Will this stock ""NET"" you a nice return?📰 Cloudflare (NET) — Technical Overview & Breakout Strategy

Ticker: NET | Sector: Cybersecurity / Edge Computing

Date: July 26, 2025

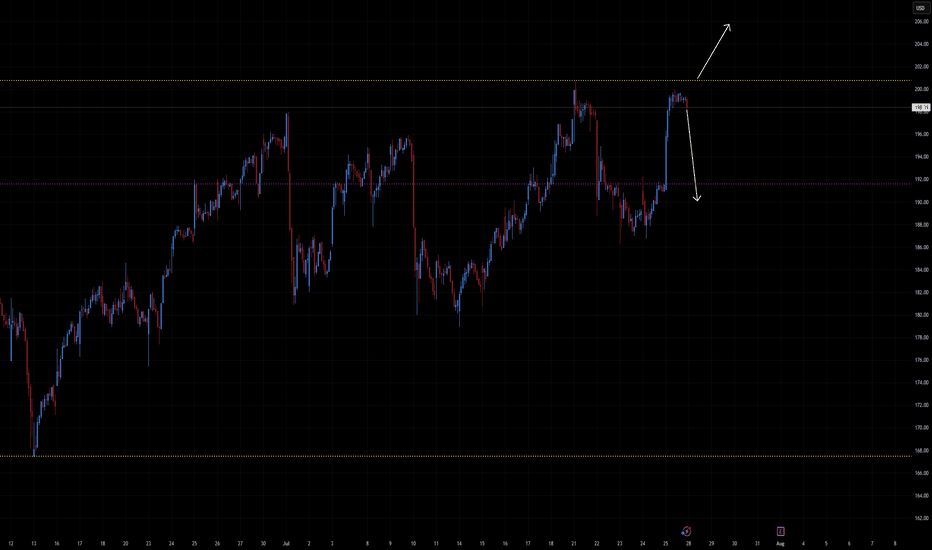

Current Price: ~$198

⚠️ Context: Past Red‑Candle Sell-Offs

NET has experienced sharp downward reversals often signaled by large bearish engulfing candles, especially during pullbacks from the $200–$205 range.

These sell-offs typically occurred with elevated volume, triggering destruction of short-term support and dragging price toward $185–$190, followed by consolidation and eventual bounce.

Those breakdowns often led to retests of the $190 support zone, with range bottoming and short-covering rallying price back toward $200+.

🧰 Current Technical Set-Up

Price is consolidating just below its 52-week high near $200.8, forming a tight range between $190 support and $200 resistance.

Moving averages:

50-day MA ~$193, 200-day MA ~$188 — all indicating bullish trend alignment.

Investing.com

Technical ratings classify NET as a Strong Buy on both daily and weekly timeframes.

🔍 Support & Resistance Levels

Support Zones:

Primary: $190–$192 (recent consolidation base)

Secondary: $185 (recovery low after last drop)

Resistance Zones:

Immediate: $200–$202 — near all-time highs

Major Breakout Target: Above $205–$207 opens upside extension

✅ Bullish Breakout Scenario

Trigger: Clear close above $202, especially with strong volume

Targets:

Short-term: $210 → $215

Extended: $220+ if breakout sustains and earnings beat arrives

Supportive Thesis: Rising demand for cyber‑security, expanding AI tools (e.g. pay-per-crawl, bot protection), and expansion into media and content creator segments. Cloudflare maintains strong institutional accumulation metrics.

❌ Bearish Breakdown Scenario

Trigger: Fall below $190–$192 zone

Targets:

First: $185

If momentum continues: $180 → $175

Risk Drivers: Overbought pullback after extended run-up, profit-taking, or broader tech selloff. Large red candles in the past preceded rapid downward moves.

📊 Summary Table

Outlook Trigger Level Target Zones Technical Notes

Short-Term Bull Above $202 $210 → $215 Breakout from high consolidation zone

Short-Term Bear Below $190 $185 → $180 Overbought exhaustion, volume decline

Long-Term Bull Sustained > $205 $220 → $230 Continued AI/protection tailwinds

Long-Term Bear Clear break under $190 $180 → $175 Broad rotation, failed breakout

🧠 Viewpoint Summary

Cloudflare is currently consolidating just below all-time highs after a strong year-to-date rally. The stock remains technically strong, but recently stretched indicators suggest potential for near-term pullbacks. A breakout above $202+ could unlock further upside, while a drop below $190 might trigger a retest toward lower support zones.

Given Cloudflare’s expanded role in AI infrastructure and cybersecurity, its trend remains attractive—but price action will be key to confirm direction.

