NVO trade ideas

NVO: Oversold, But I’m Staying PatientYes, NVO has pulled back hard — from highs near $148 to the mid-$60s, now trading around $68.33. While this selloff may look oversold on many levels, I’m still avoiding the stock for now.

The broader market remains in a downtrend, and with macro uncertainty still front and center, I’m not eager to jump in prematurely.

That said, I’ve highlighted a longer-term buy zone on the chart, with the upper band near $59.88 and the lower edge around $46.20. It’s a wide range, but it sits within a well-defined rectangular support area that I’d be comfortable scaling into — likely in tiered buys if we get there.

No rush here. Watching and waiting.

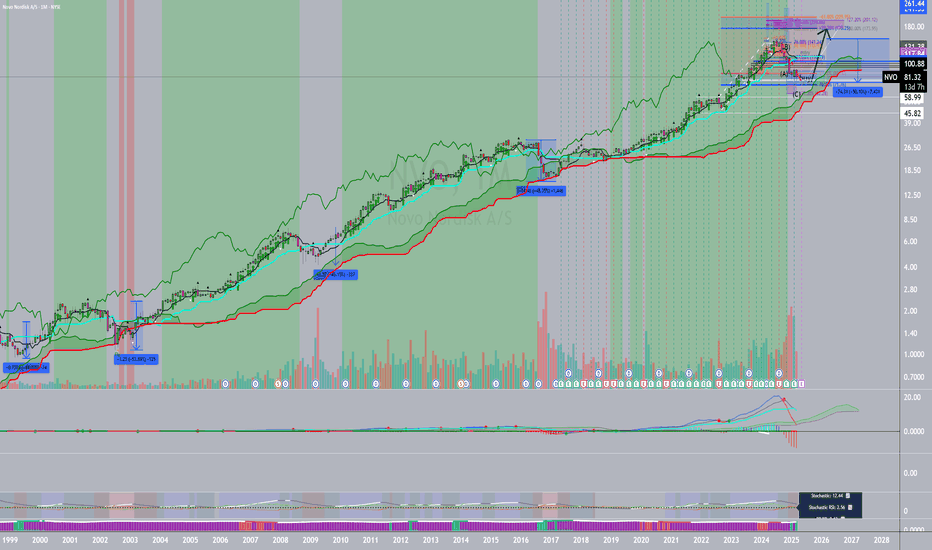

NVO, Rhyming with historical golden buy zoneUsing the Guassian Channel indicator on the monthly timeframe. We can see that in the past, after the price has significantly correct from its ATH of 50%+, price tend to reverse at the lower channel support(2times on chart) or at the upper support line ( 1 time on the chart)

Right now we are currently at the upper supprt trendline at $70

-Median line at 60$

-Lower line at 50$

Looking at the historical trend as a whole, I think we could potentialy reach the local bottom of this current correction.

My personall action.

Start buying at 70$, and we keep buying more if we go down to test lower trend line of the channel.

All I will go all in once the reversal price is confirmed.

3/27/25 - $nvo - obvious at $70... 10% size3/27/25 :: VROCKSTAR :: NYSE:NVO

obvious at $70... 10% size

- at btc conf in miami so have been hoping for a quiet week. well. whatever. another day in trumptopia. but alas, we can't tell the market what we want. so the game today is just don't make big mistakes and try and find interesting asymmetric oppties.

- i literally flipped my NVO after last post two days in and as it proceeded to rip into $80s thought "well shoot, at least i made $, which is the goal... but i paper hands that one"

- but we're back. even lower. $70.

- wegovey vs. ozempic... these 18x PE multiples r hitting that penjamin like it's going outta style.

- when i look at LLY, which is ostensibly the mkt's "favorite" in the GLP/weight loss category it's hard to ignore the fact that financials MORE OR LESS are similar and multiples are 2x higher.

- so while idk if tariffs, the euros who trade a bit more scared, greenland stuffs, GLP "share" question marks etc. etc. are affecting the day to day.

