Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.80 USD

668.79 M USD

3.85 B USD

832.31 M

About DR. REDDY S LABORATORIES

Sector

Industry

CEO

Erez Israeli

Website

Headquarters

Hyderabad

Founded

1984

FIGI

BBG000NJ96L6

Dr. Reddy's Laboratories Ltd. engages in the manufacture and marketing of pharmaceutical products. It operates through the following segments: Global Generics, Pharmaceutical Services and Active Ingredients, and Others. The Global Generics segment consists of manufacturing and marketing of prescription and over-the-counter finished pharmaceutical products ready for consumption by the patient, marketed under a brand name or as generic finished dosages with therapeutic equivalence to branded formulations. The Pharmaceutical Services and Active Ingredients segment focuses on manufacturing and marketing of active pharmaceutical ingredients and intermediates, also known as API, which are the principal ingredients for finished pharmaceutical products. The Others segment includes the operations of the subsidiary of the company. The company was founded by Kallam Anji Reddy on February 24, 1984 and is headquartered in Hyderabad, India.

Related stocks

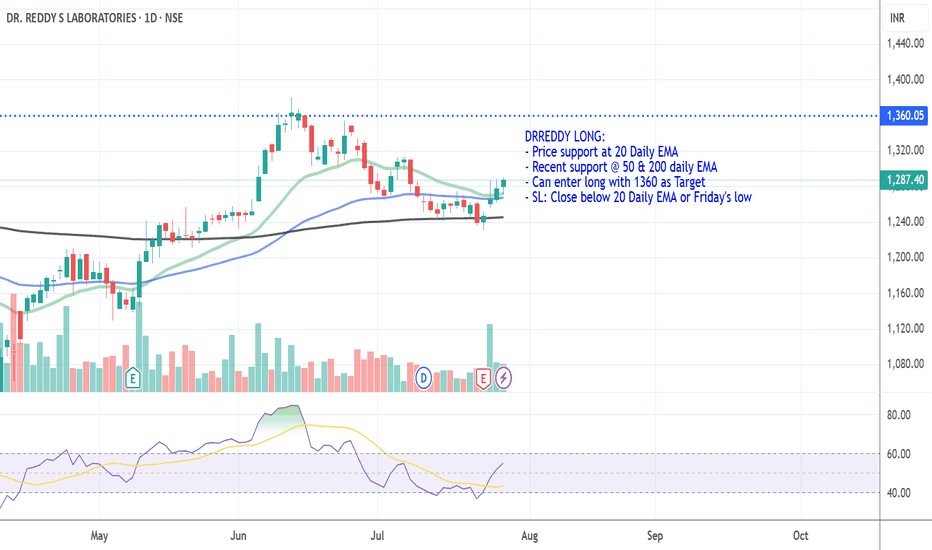

Technical bounce back on cardsRevenue: ₹8,545 crore (~11% YoY increase)

Net Profit (PAT): ₹1,418 crore (~2% YoY growth)

North America generics revenue declined ~11% to ₹3,412 crore due to pricing pressures, while Europe surged 142% YoY

Consensus estimates (SimplyWall.st): Average target at ₹1,289, with bullish/bearish range ₹

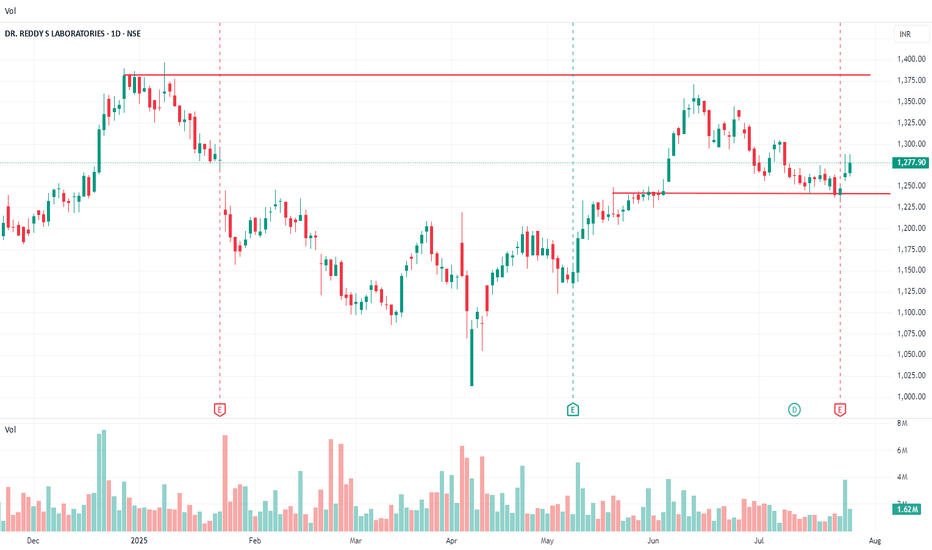

Dr Reddy on a falling wedge !!📊 DRREDDY – Falling Wedge Breakout Analysis

Date: August 2, 2025

CMP (Current Market Price): ₹1,220.60 ( Look for Support or breakdown on trend lines )

📝 Summary:

Dr. Reddy’s Laboratories has broken out of a falling wedge pattern on the daily chart, a classic bullish reversal setup. After weeks of

DRREDDY🎯 Trade Setup Summary

Parameter Value

Trade Type BUY

Entry ₹1257

Stop Loss (SL) ₹1221

Risk ₹36

Target ₹1658

Reward ₹401

Risk-Reward (RR) 11.2

Last High ₹1421

Last Low ₹1020

🧠 Key Observations

Strong Bullish Confluence: All timeframes are in an UP trend, with demand zones stacking up across HTF, MTF

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.