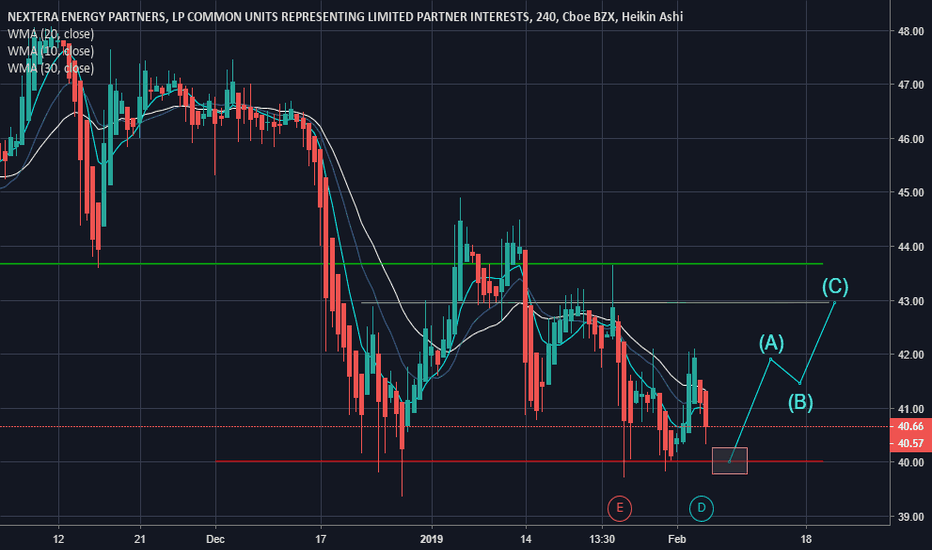

NEP -- bottom of rising channel vs. top of declining channelI am starting a position on NYSE:NEP on three thoughts:

The company should be able to resolve its financing issues.

The stock pays a hefty dividend (14.6%)

I expect the gently rising intermediate term trading channel to remain active, and the short-term, declining channel to get broken.

Somewhat balancing this view is the concern that a significant dividend cut may be approaching, if the company exits its existing Convertible Equity Portfolio Financings (CEPFs), which total almost $4.6B vs. a market cap of less than $2.2B. NYSE:NEP used 70% stock and 30% cash to retire the first of these contracts. Some of the remaining ones would allow up to 100% stock. This raises the prospect of the share count tripling as the CEPFs get retired. In that case, the dividend expense may be more than the company can manage, forcing a significant cut.

But I am looking to gradually shift my "energy" exposure from the current focus on oil and gas producers towards renewable energy and NYSE:NEP may present an opportunity to start this process at an attractive valuation.

All in all, I am giving this a try, but I will be quick to exit this position, if the green trading channel were to get violated to the downside.

NEP trade ideas

NextEra Energy / NEE vs. NEPRenewable energy investments are in high demand by many investors, but many of these companies aren't very profitable yet or are unattractive due to other fundamental issues. NextEra Energy and NextEra Energy Partners are outliers, however, as they are highly profitable while also providing a growing income stream for their owners. In this report, I'll show why I believe that NextEra Energy Partners, LP is the significantly more attractive pick at current prices, relative to the mother entity NextEra Energy, Inc

Renewable energy is in high demand around the world. Countries, corporations, and even individuals are spending heavily to increase the generation of electricity via hydro, solar, wind, geothermal energy, and so on. Many investors also want to invest in this macro megatrend, but not too many investment choices seem suitable for that. Many companies in this space are either not profitable or trading at very elevated valuations. Some have been clear bubble stocks in the past, along with many electric vehicle stocks that were also hyped up during the pandemic, which didn't work out for investors. In order to decide whether NEE or NEP is more attractive for investment today, we'll look at a couple of factors that investors might want to consider when making an investment decision.

Both companies are marketed as renewable energy investments, but their actual exposure to renewable energy is very different. NextEra Energy Partners is highly exposed to renewable energy, as that industry contributes the vast majority of its revenue and profit: The company reports that around 80% of its revenue were created with its renewable energy business, both in the most recent quarter and in the Q1-Q3 2022 time frame. By contrast, around 20% of NEP's revenue was generated by its pipeline services, which could be called a hydrocarbon or "old energy" business.

