MCK trade ideas

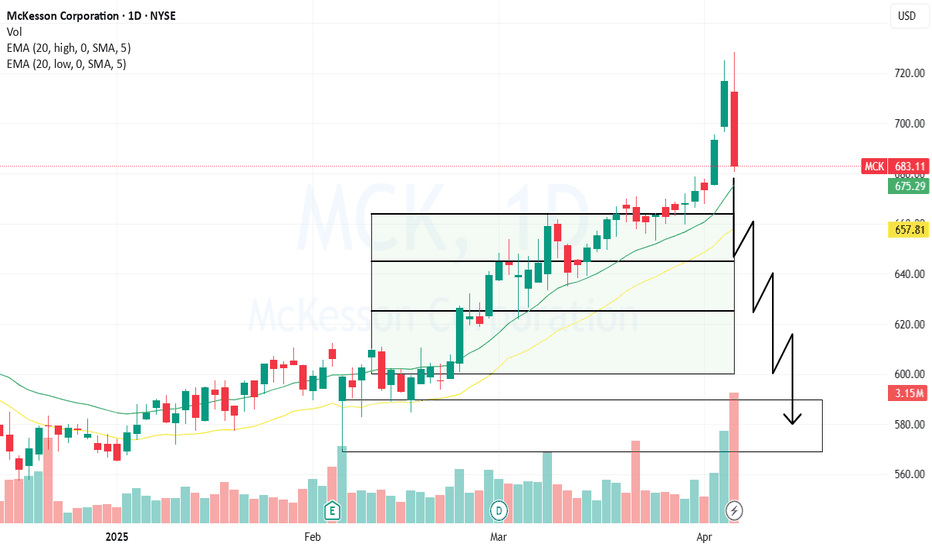

Factors that include a retrace below resistanceMany oscillators are pointing in this direction, as well as technical analysis. It has been a turbulent few weeks, but in a way, it has consistently put us at a reversal point, making it very difficult for this trend to continue beyond 700 until we see a pullback.

A major correction underway could see 500s againThe catalyst doesn't lie, but neither does the TA. We have clearly pointed out key elements to the significance of how low this can go. Major turning points sit at sub 600, volume, and volatility. This will continue to sell off, but expect a retrieval at some point closest to the low 600s.

MCK - LONG SWINGTRADEStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microeconomic study; consequently, more advanced stock traders will delve into macroeconomics and industry specific technical analysis to track asset or corporate performance. Other duties of a stock trader include comparison of financial analysis to current and future regulation of his or her occupation.

MCK in Sell ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in selling zone above top of channels

Stochastic Momentum Index (SMI) at overbought level

Money flow momentum is spiked positive and over top of Bollinger Band

Target is lower channel around $600

Expert Analysis Reveals Key Entry Points!McKesson Corporation (MCK) continues to demonstrate resilience and growth potential, evident from its recent price action and robust financial performance. Here’s a detailed analysis for potential investors.

MCK has been in a steady uptrend, currently trading at $586.34. The stock has shown consistent higher highs and higher lows, reflecting strong bullish sentiment. The recent minor pullback offers an attractive entry point for long-term investors.

Relative Strength Index (RSI): At 52.26, RSI indicates a neutral stance, suggesting there’s room for upward movement without entering overbought territory.

MACD: The MACD level at 8.41 signals a bearish crossover, indicating a potential short-term correction.

Moving Averages: MCK is trading above critical moving averages (50, 100, 200), reinforcing the long-term bullish trend. The EMAs are providing strong support, particularly at $569.76 (EMA 50) and $545.95 (SMA 100).

Pivot Point (P): $587.33

Resistance Levels (R1, R2, R3): $608.88, $633.72, $680.11

Support Levels (S1, S2, S3): $562.49, $540.94, $494.55

The stock faces immediate resistance at $608.88, with support established at $562.49.

McKesson’s recent financials reveal strong cash flow from operations, robust revenue growth, and significant profitability metrics, underscoring its solid market position.

Next Earnings Report Date: August 7, 2024

EPS Estimate: $7.21

Revenue Estimate: $82.72 billion

P/E Ratio: 26.11, reflecting moderate valuation.

Net Margin: 1.33%, showcasing efficiency in operations.

Long Position

Entry Point: Above $590.00

Price Target: $613.42 (short-term), $633.72 (medium-term)

Stop Loss: $570.00 (below EMA 50)

Short Position

Entry Point: Below $560.00

Price Target: $540.00 (near support level)

Stop Loss: $580.00 (above recent pivot)

McKesson Corporation remains a robust pick in the healthcare sector, offering substantial growth potential. The technical and fundamental indicators align to suggest a bullish outlook, with strategic entry points for both long and short positions.

Price Prediction: MCK could reach $613.42 in the short term, with further potential to $633.72, assuming favorable market conditions.

