PATH --- Pop?PATH — Setting Up for a Pop?

UiPath (PATH) is showing signs of strength as it builds a base just above key Fibonacci support and prepares for a potential breakout in the broader AI + Robotics narrative.

Technical Setup:

Price holding above the 38.2% Fib retracement from the May rally.

Volume shelf + value area support at ~$12.30–$12.50 creating a launchpad.

21/50/200 SMAs converging — this type of compression often precedes expansion.

TTM Squeeze building pressure — prior squeezes on this name have led to fast directional moves.

Fundamental Tailwinds:

PATH is an automation leader riding the AI + enterprise software wave.

Sector rotation into Robotics and AI names (SYM, ROK, RR) lifting sentiment.

Recent dark pool activity shows accumulation—large 8M+ share blocks suggest institutional interest.

Thesis:

A close above $12.70 could trigger a move into the $13.40–$14.60 resistance zone, with a possible gap fill toward $18 on strong momentum.

Risk:

Invalidation below $11.80 (50% retracement / SMA cluster). Tight risk-reward if using LEAPs or long shares.

PATH trade ideas

Next Move Decides the Trend: PATH’s $13 Level is Make or BreakYou're looking at UiPath Inc. (PATH), and it's a clean textbook setup "moment of truth".

PATH has rallied sharply off $11 and just tagged major overhead supply ($13), a former long-term support-turned-resistance zone. The reaction here matters a lot — it’s the line between a failed breakout and the start of a new bullish leg.

Technical Breakdown

1. Price Action – Retesting a Broken Base

Price slammed into the $12.90–$13.00 resistance, which was a clear prior demand zone that broke down in March. This is a classic bearish retest setup — price often rallies into this zone, exhausts, and rolls over.

However, if bulls absorb selling here, it flips the narrative to accumulation breakout.

2. Volume – No Conviction Yet

Volume on the way up was relatively weak, and there’s no high-volume breakout to confirm a structural shift. That favors a fade or stall, unless we see sudden buying pressure soon. Compare that to the heavy volume on the breakdown in March — sellers have muscle here.

3. MACD – Bearish Crossover

MACD just crossed bearish with declining histogram.

This suggests momentum is fading, and could be rolling over for a downside move.

The last time this happened (early April), it preceded a ~10% drop.

4. RSI – Bearish Divergence Setup

RSI made a lower high, while price made a higher high — a textbook bearish divergence.

RSI is now back to ~53, so momentum has already cooled off significantly.

This adds fuel to the argument that momentum peaked into resistance.

5. Structure + Fibonacci

The rally off the lows retraced ~61.8% of the previous selloff — a key Fib level.

If price fails to close above this Fib + structure zone, it becomes a high-probability reversal area.

$11.35 becomes the key support target if it rolls over.

The bull case hinges on:

Break above $13.30 with volume

MACD re-cross bullish with RSI > 60

Target would then be $14.25+, possibly back toward Jan highs

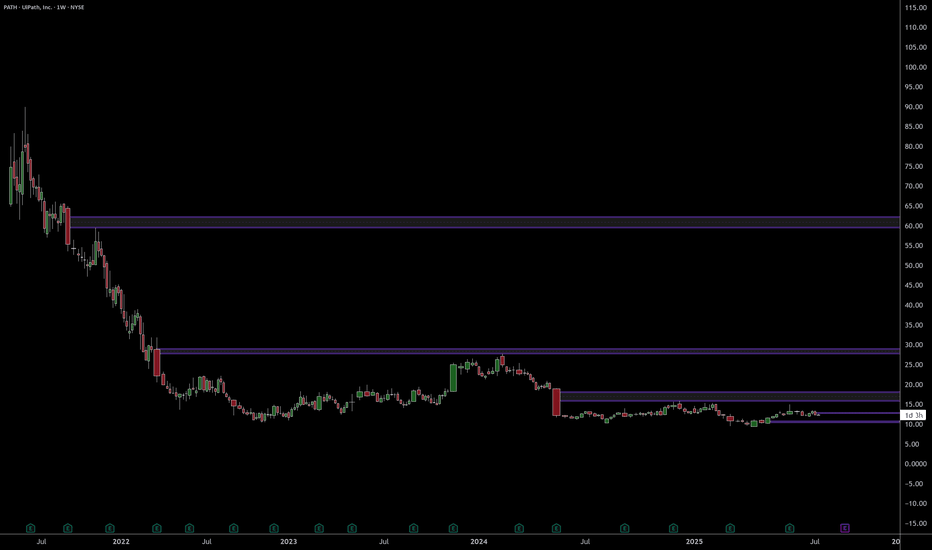

$PATH short term $19.50 long term gap fill @ $60*DISCLAIMER* For best results view on PC

This chart includes a high volume shelf and POC at $10 and a secondary shelf at $19.50 with the potential for a long term gap fill to $60 based on gap theory as well as Fib retracements

NOTICE this is not financial advice

Editors note pls put the right chart up for the tenth time

NYSE:PATH www.tradingview.com

3/13/25 - $path - meh. tough call... pass?3/13/25 :: VROCKSTAR :: NYSE:PATH

meh. tough call... pass?

