PSFE trade ideas

PSFE Paysafe Limited Options Ahead of EarningsIf you haven`t bought PSFE before the previous earnings:

Then analyzing the options chain and the chart patterns of PSFE Paysafe Limited prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-5-17,

for a premium of approximately $1.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

5/13/24 - $psfe - not worth it, staying away; downside > upside5/13/24 - vrockstar - simply too much debt in the capital stack to be interested on the long side, despite the potential for a beat/ squeeze on the almost 9 days to cover. co cutting opex and growing GP is in theory a +ve ... but seems like a bandage to a more serious growth problem if the most they can eek out is 10% - which is not enough to beat competition at this stage in the game. i think at best this is a dead money stock (unless you're really digging in and see something incredible - in which case i'd defn want to know b/c it is "cheap") and probably at worst a death by a thousand cuts.

RiskMastery's Breakout Stocks - PSFE EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at NYSE:PSFE ...

I believe this code is at a point of potential volatility.

If price can hold above $14.64 ... Bullish potential may be unlocked.

My key upside targets include:

- $16.59 (Conservative)

- $19.47 (Medium)

- $25.18 (Aggressive)

If however price falls below $11.14 ... Bearish risk potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

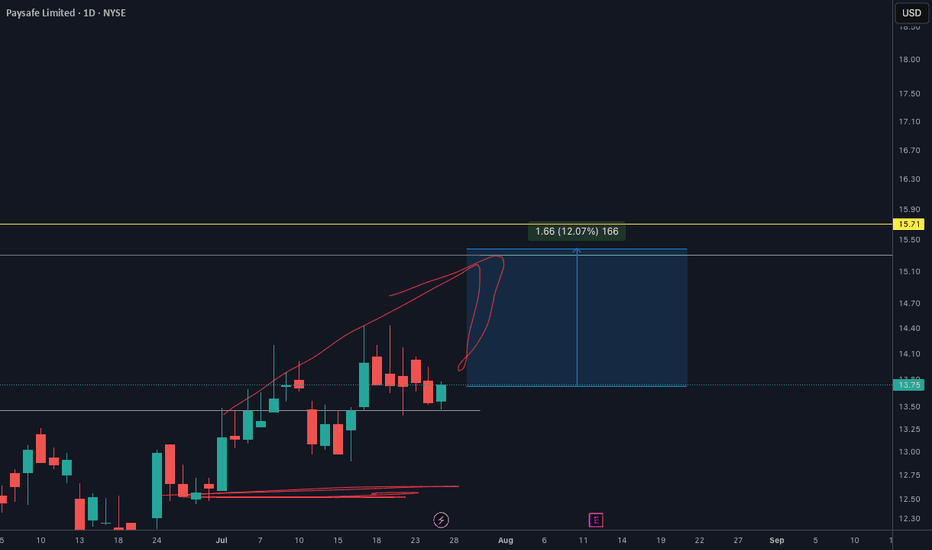

PSFE Paysafe Limited Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PSFE Paysafe Limited prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $0.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

PSFE $1.50 LOOKS LIKE A GOOD ENTRYThis ones been beat down all while expanding business. Very interested in seeing what they do with crypto. Anyways it's set for future they are just accumulating imo waiting for economic recovery which imo isnt happening yet. But it should perform well regardless at these levels. I see it easily hitting $5s if it holds after retesting the 20 day ma (blue line around $2.70) when it gets moving.

Overall I see a double bottom pattern eventually forming with this one.

Cheap Valuations for Fintech PSFERecent strategic partnerships and acquisitions, insider share buying, trading under a 2.0 P/S with ~ $1.5B annual revs and $120B transactional volume, and significant gaps to fill on the chart all make PSFE a no-brainer buy at these levels.

Just my personal opinion, not investment advice.

PSFE Earnings Run? Disclaimer

First post, so this analysis could be wrong and I am still learning as we trade everyday. These are subjective and we tend to see what you want to see. Having cleared that now:

Analysis

1) Descending channel and waiting for a breakout signal. As usual, a surprise in the upcoming earnings could be a catalyst.

2) So? Targets:

In the short term: with some volume, looking at Fib 1. area of 8.47

If it continues to trade within the channel, then we could be looking at trading the possible top and bottom channels. I do hope it doesn't go any lower, although a bad earnings report could trigger that.

In the medium-long term: looking for Fib 1.618 area and back to the initial gap down at 9.44. My wishful thinking is for it to close that gap back up to 10. Bearing in mind that it tried to close the gap earlier in September but failed, tread carefully before we start holding bags.

I would appreciate your input or to point out something that I may have missed. Or alternatively, that this is just utter bull.

Thanks, take care and good luck trading.

PSFE - OPTIONS - CALLSAll,

** Keep in mind this is 300M float i'd watch for hedge entry / big news or ER before entry. Any small candles are irrelevant to me. Need a sign.

PSFE overall decent company, promising outlook financially. They actually have a positive profit margin. However, not out of the woods entirely. I say options here, because I am not for certain it will break that 8.50/9 resistance so really just looking for short term option play here on the wedge. Could trade stock just the returns of course more ideal with options either way. If it somehow breaks $10 before ER then could see larger upside still skeptical until ER shows improvement on EPS.

Keep in mind this is 300+ Million Revenue company with barely positive margins (most companies arent even positive) as reference there are tons of other companies with less revenue and same margins trading 14-20+. So and positive ER on this company shoud catapult it to 14ish in my opinion.

PaySafe (NYSE: $PSFE) Continues To Trade Well Below IPO Price 💎Paysafe Limited provides digital commerce solutions to online businesses, SMB merchants, and consumers through its Paysafe Network worldwide. It offers digital wallet solutions under the Skrill and NETELLER brands, which enable users to upload, store, withdraw, and pay funds and APMs from a virtual account; Knect, a Skrill-related loyalty program; Net+Prepaid Mastercard, a companion product enabling NETELLER digital wallet active users to access and use stored funds anywhere that Mastercard card products are accepted; rapid transfer solutions; and issuing services for prepaid, virtual, and private label cards on behalf of its merchant customers. The company also provides eCash solutions, such as Paysafecash, a bill payment eCash solution that allow users to shop online and then pay offline in cash to finalize the transaction; paysafecard, a prepaid eCash solution; and paysafecard prepaid Mastercard that can be linked to a digital paysafecard account and used to make purchases. In addition, it offers integrated processing solutions, including a range of PCI-compliant payment acceptance and transaction processing solutions for merchants and integrated service providers comprising merchant acquiring, transaction processing, online solutions, gateway solutions, fraud and risk management tools, data and analytics, POS systems and merchant financing solutions, as well as support services for independent distribution partners. Paysafe Limited is based in Hamilton, Bermuda.