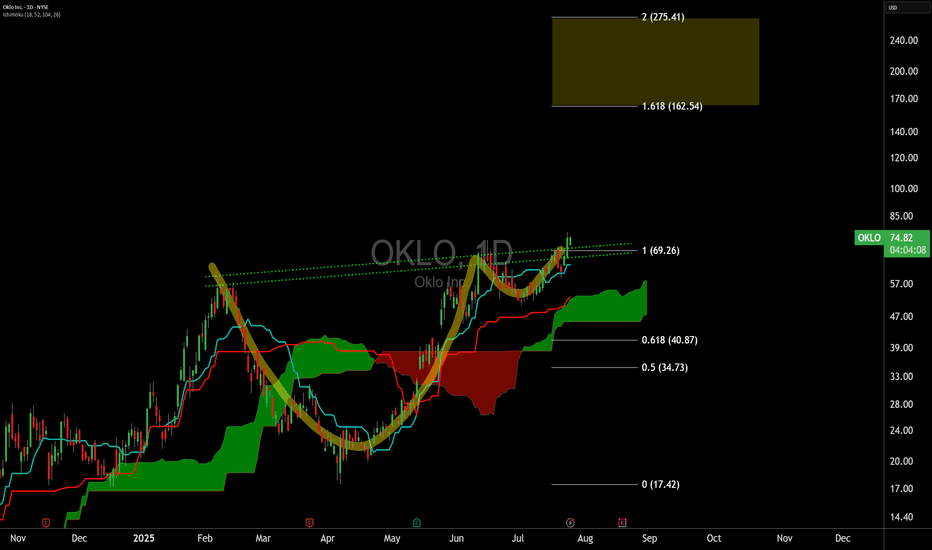

OKLO eyes on $72.37: Golden Genesis fib that should give a DIP OKLO going nuclear into a Golden Genesis fib at $72.37

Looking for a Dip-to-Fib or a Break-n-Retest new longs.

Most likely a few orbits around this ultra-high gravity fib.

.

Last Plot caught break and sister Genesis Fib

.

Older Plot caught the perfect Dip-to-Fib buys:

.

Hit the BOOST and FOLLOW to catch more such EXACT trades.

=======================================================

OKLO trade ideas

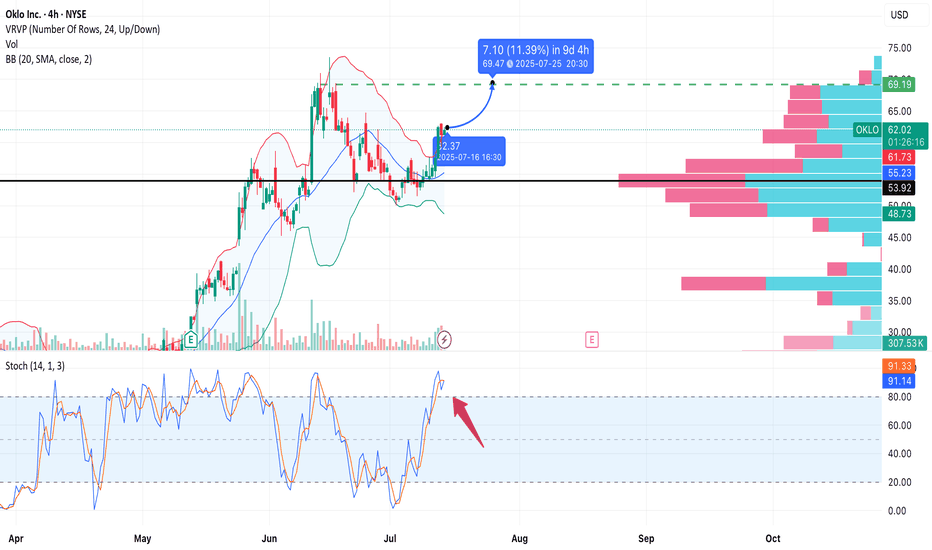

OKLO – Upside Potential Ahead of EarningsNYSE:OKLO

Type: Swing/positional

Timeframe: 4H

Style: No stop-loss, technically driven

Target: 69.50

Risk: Moderate (earnings volatility risk)

Overview:

Oklo is forming a bullish continuation pattern after consolidating above the 55.00 support area.

