Oscar Long and StrongI've been long since $11.40, tight stop loss was placed below the demand zone. Strong reaction to the upside, a very good trade on this stock with the earnings release today. If you look at my charts you will understand why I longed this at the golden pocket, one of my favoured trade setups.

OSCR trade ideas

Bullish Thesis: Why Oscar Health OSCR Could Rally Strong in 2025Oscar Health, OSCR, a technology-driven health insurance company, is positioned for a significant stock price appreciation in 2025. Despite some mixed short-term sentiment, the long-term outlook and recent analyst forecasts suggest a potential rally that could more than double the current share price. Here’s why OSCR could be a compelling bullish opportunity this year:

1. Strong Analyst Price Targets Indicate Upside of Over 125%

According to recent forecasts, OSCR is expected to reach an average price of $31.40 in 2025, with some analysts projecting highs as much as $41.31—a potential upside exceeding 125% from the current price near $13.95.

Monthly forecasts show a steady upward trajectory, with July 2025 targets around $37.24 and December 2025 targets near $34.67, highlighting sustained bullish momentum throughout the year.

The average 12-month price target is around $34.40, representing a 146% upside, signaling strong confidence in OSCR’s growth prospects.

2. Innovative Business Model and Growth Potential

Oscar Health leverages technology and data analytics to offer user-friendly, transparent health insurance plans, differentiating itself in a traditionally complex industry.

Its focus on member engagement, telemedicine, and cost-effective care management positions it well to capture market share as healthcare consumers increasingly demand digital-first solutions.

The company’s expanding footprint in both individual and Medicare Advantage markets provides multiple growth avenues.

3. Long-Term Vision and Market Opportunity

Beyond 2025, forecasts remain highly bullish, with OSCR projected to reach $53.77 by 2027 and nearly $100 by 2030, reflecting strong secular growth potential in the health insurance and digital health sectors.

Analysts see Oscar as a disruptive force with the potential to reshape healthcare delivery, driving substantial long-term shareholder value.

4. Improving Financial Metrics and Operational Execution

Oscar has been improving its loss ratios and operating efficiencies, which are critical for sustainable profitability.

The company’s investments in technology infrastructure and data-driven care management are expected to translate into better margins and revenue growth over time.

5. Market Sentiment and Analyst Ratings

While some platforms show mixed short-term sentiment, the dominant analyst consensus is a "Buy" or "Moderate Buy," supported by strong price targets and growth forecasts.

The stock’s current undervaluation relative to its growth potential creates a favorable risk-reward profile for investors.

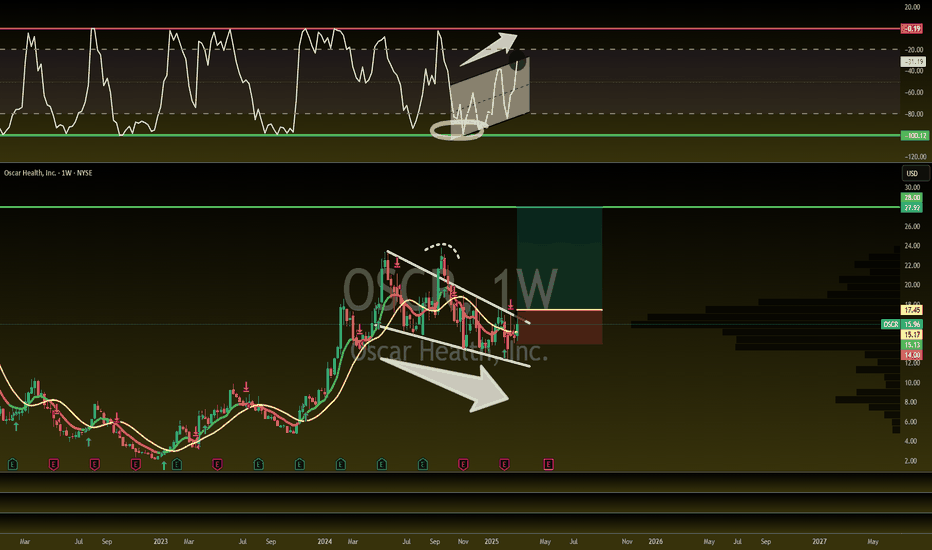

What's going on with $OSCR? Let's break it down!🚨 What's going on with NYSE:OSCR ? Let's break it down! 👇

📌 Long-term investors: Every dip = buy/add opportunity

📌 Traders: Short term, we may fill the $13.31 GAP

🔹 Massive volume shelf & consolidation between $11-$17 for nearly 2 years—the bigger the base, the bigger the breakout!