- snagged a meager position of this AH -16 or so %

- read the transcript. i'm just not impressed. all this "cash generation" is just going to buying back shares of so much stock comp. and honestly, blaming "macro economic" situation for budget decisions being kicked (which that may be true) is just nothing i want to get involved in.

- god bless if their agentic stuff is catching wind, but it sounds like it's not a needle mover and TBH the tools are getting so good that might be tough to compete so they better speed this TF up

- hoping it opens in the same range i bought it... cathie can keep holding it, it's so tough to own any sofware in this tape that's not scale/ network effect stuff (e.g. FB - social or BTC - money... etc.)

anyone actually use this and think it's worth a deeper look?

V

ON THE RIGHT $PATH - 100% UpsideNYSE:PATH - About to clear a path higher!

- Green H5 Indicator

- Bullish H5 Cross

- Wr% is up trending into the WCB

- All indicators are firmly pointed upwards

- Massive volume shelf with GAP

- 25 MA is curling up and supporting this stock

- Great fundamental play that is a leader in RPA Ai bots

- Tech Services/ SaaS sector is about to get HOT!

Measure move is $18

PT's are 19.81/28

Not financial advice

$PATH should test upper end of the range @ $21- NYSE:PATH is uniquely positioned for robotics automation which could benefit from advances in Generative AI and with launch of smarter Machine Learning & AI models.

- NYSE:PATH sits in the application layer which will provide companies to automate things with least friction while leveraging powerful models.

- NYSE:PATH is badly beaten down. However, with advancement of AI, this company could leapfrog its offering to customer

- NYSE:PATH could easily be potential acquisition by NYSE:NOW or NYSE:CRM

Don't miss the Next AI Gold Rush! WATCH NOW!In this video, we delve into the next phase of artificial intelligence and explore the companies set to benefit the most. From giants like Microsoft and Salesforce to rising stars like Snowflake and CrowdStrike, we break down how each company is harnessing AI to revolutionize their industries. Don't miss out on this deep dive into the tech titans leading the AI charge and shaping the future. Subscribe and hit the bell icon to stay updated on the latest in AI advancements! NASDAQ:CRWD NYSE:CRM NYSE:SNOW NASDAQ:MSFT NASDAQ:TEAM NYSE:PATH NYSE:SHOP NASDAQ:DDOG NYSE:NET NASDAQ:MDB

What companies are you positioned in or ready to start a position in?

Let me know in the comments below!

PATH | InformativeNYSE:PATH

Scenarios:

Bullish Scenario:

IA breakout above $14.06 can lead to $14.59, $15.19, and eventually $15.93.

Bearish Scenario:

A drop below $12.62 would target $12.34, then $11.92, and possibly $11.49.

Strong bearish confirmation below $10.98.

Strategy Recommendations:

Long Position: Only if the price sustains above $14.06 with strong volume.

Short Position: If the price closes below $12.62, targeting lower support levels.

Wait-and-See: Until a clear breakout or breakdown occurs.

*Personally I' m bearish.

Bollinger Bands Contracting. Could Explode In Either DirectionWhile it can explode in either direction (as signaled by Bollinger Bands contraction), given that it has already corrected significantly and that we have a double bottom, it more likely to move up towards the golden pocket. Expectation is $19 by next earnings.

UiPath: Gap Fill to the Upside?UiPath fell sharply in the spring after its CEO stepped down, but now some traders may look for a rebound.

The first pattern on today’s chart is the bearish gap on May 30. The AI and automation stock ended yesterday inside that zone. Could prices fill the gap to the upside?

Second, PATH is above its 50- and 100-day simple moving averages. That may suggest its longer-term trend is trying to reverse upward.

Third, this year’s low of $10.37 near the trough in 2022 may confirm that support is in place.

