RIO trade ideas

The Potential For a Great short...Could be a large Zig-Zag correction forming here I have the zones marked for the B and C leg and a trend line up to monitor for a break...basically we're looking for failure in the B box which we're currently in and to break down below our rising trend line for the potential of this move to play out.

RIO Big Picture Fibonacci zonesAs you can see mining stocks have been hot in australia for 2019. However there is a lot of resistance coming up shown by the aeroplane box formed by fibonacci extensions. I would short rio in this box and wait for a pull back either to the 0.382 or 0.618 fib extension. If we break this resistance or eventually retrace back to the penguin box, I would have my eyes on the rocket box way up there.

More upside for Rio Tinto pre-earnings?Recognia is flashing am Elliott Wave 3 extension for Rio Tinto, with a price target of $73.86. I'm skeptical that we'll get that high, because it's outside the current trend channel, which I expect to break after RIO reports earnings on August 1. However, I do think it's likely that there's upside ahead as we approach the half-year earnings date. RIO has a low P/E for the industry and a high rating from all the analysts. In addition to the upcoming earnings date, RIO goes ex-dividend August 8. With a 6.33% dividend, the approaching dividend is a significant upside catalyst for the stock.

However, there's risk of a trend channel breach on June 16, when RIO publishes its quarterly operations review. Last year, RIO broke downward out of its trend channel on June 15, for reasons I don't fully understand.

Low risk high reward set up for RIOAfter a successful bump and run reversal, RIO has now confirmed a large inverse head and shoulders formation. At the moment we are re-testing the broken resistance that should now act as support, making it a low risk high reward trade set up.

Buy in now at 57.93 Stop loss at 55.50

First target $93

$RIO Long Term H&S - Unusual Bullish Options Activity$RIO Long Term H&S formed on Monthly Chart

- Watch for breakout and close above ~$60.70 resistance level in coming days/weeks

Target - $75.00 by August

Unusual Bullish Options Activity

- $160M worth of near term call options traded today with March 15th / April 18th expirations (majority deep ITM). Will confirm positions tomorrow with updated OI numbers.

Note: Informational analysis, not investment advice.

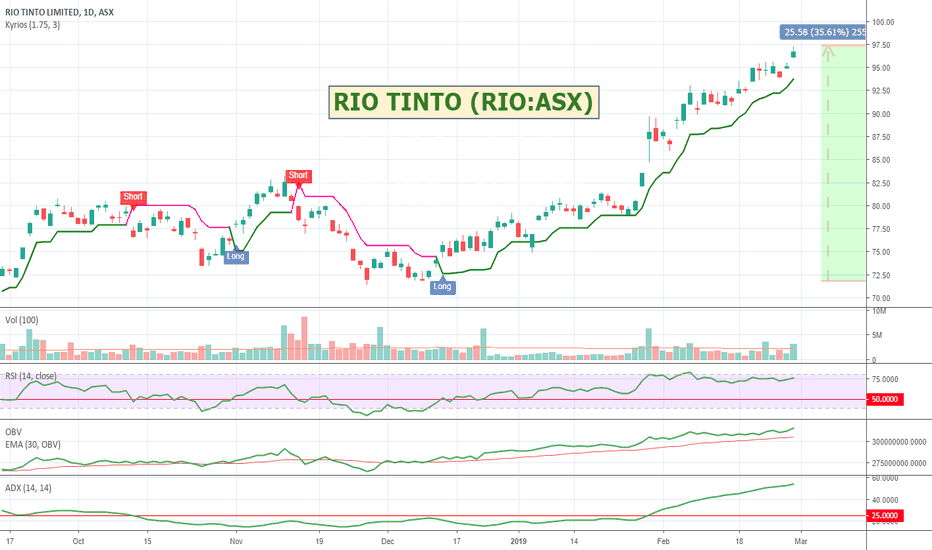

$RIO - RIO TINTO - Smooth run so farRIO might be worth a watch for anyone with a more conservative appetite. Has been running nicely since the start of the year.

Rio Tinto Limited is a mining company. The Company is focused on finding, mining and processing of mineral resources. The Company's operating segments include Iron Ore, Aluminum, Copper & Coal, Diamonds & Minerals, and Other Operations. Its products include aluminum, copper, diamonds, gold, industrial minerals (borates, titanium dioxide and salt), iron ore, thermal and metallurgical coal, and uranium. The Company's activities span across the world and are represented in Australia and North America, with businesses in Asia, Europe, Africa and South America. Its Copper product group comprises approximately four copper operating assets and over six coal operations, which includes Australia and South Africa, as well as development projects. The Diamonds & Minerals product group comprises a suite of businesses, including mining, refining and marketing operations across approximately five sectors. The Iron Ore product group operates iron ores, supplying the global seaborne iron ore trade.

RIO TINTO Epic Short Opportunity!!Epic shorting opportunity here!! The past 10 years looks to have been a huge 3-3-5 flat. Given we have had one impulsive wave to the downside prior to it, I believe we will get one more impulse to the downside to complete the correction.

Reasons for:

- B shows a clean 3-3-5 flat

- B completed at the .618 fib retracement of A

- we've only had one impulsive wave down; we need one more

Stop loss set just above previous high in case we get a bull trap. Target would be the 61.8 fib extension of A minimum.

Thanks :)

$RIO long off this Cypher with SL under X leg..Double click price column to see this chart. My move perhaps a little early however, a long off this cypher pattern seems like a reasonable opportunity to get into RIO Tinto at this level even with price potentially consolidating over the next few days. I'm actually not concerned if this stop loss gets taken out as prior swings have been very profitable.. As always, trading is risky. TA gives us probabilities but price action can be a beast, and move against us. The key is riding the gains and setting stop losses, letting the gains outweigh the losses. This makes money. NOT financial advice.