NVO trade ideas

$NVO Accumulating long term compounder! - Previously, I have shorted NYSE:NVO when it was in $75-85 when moat was weakening and then went long around $58 to $75 for 40% on the long side. Everything is documented in my two posts.

- People are asking me if NYSE:NVO is cheap or not. After cutting guidance, I believe most of the estimates for EPS about NYSE:NVO are way off which would be revised downwards.

- At the same time, I believe NYSE:NVO has kitchen sinked their guidance because of new CEO transition which is very common in the publicly traded company.

- NYSE:NVO might not be cheap after cutting guidance honestly but not overvalued either.

- NYSE:NVO could be a dead money for some time 6 months, 1 year or 2 years who knows?

- But I know that weight loss industry in general is growing overall at least till 2030 and beyond.

- Some concerns I have is NYSE:NVO leadership is getting challenged by NYSE:LLY so it could be possible that NYSE:NVO might get lesser piece of the pie. However, overall piece is growing along with it so NYSE:NVO should continue to grow but at a lower rate than earlier.

- Net free cash flow should grow and company might return on investment to shareholders via share buybacks?

- Finally, I am buying NYSE:NVO in increments and have bought first lot of shares in $50.xx and will continue to add more if it drops more. I think NYSE:NVO can test 200 monthly moving average @ $35.

- I have marked the accumulation box in the chart for your reference.

Fib resistance + RSI bullish reversal After the bearish news earlier today, it seems like Novo has had its final capitulation.

There's a fib resistance + historical resistance dating back to '21-'22.

On the weekly, the RSI is also presenting a bullish divergence - although we may want to await the closing of this week to confirm this.

Taking into account strong fundamentals, analyst consensus, it seems like this stock is a BUY!

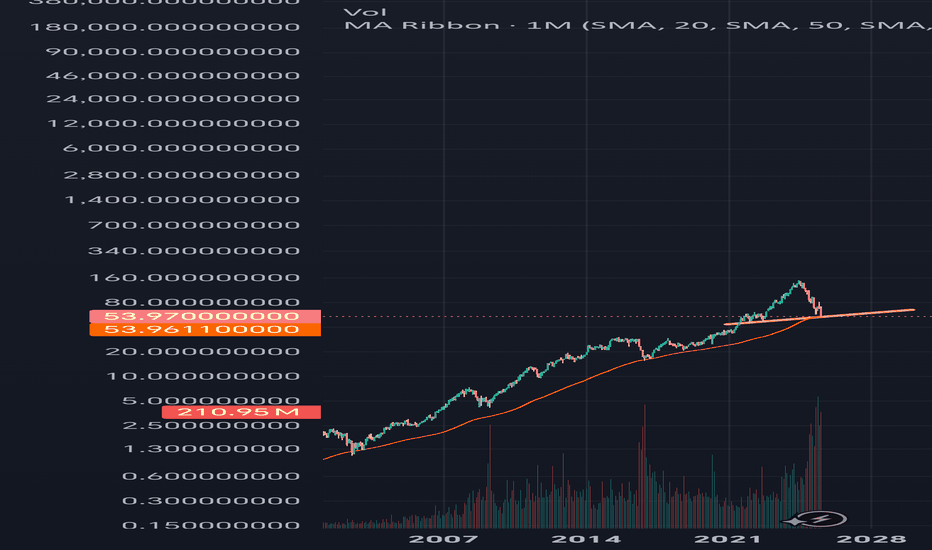

NVO going to zero? Just zoom out V.2While many are panic, just zoom out years and we can dee that it is at 30 years support trend line to the upside.

Weekly RSI printing bullishvergent, monthly at Oversold level.

Still fundamentally strong, If you love this stock, be excited.

(Last post chart didn't appear properly, I couldn't edit/delete)

Is Novo Nordisk a buy? Novo Nordisk $NYSE: NVO plummets 22% on July 29, wiping out $57.5B in market value!

Here's what's happening and how I see it.

Here’s the breakdown on why the stock hit its lowest since Nov 2022:

Slashed 2025 Guidance: Sales growth cut to 8–14% from 13–21%, operating profit to 10–16% from 16–24%. Weak U.S. demand for Wegovy & Ozempic, plus competition from cheaper compounded GLP-1 drugs (i.e. grey market), cited as key issues.

CEO Shake-Up: Lars Fruergaard Jørgensen out, Maziar Doustdar in as CEO effective Aug 7. Investors worry Doustdar’s limited U.S. experience could hurt Novo’s edge in its biggest market (57% of sales).

Competition: Eli Lilly’s Zepbound (20.2% weight loss vs. Wegovy’s 13.7%) & Mounjaro are stealing market share. Compounded GLP-1s from Hims & Hers add pricing pressure.