🔹 Rising trendline since April lows—if this breaks, expect a move to $13.31 GAP, possibly $11-$12. Strong support here unless bad news or a market correction hits.

🔹 Break above $18.27 (earnings pop) = 🚀 $20+ short term

🔹 200DMA rejection after retest from below = bearish short term

🔹 WR% is making a lower low instead of swinging higher—watching this closely.

🧐 Overall: We’re in a consolidation phase—when it moves, expect it to be quick & explosive 🔥 Best strategy: DCA & wait for the inevitable surge to $20+ (barring major setbacks).

Stay patient. Stay focused. NYSE:OSCR ’s move is coming! 💪

$OSCR 190% Upside! The MASSIVE move is already in MOTION! The MASSIVE move on NYSE:OSCR is already in MOTION! 🚀

🎯 Targets:

2025 = $28+

2026 = $35+

2027 = $45+

Falling Wedge Breakout

Approaching CupnHandle breakout

WR% Is swinging from green to red

MACD is about to flip bullish

Massive Volume Shelf launch

Fundamentals are next level

Massively undervalued

What else could you want?!

📈 Breakout confirmed. Momentum building. Smart money positioning. Are you ready?! 👇

OSCR ready to bounce and extend off of long term VWAPBlue line = 200 EMA

Light blue line = 50 EMA

Golden line = VWAP anchored at OSCR's IPO

Pink line = VWAP anchored off of bullish daily candle at the all time low reversal 12/29/22

Green line = VWAP anchored at the 3/28/23 gap up through the pink VWAP + massive volume spike 3/28/23

I'm seeing a pattern that when the price breaks below both the 50/200 EMA and the green and pink VWAPs it's followed by a strong reversal to the upside.

In addition, if you apply Elliot Wave Theory, the stock has appeared to have completed an ABC correction, begun a new impulse wave, and waiting to find support to validate that wave 2 is complete before it begins a longer wave 3.

OSCR 1W — When the Chart Speaks Before the FundamentalsThe Oscar Health chart is currently forming a textbook cup and handle — a long-term reversal structure that has completed its base and is now breaking out of the consolidation zone. The bullish structure is confirmed through price action, volume, and positioning relative to key moving averages.

The price has broken through the upper boundary of the handle, shaped as a descending wedge. The breakout is accompanied by increased volume — a clear sign of capital rotation out of accumulation. All major moving averages (EMA, MA50, MA200, WMA) are trending upward, and the price is holding above them all, confirming the bullish momentum.

According to Fibonacci extension levels, drawn from the historical low of $1.50 to the peak near $23.26, the first wave target stands at $36.71 (1.618 level), with an extended target at $45.02 (2.0 level).

Structurally, the setup suggests a medium-term scenario pointing from current levels toward the $36–45 range, with the potential to repeat the kind of explosive move seen during the 2023 phase, when the price increased more than sixfold.

On the fundamental side, Oscar Health is actively recovering: in 2024, revenue grew by more than 50%, net losses were cut nearly in half, and the client base continued to expand. The company is strengthening its share in the digital insurance market and gaining support from institutional investors, including Morgan Stanley and Capital Group. The latest quarterly report was positively received.

The breakout is technically clean and fundamentally supported. The immediate pullback zones sit at $14.95 and $13.40. Below that, moving averages may act as control zones for reaction.

OSCR to bounce Oscar had outstanding earnings and presented another opportunity for an entry. This company provides a new way to think about health insurance. Employers will save money by providing direct-to-employee insurance plans. This allows employees to avoid being lumped into an average basket of healthy, middle-of-the-road, and sicker colleagues. this phenomenon causes overpaying for many employees.

TA-wise: We see a break of the resistance, and a retest to come. On the break, I sold my 35$ LEAPS I bought a while back and locked in a 50% win. I still have 25$ LEAPS but am considering adding commons or some ITM LEAPS. My near-term target is around 18$ or about a 33% upside.

