Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.20 USD

2.68 B USD

23.10 B USD

232.87 M

About Sherwin-Williams Company (The)

Sector

Industry

CEO

Heidi G. Petz

Website

Headquarters

Cleveland

Founded

1866

FIGI

BBG000BSXQV7

The Sherwin-Williams Co. engages in the development, manufacture, distribution, and sale of paint and coatings. It operates through the following segments: Paint Stores Group, Consumer Brands Group, Performance Coatings Group, and Administrative. The Paint Stores Group segment caters to the needs of architectural and industrial paint contractors and do-it-yourself homeowners. The Consumer Brands Group segment manufactures and distributes a broad portfolio of branded and private-label architectural paint, stains, varnishes and other industrial products. The Performance Coatings Group segment develops and sells industrial coatings for wood finishing and general industrial applications. The Administrative segment refers to the administrative expenses and assets of the company’s new global headquarters and research and development center, both currently under construction. The company was founded by Henry Sherwin and Edward Williams in 1866 and is headquartered in Cleveland, OH.

Related stocks

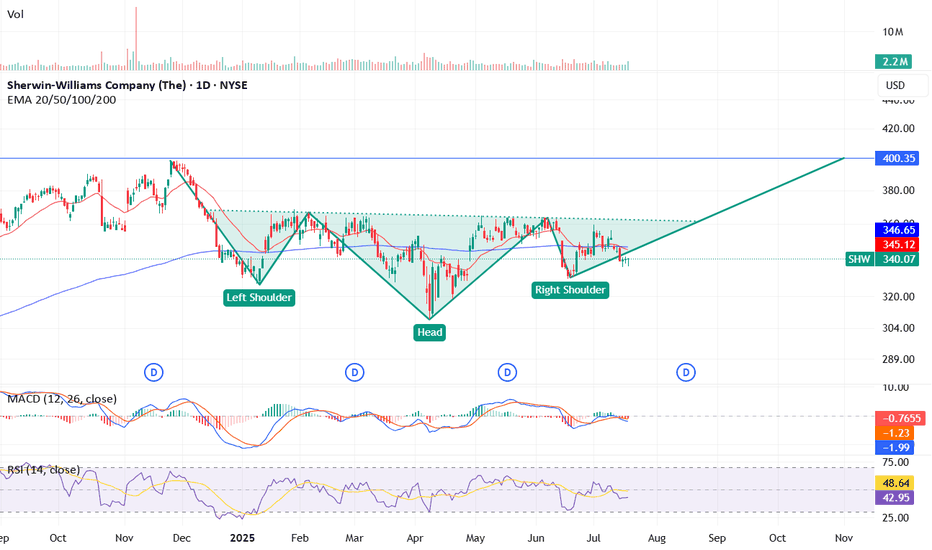

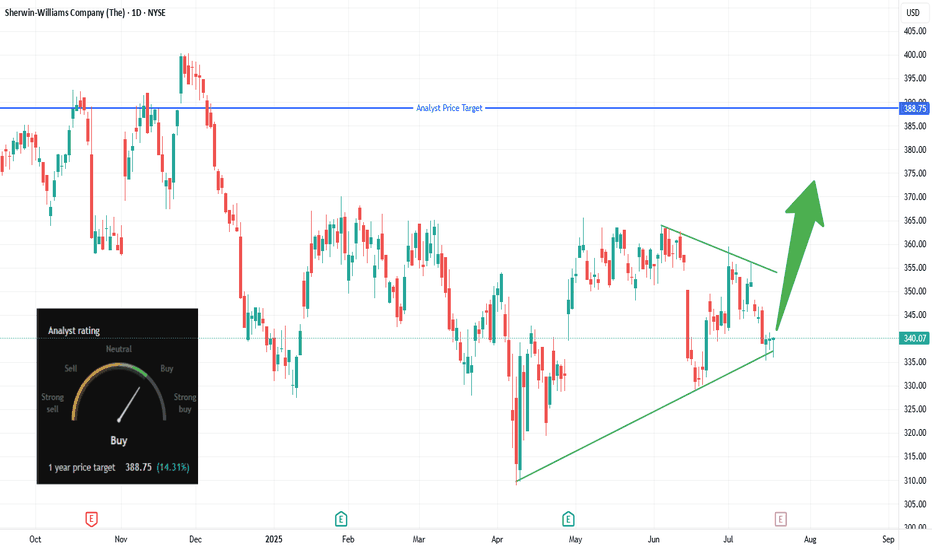

SHW Bulls Ready to Paint the Tape Green?📋 Trade Summary

Setup: Price bouncing off ascending trendline support in a tightening triangle pattern.