MCK a large cap medical supply company LONGMCK is a large cap medical supply company- it has experienced respectable earnings reports

and steady growth as medical entities including surgery centers and hospitals are busy catching

up on electric surgeries from the COVID era. It is rising ar or under the second upper VWAP

line. The dual time frame RSI indicator ( by Chris Moody) shows that every time the faster

RSI ( 1 hour) RSI drops down to the 50 level it rebounds with a corresponding price move up.

These episodes are shown as thin black vertical lines. One of them is at present. The

forecasting algorithm of Lux Algo predicts a further rise to the level of 575 in the next six

weeks. The last earnings was quite solid with the next earnings in 4 weeks.

I will take a long trade here. I will add to the position for any dips to or below the

running EMA 9 but not reaching the EMA100.

I will take a partial profit at 560 and cut the position down to 25% the day before earnings for

purposes of good risk management. If price crosses under the running EMA100 I will

close the trade and collect the unrealized profit.

MCK = PERMA-BULL! Long-term buy & hold.Over the past 2 years, MCK has been in a rock-solid, aggressive uptrend, gaining 50% in '22 and 30% in '23. The weekly TTM squeeze just fired LONG (again) for the 4th time in three years. This beast is a case-study in layered AVWAP! You could wait for a pullback (since it is slightly extended from it's most recent Layered AVWAP). My fear is that it just establishes yet another layer and never comes back to touch the current one (as has been the case for the last 4 layers). I plan to buy ITM Calls and sell monthly calls just above the established channel and see how long I can ride this bull :)

either the best recovery or solid continuationidk why NYSE:MCK is down $20 in the post market but the top to bottom was over $25. earning and guidance both beat and future guidance is strong. some link to a rite aid bankruptcy has seemed to be the only dark cloud news. The technicals did max out on its push up to ath......so was this just a technical over extension combine with profit taking and a shade of bad news? Do we see this recover losses or continue? I am gonna play this by ear and keep close eye on volume it's probably gonna be our first confluence with price action. The broader Markets are really starting to overextend so keep an eye on the proper sectors in this case medical and medical device /equipment.

MCK DAILY - Breakout on EarningsToday a gap up on positive earnings and revenue, Today an ascending triple top breakout on the point & figure.

This is a health care stock (timely sector) with superb financials.

This is not financial advice, but if I were to load into this stock, I would:

a) look for a pullback to 381.43 (potential VPOC support) for potential entry

b) Look for a further pullback to 376.19 (Gap fill) for potential entry

c) In the event this is a runaway gap, I would look for a breakout above 401.78 (52 week high), where there should be free sailing ahead.

d) Point & figure target is currently 459 (long position only).

2nd BEST SHORT in the entire Market right Now. MCK SHORT @ $359This trade I have been in for a while but thought I would post it here as its a similar setup to the SQM SHORT I posted last week. That SQM SHORT I labeled as "BEST SHORT Opportunity in the Market". Well this one is the 2nd Best in my opinion. Simply because it has been a little stronger stock and in a better sector (Healthcare) than SQM.

Having said that this stock is up HUGE and tagged MAJOR Resistance at $374 level. It also is very over bought and was making NEW ATH in the face of a falling market. As people scramble to protect their profits this one will crater to EMA 39 on Monthly Chart which lies at $243 level. Target Price for this is $244.93.

Entry was $359.06. Stop Loss = Confirmation CLOSE > $379.70. Target = $244.93. That is a 5.5:1 Reward:Risk ratio!!. As mentioned before this trade setup historically has a >85% Probability of working out EXACTLY as shown here.

Recently this trade broke down from a Rising Bearish Wedge and is now well into profit.

MCK , LONG 🚂Choo Choo~Long MCK as my first chess piece in market re-entry from cash , I like MCK reminds me of a slow train climbing away inch by inch foot by foot . Market closed in GTM today per SPY...

Plan

Entry - 360.38

Stop Vs 21 ema

PT1 R1 , stop to half risk

PT2 R2 , stop same

HourWD - sell some

21 WD - out balance

*Caution will be exercised pre earnings ( Nov 01 AMC ) . Will see where trade is at that point and asses , if we chop sideways with no PT hits I will have to downsize to respect a gap down potential ..

Also eying up RYAN , LABU/XBI , and anything else pushing showing strength ....progressive exposure ...

Jumping S-curvesIn this post, I will explain what jumping S-curves means and how you can identify potential S-curves before they jump .

First, let's begin with the chart above (also copied below).

This is a yearly chart of McKesson Corporation (MCK), a medical supplies company.

As you can see in the chart below, this stock has been soaring over the past year despite most other stocks being significantly lower.

Here is the performance of the S&P 500 over the same time period.