The price has broken above the Bollinger Band basis and reclaimed the 61.78 resistance zone.

Stochastic shows overbought conditions, but the trend remains strong.

The volume profile reveals a low-resistance zone up to ~69.50, offering clean air for upward momentum.

Entry Zone:

• Entry near 62.2 (market price)

• The setup remains valid while price stays above ~61.5

• Upcoming earnings (July 19) may act as a catalyst

Target:

• Take Profit: 69.50

Expected move: +11%

No Stop? Then Watch Closely:

Soft invalidation if price breaks below 59.50 (4H close)

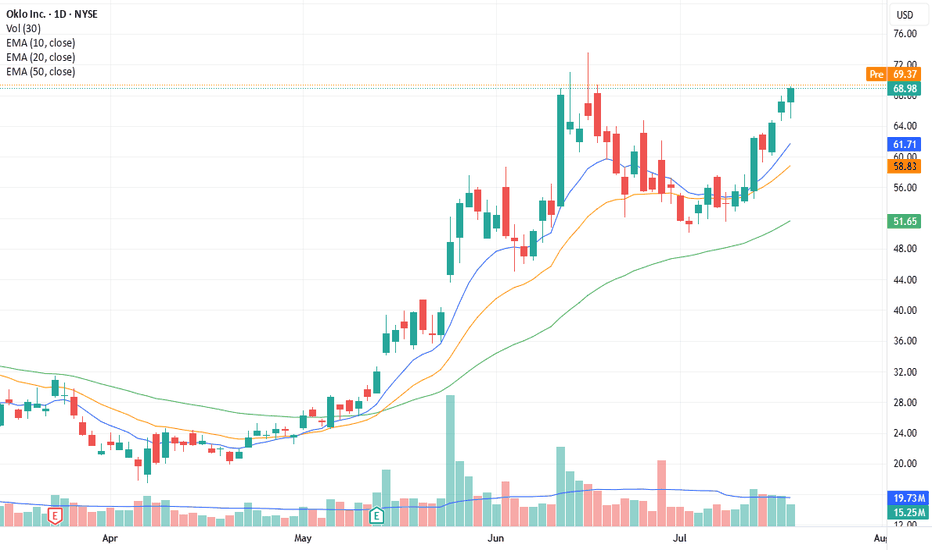

OKLO ($OKLO) — Consolidation After a Powerful Run: What’s Next?NYSE:OKLO After a +180% breakout earlier this year and a strong return above the $60–62 resistance zone, OKLO is now consolidating under $73.40. Let’s break it down 👇🔍 Technical Overview (4H chart)

• Breakout above key resistance ($59–62), which now acts as support.

• Price is consolidating in a bullish flag formation.

• Bollinger Bands are tightening — potential volatility ahead.

• Volume declining — market in a wait-and-see mode.

📉 Indicators:

• Stochastic Oscillator: curling down from 80+ zone — short-term exhaustion

• RSI: rolling over below 60 after peaking near 70 — momentum is fading

• Price Action: Still holding above support, but losing bullish strength📰 What drove the price to $55 (Feb 2025)?

• ✅ Wedbush sets $55 target, highlighting AI data center energy demand

• ✅ Q1 earnings: net loss narrowed to $0.07/share from $4.79/share

• ✅ Regulatory optimism: fast-track support for SMRs by U.S. government

📉 The following correction was largely technical (profit-taking after overextension).🚀 Why OKLO surged again to $73+ (June 2025)

• 🛡 $100M DoD contract for Aurora reactor on Eielson Air Force Base

• 💸 New capital round ($460M), backed by Bill Gates and Nvidia Ventures

• 📈 Wedbush upgrades target to $75, citing defense + AI synergy📐 What I’m Watching Now

Price remains above key support (~$61.8), but both RSI and Stoch are weakening. A breakdown below support may open the way for deeper correction — but volume will be the trigger.