Here's what I see:

There's a strong bearish sentiment, but the stock is very underpriced.

Considering the current stock price, EPS is at an all-time high. This means investors get more earnings for their stock.

P/B, P/E, and P/S ratios are at the lowest level since 2017! This is despite revenue growth of 25%+ for 3 consecutive years.

Operating margins are still quite healthy.

The company still has a very significant share (over 50%) of the GLP1 drugs worldwide.

The valuation of this company is now at the best level of the last 7-8 years.

There might be more volatility ahead, but I see the recent price drop as an opportunity to buy a pharma giant at a big discount, giving investors a margin of safety.

Quick note: I'm just sharing my journey - not financial advice! 😊

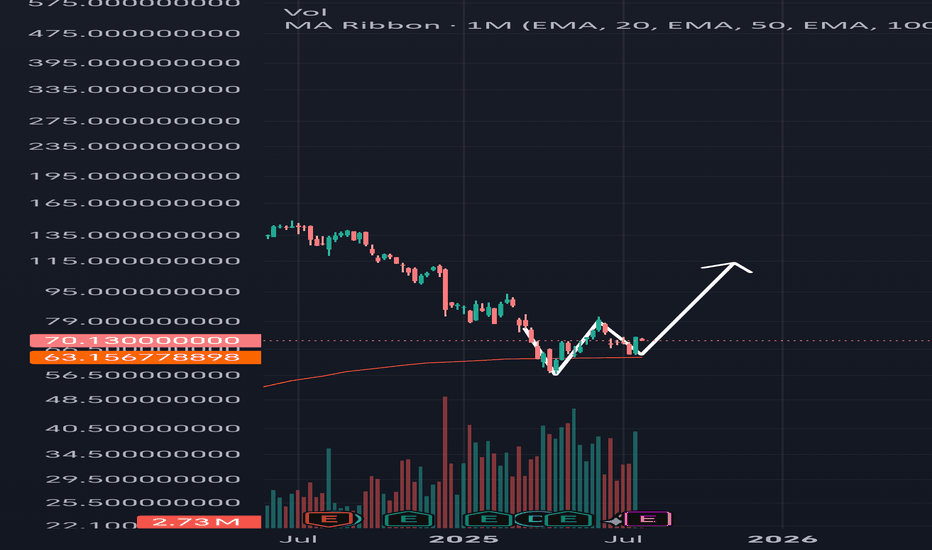

NVO Could Bounce Back Soon ?!NVO dropped hard (over 20%) mainly because of a legal issue. I think this is temporary and will get solved with time. The stock is now super oversold and sitting on strong support around $52–53.

• Entry: $52–54

• Target 1: $56.90

• Target 2: $66.40

• Stop Loss: $50

If the issue clears, we could see a strong rebound and possibly a full recovery of this drop.

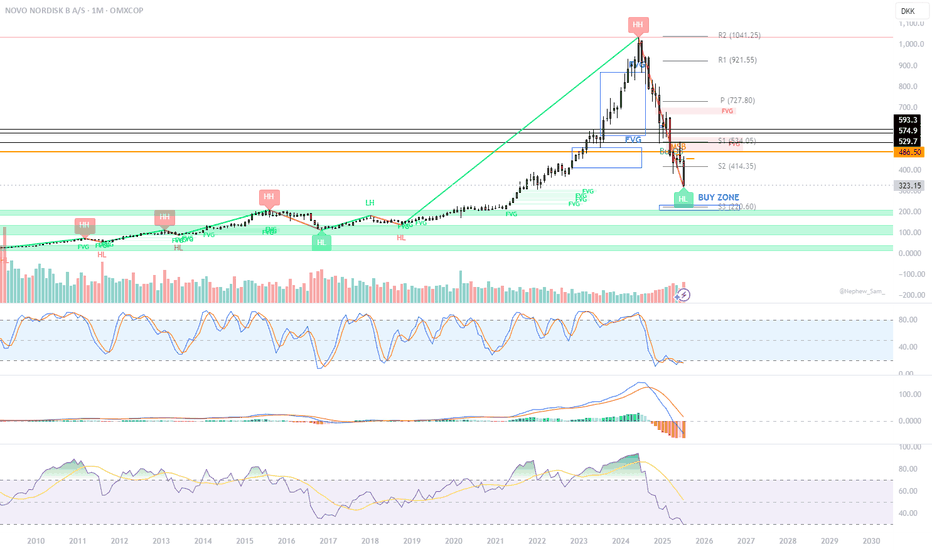

Novo Nordisk, generational buying opportunity? Novo Nordisk is currently experiencing one of the largest drawdowns in its history, primarily triggered by a downward revision of guidance for FY25 and FY26.