NET trade ideas

$NET — Ascending-Base BreakoutNYSE:NET — Ascending-Base Breakout

• Seven-month ascending base resolving through $184-186 supply

• Volatility contracting; RS already at 52-w highs

• Cloud-security group remains a leadership pocket

📈 Trigger = daily close > $188.50 on strong volume

🛑 Risk line = < $175 (1.5 × ATR, below shelf)

🎯 Measured move targets $194 → $204, scope to $208-210

Keeping this front-row for follow-through.

#NET #BreakoutWatch #BaseBreakout #TechnicalAnalysis #Stocks #trading

An Internet Disaster - NET & GOOGL FallAs of Thursday, June 12, 2025, a significant internet outage has disrupted services across multiple major platforms, including Google, Amazon Web Services (AWS), Spotify, YouTube, Discord, and Shopify. Cloudflare acknowledged experiencing intermittent failures and noted that some services were beginning to recover, though users may continue to encounter errors as systems stabilize.

The root cause of the disruption has been identified as an issue with Google Cloud's Identity and Access Management (IAM) service, which affected various services globally. While Cloudflare's core services were not directly impacted, some of its services relying on Google Cloud experienced issues.

Imagine how far Net could've fallen if IGV / Cloud stocks weren't strong today.

Will Tomorrow’s Secrets Remain Safe?The financial world stands at a critical juncture as the rapid advancement of quantum computing casts a shadow over current encryption methods. For decades, the security of sensitive financial data has relied on the computational difficulty of mathematical problems like integer factorization and discrete logarithms, the cornerstones of RSA and ECC encryption. However, quantum computers, leveraging principles of quantum mechanics, possess the potential to solve these problems exponentially faster, rendering current encryption standards vulnerable. This looming threat necessitates a proactive shift towards post-quantum cryptography (PQC), a new generation of encryption algorithms designed to withstand attacks from both classical and quantum computers.

Recognizing this urgent need, global standardization bodies like NIST have been actively working to identify and standardize quantum-resistant algorithms. Their efforts have already resulted in standardizing several promising PQC methods, including lattice-based cryptography (like CRYSTALS-Kyber and CRYSTALS-Dilithium) and code-based cryptography (like HQC). These algorithms rely on different mathematical problems believed to be hard for quantum computers, such as finding the shortest vector in a lattice or decoding general linear codes. The finance industry, a prime target for "harvest now, decrypt later" attacks where encrypted data is stored for future quantum decryption, must prioritize adopting these new standards to protect sensitive financial transactions, customer data, and the integrity of financial records.

The transition to a quantum-safe future requires a strategic and proactive approach. Financial institutions need to conduct thorough risk assessments, develop phased implementation roadmaps, and prioritize crypto agility – the ability to switch between cryptographic algorithms seamlessly. Early adoption not only mitigates the looming quantum threat but also ensures regulatory compliance and can provide a competitive advantage by demonstrating a commitment to security and innovation. As technology leaders like Cloudflare begin to integrate post-quantum cryptography into their platforms, the financial sector must follow suit, embracing the new cryptographic landscape to safeguard its future in an era defined by quantum capabilities. Adopting post-quantum cryptography is essential, as merely using a different mathematical method does not ensure protection against quantum computing threats.

Cloudflare: ProgressCloudflare has demonstrated impressive upward pressure, surging more than 40% in just a few days. In response, we now consider waves 3 and 4 in green as finished and locate the stock in the final stretch of this impulse move, which should ultimately complete the orange wave iii. Given that key expansion levels have already been reached, we expect the wave iii high to form soon. Afterward, we anticipate a sharp wave iv correction, with downside potential toward the $122.68 support.

Cloudflare, Inc. Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Cloudflare, Inc. Stock Quote

- Double Formation

* ABC Flat Feature | Entry Bias & Subdivision 1

* (Consolidation Argument)) At 101.00 USD

- Triple Formation

* Trendline & Pennant Structure | Subdivision 2

* Numbered Retracement | Uptrend Bias | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

2/6/25 - $net - I'll fade on a pop, sidelines2/6/25 :: VROCKSTAR :: NYSE:NET

I'll fade on a pop, sidelines

- deepseek reflex pump indexer

- this company is impressive. underlying trends strong. will eventually grow into these mutliples

- but this mkt is getting a bit long in the tooth with 25-30x sales plays growing in the 20s. i'm in the mkt long enough to know... enjoy... but don't take your eye off the momo ball bc any miss, any change in risk appetite sends these things down 20-25% fast, and they're even hard to buy there, initially.

