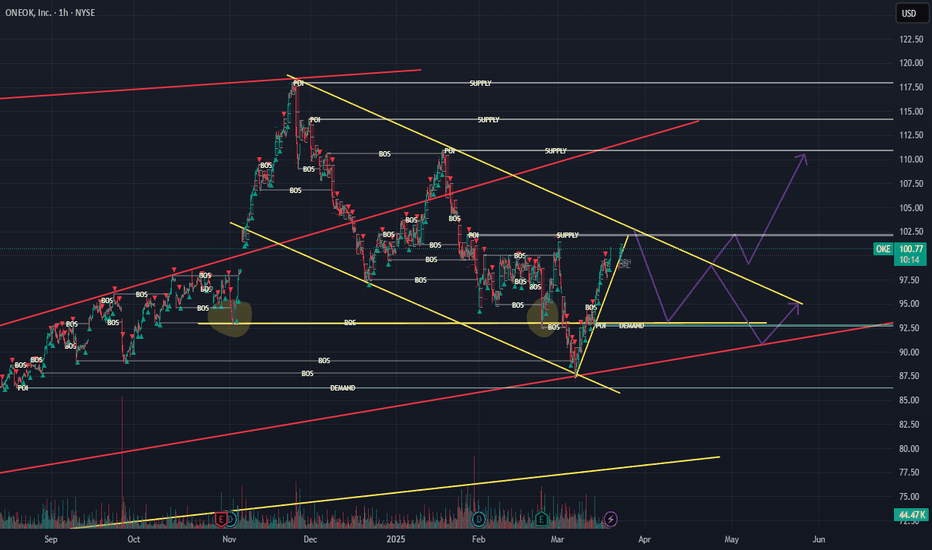

OKE Recovery in ProgressThe news cycle pushed the stock much lower than anticipated but seems to have recovered. Moving forward we can expect 2 scenarios with the stock price retesting long term trendlines or a continued rally fueled by increasing gas prices and Fed interest rate cuts.

The chart shows, in my opinion, 2 potential scenarios for the stock price.

OKE trade ideas

$OKE demonstrates solid long-term technical strength Technical Analysis

As of February 28, 2025, ONEOK Inc. (NYSE: OKE) is trading at $100.39. The stock has shown a bullish trend in the long term, while the short-term trend appears bearish. Key support levels are identified at $95.81 and $93.97, with resistance around $102.90.

The Relative Strength (RS) Rating has improved to 73, indicating enhanced price performance, though it remains below the ideal score of 80 or higher.

TradingView's technical analysis currently rates the stock as a 'sell,' noting that market conditions can change, as evidenced by a 'buy' trend over the past week and a 'strong buy' signal over the past month.

Fundamental Analysis

ONEOK Inc. operates in the Oil & Gas Operations industry with a market capitalization of approximately $63.21 billion. The company has a Price-to-Earnings (P/E) ratio of 20.4, Price-to-Sales (P/S) ratio of 3.2, and Price-to-Book (P/B) ratio of 3.4. The dividend yield stands at 4.02%.

Recent financial guidance for 2025 estimates net income attributable to ONEOK between $3.11 billion and $3.61 billion, with diluted earnings per share ranging from $4.97 to $5.77.

Analysts have set a 12-month average price target of $95.75, with estimates ranging between $83.00 and $111.00.

Validea's analysis, based on the Peter Lynch strategy, assigns ONEOK an 88% rating, reflecting strong fundamentals and valuation.

In summary, ONEOK Inc. demonstrates solid long-term technical strength and robust fundamental metrics. Investors should monitor short-term technical indicators and market conditions when considering investment decisions.

OKE: testing support?A price action below 69.00 supports a bearish trend direction.

Expect further downside potential for a break below 68.00.

The downside target price is set at 66.00 (just below its 50% Fibonacci retracement level).

The stop-loss price is set at 72.00.

Testing major support (see the black dotted trendline).

Downside price momentum supports the bearish trend direction.

Remains a risky trade.

