Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.76 USD

251.60 M USD

5.80 B USD

98.78 M

About Robert Half Inc.

Sector

Industry

CEO

Michael Keith Waddell

Website

Headquarters

Menlo Park

Founded

1948

FIGI

BBG000BS5DR2

Robert Half, Inc. engages in the provision of talent solutions and business consulting services. It operates through the following segments: Contract Talent Solutions, Permanent Placement Talent Solutions, and Protiviti. The Contract Talent Solutions segment refers to the fields of finance and accounting, technology, marketing and creative, legal, and administrative and customer support. The Permanent Placement Talent Solutions segment focuses on accounting, finance, tax, and accounting operations personnel. The Protiviti segment solves problems in finance, technology, operations, data, digital, legal, human resources, governance, risk, and internal audit. The company was founded by Robert Half in 1948 and is headquartered in Menlo Park, CA.

Related stocks

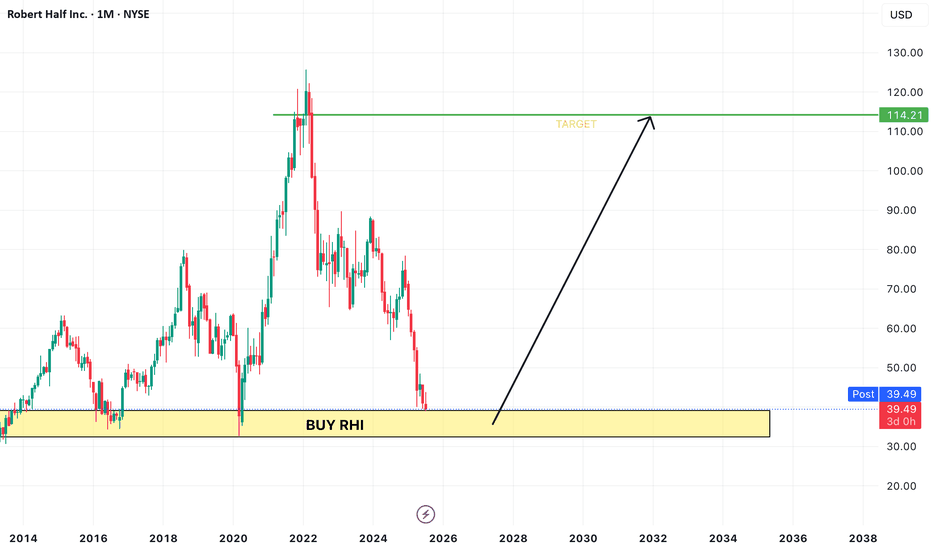

White Collar job sentiment has been plunging since 2022Robert Half has been around for quite sometime...I look at this chart as a sentiment indicator for "white collar workers". While white collar workers and the American middle class are not synonymous you could say that many people in the middle class are employed as white collar workers so it is a c

RHI to $68My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones at bottom of channels (period 100 52 & 26)

Stochastic Momentum Ind

5/30/24 - $rhi - detailed thinking: i'd remain greedier to buy.5/30/24 - vrockstar - NYSE:RHI - doing a follow up comment here given the stock now at 52wk lows and was flagged to me by a friend to take a look.

1) my valuation comments vs. the 4/25/24 comment don't change much. you're looking at a situation where it's a matter of where bottom EPS is and what

4/25/24 - $rhi print - +ve bias but only dip byr - vrockstar4/25/24 - vrockstar - well managed business, net cash helps in this global fiat debt chitshow, 20x PE not awful for scaled biz, employees churning like butter helps, ACN one way, TYL the other - not really even perfect comps by any sense, but think this would be a dip buy on a "miss" all else equal

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RHI is 39.49 USD — it has decreased by −0.08% in the past 24 hours. Watch Robert Half Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Robert Half Inc. stocks are traded under the ticker RHI.

RHI stock has fallen by −6.06% compared to the previous week, the month change is a −4.62% fall, over the last year Robert Half Inc. has showed a −34.86% decrease.

We've gathered analysts' opinions on Robert Half Inc. future price: according to them, RHI price has a max estimate of 55.00 USD and a min estimate of 35.00 USD. Watch RHI chart and read a more detailed Robert Half Inc. stock forecast: see what analysts think of Robert Half Inc. and suggest that you do with its stocks.

RHI stock is 2.24% volatile and has beta coefficient of 1.13. Track Robert Half Inc. stock price on the chart and check out the list of the most volatile stocks — is Robert Half Inc. there?

Today Robert Half Inc. has the market capitalization of 4.03 B, it has decreased by −4.05% over the last week.

Yes, you can track Robert Half Inc. financials in yearly and quarterly reports right on TradingView.

Robert Half Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

RHI earnings for the last quarter are 0.41 USD per share, whereas the estimation was 0.40 USD resulting in a 2.62% surprise. The estimated earnings for the next quarter are 0.43 USD per share. See more details about Robert Half Inc. earnings.

Robert Half Inc. revenue for the last quarter amounts to 1.37 B USD, despite the estimated figure of 1.35 B USD. In the next quarter, revenue is expected to reach 1.36 B USD.

RHI net income for the last quarter is 40.97 M USD, while the quarter before that showed 17.35 M USD of net income which accounts for 136.13% change. Track more Robert Half Inc. financial stats to get the full picture.

Yes, RHI dividends are paid quarterly. The last dividend per share was 0.59 USD. As of today, Dividend Yield (TTM)% is 5.67%. Tracking Robert Half Inc. dividends might help you take more informed decisions.

Robert Half Inc. dividend yield was 3.01% in 2024, and payout ratio reached 86.81%. The year before the numbers were 2.18% and 49.54% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 116.1 K employees. See our rating of the largest employees — is Robert Half Inc. on this list?

Like other stocks, RHI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Robert Half Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Robert Half Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Robert Half Inc. stock shows the sell signal. See more of Robert Half Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.