SHW trade ideas

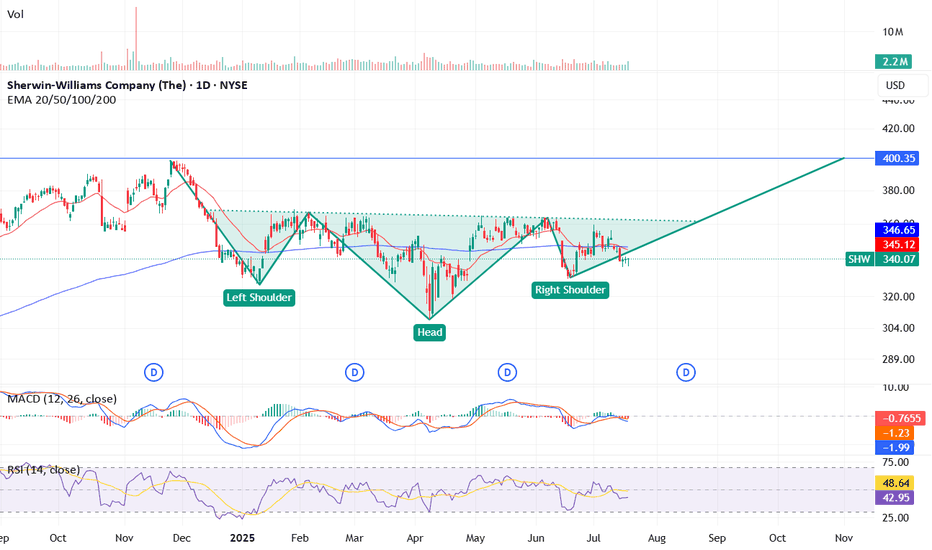

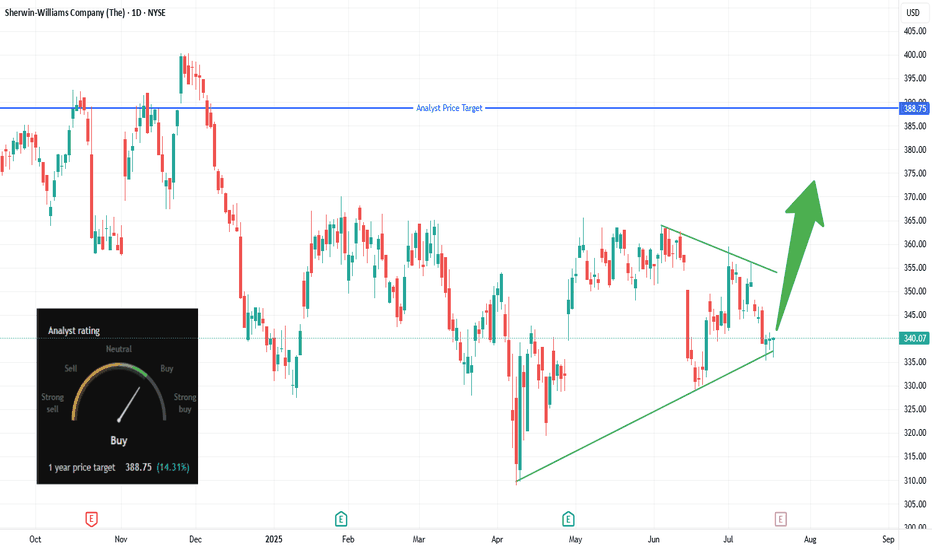

SHW Bulls Ready to Paint the Tape Green?📋 Trade Summary

Setup: Price bouncing off ascending trendline support in a tightening triangle pattern.

Entry: Market buy at ~$340

Stop-loss: Below channel support at $327.74

Targets:

Initial: $355 (trendline break)

Main: $388.75 (analyst price target)

Risk/Reward: ~1:3 R/R

🔎 Technical Rationale

Trendline Support: Price is holding the ascending channel bottom for several months.

Triangle Squeeze: Compression signals potential for a volatility breakout.

Daily Timeframe: Recent bounce coincides with overall market rotation into industrials.