OSCR (Long) - Impressive growth, with low but improving marginsMy last healthcare idea, which is also my most recent, has gone spectacularly wrong after the stock fell precipitously on news which I was not able to source despite my extensive efforts. So, what else to do then than to jump on another attractive healthcare idea - NYSE:OSCR

Fundamentals

The underlying growth of NYSE:OSCR can only be described as impressive, with the firm growing by more than 40% every quarter (y-o-y) ever since it has gone public back in 2021 (despite already reaching over 10b in annual sales) - I left the numbers in the chart for a reference

The reason why its valuation is so low (0.4 P/S) compared to its peers is mainly the razor-thin margins , with EBITDA margins hovering only around 2% - but this is coming from a negative territory and most importantly, continues improving.

The firm just reported another stellar earnings and from the public discourse, its insurance solutions seem to steaming through the market and gaining market share

The main risk, which is pretty significant if realized, is political, and tied to the ACA subsidies - for a great article you can read about it here

However, for someone who plans to hold for the next 3-6 months (like myself), this shouldn't be an issue

Technicals

As mentioned, the firm recently released stellar earnings which propelled the price >20% higher. After a little consolidation, the price seems to have held its ground and is now poised to go higher

The stock price also broke out from a base as depicted on the chart, though I have to admit, it does not have the degree of accumulation I would prefer but the overall setup still looks very attractive

Momentum indicators like Stochastic and MACD are all entering positive territory, meaning we are likely only entering the upside potential

Trade

I entered the trade right after the breakout as I had been eyeing the stock for some time. The next few days confirmed the breakout and the stock is now seemingly heading higher, providing another good entry point

The low of where the stock price now consolidated also represents a great stop loss point (marked by the red line on the graph)

No price targets as I am just looking to watch how the price action evolves over next weeks, but breaking the previous local high would be a good point for potentially adding

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, Please leave a like, comment or a donation , it motivates me to keep producing ideas, thank you :)

A thank you gift to my supporters! OSCR chart (it's BEAUTIFUL)Again, thank you to everyone who follows, who supports, who gains anything from any of my analysis. Outside of my personal trading, you guys are what keep me so close and connected to the trading world and I appreciate that you're here to be on this journey with me!

This is Oscar Healthcare - The chart speaks for itself. IPO'd in the SPAC doomsday's and found itself sitting in the $2-4 range for quite some time. I loaded up and this is one of my biggest all time winners (outside of REAL).

They've subsequently proven themselves over and over again and found themselves sitting in the $20 range for a bit until Mr. Trump was elected president and the healthcare industry ran scared (for potentially good reason).

But put aside that this was sitting at $12-13 for a while (extremely undervalued territory as the chart indicates). The algorithms on OSCR never disappoint and it all comes down to one pretty little color called PURPLE!

Watch this video and you'll understand the beauty of this chart and the workings of the market.

Happy Trading all :)

$OSCR is BREAKING OUT! 82% UPSIDENYSE:OSCR is BREAKING OUT! 82% UPSIDE

Oscar crushed recent earnings and now is getting the attention then deserve!

They are massively undervalued and a disruptor of the health insurance industry.

$15 Falling Wedge Breakout =

$28 Measured Move (MM)

Not financial advice

$OSCR - 77% Upside if we HODOR!!NYSE:OSCR - HODOR!!!

Strong Support has been created at $12.15-$13.25 throughout the last two years.

It's held every time, if we hold again and market plays ball then...

🎯$16.50 & $23 are INBOUND!

- All indicators curling up

- At key support

- Name has a lot of big names behind it.

- Extremely undervalued

Not financial advice

60% Upside - H5 Trade of the Week!H5 Trade of the Week!

In this video, we are talking about a phenomenal potential trade that allows us to take action if we get some key items.

Everything is lining up for this one. We just need a few more items, and it will be time to enter!

NYSE:OSCR Breakout = $24/ $28

Not financial advice

WorriedI was bullish on OSCR and still trying to be but recently things have changed.

Bearish signs:

1. It's curling over in a high volume resistance. (potential double top also).

2. Recently fell below a long term trendline (Grey line) and rejected on a retest.

To look out for:

1. Falling below the yellow trendline

2. Falling into the volume void.

If all of the above occur:

Target will be the Fibonacci gold zone.

I still have a position, but a break below the yellow trendline and I will close my position and wait for it to retrace to the Fibonacci target.

This is looking very similar to BTC.