Next, prices have cleared a falling trendline along the peaks of September and October. The lower study with our 2 MA Ratio also shows the 8-day exponential moving average (EMA) has crossed above the 21-day EMA. Those points may suggest that its short-term trend has gotten more bullish.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Fundamental analysis on UI Path: medium-long term.Hello everyone,

It's a fundamental analysis, all the way I used some technical analysis tools (see, fibionacci retracement, channels, trend-lines and resistances) because, since not having enough history (the IPO having been in 2021) technical analysis has to give precedence to the fundamental analysis, especially when it's not crypto assets but companies really operating in the markets, and especially among all, the technology one (automation/AI sectors)!

Let's start with fundamental analysis:

UI Path: An explosive growth opportunity?

UI Path (NYSE: PATH), a leader in the robotic automation industry (RPA), may be poised for significant upside. With a market set to grow from $10 billion in 2023 to over $23 billion by 2028 (CAGR of 19%), UI Path is perfectly positioned to ride this wave. Currently, the share price has fallen to $13.06 (as of Oct. 19, 2024), making it a potentially undervalued opportunity.

Strengths:

Continued revenue growth: In 2023, UI Path reported revenues of $1.06 billion, up 19 percent from the previous year. Forecasts indicate revenues of 1.25 billion by 2024, with the possibility of exceeding 1.7 billion by 2026, for an annual growth rate of 15%.

Loyal and expanding customers: With a 130% retention rate, customers not only remain loyal, but also increase their investment in UI Path's platform, signaling trust and steady growth.

Profitability in sight: The company is rapidly improving its operating margins, and is expected to become profitable in the second half of 2025. Gross margins are already at 80 percent, providing a solid foundation for future growth.

Strong liquidity: UI Path has $1.8 billion in cash and minimal debt exposure. This position of strength allows it to invest in innovation and weather any economic shocks.

Propelled by artificial intelligence: UI Path is integrating new capabilities based on artificial intelligence, making its solutions even more powerful and sought-after, especially as digitization increases in every industry.

Potential valuation and upside:

Current price: Currently, the stock trades at $13.06.

Price target: Analysts predict an average target of $22, with an optimistic estimate as high as $27. This represents a potential upside of 68 percent to over 100 percent.

Valuation Multiples: With a current Price/Revenue ratio of about 6.8x, the stock is undervalued relative to the historical average for growth technology stocks. A return to a 10x ratio could bring the stock price to $22-23.

Why get in now?

on the continued expansion of the automation market and UI Path's solid positioning, the current price of $13.06 seems to offer an attractive entry opportunity. If the market recognizes the expected growth and impending profitability of the company, we could see a significant upside of 70-100% in the next 12-18 months.

For UI Path, I would personally tend to be bullish, but with some caution. Here's why:

Bearish aspects (to consider):

Stock valuation: Although currently trading at lower levels than peaks, UI Path remains relatively expensive compared to other tech companies. If it fails to demonstrate profitability on schedule (by the second half of 2025), there could be bearish pressure.

Growing competition: The automation and AI industry is becoming very competitive, with large and small players entering the space. This could put pressure on margins and UI Path's ability to maintain its leadership.

Dependence on macroeconomic environment: A global economic slowdown or reduced technology spending by businesses could negatively affect UI Path's growth, as many companies may postpone implementation of automation solutions.

Technically:

If one wants to trade , one would have to wait for a break of the red channel for bullish confirmation. However, in the past few sessions, we are bouncing off the mm50 daily, which could act as support. However, one has to be careful as nothing prohibits that before going to make the targets indicated by the resistances (orange horizontal lines) it could make further bottoms. If one wants to hold , this entry level is also perfect. I expect in the next 5 years a boom in this stock. Yes, I calling for a pump :D

I would like to remind you that this is not intended to be an incentive to invest, disinvest or stay flat but is only the result of fundamental and technical studies and analysis.

Thanks for your attention and remember this analysis in a few years.

Omar

PATH $12.80 | Automation Robotics etc for take over or turnover of float

for the next leg or season of ROBOTICS HUMANOID play only this one is focused on BUSINESS ADMiN prhaps transition into AutoWorkers

as most VCs and Active Players are waiting for FiGURE Ai to go public

this is one of the under rated PROXY play with huge applications and real world cases

this could be as epic like iSRG RObotics healthcare dominating since year 2000

UiPath ($PATH) Stock Surges After Q2 Earnings Beat Key Highlights of UiPath’s Q2 CY2024 Results:

- Revenue: $316.3 million, a 10.1% year-on-year increase, beating analyst estimates of $303.7 million.

- Adjusted Operating Income: $6.45 million, well above expectations of $0.4 million.