📌 Break above $73.40 on strong volume could mark the next bullish leg

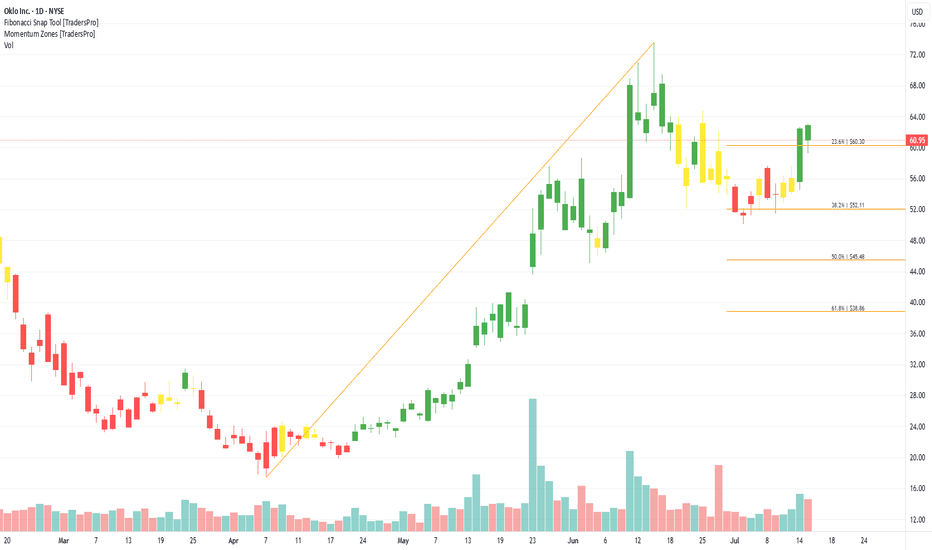

oklo break out The 14 jul 25 was probably a day to buy. of course hind sight is 20/20 but the chart gave a good indication to enter. risk wise maybe the reward we looking for is too much.

alternatively, there have also been places where the chart looked good but in the end getting stopped out. so likely that this one is a missed chance but not one that is perversely glaring

Oklo Inc. (OKLO) Builds the Future of Nuclear EnergyOklo Inc. (OKLO) is a nuclear energy company developing compact, advanced fission power plants designed to deliver clean, reliable energy with minimal waste. Its flagship design, the Aurora powerhouse, aims to provide scalable power solutions for remote locations, data centers, and industrial applications. Oklo’s growth is driven by the global push for zero-carbon energy, innovation in small modular reactors, and rising interest in alternative baseload power sources.

On the chart, a confirmation bar with rising volume signals strong buying momentum. The price has entered the momentum zone by breaking above the .236 Fibonacci level. A trailing stop can be set just below that level using the Fibonacci snap tool to protect gains while staying exposed to further upside.

$OKLO Bullish SetupNYSE:OKLO is setting up a textbook cup and handle breakout on the daily chart, signaling a potential continuation of its impressive uptrend. The cup formed over several months with a rounded bottom, showing healthy accumulation behavior and strong trend structure. Following that, the handle is shaping into a clean bull flag — marked by a tightening price range with declining volume, which is typical before a breakout. The breakout trigger is a daily close above the $56–57 range, which would confirm the pattern and likely lead to strong momentum upside.

Using measured move logic and Fibonacci extensions from the cup’s depth and the flag’s structure, I’ve mapped out four staged price targets: $74.50, $108.00, and $184.25. These represent a potential upside of 31%, 91%, and 233% respectively if the pattern plays out fully. RSI is curling up around 54, which hints at building momentum — a breakout above 60 would further confirm strength. The Lum3n Trend Cloud remains bullish, the 8/21 EMAs are intact, and the 200-day moving average is far below current price levels, supporting the long-term bullish bias.

If NYSE:OKLO can break out of this handle with conviction and strong volume, the setup offers one of the cleanest technical continuation patterns on the chart right now. Watch closely for a breakout and hold above the $56 neckline — confirmation here could kick off the next powerful leg higher.

OKLO — when nuclear momentum breaks resistanceSince late 2024, OKLO had been consolidating inside a clear rectangle between $17 and $59. The breakout from this long-term range triggered a new bullish impulse. The price has since returned to retest the breakout zone, now aligned with the 0.618 Fibonacci retracement at $51.94. The retest has completed, and the price is bouncing upward, confirming buyer interest.

