Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.89 USD

17.12 B USD

63.97 B USD

2.51 B

About Merck & Company, Inc.

Sector

Industry

CEO

Robert M. Davis

Website

Headquarters

Rahway

Founded

1891

FIGI

BBG000BPD168

Merck & Co., Inc. is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products. The Animal Health segment discovers, develops, manufactures, and markets animal health products, such as pharmaceutical and vaccine products, for the prevention, treatment and control of disease in livestock, and companion animal species. The Other segment consists of sales for the non-reportable segments of healthcare services. The company was founded in 1891 and is headquartered in Rahway, NJ.

Related stocks

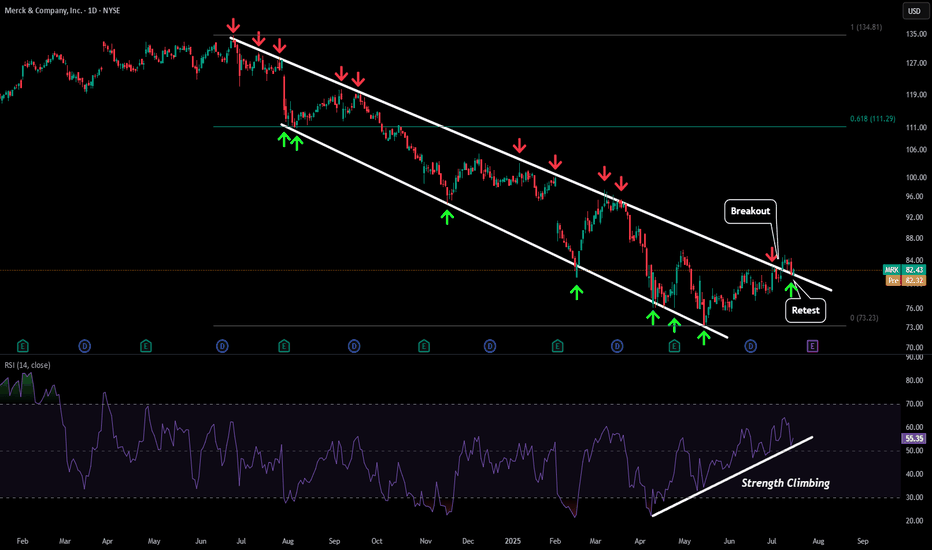

MRK - Retesting BreakoutAfter being in a downtrend for almost a year things finally look like they are starting to turn around for MRK.

Recently price broke the downwards sloping resistance and has retested that level as a new support level. We have also seen strength increasing on our daily RSI bringing some life back i

MRK Buying Opportunity!MRK is currently undervalued. The stock price dropped approximately 45% from June 25th of last year to May 15th of this year. At present, the price has bounced off a long-term weekly trendline that has been respected since 2009, indicating a strong rejection zone.

Additionally, on the daily timefra

MRK Wave Analysis – 14 July 2025- MRK reversed from the support zone

- Likely to rise to resistance level 85.00

MRK recently reversed up from the support zone surrounding the long-term support level 73.45 (which has been reversing the price from the start of 2020, as can be seen from the weekly MRK chart below).

The upward rever

AAA - Setup from the bottomInverse head and shoulders pattern on the daily timeframe and if you were to break it down further to 12hr it should be also clear.

Monthly rsi sharply bounced back below an RSI of 30, weekly rsi has been below 30 rsi for multile touches

rsi line and rsi moving average crossover indicating change i

Merck Wave Analysis – 19 May 2025

- Merck reversed from support area

- Likely to rise to resistance level 80.00

Merck recently reversed up from the support area between the long-term support level 73.35 (which has been reversing the price from the middle of 2020) and the lower weekly Bollinger Band.

