NKE trade ideas

NKE 7/22/2022Nothing but net for the Bears. Swoosh.

Please see my original analysis.

NKE Daily Chart analysis

Since seeing the Death cross signal appear on the Daily chart, NKE has systematically been broken down by the Bears.

Price broke down from a Distribution stage.

The Bears followed by break thru two Support areas and turning them into Resistance: 139.10 & 121.20

Price has made a series of lower highs and lower lows to confirm the Downtrend.

It is also rejecting the 50ema, which is acting as Dynamic Resistance.

NKE is in extreme bearish conditions.

I will continue to look for short entries.

Since NKE is trending (currently in a Downtrend), I will look for short entries at areas of value: Resistance and/or Dynamic Resistance areas.

Currently, price has pulled back to the 50ema Dynamic resistance area.

We have Bearish price rejection at this resistance.

We also have an Overbought Stochastic reading.

We’ve been presented this same opportunity under the same conditions 3 times now with this one being #4: Downtrend + Pullback to 50ema + Overbought Stochastic

This is my cue to enter trade short

Entering trade short.

Entry: 109.13

Stop loss: 117.30

Target: 88.86

NKE - SHORT TERM BULLISH SCENARIONike, Inc. is the world's largest supplier of athletic shoes and apparel and a major manufacturer of sports equipment. The company has a great history and is one of the most recognizable brands in the world.

Since the price reached an all-time high in November 2021 the stock tumbled more than 50 %

Possible short-term buy in the price channel.

Re-test of the support level of $80 is expected and, that will provide a better risk-reward ratio for the bulls with a target of the $ 100 resistance

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Nike is the New K-Swiss? Sheesh! A reach, or plausibly true?Well honestly, seeing that Nike's chart only exciting moment was during the bull run of Covid-19, I can only make the assumption that maybe that was the peak of Nike's capitulation.

Nike seemingly isn't the global sports fashion it used to be as sports are becoming the 2nd preference for entertainment nowadays. Let's be honest, you're excited about the game because of the social reward it brings.

The pandemic for sure snuffed that.

Kids love tablets. Kids love Fortnite. As a matter of fact everybody loves video games and social media, as the human game moves from social to individual based lifestyles. We're moving into a main character world society.

So I see Nike either becoming a pure fashion house which is crazy, or just becoming a ranging chart eventually priced to hit zero as Nike fades away.

I think for any of these legacy brands that can't keep up with a static high quality product that stands the erosion of time. Look at Hermes, the pricing on that stock is ridiculous, with neutral technical readings.

What do you think?

Green, potential growth - Nike acquires supply chain integration that

overlaps reseller industry while maintaining

green business model. A new shoe tech maybe . But what tech can nike implement into its approach that can really groundbreaking without setting a new pricing model for its products?

Yellow - Nike is still cool but can't seem to

shake new innovations by competitor

entering the space. might get stuck in a

outdated fashion model as 2 - 3 new generations

of humans entering grade school might think

nike is for lames. thats if kids even care about streetwear at

that point. Let's not forget with any trend, they end or restructure itself.

Trends are subjective to value by herd mentaility.

Red- Nike becomes the new K Swiss. I think this will also

correlate into the new interest of the incoming generations

whom all seem to be or will be metahumans.

generation meta. the generation that will only see value as intrinsic, but that's a maybe and very

speculative. Nike is only seemingly popular in social environments where it reigns supreme. The kids only like dunks.

Jordan branded nonndurables are just ehh.

Honestly when it comes to apparel brands, personally I don't see myself engaging any non durable seriously.

PS: Had to republish due to House Rule Violations.

NKE 6/5/2022NKE

Tighten up those laces. NKE making a run downhill

1) NKE’s uptrend came to a holt when it approached high of 175. Price attempted to make a second run at 175 failed. Price has now created a Double top pattern and resistance at 175 area.

2) Price has fallen to support area at 139. It attempts to bounce but can only move-up to 147. Price has started to build-up between 139-147 with a possible Double Top pattern above. There is also a Death Cross between the 50 & 200 ema signaling the bearish conditions. This was the initial entry to short trade.

3) Price breaks down from build-up at support. Both Double Top pattern and Distribution stage are confirmed.

4) After breakdown, price pulled back to previous Support looking to turn it into Resistance. This was opportunity to enter trade short if you missed entry at build-up. See #2

5) Price successfully turns previous Support area into Resistance by bouncing off and making a lower low. This move also confirmed NKE entering Downtrend.

6) After making lower low and falling to 103, price pulls back to previous low of 120 with the 50ema also acting as Dynamic Resistance. Currently, we also have an Overbought stochastic signal. With a Downtrend confirmation, a pullback to resistance, and an Overbought Stochastic, this is my cue to enter trade short.

Will be entering trade short.

