RBRK trade ideas

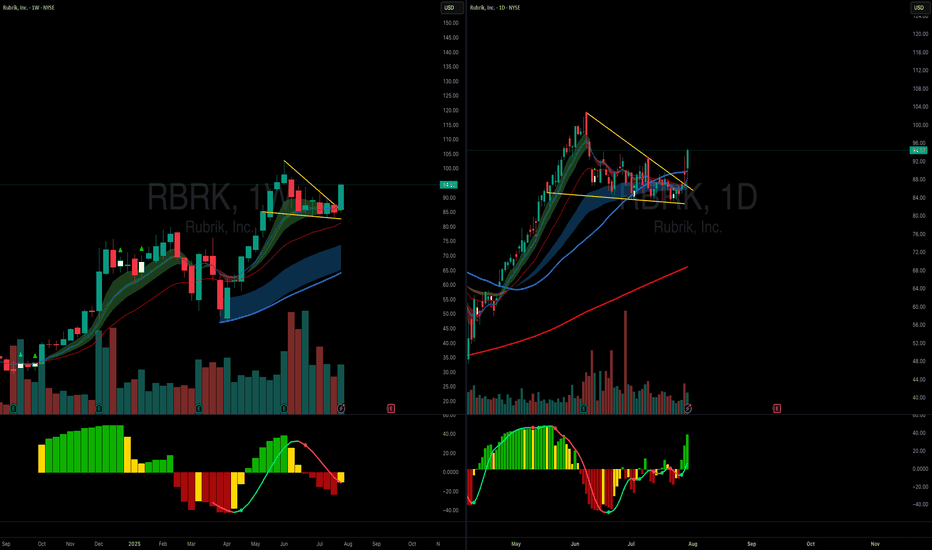

6/5/25 - $rbrk - I don't get it... lol6/5/25 :: VROCKSTAR :: NYSE:RBRK

I don't get it... lol

- looks like they listed it to sell someone's bags

- didn't understand the valuation at $20... much less $100

- beyond tempted to short this

- but the lower risk way is to let a pop happen, if does... and play accordingly or move on

- buying this would be the smooth brain choice, though, and a lot of times eliminating the low IQ option is what allows us to keep the book trending well over time

- also note the green line... it's literally straight. that's so beyond unnatural and for a sus-AF valuation company that it just gives me the shivers. beware of the straight lines.

- anyway... perhaps someone knows something. google trends solid. they spend SO much on marketing... to create their fake sales growth... that perhaps they "beat" lol. but reality is that w/ negative ebitda mgns, and bought sales growth, this stock will eventually find it's home back toward that IPO price. i'd be happy to short it once it cracks or on one last thrust higher

good luck to holders. might be worth another look if u have this thing as some sort of LT buy. do you know what u own?

V

RBRK Rubrik Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBRK Rubrik prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RBRK watch $76.xx: Golden Genesis + Local 4.236 may give a DIPRBRK got a nice strong boost from the last earnings report.

Now at a tight confluence of Golden Genesis plus local 4.236

Look for a dip to buy or a Break-n-Retest of $76.30-76.41 range.

=======================================================

.

Breaking: Rubrik, (NYSE: RBRK) Surge 18% In Premarket TradingRubrik, Inc. (NYSE: RBRK) a company providing data security solutions to individuals and businesses worldwide, offering enterprise data protection, unstructured data protection, cloud data protection, and SaaS data protection solutions; data threat analytics; data security posture; and cyber recovery solutions saw its stock surged about 18% on Friday's premarket session amidst fourth quarter and fiscal Year 2025 financial results.

Earnings Highlight

Results exceeded all guided metrics

Fourth quarter subscription ARR grew 39% year-over-year to $1,092.6 million

Fourth quarter revenue grew 47% year-over-year to $258.1 million

2,246 customers with $100K or more in Subscription ARR, up 29% year-over-year

First Quarter and Fiscal Year 2026 Outlook

Rubrik is providing the following guidance for the first quarter of fiscal year 2026 and the full fiscal year 2026:

First Quarter Fiscal 2026 Outlook:

Revenue of $259 million to $261 million.

Non-GAAP Subscription ARR contribution margin of approximately 4.0% to 5.0%.

Non-GAAP EPS of $(0.33) to $(0.31).

Weighted-average shares outstanding of approximately 192 million.

Full Year 2026 Outlook:

Subscription ARR between $1,350 million and $1,360 million.

Revenue of $1,145 million to $1,161 million.

Non-GAAP Subscription ARR contribution margin of approximately 4.5% to 5.5%.

Non-GAAP EPS of $(1.23) to $(1.13).

Weighted-average shares outstanding of approximately 198 million.

Free cash flow of $45 million to $65 million.