The upward reversal from this

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MRK5002693

Merck & Co., Inc. 2.45% 24-JUN-2050Yield to maturity

7.19%

Maturity date

Jun 24, 2050

MRK5319197

Merck & Co., Inc. 2.9% 10-DEC-2061Yield to maturity

7.12%

Maturity date

Dec 10, 2061

US58933YBF1

MERCK & CO. 21/51Yield to maturity

7.09%

Maturity date

Dec 10, 2051

US58933YBA2

MERCK & CO. 20/40Yield to maturity

6.41%

Maturity date

Jun 24, 2040

US58933YAT2

MERCK CO. 2045Yield to maturity

6.29%

Maturity date

Feb 10, 2045

MRK4806294

Merck & Co., Inc. 4.0% 07-MAR-2049Yield to maturity

6.20%

Maturity date

Mar 7, 2049

MRK3900816

Merck & Co., Inc. 3.6% 15-SEP-2042Yield to maturity

6.16%

Maturity date

Sep 15, 2042

US58933YAJ4

MERCK CO. 13/43Yield to maturity

6.07%

Maturity date

May 18, 2043

MRK5584756

Merck & Co., Inc. 5.15% 17-MAY-2063Yield to maturity

5.94%

Maturity date

May 17, 2063

MRK5584925

Merck & Co., Inc. 4.9% 17-MAY-2044Yield to maturity

5.73%

Maturity date

May 17, 2044

MRK.GF

Merck & Co., Inc. 5.76% 03-MAY-2037Yield to maturity

5.70%

Maturity date

May 3, 2037

See all MRK bonds

Curated watchlists where MRK is featured.

Frequently Asked Questions

The current price of MRK is 84.71 USD — it has increased by 0.71% in the past 24 hours. Watch Merck & Company, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Merck & Company, Inc. stocks are traded under the ticker MRK.

MRK stock has risen by 3.68% compared to the previous week, the month change is a 6.37% rise, over the last year Merck & Company, Inc. has showed a −32.79% decrease.

We've gathered analysts' opinions on Merck & Company, Inc. future price: according to them, MRK price has a max estimate of 141.00 USD and a min estimate of 82.00 USD. Watch MRK chart and read a more detailed Merck & Company, Inc. stock forecast: see what analysts think of Merck & Company, Inc. and suggest that you do with its stocks.

MRK stock is 1.65% volatile and has beta coefficient of 0.38. Track Merck & Company, Inc. stock price on the chart and check out the list of the most volatile stocks — is Merck & Company, Inc. there?

Today Merck & Company, Inc. has the market capitalization of 212.71 B, it has decreased by −1.89% over the last week.

Yes, you can track Merck & Company, Inc. financials in yearly and quarterly reports right on TradingView.

Merck & Company, Inc. is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

MRK earnings for the last quarter are 2.22 USD per share, whereas the estimation was 2.13 USD resulting in a 4.10% surprise. The estimated earnings for the next quarter are 2.02 USD per share. See more details about Merck & Company, Inc. earnings.

Merck & Company, Inc. revenue for the last quarter amounts to 15.53 B USD, despite the estimated figure of 15.34 B USD. In the next quarter, revenue is expected to reach 15.90 B USD.

MRK net income for the last quarter is 5.08 B USD, while the quarter before that showed 3.74 B USD of net income which accounts for 35.69% change. Track more Merck & Company, Inc. financial stats to get the full picture.

Yes, MRK dividends are paid quarterly. The last dividend per share was 0.81 USD. As of today, Dividend Yield (TTM)% is 3.78%. Tracking Merck & Company, Inc. dividends might help you take more informed decisions.

Merck & Company, Inc. dividend yield was 3.14% in 2024, and payout ratio reached 46.32%. The year before the numbers were 2.72% and 2.07 K% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 75 K employees. See our rating of the largest employees — is Merck & Company, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Merck & Company, Inc. EBITDA is 26.68 B USD, and current EBITDA margin is 39.30%. See more stats in Merck & Company, Inc. financial statements.

Like other stocks, MRK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Merck & Company, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Merck & Company, Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Merck & Company, Inc. stock shows the sell signal. See more of Merck & Company, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.