NextEra Energy Inc., on the other hand, is not as heavily exposed to renewable energy. NEER, NEE's renewable energy business unit, contributed just $1.6 billion of the company's overall revenue of $6.7 billion during the most recent quarter, or 24%. The majority of NEE's revenue is contributed by Florida Power & Lighting, a regulated electric utility. FPL has some renewable energy assets as well, but also uses non-renewable power assets for electricity generation on top of offering distribution etc. Overall, that makes NEE a less renewable-focused company relative to NEP. That does not have to be a bad thing per se, but for an investor that seeks to add renewable energy exposure, NEP with its ~80% exposure seems more suitable than NEE, which is more comparable to a typical regulated electric utility.

A stock's valuation should always be considered when making investment decisions. Today, NEE trades at 28x this year's expected net profits, using the midpoint of management's guidance range. That's a pretty high valuation for an electric utility, and explains why NEE only receives a Valuation Score of F. Meanwhile, NEP is trading at just 8x CAFD today, which translates into a cash flow yield of 12.5% (versus an earnings yield of less than 4% for NEE). Not surprisingly, NEP has a way better Valuation Score of C+. NEP's valuation is thus not perfect, either, but easily outclasses the valuation NEE trades at. For those that prefer to look at net profit for both companies, although one can argue that cash flow is more telling for an LP like NEP, NEP looks way cheaper than NEE, as NEP's forward earnings multiple is 13.5 -- less than half as much compared to the valuation NEE trades at, despite NEP's better growth. Both companies have enjoyed healthy growth in recent years. During the most recent quarter, NEP grew its EBITDA (earnings before interest, taxes, depreciation, and amortization) by 13% year over year, while CAFD (cash available for distributions) grew by an even better 17% year over year.

NEP continues to add new assets regularly, which drives its growth, although organic growth via rate increases and output optimization also plays a role. Overall, NEP isn't very large yet, with a market capitalization of $7 billion. An acquisition worth a couple hundreds of millions of dollars is thus enough to move the needle -- that's not true for NEE, which is valued at around $170 billion. Only very large takeovers or new projects move the needle for NextEra Energy, Inc.

NEE forecasts that its earnings per share for 2022 will total $2.85 (final results have not been released yet), which would be up by 12% year over year. For a large electric utility, that's still pretty strong, but it's not as exciting as the growth that NEP has been delivering. Going forward, that should hold true as well. NEE is forecasting earnings per share growth of 7% for 2023, while EPS forecasts for 2024 and 2025 stand at 9% and 7%, respectively, using the midpoint of the EPS guidance range for each respective year.NEP, meanwhile, will likely deliver double-digit growth going forward, at least if management is correct. The company forecasts that its cash available for distribution run rate will be around $820 million at the end of 2023, which would be up from $730 million in 2022, which makes for a 12% increase. While management has not given out guidance numbers for 2024 and beyond, the higher growth in 2023, coupled with the fact that driving meaningful inorganic growth is easier as smaller acquisitions can have a larger impact, make me believe that NEP has a good chance of growing faster than NEE in 2024 and 2025 as well. That also impacts the dividend growth rate, which gets us to the next point.

NEP - decent short term opportunityPublishing an update to an unsuccessful projection with NYSE:NEP last month. It was sitting at the 200MA and it's most recent drawdown had triggered a fear signal. These are less common in the utilities sector, which made it look like a decent contrarian opportunity. Throughout the remainder of March we saw a rotation out of safety sectors like utilities and staples into growth sectors like tech and discretionary, and NEP fell another 13% (wicking below where I would normally place my stop loss).

This is an interesting price point for NEP. It's at the center of its long term channel, with the lower band of the channel historically being tested during broad market drawdowns. Earnings are coming up this month and NEP has a history of slight increases after both earnings beats and misses. We see a recent lower low (not good) but bullish divergence between RSI and price (good). Additionally, when a major support level like the 200MA fails that level typically becomes overhead resistance, so any favorable opportunity here will likely be brief.