Technically, the trend remains firmly bullish. The price closed above the prior range, EMAs are aligned below, and the volume spike during breakout supports genuine demand. The volume profile shows a clean path toward $100, indicating limited resistance ahead. The structure suggests a controlled rally rather than an exhausted move.

Fundamentally, OKLO is a next-generation SMR (Small Modular Reactor) company focused on delivering compact, efficient nuclear power solutions. Following its public debut via SPAC and recent capital injection, OKLO is transitioning from development to implementation. Institutional interest is holding strong, and the broader move toward decarbonization and energy independence places the company in a strategic position.

Target levels:

— First target: $100 — psychological and technical resistance

— Second target: $143 — projected from prior range breakout

OKLO isn’t just another clean energy ticker — it’s a quiet disruptor with nuclear potential. The chart broke out. The volume confirmed. Now it’s time to see if the market follows through.

OKLO Weekly Options Setup – Bearish Reversal Risk (2025-06-11)📉 OKLO Weekly Options Setup – Bearish Reversal Risk (2025-06-11)

Ticker: NYSE:OKLO | Bias: 🟥 Moderately Bearish

Entry Timing: Market Open | Confidence: 65%

🔍 Model Consensus Overview

📍 Price: ~$68.00

📈 Short-Term (5-min): Strong momentum, price > EMAs, MACD bullish

📉 Daily Chart: RSI >80, price well above upper Bollinger Band → overbought

📉 News Catalyst: $400M dilutive equity offering adds downside pressure

⚠️ Max Pain: $58 → suggests strong gravitational pull

🧠 AI Model Breakdown

Bullish View (Grok/xAI):

• Strong intraday chart → targets $70+

• Recommends call play (low conviction)

Bearish View (Llama, Gemini, DeepSeek):

• Daily exhaustion + dilution = reversal setup

• Favor puts (strikes around $61) for downside exposure

• Use weekly contracts for high R:R plays on reversion toward $60–$58

✅ Recommended Trade Setup

🎯 Strategy: Naked PUT (short bias)

📍 Strike: $61

📅 Expiry: 2025-06-13

💵 Entry Price: $0.55

🎯 Profit Target: $1.10 (+100%)

🛑 Stop Loss: $0.26 (–50%)

📈 Confidence: 65%

⏰ Entry: At open

📏 Size: 1 contract (risk-controlled)

⚠️ Risks to Monitor

• 🚀 Bullish momentum at open could squeeze premiums

• ⏳ Weekly theta decay = fast time burn if reversal is slow

• ⚡ Gaps or price whipsaws could breach stops before thesis plays out

• 📉 Trade only with capital you’re prepared to risk on rapid decay

📉 NYSE:OKLO is hot but stretched — fading momentum or riding breakout?

💬 Drop your play 👇 | Follow for more AI-powered weekly setups.

OKLO can go locoPattern: Classic cup and handle formation. Handle forming as a bull flag — very bullish continuation setup.

Resistance: ~$57.78 — key neckline from prior highs. Needs strong close above this level for confirmation.

Volume: Declining during handle = textbook. Suggests controlled pullback. Watching for volume spike on breakout.

Moving Averages: Price is trading above all key MAs, confirming bullish trend structure.

🔥 Most Favorable Path:

Let price tighten within the handle, then breakout above $57.78 on increased volume. If confirmed, target $66–70+ based on measured move from cup base to neckline.

⚠️ Invalidation:

Break below $50 with volume would invalidate handle and signal potential deeper retracement.

✅ Summary:

Setup: Cup & Handle

Bias: Strongly bullish

Entry trigger: Break + close > $57.78

Targets: $66 → $70 zone

Risk level: Manage below $50

*Not a financial advice

OKLO - bullish breakout soonToday we are analysing Oklo Inc stock on a weekly timeframe.

We see there is a cup and handle pattern formed, a strong bullish continuation pattern.

This pattern often signals a strong move higher once confirmed.

We see the price gets rejected at around £53.19 which creates a rounded bottom signalling the 'cup' part of the pattern.

The price eventually rallies back to retest the resistance completing the right side of the cup.

A handle forms just beneath this resistance which is shown with descending candles as a short term pullback indicating consolidation before a potential breakout.