Whenever I see something highly unusual in a chart, such as extreme outperformance, I check the higher timeframes to see what's driving price on a technical level. Below is the yearly chart for MCK.

When I examine price action over a long time period, I always log adjust my chart. Below is the log-adjusted chart.

Upon seeing this chart I immediately knew what was going on: the stock price jumped S-curves. I will try to illustrate below how I reached this conclusion.

To begin, I drew Fibonacci levels from the last reaction low to the last reaction high on the yearly timeframe.

The previous reaction low was the bottom of 2008 because that bottom was a Fibonacci retracement of some earlier reaction high, the reaction high is the top in 2015 because price did not surpass that high without first undergoing a Fibonacci retracement (to the golden ratio).

As you can see above, from 2015 to 2018 the price retraced down to the golden ratio (0.618) on the yearly chart. It is often from this retracement level that the base of the second S-curve is created. (For simplicity, I only included the 0.618 Fibonacci level on the chart).

Some may say that this pattern is merely a bull flag or pennant. (See chart below)

Indeed, bull flags and pennants can be another way to visualize S-curve jumps.

Whereas, on a deeper, more mathematical level, S-curve jumps are logarithmic spirals (approximated as Fibonacci spirals or Golden spirals). If you wish to delve deeper into logarithmic spirals, including the Golden spiral, you can check out this Wikipedia page: en.wikipedia.org

These Fibonacci or Golden spirals are present on mostly every chart and they appear on mostly every timeframe (hence they are fractal ).

One of the best charts you can use to visualize these spirals is the chart of Bitcoin. Below are charts of Bitcoin which attempt to show the endless fractal nature of Fibonacci spirals (or "S-curve jumps").

I've only illustrated a few of the spirals, but indeed there are numerous spirals. (I tried to do my best using the tools on Trading View to draw these spirals, but it can be quite hard to manipulate the curves perfectly to price action.)

One may ask what about when price falls? That is obviously not an S-curve jump since the price is falling.

Actually, when price is crashing it is usually just an S-curve jump, or Fibonacci spiral, on the inverted chart.

Although I have not tested it with scientific rigor, I do hypothesize that Bitcoin's price movement is a series of infinitely fractal and competing Fibonacci spirals on various timeframes, including Fibonacci spirals on inverted scales. Price movement can be thought of as an infinite series of S-curve dilemmas where infinitely fractal S-curves, including those of which are inverse S-curves, compete to govern the next price move.

Each dilemma is resolved when an S-curve reaches its inflection point, such that it governs price movement and price moves rapidly in that direction until it approaches capacity and faces its next dilemma.

Those who know Calculus may recognize this chart. Indeed this is the graph of a logistic function. The mathematical terminology for an "S-curve" is sigmoid function .

Here are some more interesting charts of S-curves (none of which is intended to be investment advice)

Meridian Bioscience (VIVO) jumps S-curves on its yearly chart

The U.S. Dollar Index jumps S-curves on its yearly chart

The entire price action of Chinese EV Company (NIO) is an S-curve that just completed a perfect golden ratio retracement

Japan's faces a population S-curve dilemma

Citigroup underwent S-curve growth up until the Great Recession.

Then it crashed or underwent S-curve growth on the inverted chart.

In summary, price movement involves an endless series of S-curves or Fibonacci spirals. Identifying an S-curve on a high time frame before it reaches its inflection point and breaks out can lead to tremendous gains (among the most lucrative gains one can realistically make in the financial markets).

McKesson: A Boring Stock Plods HigherDrug distributor McKesson has been a surprising breakout stock in 2022 thanks to strong earnings. It’s the 14th-best performing member of the S&P 500 this year, according to TradeStation data. MCK is also the biggest gainer apart from inflationary plays like energy and fertilizers.

Nonetheless, it’s been relatively quiet for several months as the earlier surge is digested.

The first pattern on today’s chart is the level around $340, near MCK’s peak in May. The stock tested that area in late September and bounced, which could mean old resistance has become new support.

Second is the confluence between that price zone and the 100-day simple moving average (SMA). Also notice how MCK bounced at the 100-day SMA in June.

Third, MACD just turned higher.

Finally, this week’s bounce reestablishes MCK above its 50-day SMA and 21-day exponential moving average (EMA). Is the trend turning favorable again?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. You Can Trade, Inc. is also a wholly owned subsidiary of TradeStation Group, Inc., operating under its own brand and trademarks. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

8/31/22 MCKMcKesson Corporation ( NYSE:MCK )

Sector: Distribution Services (Medical Distributors)

Market Capitalization: $52.319B

Current Price: $367.00

Breakout price: $369.40

Buy Zone (Top/Bottom Range): $355.55-$334.35

Price Target: $403.40-$407.60

Estimated Duration to Target: 37-40d

Contract of Interest: $MCK 10/21/22 370c

Trade price as of publish date: $13.90/contract