While NEP and utilities may experience continued downtrend if the broader market continues to favor growth, an entry here with profit taking at the 200MA will represent a good opportunity to accumulate. I only follow this strategy for positions that I plan to hold for the long term. The next major support level below this is ~$52.50

NEE XLU

Short trade on NEPNextEra is a clean energy company with interests in wind and solar projects across North America.

The stock showed a lot of strength for several months, but has now become a broken leader.

NEP broke down below the previous breakout level (white dotted line on chart) and below its 200-day moving average.

The short-term rally in the stock now gives a low-risk place to sell the stock short and bet on a continued move lower. the 50-day and 200-day moving averages, along with the previous resistance level near the $77 mark, should act as resistance.

I'm working a stop at 77.80, just above the swing high.

Diamond Top FlagExperimenting (o: and could go either way. Most would consider this a bearish signal..

I do not see a lot of the diamond tops...I have seen a few as of late.

I am curious to see where this one goes. These supposedly are not seen often.

It is often a bearish signal but not always and occurs after a considerable uptrend. Can just signal a retracement

Just an observation

V Bottom Symmetrical TriangleHas broken out of V bottom and topped prior high. Folks do not think of this one when they think of solar

Targets 2 are 103.5 to 115. Target 2 is usually long term so my focus is on targets 1. As a rule, target 2 is hit after a pullback and later on down the road.

NEP is overbought today on RSI daily set at 9/80 and 30. It is not overbought using these settings on weekly and monthly..not yet. Overbought conditions can go on for a while and it subjective. I do take note of it and keep an eye for a pull back when I see a security is overbought in any time frame.

NextEra Energy Partners, LP acquires, owns, and manages contracted clean energy projects in the United States. It owns a portfolio of contracted renewable generation assets consisting of wind and solar projects, as well as contracted natural gas pipeline assets. The company was founded in 2014 and is headquartered in Juno Beach, Florida.

Not a recommendation

Plans are a good thing to have. Planning when to buy and when to sell, where your stop will be. I write down where the idea came from prompting me to buy the security. At the end, I write down my proifit margin and what I can do to improve. I also write down the pattern I used to trade it and take a snap shot of the chart the day I bought it and the day I sold it.

Having a plan helps you keep your chips. It helps you learn from your mistake.

V Bottom Overbought on Daily RSIHas broken out of V bottom and topped prior high. Folks do not think of this one when they think of solar

Targets 2 are 103.5 to 115. Target 2 is tough in this market so I did not put it on chart. As a rule, target 2 is hit after a pullback

NextEra Energy Partners, LP acquires, owns, and manages contracted clean energy projects in the United States. It owns a portfolio of contracted renewable generation assets consisting of wind and solar projects, as well as contracted natural gas pipeline assets. The company was founded in 2014 and is headquartered in Juno Beach, Florida.

Not a recommendation

NEP 1D 200EMA TRAILING STOP LOSSHow can I use Exponential Moving Averages (EMA) to trail your Stop Loss?

The exponential moving average provides us with great areas of dynamic support and resistance levels. This information is especially useful for traders that are placing stop loss (SL) orders.

Rather than using static levels for your stop loss, you can trail your SL above/below a relevant EMA. As an aside note, make sure you always use a buffer for your SL to account for the inevitable false breakouts.

Here is an example:

Next Era Partners : A solar & wind yieldco run by the best.Next Era partners is a solar & wind yieldco run by Next Era Energy $NEE - which is beginning to yield large returns on the scaling properties of solar and wind energy. Expect these guys to continue to be extremely effective in the wholesale electricity markets. Pays a handsome dividend plus capital accumulation is all but guarunteed as we march foward with decarbonization in the United States.

Clean energy utility subsidiary with explosive growthNextera Energy Partners is a subsidiary of NEE - Nextera Energy which just hit a new high. They are well capitalized, are growing EPS exponentially, and have a high dividend at a low payout ratio to boot. Some insider buying is a nice kicker. This looks extremely undervalued at this level. It is a VERY long term play (possibly lifetime).

Disclaimer Note: I will only share the best ideas I have, simply because I want to help others, as no one has helped me. After many years of study I believe I understand the markets well. My personal goal is to save enough in the next 10 years so I can have some retirement time before I am dead. I hope this information can help others as well.