Focusing strictly on technical analysis:

For the first time, the monthly 200 EMA is serving as a key support level for Novo Nordisk - an area the stock has never approached in its previous history.

The long-term trendline, originating in 1989 and successfully tested three times since 1995, remains intact and is being approached once again.

Both support levels - the monthly 200 EMA and the long-term trendline from 1989 - are now converging in the same price area.

In addition, the latest twelve months (LTM) P/E has compressed to 13.8x, representing its lowest multiple in over two decades.

In the context of a highly valued broader market, Novo Nordisk is now trading at what can be considered a fair level from a purely technical perspective.

$NVO offers solid risk to reward for long term buyers! - I had previously called out that NYSE:NVO would have more pain to come when it was in $85-90s I have attached the link with this post for my reader's reference.

- Now, I am turning bullish on this name given these prices and compressed multiples for the growth prospects it offers.

Fundamentally,

Year | 2025 | 2026 | 2027 | 2028

EPS | 3.93 | 4.78 | 5.41 | 5.97

EPS growth% | 25.41% | 21.60% | 13.19% | 10.24%

For a quality name growing EPS > 20% deserves a fair forward multiple of 25.

| Year | Bear (fp/e = 15) | Cons. Base (f. p/e = 20) | Base (fpe = 25) | Bull Case (fpe=30)

| 2025 | $58.95 | $78 |. $98.25. |. $117.9

| 2026 | $71.7 | $95 |. $119. |. $143.4

| 2027 | $81.15 | $108 |. $135 | $162.3

| 2028 | $90 | $119 |. $149.25 | $179.1

As you can see, If you buy NYSE:NVO under $60 then you will be making money even if multiple remains compressed i.e bear case. Only thing you have to do is hold and returns would amplify once there is optimism back in the market which will lead to multiple expansion.

My fair value for NYSE:NVO for this year is $78 based on the conservative base case.

$NOVO_BNovo Nordisk has had a tough time over the past 13 months, with its stock falling significantly. The main reason is growing investor concern that the explosive growth in sales of Wegovy and Ozempic may be slowing down, especially as competition heats up — particularly from Eli Lilly. Just a few days ago, Novo cut its full-year growth forecast, which confirmed some of those market worries.

At the same time, they announced a leadership change. Current CEO Lars Fruergaard Jørgensen is stepping down, and from August 7, Mike Doustdar will take over. He’s been with Novo since 1992 and has led the company’s international operations with great success. He’s also completed executive education at Harvard, and he’s widely seen as a strong, action-oriented leader with global experience.

Looking at the chart the price has almost always swayed up and down within this tunnel. Occationally falling to the trendline bellow.

Now we are at the trendline below - Meaning we are at an absolute panic state. One og the biggest pharma companies in the world - who in a matter of 5 years will bring a weight loss pill to this world - is ready for a new start.

Still somewhat of a falling knife - so be careful. But keep an eye out for a speedy return upwards.

Why Did Novo Stock Fall So Sharply YesterdayNovo Nordisk shares plunged nearly 20–23% on July 29, 2025, marking its worst trading day since Black Monday in 1987.

Significant Downgrade of 2025 Financial Outlook

The company revised its sales growth forecast for 2025 down to 8–14%, from its prior guidance of 13–21%, and reduced expected operating profit growth from 16–24% to 10–16%. This adjustment was attributed to weaker-than-expected demand for Wegovy and Ozempic, and rising competitive pressures

#TheWallStreetJournal

I will start my accumulation using DCA, but will be happier to start buying this stock heavily from $47 zone.

trade with care.

I look forward to connecting with you

Novo Nordisk (Revised) | NVO | Long at $47.78**This is a revised analysis from February 5, 2025: I am still in that position, but added significantly more below $50**

Novo Nordisk NYSE:NVO is now trading at valuations before its release of Wegovy and Ozempic... From a technical analysis perspective, it's within my "major crash" simple moving average zone (gray lines). When a company's stock price enters this region (especially large and healthy companies) I always grab shares - either for a temporary future bounce or a long-term hold. While currently trading near $47 a share, I think worst case scenario here in 2025 is near $38-$39. Tariffs may cause a recession in the second half of 2025, so no company would be immune.

As mentioned above, I am still a holder at $86.74. However, I went in much heavier within my "major crash" simple moving average band and have a final entry planned near $38-$38 (if it drops there). My current cost average is near $55.00.