🚀 Catalysts & Context

Analyst Price Target: $388.75 (+14% upside, see chart)

Recent Buy Ratings: Analyst consensus now “Buy” after last earnings.

Sector Rotation: Paint/coatings sector seeing inflows as cyclicals recover.

📈 Trade Management Plan

Entry: Market buy at $340; consider adding above $355 on confirmed breakout.

Stop-loss: $327.74 (below channel support).

Adjustment: Trail to breakeven after move above $355.

Scaling:

Take partial profits at $355

Hold remainder toward $388.75

🗳️ What’s Your View?

Are you watching SHW? Comment below or vote:

🔼 Bullish

🔽 Bearish

🔄 Waiting for confirmation

** Be sure to follow us so you don't miss the next big setup! **

⚠️ Disclaimer: Not financial advice. Trade at your own risk.

Sherwin-Williams Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams Stock Quote

- Double Formation

* (Target Entry Or Gap Fill)) At 770.00 USD | Completed Survey

* ((No Trade)) On Reversed Settings | Subdivision 1

- Triple Formation

* (Anchored VWAP)) + Cup & Handle Structure | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 300.00 USD

* Entry At 360.00 USD

* Take Profit At 460.00 USD

* (Consolidation Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Sherwin Williams, you will always need paintNYSE:SHW looks good here, pushing agains multi year horizontal resistance

* ER out of the way,

* weekly bull flag break here, need to confirm the weekly close,

can buy leaps or debit spreads, half size here and add on weekly confirmation.... not financial advice ;D

Sherwin-Williams | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams

- Double Formation

* 270.00 USD | Support Area | Subdivision 1

* Neckline | Uptrend Bias

- Triple Formation

* Flag Structure | Continuation Area Attempt | Subdivision 2

* 400.00 USD Resistance Area

* Triple Bottom | Retracement 50% | Subdivision 3

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

SHW Multi-Time-Frame Squeeze SHW has a history of making outsized moves on the back of Daily Squeeze action. In the recent past, it has moved in "harmonic" 50+ point surges. If the next daily squeeze fires long, I look for it to run up to it's prior high at $354. If it behaves like it did last quarter, this could happen on the run up into earnings. Thankfully, we're 1 month out, which gives us the added benefit of rising IV in the options. I'll buy calls or call butterflies and look to exit prior to the earnings event (to avoid IV crush and the event risk)!

Mean Reversion Strategy with High Win Rate on SHWFollowing on my thread, this time around I am applying my mean reversion strategy on SHW. This is a symbol with more than 20 years of price data. This proves that the strategy is inherently profitable across diverse assets and not subjected to overfitting risk. This study shows a strong positive expectancy as the win rate is above 90% while the average profit on a profitable trade is slightly larger than the average loss on a loss trade.

SHW Long OpportunitySHW has just over 13 days lost 20%. With earnings season coming up and SHW's full-year Zacks Consensus Estimates are calling for earnings of $9.48 per share and revenue of $21.88 billion. These results would represent year-over-year changes of +16.32% and +9.68%, respectively. Quite a high bar. According to our modelling the stock will be taking a breather going into earnings with some upside potential.

SHW is on a knife's edge.SHW is showing every sign of impending reversal it can while still maintaining its upward price channel. Even with yesterday's (1/3/22) sharp price decline, today it found support at the bottom of the channel.

The expected move the options are pricing in for the Jan 21, 2022 expiration date is about ∓ 3% shown as a yellow triangle here. Statistically; however, the expected move only has a 68.2% chance of being correct.

There are only 3 paths I see SHW taking in the next month:

1. Throughout the year SHW has tended to grow by about 30% and cool off by 10% and repeat, if that happened here then we should see the price follow the green arrow and usually take a meandering path to do so.

2. If the max pain price is correct then by Jan 21st, we should have a full correction, which some think SHW is overdue for, down to $290, following the white arrow.

3. And if the bounce off of support holds throughout this week, then we should expect the top of the channel to be tested again along with a new ATH following the purple arrow.

At the moment, I don't have any money in SHW because it's on a knife's edge. If we follow purple and top the channel I'll be buying Feb puts and if we have a close this week below the channel support (which also needs to break the RSI wedge), then I'll also buy Feb puts.