Shopify Stock (NYSE: SHOP) Why The Surge TodayThird-quarter revenue of $1.7 billion was marginally higher than analysts' estimates and represented an increase of 25% over the year-ago quarter. The top-line beat affirms the momentum Shopify has been building in recent quarters, which has 70% year to date.

More businesses are signing up for subscriptions and driving steady growth in the company's merchant solutions business. But the stock is also responding to Shopify's improving profitability on the bottom line.

Operating income came in at 7% of revenue, or $122 million, reversing last year's operating loss of $346 million. The company's decision to sell its logistics operation to free up resources and lower expenses is clearly paying off, and shareholders are being rewarded.

Management expects the momentum to continue with the holiday shopping season coming up. For the fourth quarter, revenue is expected to be in the low-to-mid-twenties year over year excluding the impact of sales in the logistics business from the fourth quarter of 2022.

Moreover, free cash flow margin relative to revenue was a healthy 16% in the third quarter, and management expects it to remain in the high-teens range in Q4.

Here's an opportunity to watch

For a stock trading at a high price-to-sales ratio of 12, Shopify hit all the right notes in its latest update. The company should continue to see healthy margins and growing free cash flow over the long term, which could push the stock to new highs.

As we enter 2024, investors will want to watch Shopify's payments business following its Buy With Prime integration with Amazon. This should benefit Shopify merchants and lead to higher checkout conversion, which could boost the company's revenue.

SHOP trade ideas

Why I'm Going Long on ShopifyOn the weekly timeframe for NYSE:SHOP , I noticed four things immediately:

- A candle close above the bullish flag forming, indicator bullish momentum.

- NYSE:SHOP recently created swing highs at $53.70 and then broke it and bounced perfectly off of it showing that $53.70 is a KEY level.

- When price bounced off of $53.70, it was also at the 5 SMA, adding more confluence to my trade

- Lastly, I saw a divergence on the volume indicator, which is always a good sign of confluence for my trades.

Given these four reasons, I am bullish on NYSE:SHOP as of now.

Stop Loss / Take Profits

Stop loss:

The stop loss of this trade is set at $55.42, which is the most recent low.

Take Profits:

All of these take profits are set at levels that I felt were phycological levels.

My plan would be to scale out half of my position at TP1, 1/2 of the remaining position at TP2, and fully out at TP3

If TP3 is hit, this will be a 1:1.44 R:R trade.

Let me know what you think of this trade!

SHOP Short IdeaIdea of a swing position short on this asset after a beautiful bull trap on a reversal configuration.

We had a big dump of the asset then a correctif period that seams to be over soon for me and this bull trap can definitly be the perfect short signal.

As target I try to be as conservative as I can but if this pattern is correct then we can see a huge drop of the price in the following months.

Great Trade !

SHOP | Informative | Day trade planNYSE:SHOP

Price Action & Candlestick Analysis:

The price seems to be in a short-term downtrend, as it's mostly moving below the moving averages.

The long blue bar shows a strong bullish movement in one of the 15-minute intervals, but it seems the momentum could not be maintained, as the price started declining shortly after.

Moving Averages:

There are two moving averages, one short-term (potentially 50-period) and one long-term (potentially 200-period). The stock price is currently below both, which is generally a bearish signal.

The moving averages appear to be converging slightly towards the end, potentially indicating a change in trend in the future if they crossover.

Volume:

There's a significant spike in volume during the bullish move. This suggests that there was strong buying interest during that time.

Following the bullish spike, the volume seems to taper off, which can be an indication of a decrease in trading interest or momentum.

Support and Resistance Levels:

The "Bullish Line" is set at 53.48, which might act as a resistance level in the short term. If the price breaks above this with significant volume, it could lead to further bullish movement.

The "Bearish Line" is marked at 52.49. This might serve as a short-term support level. A breach below this line could indicate further downward movement.

Target prices are set at various levels, with the nearest being Target Price 1 at 52.06, then 51.37, and the lowest being 50.69. These could serve as potential support levels or price targets for a bearish move.

On the upside, if there's a change in trend, the target prices are 54.57 and 55.28.

RSI (Relative Strength Index):

The RSI seems to be hovering around the mid-level, currently at 42.70, indicating neither overbought nor oversold conditions.

The movement of the RSI is generally flat, suggesting no strong momentum in either direction at the moment.

Overall Sentiment:

The overall sentiment from this chart seems to be slightly bearish, considering the price is below both moving averages and is closer to the bearish line.