Technical Outlook

As of the time of writing, NYSE:RBRK shares are up 18.56% on Fridays premarket session forming a gap up pattern which is a strong bullish reversal pattern. NYSE:RBRK shares closed Thursday's session with a weak momentum as highlighted by the Relative Strength Index (RSI) at 35 but this 18% premarket surge could place NYSE:RBRK on the cusp of a bullish campaign with eyes set on the $88 pivot point.

Similarly, should NYSE:RBRK shares consolidate the 65% Fibonacci retracement point is well capable of acting as s support point before it picks momentum up.

RBRK: Runaway gap followed by a flag pattern NYSE:RBRK Runaway gap followed by a flag pattern.

Tailwinds: AI, Data, Cybersecurity

My price levels:

Entry Levels: 65-71

Stop Loss: 59

These are my price levels. Not recommendations. Decide your own price levels based on your personality, timeframe and risk.

Pricing pressure across sector= extreme caution warranted

11:32 AM EST, 12/02/2024 (MT Newswires) -- CrowdStrike (CRWD) and Palo Alto Networks (PANW) are increasing discounts to accelerate market share gains in cybersecurity, creating potential broader pricing pressures across the sector, Morgan Stanley said in a report on Monday.

The firm said it remains positive on long-term trends in cybersecurity, driven by expanding technology industry with generative artificial intelligence and public cloud adoption.

However, a tougher spending environment, pricing pressures, uncertain US fiscal policies, and high valuations necessitate a more selective approach for 2025.

Morgan Stanley downgraded SentinelOne (S) and Tenable (TNB) to equal-weight from overweight and upgraded Okta (OKTA) to overweight from equal-weight. Okta's price target was raise to $97, while Tenable's price target was lowered to $47.

The brokerage also raised price price target for Fortinet (FTNT), CrowdStrike and CyberArk Software (CYBR) to $113, $390 and $316, respectively.

Price: 346.98, Change: +1.01, Percent Change: +0.29

www.mtnewswires.com Copyright © 2024 MT Newswires. All rights reserved. MT Newswires does not provide investment advice. Unauthorized reproduction is strictly prohibited.

6/11/24 - $rbrk - valuation ambiguous. not fading but -ve MT r/r6/11/24 - vrockstar - NYSE:RBRK - this is defn on a shorter list of "cyber-related" names i keep on the related list. but here's my issue here. it's ambiguous middle of the pack financials and cap. 7 bn and you get 1 bn of revenue next year growing 20% a year and not pro forma profitable. that's just not something the market is paying for.

the wrinkle? don't fade new IPOs into their first EPS. i've gotten burned so many times when i used to short more things b/c as we all know IPOs tend to over value a lot of things initally and set the bar high in the ST to entice buyers. but it's usually always a bar that is beaten bc they can justify spending more juice, or employees have seen this coming and the org is clicking a tinge more in the immediate term. whatever it is - this is not something to fade. the valuation also isn't obscene like NASDAQ:WING where you get a chicken wings company that has tech margins so people put 20x on it. so in that context, 7x is just right down the middle of the road for this type of tech.

i'd be a buyer, but honestly if i told you the price many would probably chime in lol (so maybe i should do that), but it's closer to 5x let's say - which puts this "in the 20s" let's say.

gl to holders. i hope it pops. if we see anything approximating 20% though - i'm going to be taking the other side of the trade for funding and reversion to the mean.

have a good day all

V

Rubrik Stock Surges 20% in NYSE DebutOn Thursday, Shares of data management software maker Rubrik (NYSE: NYSE:RBRK ) surged 20% in its New York Stock Exchange debut, the latest sign that public market investors are showing an appetite for tech IPOs. The stock opened at $38.60 per share, after the Microsoft-backed company priced its IPO at $32 a share on Wednesday, above its expected target of $28 to $31 per share.

In selling 23.5 million shares, it raised $752 million, leaving it with a valuation of $5.6 billion. Rubrik shares are trading under the ticker “RBRK.”

In the last decades, Many technology companies appeared on public markets as central banks kept interest rates low. Worries about a weakening economy starting in late 2021 led investors to become less interested in unprofitable companies. Since then, few start-up technology companies have been willing to try going public. But that could be changing. Reddit

and Astera Labs which sells data center connectivity chips, went public in March.

Rubrik ( NYSE:RBRK ), founded a decade ago, reported a $354 million net loss in the latest fiscal year, compared with a $278 million loss in the year prior. The company now generates 91% of its revenue from subscriptions, up from 59% two years ago.

Microsoft also invested in the company in 2021. Rubrik’s co-founder and CEO, Bipul Sinha, has 8% control. Lightspeed Venture Partners, where Sinha was previously a startup investor, has 25% of the voting power.

A company will decide on the timing for its IPO six to eight weeks ahead, relying partly on input from bankers, said Ravi Mhatre, managing director at Lightspeed Venture Partners, which was the sole investor in Rubrik’s first round of venture capital.