ONEOK STOCK ANALYSISONEOK, Inc. engages in gathering, processing, fractionating, transporting, storing and marketing of natural gas. It operates through the following segments: Natural Gas Gathering and Processing, Natural Gas Liquids and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment offers midstream services to producers in North Dakota, Montana, Wyoming, Kansas and Oklahoma. The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, treat and distribute NGLs and store NGL products, in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region, which includes the Williston, Powder River and DJ Basins, where it provides midstream services to producers of NGLs and deliver those products to the two market centers, one in the Mid-Continent in Conway, Kansas and the other in the Gulf Coast in Mont Belvieu, Texas. The Natural Gas Pipelines segment provides transportation and storage services to end users. The company was founded in 1906 and is headquartered in Tulsa, OK.

i have a lot to say but imma keep it short

ps if price breaks that white level $45 its lookin screwed that aside im long

the orange levels are going to be levels where we will expirience influential resistance

no worries

that aside im looking at a list of cnbc top 10 stock picks and the big boys portfolios

started with dvn

from there im going to be looking at stocks in the same industry

and i will share my picks of stocks that will out perform those ones

new buffetology type cocktail you feel

SENNASEASON2022

Pullback FishingOKE is trading in an ABC Bullish pattern. Targets calculated by using the AB leg and fib levels. Targets are D.

Short interest 1.89% and NVI is high showing interest.

No recommendation, although I am adding to my position.

Estimated earnings 2-22.

PE 17.11 and EPS 3.43.

Dividend is 6.36%

ONEOK, Inc., together with its subsidiaries, engages in gathering, processing, storage, and transportation of natural gas in the United States. It operates through Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines segments. The company owns natural gas gathering pipelines and processing plants in the Mid-Continent and Rocky Mountain regions. It also gathers, treats, fractionates, and transports natural gas liquids (NGL), as well as stores, markets, and distributes NGL products. The company owns NGL gathering and distribution pipelines in Oklahoma, Kansas, Texas, New Mexico, Montana, North Dakota, Wyoming, and Colorado; terminal and storage facilities in Kansas, Missouri, Nebraska, Iowa, and Illinois; and NGL distribution and refined petroleum products pipelines in Kansas, Missouri, Nebraska, Iowa, Illinois, and Indiana, as well as owns and operates truck- and rail-loading, and -unloading facilities connected to NGL fractionation, storage, and pipeline assets. In addition, it operates regulated interstate and intrastate natural gas transmission pipelines and natural gas storage facilities. Further, the company owns and operates a parking garage in downtown Tulsa, Oklahoma; and leases excess office space. It operates 18,900 miles of natural gas gathering pipelines; 1,500 miles of FERC-regulated interstate natural gas pipelines; 5,100 miles of state-regulated intrastate transmission pipeline; and 6 NGL storage facilities. It serves integrated and independent exploration and production companies; NGL and natural gas gathering and processing companies; crude oil and natural gas production companies; propane distributors; municipalities; ethanol producers; and petrochemical, refining, and NGL marketing companies, as well as natural gas distribution companies, electric generation facilities, industrial companies, producers, processors, and marketing companies. The company was founded in 1906 and is headquartered in Tulsa, Oklahoma.

OKE: Trend Continuation, 14.53% Potential Profit!Description: OKE is trending higher and in an uptrend meaning that highs are getting higher and lows are getting higher. The uptrend line on the chart and the Trending Band Indicator (which measures trend) supports the Long Position.

Stats:

1. Ideal buy range: $52.6 - $54.2

2. Take profit: $60.69

3. Stop Loss: $51.4

4. Risk To Reward: 1 / 5

5. Accuracy Rating: 85%

OKE one of my favorite aristocrat stocksI've been an OKE shareholder for a couple of years now with an avg price of $61. This stock was destroyed at the onset of COVID. The demand for Natural Gas, Liquid Natural Gas and Propane remains high and OKE is one of the biggest pipeline owners in the USA. They have consistently paid their dividend and should look to restructure their debt. This is a great long term hold if you are looking for a great anchor stock for your portfolio.

One word of caution... If the Biden administration shuts down the DAPL (Dakota Access Pipeline), this could hurt OKE.