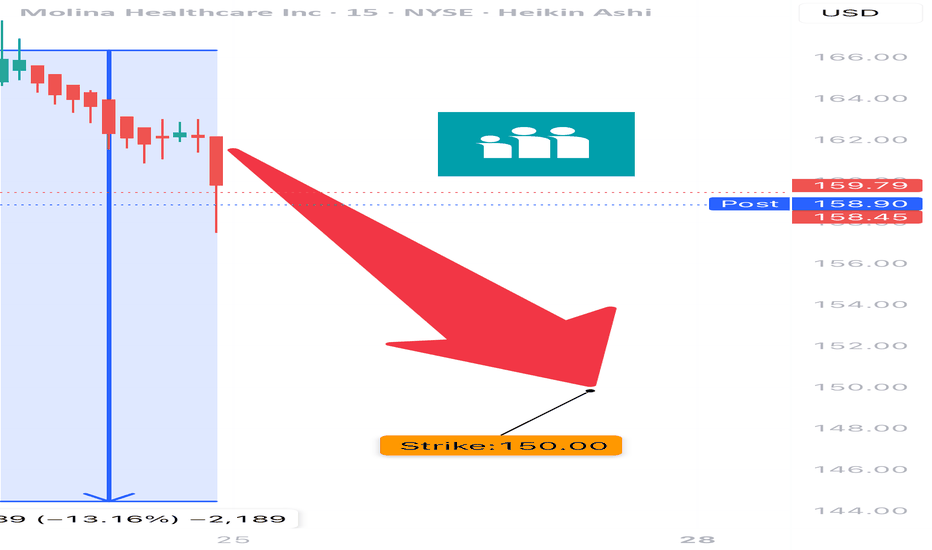

MOH PUT TRADE ALERT (07/24)

🚨 MOH PUT TRADE ALERT (07/24) 🚨

📉 Extreme Oversold. Institutional Selling. Setup is Real.

🧠 Key Stats:

• RSI: 13.2 = insanely oversold

• Volume: 🔺2.6x last week = institutions dumping

• Put/Call Ratio: 0.33 → heavy bearish bets

• VIX: Low → IV still cheap 💰

🔥 TRADE IDEA

🔻 Buy MOH $150 PUT exp 8/1

Key facts today

Molina Healthcare's Q2 2025 earnings were $5.48 per share, missing estimates due to rising medical costs. The company also lowered its full-year earnings guidance.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.36 USD

1.18 B USD

40.65 B USD

53.57 M

About Molina Healthcare Inc

Sector

Industry

CEO

Joseph M. Zubretsky

Website

Headquarters

Long Beach

Founded

1980

FIGI

BBG000MBHNC8

Molina Healthcare, Inc. engages in the provision of health care services. It operates through the following segments: Medicaid, Medicare, Marketplace, and Other. The company was founded by C. David Molina in 1980 and is headquartered in Long Beach, CA.

Related stocks

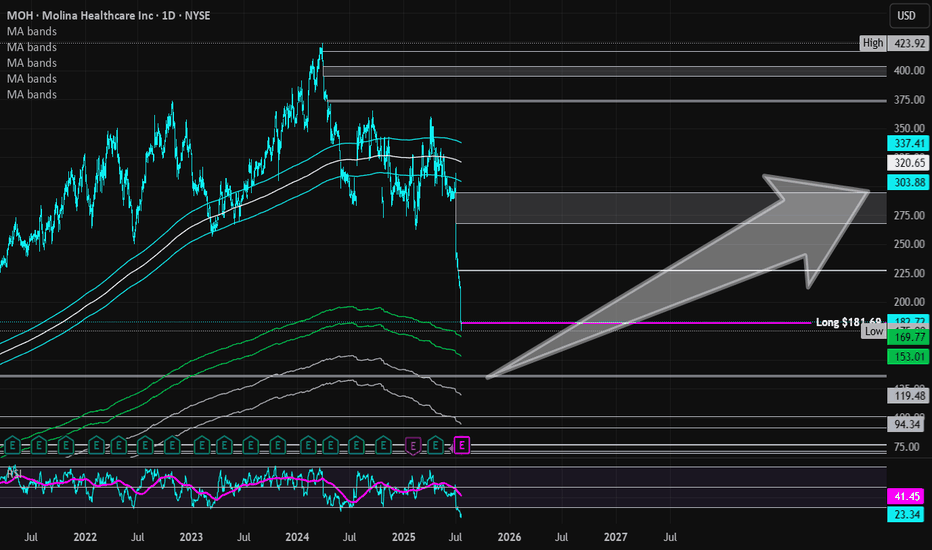

Molina Healthcare | MOH | Long at $181.69Healthcare providers and services are at a major discount right now: and may be discounted even more this year. I am personally buying and long-term holding the fear, knowing the baby boom generation is going to utilize our healthcare system at a rate unseen in modern times. While the price discount

