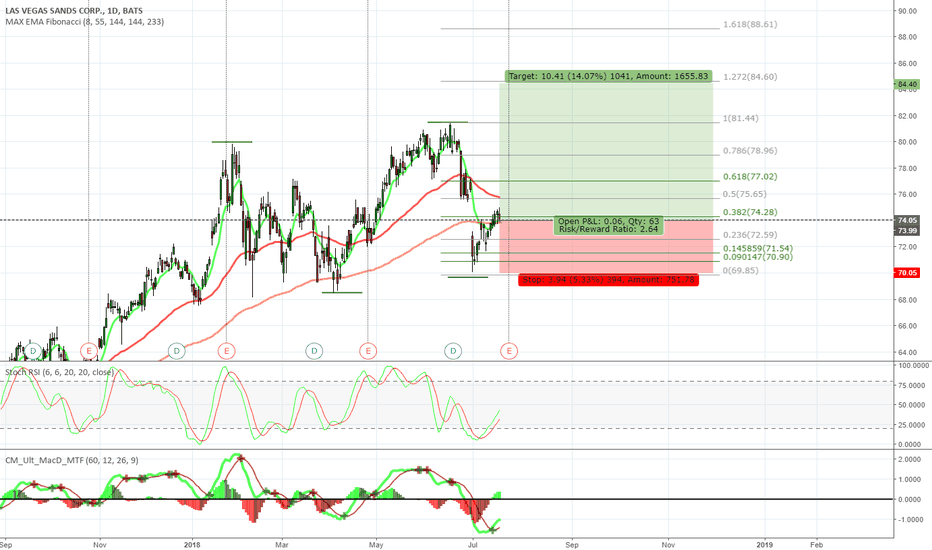

LVS Bearish Counter Trend TradeTime for Bullish trend for LVS is Over! LVS is going up for last couple of weeks and now at a multiple time frame resistance. Seasonality shows May is 71% bearish. For april, seasonality was 51% bearish with a 1:1 reward/risk. It has gone up most of the month and now high probability of reversing.

$LVS A lot of people are betting on Las Vegas Sands into earningLas Vegas Sands report earnings on the 17th April and whispers are that it will be a beat. We are not going long into this strength as the stock has already had a very impressive run. We are hoping for a pullback after a initial pop to meet the golden pocket resistance.

LVS - Bearish-neutral Iron CondorStock has sold off since May/June, with no recovery since last earnings report. Betting on price to stay within this range.

35/40/62.5/67.5 JAN19 IRON CONDOR @ 0.64 CREDIT

General plan:

Roll if necessary & if possible to reduce risk.

Target maximum profit, unless significant profit appears early.

Comment or direct message for discussion, or on other interesting ideas!

Follow for updates.