However, the RSI is near the middle, and the moving averages are converging, so there could be potential for a change in trend. It would be crucial to watch for breakouts above resistance or breakdowns below support, coupled with volume, for a clearer direction.

Bullish on Shop.

Hello all, As you can see here on the 15-minute chart we are in a channel. I drew these lines and supply zones on the hourly chart. I am looking for a bullish breakout and retest of resistance with a high volume bounce off with good volume on the Hiekin Ashi candlestick chart. I am looking long because the market seems to go where the liquidity is. Thank you for reading my analysis.

Shopify: Will Santa Come to Town?The fourth quarter has begun, and attention may soon turn to holiday spending and Black Friday. Today’s chart focuses on Shopify, a key player in the growing world of online commerce.

The first pattern is the August low of $51.20. SHOP has flirted with this level for almost two weeks without closing below it. Is support in place?

Second, the consolidation has occurred around the rising 200-day simple moving average. That may suggest a longer-term uptrend is underway.

Third, the MACD histogram has been growing less negative. Traders may watch for a potential flip back to positive.

Next is the short-term falling trendline along the highs of September 29 and October 6. A close above that resistance could potentially draw buyers from the sidelines.

Finally, SHOP has had some potentially positive fundamental events like strong earnings and an integration with Amazon Prime on August 31. Instacart also added a new connection last month.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

$SHOP Ready to Move Higher?It is hard to believe but there is a lot to like about this NYSE:SHOP chart. What I like is that it has recently come back and touched the rising 40 Week MA (white). It Just bounced off the AVWAP from all time high (meaning that the aggregate of shareholders since that time are in the money). It is well above the 18-month AVWAP. And it is moving up through the short-term MAs. It is yet to cross the 21 EMA (blue). MACD has just crossed up. If / when the market turns positive, I will be looking for a long entry likely using the 40 Week MA as a stop area.

Ideas, not investing / trading advice. Comments always welcome. Thanks for looking.

SHOP - accumulation opportunityNYSE:SHOP has had an incredible year and we may have another strong accumulation opportunity in front of us. SHOP has been in a strong uptrend since recovering its 200MA in January. We the December 2022 low and an overbought condition in February 2023 set a range for the measured move of the gap up on May earnings.

The May gap came close to closing during the August drawdown, but support held at the VWAP from the December 2022 low.

I'm skeptical that the most recent gap up is an exhaustion gap that will fill quickly (note the low volume). If this gap closes and recovers the pattern may resemble a cup and handle.

Also note the following:

A fib timezone from July 2022 earnings to October 2022 earnings aligning to key pivot points.

The red VWAP from all time high converging with the 200SMA and the VWAP from the December 2022 low

Blue VWAPs from the May gap up, July high, and August low

Game plan

Entry 1 ~61, above the August gap open and aligning to the VWAPs from the May gap and July high

Entry 2 ~58, aligning with the top of the August gap open and the VWAP from the August low

TP 1 ~67 which would likely conclude the formation of a cup and handle

TP2 ~71 top of the measured move from the August gap and a higher high below a fib extension

SL ~56-57

Re-entry - If I'm stopped out I will likely re-enter ~50-52 on a retest of the red and green VWAP and 200SMA

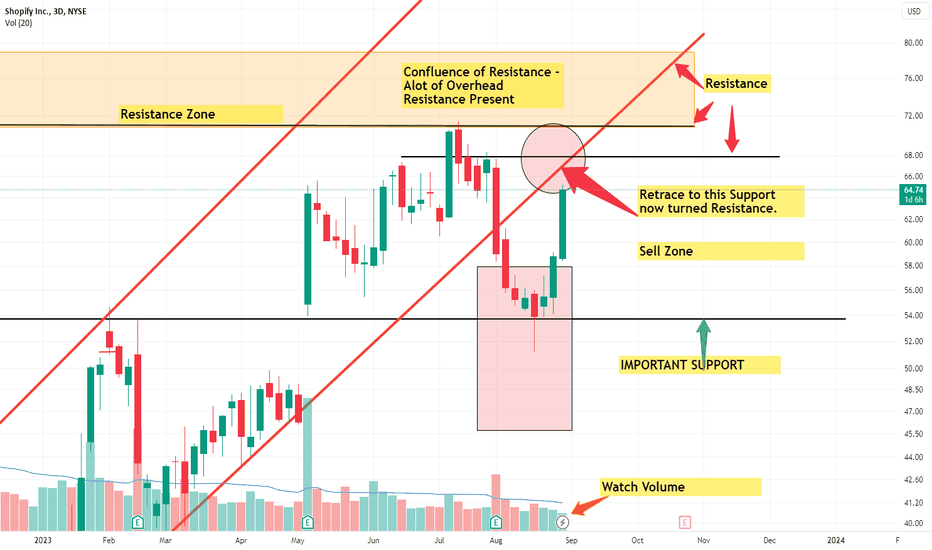

Shopify Short term Sell Target Off Major Support BounceHI guys, ive been following Shopify (SHOP), since its test of some important SUPPORT. This is a quick update from my previous idea. (Which you can find down below for more context)

We've currently bounced extremely bullish off the SUPPORT level, heading towards a SUpport turned Resistance line associated with the UPTREND channel i identified.