Enter after the breakout is confirmed.

OKLO might fill a gap from May 23OKLO is exhibiting a classic gap-fill setup following the price action on May 23rd, when it surged and left a visible gap on the chart. Given the current technical conditions and waning momentum, there is a high probability that OKLO will retrace to fill this gap. Gap-filling is a common behavior in equities, especially when the gap forms without strong fundamental catalysts or when volume fails to confirm the breakout. Traders should anticipate a potential pullback toward the pre-gap price zone as the market seeks to test prior support levels and reestablish a balanced price range before any sustained move higher. It also looks to be completing a handle of a cup. meaning more bullish potential on the horizon.

OKLO’s Energy: Time for a Cup (and Handle) of Coffee-FueledChart Pattern and Technical Setup

Key Levels

Current Price: $52.72

Resistance (Cup Rim): ~$54–$55

Support Levels:

$31.46 (intermediate support)

$20.00 and $17.60 (strong support zone)

‼️ A clear cup and handle formation, a bullish continuation pattern. The cup is well-defined, with a rounded bottom and a rim near the $54–$55 level.

📊 The handle is forming, indicating a potential breakout if the price closes decisively above the cup rim (around $54–$55).

Measured Move Target

The height of the cup is approximately $39.60, representing a 222.26% move from the bottom to the rim.

If the breakout occurs, the projected target is near $94 , as shown by the dotted orange trendline and the measured move arrow.

Moving Averages

EMA 20/50/100/200 are all trending upwards, supporting the bullish momentum.

EMA20: $40.35

EMA50: $33.63

EMA100: $30.33

EMA200: $25.63

MACD Indicator

The MACD is bullish, with the MACD line above the signal line and green histogram bars, indicating upward momentum.

Previous MACD crossovers have coincided with significant price moves.

Volume and Momentum

The most transactions so far have been at $21 .

The price action and MACD suggest increasing buying interest as the handle forms.

Summary

A bullish outlook for Oklo Inc. (OKLO), with a classic cup and handle pattern pointing to a potential breakout.

A decisive move above $54–$55 could trigger a rally toward the $94 target.

Key support levels are at $31.46, $20.00 , and $17.60, which may act as safety nets in case of a pullback.

The overall technical setup, including rising EMAs and a bullish MACD, supports the case for further upside, provided the breakout confirms.

Even if the markets go in the opposite direction, there is a high probability that OKLO will diverge from the market.

Estimated timeframe to complete formation is 4 weeks (1-7 July)

Bullish Setup After MACD Divergence and Potential Pullback📊 Price Action & Chart Structure

Current Price: $37.43, down 5.79% on the day.

Recent Trend: The stock had a significant rally followed by a pullback and now appears to be forming a potential bullish continuation pattern.

Key Levels:

Support Zone:

$31.46: Potential short-term support (highlighted with a purple line).

$17.60: Strong long-term support zone, previously respected.

Fibonacci Levels (on the recent swing low to high):

0.382 at ~$33.50

0.618 at ~$28.50

Projection:

A bullish scenario is suggested with a projected upward move (purple arrow) after a potential pullback toward the $31–$33 zone.

Target appears to be around $55–$60, assuming the bullish scenario plays out.

📈 MACD Indicator Analysis

MACD Line (Blue) has crossed below the Signal Line (Orange) – a bearish crossover.

Histogram is shrinking, suggesting decreasing bullish momentum.

The yellow circle and arrow point to this bearish divergence, implying a short-term pullback or correction may be imminent.

📌 Interpretation & Strategy

Short-Term: Bearish divergence on MACD implies a likely dip toward the $31–$33 area. This could be a good buy-the-dip opportunity for bullish traders.

Medium-Term: If price holds above $31 and forms a higher low, continuation toward the $50–60 region is probable.

Invalidation: A drop below $28.50 (Fibo 0.618) would weaken the bullish case. A fall below $20 would invalidate the pattern entirely.

✅ Conclusion

🟡 Watch for a pullback toward $31–33.

🟢 Bullish above $31 with a target of $55–60.

🔴 Caution if price closes below $28.50, and strong bearish bias if it breaks below $20.