Oooh MolinaMolina has a safe and clean looking chart. I don't see price getting much below the marked level of ~$250, if it even goes there.

The longer it consolidates the lesser the chance of price going there which I think is already the case here (as the consolidation 'washes' out the strength of the down

Bullish continuation NYSE:MOH is looking at a bullish continuation after the stock saw a break above the falling wedge formation, confirming the upside continuation over the longer-term period. Strong bullish break above 340.00 further confirms the upside.

Long-term MACD is looking at a strong long-term bullish mom

MOH long term potentialMOH has corrected nicely after a huge run. This is a stock that a few legendary investors have added as of late. If you expect medicare/medicade expenses to increase by 7% on average, and more people to sign up over time, this stock will hugely benefit. I note a basing at the most recent fib level.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MOH5414064

Molina Healthcare, Inc. 3.875% 15-MAY-2032Yield to maturity

6.48%

Maturity date

May 15, 2032

MOH5939489

Molina Healthcare, Inc. 6.25% 15-JAN-2033Yield to maturity

6.45%

Maturity date

Jan 15, 2033

MOH5074366

Molina Healthcare, Inc. 3.875% 15-NOV-2030Yield to maturity

6.09%

Maturity date

Nov 15, 2030

MOH5003223

Molina Healthcare, Inc. 4.375% 15-JUN-2028Yield to maturity

5.95%

Maturity date

Jun 15, 2028

MOH5939488

Molina Healthcare, Inc. 6.25% 15-JAN-2033Yield to maturity

—

Maturity date

Jan 15, 2033

See all MOH bonds

Frequently Asked Questions

The current price of MOH is 153.03 USD — it has increased by 1.95% in the past 24 hours. Watch Molina Healthcare Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Molina Healthcare Inc stocks are traded under the ticker MOH.

MOH stock has fallen by −3.87% compared to the previous week, the month change is a −34.71% fall, over the last year Molina Healthcare Inc has showed a −56.38% decrease.

We've gathered analysts' opinions on Molina Healthcare Inc future price: according to them, MOH price has a max estimate of 330.00 USD and a min estimate of 153.00 USD. Watch MOH chart and read a more detailed Molina Healthcare Inc stock forecast: see what analysts think of Molina Healthcare Inc and suggest that you do with its stocks.

MOH stock is 4.33% volatile and has beta coefficient of −0.03. Track Molina Healthcare Inc stock price on the chart and check out the list of the most volatile stocks — is Molina Healthcare Inc there?

Today Molina Healthcare Inc has the market capitalization of 8.57 B, it has decreased by −5.48% over the last week.

Yes, you can track Molina Healthcare Inc financials in yearly and quarterly reports right on TradingView.

Molina Healthcare Inc is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

MOH earnings for the last quarter are 5.48 USD per share, whereas the estimation was 5.62 USD resulting in a −2.46% surprise. The estimated earnings for the next quarter are 4.20 USD per share. See more details about Molina Healthcare Inc earnings.

Molina Healthcare Inc revenue for the last quarter amounts to 11.43 B USD, despite the estimated figure of 10.95 B USD. In the next quarter, revenue is expected to reach 10.93 B USD.

MOH net income for the last quarter is 255.00 M USD, while the quarter before that showed 298.00 M USD of net income which accounts for −14.43% change. Track more Molina Healthcare Inc financial stats to get the full picture.

No, MOH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 5, 2025, the company has 18 K employees. See our rating of the largest employees — is Molina Healthcare Inc on this list?

Like other stocks, MOH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Molina Healthcare Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Molina Healthcare Inc technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Molina Healthcare Inc stock shows the sell signal. See more of Molina Healthcare Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.