Why do I still have faith in NYSE:NVO ? Because no one else does right now, yet it generated $42 billion in revenue, $14 billion in profits, and has significant cash flow YoY. The company has a massive pipeline, despite Wegovy and Ozempic competition, and I think the market is undervaluing its position in the pharmaceutical industry.

Revised Targets in 2028:

$60.00 (+25.6%)

$70.00 (+46.5%)

$80.00 (+67.4%)

$NOVO_B updated channelNovo Nordisk has had a tough time over the past 13 months, with its stock falling significantly. The main reason is growing investor concern that the explosive growth in sales of Wegovy and Ozempic may be slowing down, especially as competition heats up — particularly from Eli Lilly. Just a few days ago, Novo cut its full-year growth forecast, which confirmed some of those market worries.

At the same time, they announced a leadership change. Current CEO Lars Fruergaard Jørgensen is stepping down, and from August 7, Mike Doustdar will take over. He’s been with Novo since 1992 and has led the company’s international operations with great success. He’s also completed executive education at Harvard, and he’s widely seen as a strong, action-oriented leader with global experience.

Looking at the chart the price has almost always swayed up and down within this tunnel. Occationally falling to the trendline bellow.

Now we are at the trendline below - Meaning we are at an absolute panic state. One og the biggest pharma companies in the world - who in a matter of 5 years will bring a weight loss pill to this world - is ready for a new start.

Still somewhat of a falling knife - so be careful. But keep an eye out for a speedy return upwards.

NYSE:LLY on the other hand has a bit of the same trend BUT… price has hit the top of the channel…

NOVO potential enter zoneThe stock is trading inside a major monthly “BUY ZONE” (DKK 280–325), which aligns with historical Fair Value Gaps (FVGs) from 2015–2018.

A Higher Low (HL) structure has formed, and as long as it holds, the long-term bullish structure remains valid.

Multiple FVGs have now been retested, suggesting a potential accumulation phase.

NVO going to zero? Just Zoom outWhile many are panicking, just zoom out for a few years, and we can see that it is at a 30-year support trend line to the upside.

Weekly RSI is printing a bullish divergence; monthly RSI is at an oversold level.

Still fundamentally strong. If you love this stock, be excited.

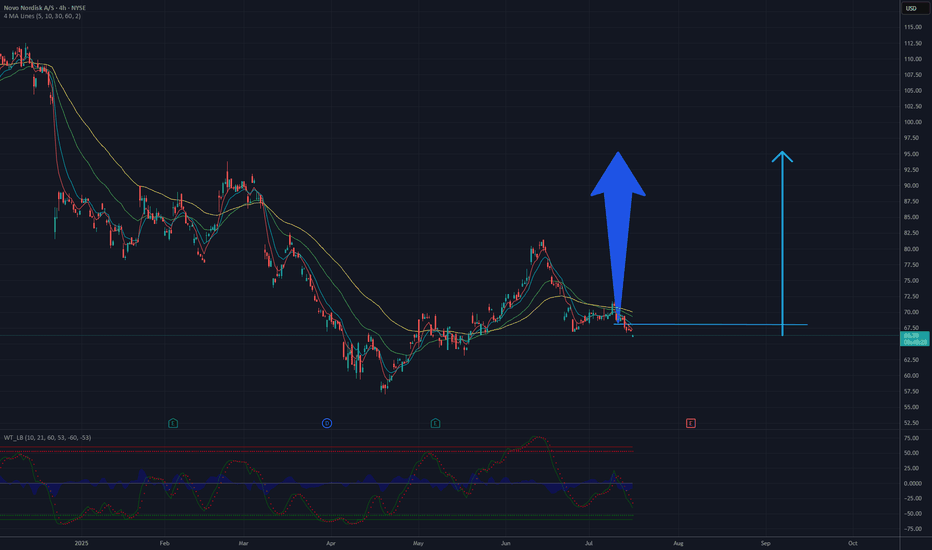

Potential Upside Move in Novo Nordisk Stock Toward the $90–$100 Based on the 4-hour chart of Novo Nordisk A/S (NYSE: NVO), the stock has undergone a strong downward correction from above $165, but is now showing signs of a potential technical bottom near the $65 level. Price action has stabilized, and oscillators indicate oversold conditions, suggesting a possible trend reversal.

The chart shows a short-term consolidation after a bounce, and the moving averages (MA 5/10/30/60) are converging — a setup that often precedes a bullish breakout. The $90–$100 area aligns with former support-turned-resistance zones, making it a natural target for a corrective upward move.

Conclusion: If the current momentum holds and the price breaks out of the local consolidation, a move toward the $90–$100 range appears likely as part of a broader rebound following the extended downtrend.

Potential TP : 90-95 USD