Entry: Market buy at ~$340

Stop-loss: Below channel support at $327.74

Targets:

Initial: $355 (trendline break)

Main: $388.75 (analyst price target)

Risk/Reward

Sherwin-Williams Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams Stock Quote

- Double Formation

* (Target Entry Or Gap Fill)) At 770.00 USD | Completed Survey

* ((No Trade)) On Reversed Settings | Subdivision 1

- Triple Formation

Sherwin Williams, you will always need paintNYSE:SHW looks good here, pushing agains multi year horizontal resistance

* ER out of the way,

* weekly bull flag break here, need to confirm the weekly close,

can buy leaps or debit spreads, half size here and add on weekly confirmation.... not financial advice ;D

Sherwin-Williams | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams

- Double Formation

* 270.00 USD | Support Area | Subdivision 1

* Neckline | Uptrend Bias

- Triple Formation

* Flag Structure | Continuation Area Attempt | Subdivisio

SHW Multi-Time-Frame Squeeze SHW has a history of making outsized moves on the back of Daily Squeeze action. In the recent past, it has moved in "harmonic" 50+ point surges. If the next daily squeeze fires long, I look for it to run up to it's prior high at $354. If it behaves like it did last quarter, this could happen on t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SHW is 340.10 USD — it has decreased by −0.80% in the past 24 hours. Watch Sherwin-Williams Company (The) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Sherwin-Williams Company (The) stocks are traded under the ticker SHW.

SHW stock has risen by 0.18% compared to the previous week, the month change is a −2.20% fall, over the last year Sherwin-Williams Company (The) has showed a 1.40% increase.

We've gathered analysts' opinions on Sherwin-Williams Company (The) future price: according to them, SHW price has a max estimate of 420.00 USD and a min estimate of 296.00 USD. Watch SHW chart and read a more detailed Sherwin-Williams Company (The) stock forecast: see what analysts think of Sherwin-Williams Company (The) and suggest that you do with its stocks.

SHW stock is 1.10% volatile and has beta coefficient of 0.71. Track Sherwin-Williams Company (The) stock price on the chart and check out the list of the most volatile stocks — is Sherwin-Williams Company (The) there?

Today Sherwin-Williams Company (The) has the market capitalization of 84.83 B, it has decreased by −1.74% over the last week.

Yes, you can track Sherwin-Williams Company (The) financials in yearly and quarterly reports right on TradingView.

Sherwin-Williams Company (The) is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

SHW earnings for the last quarter are 3.38 USD per share, whereas the estimation was 3.76 USD resulting in a −10.04% surprise. The estimated earnings for the next quarter are 3.49 USD per share. See more details about Sherwin-Williams Company (The) earnings.

Sherwin-Williams Company (The) revenue for the last quarter amounts to 6.31 B USD, despite the estimated figure of 6.29 B USD. In the next quarter, revenue is expected to reach 6.22 B USD.

SHW net income for the last quarter is 754.70 M USD, while the quarter before that showed 503.90 M USD of net income which accounts for 49.77% change. Track more Sherwin-Williams Company (The) financial stats to get the full picture.

Yes, SHW dividends are paid quarterly. The last dividend per share was 0.79 USD. As of today, Dividend Yield (TTM)% is 0.88%. Tracking Sherwin-Williams Company (The) dividends might help you take more informed decisions.

Sherwin-Williams Company (The) dividend yield was 0.84% in 2024, and payout ratio reached 27.10%. The year before the numbers were 0.78% and 26.17% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 63.89 K employees. See our rating of the largest employees — is Sherwin-Williams Company (The) on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sherwin-Williams Company (The) EBITDA is 4.41 B USD, and current EBITDA margin is 19.04%. See more stats in Sherwin-Williams Company (The) financial statements.

Like other stocks, SHW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sherwin-Williams Company (The) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sherwin-Williams Company (The) technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sherwin-Williams Company (The) stock shows the neutral signal. See more of Sherwin-Williams Company (The) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.