- so while i'm not fading a co where expectations/ beats are the norm... any pop of say >10%, ideally larger... i'm fading you as a hedge to stuff that's legit growing just as fast and valued at like 1/10th (*ahem* uber, *ahem* uber... and i'll even throw in btc, tho that's a different discussion).

so. hope you're right. but better be ready to face me on the otherside if this pops AH, otherwise on a dip, i won't be buying and just look to play elsewhere.

V

$NETNET PUT I SEE NYSE:NET PRODUCING LOWER LOWS IN THE NEXT COUPLE OF WEEKS so look out for lower lows if you have any calls but like I also stated it should be a couple of weeks I have puts that expire on the 31st of this month i may be right or I may be wrong let's just sit back and see plus there is bearish RSI divergence on the weekly

Cloudflare: ResistanceBy expanding the green wave 3, NET recently stretched above the resistance at $117.70. However, the stock only briefly surpassed this level before encountering selling pressure, which pushed it back to its early December levels. Primarily, we expect the price to overcome this resistance to complete the green five-wave structure and, thus, the orange wave iii. A still ongoing wave alt.ii correction remains a possibility in the context of our 30% likely alternative scenario.

Cloudflare (NET) AnalysisCompany Overview:

Cloudflare NYSE:NET , a global leader in cybersecurity, content delivery networks (CDN), and edge computing, is well-positioned to capitalize on increasing digital transformation and growing demand for secure, efficient cloud infrastructure.

Key Growth Catalysts:

Strategic AI Partnerships 🤝

Cloudflare’s collaboration with Microsoft Azure enhances its AI infrastructure, fostering innovation and bolstering its competitive edge in enterprise cloud solutions.

Zero Trust Leadership in Cybersecurity 🔐

Cloudflare’s Zero Trust platform addresses growing enterprise needs amid rising cyber threats and increased remote work adoption.

Advanced threat intelligence and access controls make it a leader in next-gen cybersecurity solutions.

Edge Computing & IoT Opportunities 🌐

Edge computing solutions are experiencing strong adoption, fueled by:

Growing demand for 5G networks and the IoT revolution.

The edge computing market is projected to reach $87.3 billion by 2026.

Cloudflare’s focus on reducing latency and enhancing network efficiency positions it to capture market share.

Global Expansion & Untapped Markets 🌍

New data centers in underserved regions expand Cloudflare’s global reach, improving service delivery and unlocking revenue opportunities in untapped markets.

Investment Outlook:

Bullish Stance: We are bullish on NET above $90.00-$91.00, supported by strong positioning in AI, cybersecurity, and edge computing, coupled with robust global expansion strategies.

Upside Target: Our price target is **$145.00-$150.00

Technical Analysis on Cloudflare (NET)Cloudflare ( NET ) experienced exponential growth between 2020 and 2021, followed by a sharp decline in 2022. This decline halted around a support level at approximately $40, which has been tested multiple times as a key level.

Recently, the stock broke through a significant volume area, also surpassing a key resistance level that had been tested multiple times in the past.

Bullish Scenario

Currently, it appears to be in a retest phase. If this level can hold as new support, the stock could continue its upward trend, with an initial target around $130.

Bearish Scenario

If the retest fails, as it did in April 2024, the stock may retrace toward the POC area, located around $60. A move below this key level would increase the likelihood of a further decline toward the critical $40 support, previously tested multiple times, where it could attempt to stabilize once again.

longIt's very risky now.

It might have bottomed near term at 1.8834/36 and managing to rally beyond 1.90 again. And if someone expects this, he may not be wrong because stochastic made a positive cross, a doji plus a bullish candle but thats not too enough.

Someone else might come.. and say no, It's going down. and he also has good reasons. Why? GBPUSD almost touch the 1.8967-65 resistance, and it might be a place to find plenty of sellers. Also the bullish candle didn't close above 1.8953 bearish candle open. rather closed at 1.8946

All in all..Bullish trend is not confirmed, it has to make a close above 1.8967, things are pretty much trapped within 1.8834/36 low / bottom and 1.8965/67 high / top. And only IF bears enter to take control now and push prices lower again, most likely we will break the 1.8834.

I am staying out until either side is broken.

$NET - Let's go! NYSE:NET Cloudflare looks good. It is squeezed between the two VWAPs. The lower VWAP acts as a support and upper VWAP acts as a resistance.

I added more on this pullback. Once it closes above the upper VWAP, I believe it can launch to the $96 to $100 area. 🚀

When Cloudflare moves, it moves fast.

Targets are in the chart.

As always, I share my opinions and trades. I'm not suggesting anyone follow my trades. You do you.