- but at nearly 4% fcf yield, ROICs akin to the biggest tech moats, orthogonal to US/chips correlation (nevermind the geo), drugs like this being secular winners (and these guys do have pole positions)... it's pretty obvious again.

- have started to play some of the 2027 ITM expires leveraged anywhere from 2 to 3-1 so i don't need to neck out. ideally we get one more flush to the mid 60s and i can really size this up. but honestly, this is a pretty obvious LT buy zone and i'll adjust the strike accordingly based on the ST day to day.

- what chu think anon? wegovey and chill?

V

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

3/12/25 - $nvo - Hey now.. mr. mkt. i'll buy some3/12/25 :: VROCKSTAR :: NYSE:NVO

Hey now.. mr. mkt. i'll buy some

- i'm the first to tell you, i think pharma is rotton to the core

- but let's play the game here, emotions r a PnL killa

- sub 20x PE for 20-30% GROWTH?

- 4%+ cash yields

- EU's biggest co (and btw that's great orthogonal exposure to US tech)

- healthcare "defensive", and you get growth here?

- looks like i'll be ST call buying to get exposure higher on this sell off... but would also consider adding this to my 1-3% book that i'd like to rent over the coming 3-6 months while we chop sideways.

thoughts?

V

We are flipping resistance into support?Hey traders! 📈

Looking at these chart.

It seems like we broke resistance and might be consolidating above it.

Classic retest or fakeout? 🤔

What do you guys think, are we gearing up for a move toward TP1, or do we have the momentum to push straight to TP2?

RSI is cooling off, which looks more like a healthy consolidation rather than weakness—could be setting up for a solid long-term move.

Let me know your thoughts! 🔥

I am cautiously calling the bottom on NVOIt might be a bit early to call this a bottom, especially given the unpredictable market, but I’m noticing a few key signals aligning:

The 8/21 curl following a double bottom

A break above the 50-day SMA occurring on a red day like today

Momentum shifting positive and being released from a squeeze

That said, stay cautious—this setup has tricked me before.

Opening (IRA): NVO March 28th 76 Covered Call... for a 74.50 debit.

Comments: Taking what amounts to a modest directional shot with a break even below the 52-week lows, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 74.50

Max Profit: 1.50

ROC at Max: 2.01%

50% Max: .75

ROC at 50% Max: 1.00

Will generally look to take profit at 50% max and/or roll out the short call if my take profit isn't hit by expiry.

Finally a stock I like...this one is a real dealFinally, an investment idea! (after how much doom and gloom?) — Novo Nordisk.

You will all be familiar with Ozempic, the Danish company’s flagship product and the reason so many celebrities, influencers, b listers and regular schmegular Americans are suddenly skinny. I ignored the stock for most of ‘23/24, because it was so expensive. I am still a value investor (for my sins) and I just didn’t see a lot of value there — it was priced in.

Imagine my surprise as I was thinking about “megatrends” (vom) for the year ahead — AI, data, 'zempy. Novo stock has fallen 37.80% in the last six months. And you know what that means…that’s a real deal!

Why is it a real deal? (Don’t you like booze stocks Eden?)

Ozempic is not going away. At this point it is synonymous with weight loss as “Uber” is to ridesharing or Google is to search.

Note this data per Barclays, from recently issued rx data in the US — Ozempic script issuance has grown +8.4%, while WeGovy slightly trails it at 7.4% — both owned by Novo. While Eli Lilly also makes a GLP, Novo is still the leader.

Strong guidance from management on sales — +16% - 24% — roughly implies revenue of $48bn for ‘25 and $57bn for ‘26…that’s a compounder.

America and much of the western world has an obesity problem. There is a clear incentive for governments to underwrite the drug because obesity has a clear social + fiscal cost on society — per UoA, the fiscal cost of obesity in NZ is at least $2bn¹.

People have an incentive to use Ozempic, because they are vain.

This is a nice hedge against the booze stocks I like so much. Benefit from both sides of the trade — buy booze at low teens multiples; buy Novo and benefit from lower drinking rates as there’s several studies that imply ‘Zempy reduces drinking.

I don’t want Ozempic, because I like to live the good life.