- Earnings Per Share (Non-GAAP): $0.04, slightly ahead of expectations of $0.03.

- Annual Recurring Revenue (ARR): $1.55 billion, up 18.6% year on year.

- Free Cash Flow Margin: 13.4%, down from 30.2% in the previous quarter.

UiPath ( NYSE:PATH ), a leader in automation software, delivered a strong second quarter for fiscal year 2024, exceeding analyst expectations and providing upbeat guidance. The company reported revenue of $316.3 million, marking a 10.1% increase from the previous year. While its gross margin dipped slightly to 80%, the overall results showcase UiPath’s resilience and growth potential in the competitive automation market.

A Closer Look at the Numbers

UiPath’s Q2 performance is noteworthy, given the current economic landscape. The company’s revenue beat by 4.1% compared to estimates, reflecting robust demand for its automation solutions. However, the free cash flow margin fell to 13.4%, signaling potential challenges in maintaining cash profitability amid rising operational expenses.

The adjusted operating income of $6.45 million, significantly higher than analysts’ expectations, underlines improved execution and efficiency. CEO Daniel Dines credited the positive results to the company’s AI-powered automation platform, which continues to attract enterprise clients seeking to optimize their operations.

UiPath ( NYSE:PATH ) also raised its full-year revenue guidance to $1.42 billion, highlighting management’s confidence in sustaining growth. Despite a slight dip in quarterly free cash flow, the company’s ability to generate cash and reinvest in its business remains strong, making it a compelling investment opportunity.

Technical Outlook

On the technical front, NYSE:PATH stock has been trading within a falling wedge pattern since February 20, 2024—a pattern often seen as a bullish reversal signal. This formation occurs when price action is bounded by two converging trendlines sloping downward, indicating that the selling momentum is losing steam.

The recent earnings beat acted as a catalyst, pushing NYSE:PATH stock up by 8.48% in Friday’s premarket trading. The breakout from the falling wedge pattern suggests a shift in investor sentiment, transitioning from bearish to bullish. The stock’s RSI (Relative Strength Index) has moved from an oversold level of 38 to a more balanced position, indicating renewed buying interest.

Moreover, the daily price chart reveals that NYSE:PATH has broken through key resistance levels, setting the stage for further upside. Historically, a falling wedge pattern often precedes a rally, as the consolidation phase allows the stock to build momentum before resuming an upward trajectory.

What Investors Should Watch

UiPath’s stock performance will hinge on its ability to sustain growth amid economic uncertainties. Investors should monitor upcoming earnings to see if the company can maintain its recent momentum. Key price levels to watch include the $14.50 mark, which represents a critical resistance level. A successful breach could propel NYSE:PATH higher, while failure to hold current gains might see the stock retest previous support levels near $12.

The focus will be on UiPath’s cash flow margins and whether the company can stabilize these figures in the coming quarters. While the automation market remains highly competitive, UiPath’s strong Q2 results and bullish technical setup suggest that the stock could be poised for a meaningful recovery.

Conclusion

UiPath’s Q2 earnings exceeded expectations on several fronts, providing a much-needed boost to investor confidence. The combination of strong revenue growth, elevated ARR, and a positive technical breakout points to a brighter outlook for $PATH. However, sustaining this performance will require continued execution, especially as the company navigates fluctuations in cash profitability.

Investors with a focus on growth and a willingness to embrace some volatility might find NYSE:PATH an appealing opportunity, particularly given its leadership in the expanding automation sector. With Wall Street’s estimates now adjusted upwards, UiPath looks set to capitalize on its current momentum and drive further shareholder value.

PATH UiPath Options Ahead of EarningsIf you haven`t bought PATH before the previous earnings:

Now analyzing the options chain and the chart patterns of PATH UiPath prior to the earnings report this week,

I would consider purchasing the 13usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $1.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Island Gap Potential, Dark Pool Buy Zone, HFTsThis stock has the potential to form an island gap, which are caused by High Frequency Trading activity that triggers on news. The gap down was too huge, so fundamentals are above the current price. This would be a gap UP potential at this point, to create the island gap.

The lows have been established clearly, so selling short this stock is not wise. But smaller funds and retail may try, as they tend to sell short stocks within a Dark Pool buy zone. Chaikin Osc and Money Flow Index are moving upward but the angle of ascent on price is steeper. The faster price ascent could be rapid accumulation from derivative developers.

UIPath creates software for Robotic Process Automation. It was one of the stocks discussed in the Case Study I did with my students in the summer of 2022 on the disruptive new technologies to watch over the next decade.