Entry: 120.95

Stoploss: 130.38

Target: 91.00, +24.65%, 3.1 RR ratio

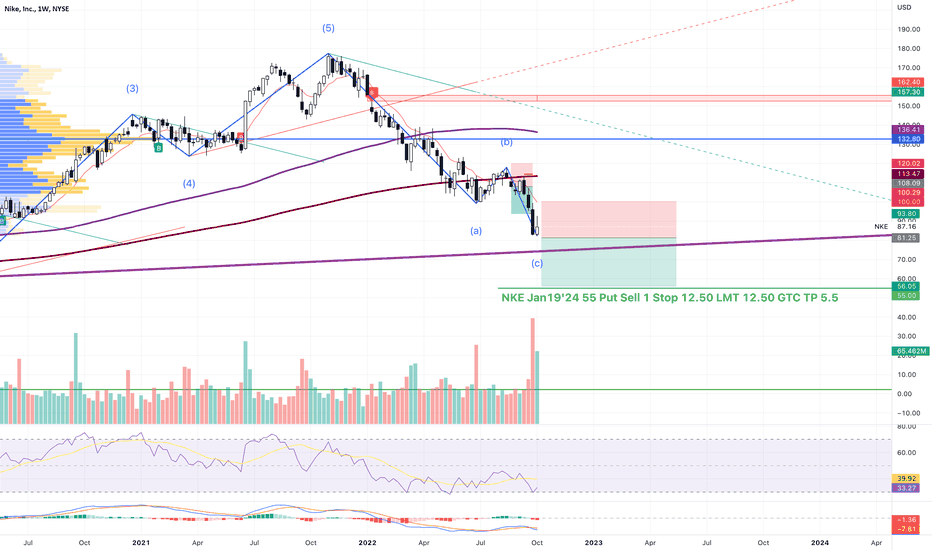

Elliott Wave View: Nike (NKE) Incomplete Bearish SequenceNike (ticker: NKE) shows incomplete bearish sequence from the all-time high 11.5.2021 high as well as from 3.30.2022 high. The ideal and minimum target for this bearish sequence is around 77. The right side therefore remains to the downside and rally should fail in 3, 7, or 11 swing.

Near term, the Elliott Wave view on Nike (NKE) suggests that cycle from 9.13.2022 high is in progress as a 5 waves impulse. Down from 9.13.2022 high, wave (1) ended at 94 and rally in wave (2) ended at 99.89. Nike then resumed lower in wave (3) with internal subdivision as another impulse in lesser degree. Down from wave (2), wave 1 ended at 94.48 and wave 2 ended at 98.32. Wave 3 ended at 82.33, wave 4 ended at 86.20 and final leg lower wave 5 ended at 82.15 which completed wave (3). Wave (4) rally is in progress as a zigzag Elliott Wave structure. Up from wave (3), wave A ended at 86.47 and pullback in wave B ended at 85.25.

Final leg higher wave C is expected to complete at 89.5 – 92.12 area and this should end wave ((4)) as well. This is a 100% – 161.8% Fibonacci extension of wave A. From this area, the stock can resume lower in wave (5). Near term, as far as pivot at 99.9 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.

Nike Potential Buy From Current SupportI'm not a stock trader but when I see a stock at an overbought or oversold price, I just can't resist the temptation to analyze and if possible, catch some few pips in.

Nike has been on a solid downtrend since December of last year, 2021, we are currently seeing prize at a major support level which was tested in May 2020, we may see two things happen at this juncture; we may see a bearish continuation if our level of support is broken, the market may continue downward to point X(65.43) before an upward reversal or it may also sell further till point Y(49.99) which would bee a good price for buyers of this stock., nonetheless, we may see the market continue upward if it breaks the 99 dollars price level till at least point T(129.81).

NB: You may want to start looking for buy signals on the hourly timeframes at current support or signs of a break below structure.

a valuable oversold company!!! (Long)Strong consumer demand has been the main source of confidence in the world's largest economy in the post-pandemic environment. Even as the Federal Reserve embarked on its most aggressive monetary tightening cycle in decades, many economists argued that a soft landing was still possible, given significant pent-up demand for consumer goods such as shoes, clothing and cars.

But yesterday's report from Nike (NYSE:NKE) revealed that the strongest pillar of the US economy could be in jeopardy as consumers face a double whammy in the form of high inflation and rising interest rates. }}.

The world's largest sporting goods company told investors yesterday that it is grappling with a huge pile of unsold products, forcing it to offer aggressive discounts and squeeze margins.

On Thursday, the Oregon-based company said global inventories had risen 44% to $9.7 billion in the quarter ended Aug. 30. In North America, the company's largest market, they increased 65% compared to the previous year, mainly due to slowing demand and delayed shipments.

In this context, Nike will see its margins erode, falling between 200 and 250 basis points this fiscal year; the previous estimate was that margins would remain flat or decline by 50 basis points, at most.

The company's minimum considering targets on Wallstreet is $88 according to Tipranks. which the average cost of the shares is $114.

then we set the next objectives to follow according to the profitability of the company. (Let's go long).

Objectives:

tp1-$93

tp2-$103

tp3-$113

NIKE: Continuation of Bearish Movement Ahead, Short Opportunity?Hello Fellow Global Stock Investor/Trader, Here's a Technical outlook of NIKE!

NIKE has broken out of Ascending Broadening Wedge. Furthermore, The MACD indicator created a Death cross, indicating potential bearish movement ahead.

All other explanations are presented on the chart.

The roadmap will be invalid after reaching the target/Resistance area.

"Disclaimer: The outlook is only for educational purposes, not a recommendation to put a long or short position on the Stock"

NKE - Strong Uptrend ContinuationGreen line shows the dominant bullish trend, this extends back for awhile

White line shows apparent downtrend, with a nice falling wedge to allow for the breakout to the upside and hence continuation

I expect price short term to rise back to dotted orange line, this is shown with bars pattern

NIKE - BULLISH SCENARIOThe downtrend for Nike Inc seems to be over. The American sportswear company got huge support at the $ 100 price level.

The 1st,2nd, and 3rd resistance levels are located respectively at $ 118, $ 130, and $ 140

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.