Normally when we break down or break above trend lines, that we have respected for some time. We tend to retrace back to that same line to Re-Test it.

Such is the case for Shopify.

Watch the Volume, an INCREASE/ SPIKE in Volume is absolutely needed to get back ABOVE, resuming our UPTREND.

But due note: we are heading into Labor day weekend, thus RISK of LOW VOLUME.

I would then consider if you were able to take positions from the SUPPORT level bounce

To think about off loading some of your position here.

If we do get back into the UPTREND channel from my previous POST. We can look to take new positions if SUPPORT is CONFIRMED.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

Shopify Macro Pattern Bullish Until Proven OtherwiseHi Guys! This is a Macro Technical Analysis on Shopify (SHOP) on the 1 Week Timeframe.

Its to add to my previous analysis while keeping it brief and concise.

Recently we Broke through and confirmed BELOW both the Uptrend Channel and the 21 EMA.

Normally this spells TROUBLE, especially if we confirm BELOW 21 EMA, as this moving average normally holds SUPPORT through BULLTRENDS.

Even more so that the MACD has crossed BEARISH as well.

However digging deeper, its seen that the channel and 21 EMA break was followed by DECLINING VOLUME.

Normally, for Trend Reversals and for the direction of a trend to actually go that way you need a spike in VOLUME.

(Watch VOLUME in the coming weeks. Can give us hints to what will come next.)

Comparing our current move to previous moves, look to "Similar Pattern". It may be probable that we just move side ways before continuing our UPTREND.

Notice how to the T, our current move follows the previous example. The 21 EMA is also flattening out, indicating this sideways movement.

Another likely scenario, if volume picks up can be a test of the 50 SMA (Green moving average).

BUT provided this Weeks candle closes ABOVE we are testing support. So if we can stay ABOVE this, 50 SMA is less Probable. So pay attention to this weeks candle close and for CONFIRMATION.

Also NOTE we have had a BULLISH CROSS of the 21 EMA above the 50 SMA.

Along with how previous history BUllish move played out.

This makes me think we are in the Early phases of a BULL run in Shopify.

This is NOT a DEFINITE, Sure thing but we may be mirroring the "Similar Pattern".

But always remember that things that happened before does not have to happen again.

I think other than Volume, another MAJOR thing to watch is the MACD.

Particularly, the main focus should be staying ABOVE the 0 level.

Going BELOW 0 level, may indicate further price DECLINES.

So watch how the Histogram bars shape up, we want smaller RED bars that change to a lighter RED color. Eventually would like to see GREEN bars in the coming weeks. That would give confidence that BULLISH momentum is coming back to Shopify.

Take a look at how the MACD shaped up during the "Similar Pattern". If we stay ABOVE 0 level, all is good.

Keep that in the back of the mind as you follow the MACD.

RSI also gives some clues. The area between the RED & BLACK Horizontal lines, coincides with being BELOW 21 EMA.

If we are below the RED line, normally its a good area to add to your position during a BULL run.

The warning sign is if the RSI drops towards and BELOW the BLACK line, that would lead to further PRICE Declines.

Using both the MACD and RSI in combination will help remove false signals. If you see that the histograms are turning light red, to light green and the RSI curved back up towards and ideally above RED line. This would likely push Price back ABOVE 21 EMA, and continue our BULL Run.

I think this week, its important to stay ABOVE the SUPPORT line. Staying above may bring in more confidence.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

SHOP: Bullish Pendant FormedI am bullish on SHOP for 4 reasons:

1) We held the 1W MA and it has acted as support since Feb 28. It is curling up, meaning that the trend is now bullish.

2) We have formed a bullish pendant on the daily and weekly time frame.

3) We have recently touched the green Bollinger band on the RSI.

4) The 0.236 fib level at 59.91 recently acted as support.

I am long until the earnings call on August 2 with a price target of $82, which corresponds to the 0.382 fib level and the previous support/resistance level back in Feb 2022. Stop loss is below $55.