This does not mean the vast majority of people won’t use Ozempic. At the moment, one in eight Americans have used a GLP. That’s +334mn people. 40% of Americans are obsese.

There’s a Lollapalooza effect happening here — a bunch of incentives — vain people, governments wanting less obese people, the various side health benefits of GLPs, etc. I like when a lot of incentives are aligned because you’re relying on psychology rather than projecting numbers on an excel spreadsheet.

Novo has sold off recently due to a trial of its CagriSema drug missing expectations. Eyes on the prize, though — current GLPs, which still have plenty of market to saturate.

Eli Lilly has traded up in recent times, while Novo has traded down. The two tend to trade in lockstep so the disconnect is an opportunity to buy the world’s leading GLP maker at a good price.

Eli Lilly is the closest comp, but it trades at a 38x fwd multiple, while Novo trades at 20x — i.e. an almost 50% multiple discount (see chart). I like that too…

Note analyst recs on chart also…

This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

Buy Opportunity for NVONovo Nordisk A/S – Financial Summary and Outlook (2024):

Sales Growth: Up 23% in Danish kroner (DKK 204.7 billion) and 24% at constant exchange rates (CER).

Operating Profit: Increased by 21% (DKK 91.6 billion).

Net Profit: Rose 18% to DKK 72.8 billion.

Product Highlights:

Wegovy (Obesity): Sales surged 48% in Q3 (DKK 17.3 billion).

Ozempic (Diabetes): Slight sales dip but remains a key contributor.

Challenges:

CagriSema Trial: Missed expected weight-loss targets, leading to stock decline.

Outlook:

Adjusted sales growth forecast: 23%-27%; operating profit: 21%-27% (CER).

Focus remains on high-demand products (Wegovy, Ozempic) and R&D for future growth.

$NVO more pain ahead! Headed down to $46-55 - NYSE:NVO was one of the hottest stocks of 2024 is now facing immense challenges by other healthcare companies in weight loss drug.

- With weak results, it sets up for disappointment for 1-2 quarters. Quick turnaround in experiments isn't feasible and would need considerable time to show promising results.

- It's better to put it on watchlist, attend earning call however it is likely that it might underperform FY 2025 or alteast first half of FY 2025.

Novo Nordisk | NVO | Long at $86.74The Good:

NYSE:NVO expects its GLP-1 drugs Wegovy and Ozempic to soon come off the Food and Drug Administration's official shortage list.

Just reported better-than-expected net profit in Q4 2024, amid soaring demand for its obesity drugs.

Revenues for the Q4 2024 came in at $11.6 billion, up 30% compared to the same quarter in 2023.

From a technical analysis perspective, hovering near my historical simple moving average which may lead to a near-term price increase due to positive earnings

The Bad:

Slower growth in 2025 (16%-24% for 2025 vs 18%-26% in 2024).

Chart has been on a major run since 2020 and may be due for further correction.

Personally, the positives outweigh the negatives given the obesity drug demand. Thus, at $86.74, NYSE:NVO is in a personal buy zone.

Targets:

$96.00

$105.00

Final Puke in Process - Wave 5We are approaching a strong trendline support level which begain back in 2017. The stock is heavily oversold, RSI is in a descending wedge pattern. We are also approaching the golden pocket Fibonacci retracement which can provide additional support.

I expect a reaction at these levels and a breakout from the falling wedge pattern on the RSI. So far patience has been the best strategy, I do think this is the final Wave 5 of the correction and so this puke can continue a little further. It's hard to get the optimal entry on a falling knife, to play it safe you can await the wedge breakout with strong bullish volume.

Not financial advise.

NVO: A Strong Buy Opportunity for 2025 **NVO: A Strong Buy Opportunity for 2025** 🚀📈

NVO is shaping up to be a compelling buy for this year. The setup is there, fundamentals remain strong, and the market conditions could favor a significant move. Keeping a close eye on key levels—this could be one of the best opportunities of 2025.

Chart incoming on TradingView! 📊 #NVO #Investing #Trading #StockMarket

Novo Nordisk shares rise on fourth-quarter profit beat, Wegovy sales jump