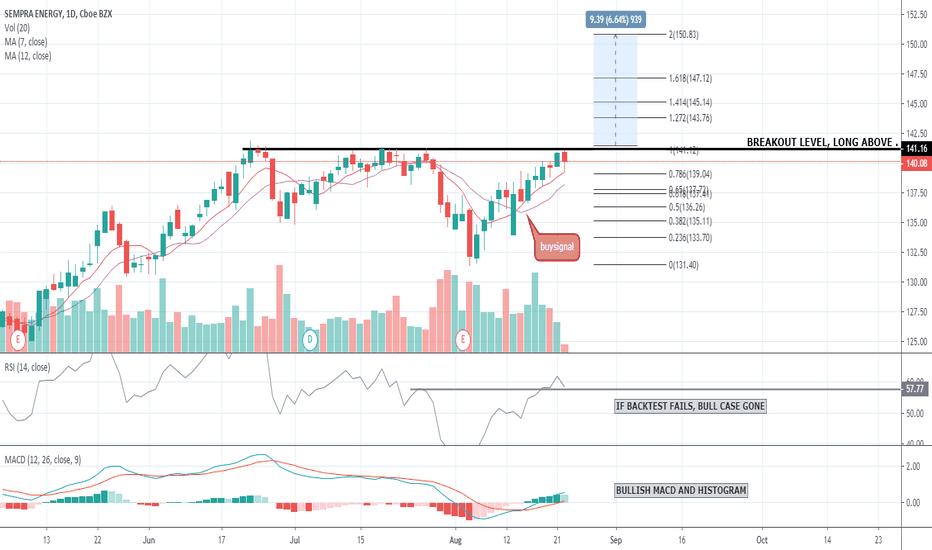

$SRE SEMPRA ENERGY ON VERGE OF BREAKOUT.======BREAKOUT TARGET $150======

BREAKOUT LEVEL $141

RSI ON CRITICAL BACKTEST LEVEL, INVALID IF IT BREAKS.

VOLUME A WORRY.

Sempra Energy is an energy-service holding company, whose operating units invests in, developing and operating energy infrastructure, and provides gas and electricity services to their customers in North and South America. It operates through the following segments: San Diego Gas & Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra South American Utilities, Sempra Mexico, Sempra Renewables, and Sempra LNG & Midstream. The SDG&E segment delivers electricity in San Diego County and Southern Orange City, California and also transports electricity and natural gas for others. The SoCalGas segment owns and operates a natural gas distribution, transmission, and storage systems that supplies San Luis Obispo, California in the north to the Mexican border in the south, excluding San Diego County, the city of Long Beach and the desert area of San Bernardino County covering the residential, commercial, industrial, utility electric generation, and wholesale customers. The Sempra South American Utilities segment operates Chilquinta Energia, which distributes electricity in Valparaiso and Viña del Mar in Chile; and Luz del Sur S.A.A., which distributes utility in Lima, Peru. The Sempra Mexico owns and operates natural gas-fired power plant, natural gas distribution systems, natural gas pipelines, and Energia Costa Azul liquefied natural gas regasification terminal. The Sempra Renewables segment operates wind and solar energy generation facilities and invests and develops projects in Arizona, California, Colorado, Hawaii, Indiana, Kansas, Minnesota, Nebraska, Nevada, and Pennsylvania. The Sempra LNG & Midstream segment develops and operates natural gas storage and related pipeline facilities in Alabama, Louisiana, and Mississippi, and has marketing operations in California. The company was founded on October 11, 1996 and is headquartered in San Diego, CA.

SREA trade ideas

SRE Long ideaSRE. I like this trade. The energy market is heating up. OIL is moving higher which will drive this sector. Not the curling higher MA's on the 4 hr chart. The price is above them all. This is a good looking chart. I'd set my stops at $111, and 1st target at last significant high around $123. I also took a position in 3x GUSH.

SRE continues uptrendSRE has been a good long opportunity since breaking above the $72 zone. On the weekly chart the 50ma has acted as support throughout the trend.

While the pullbacks on the weekly have all been within the normal parameters they have been a little more cumbersome to trade on the daily chart. The last two deep pullbacks both dropped to test the 200ma and figure 100 before bouncing back up. Now that area is cleared and, after earnings were released on 4th November, the bullish move continues.

A buy opportunity for SRE if you are happy to accept possible pullbacks.

New 52WK High only attracted buyersWill this breakout from June high help the price print a promised land $111.50. The chance increased as long as price stays above %105.25 and $103.85 area expect this to trade higher. Sempra Energy is a holding company. During the year ended December 31, 2011, Sempra Energy's business was organized in five segments consisting of San Diego Gas & Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra Generation, Sempra Pipelines & Storage and Sempra LNG (liquefied natural gas). The company is one of a few companies that will ultimately benefit from current on going crises in Ukrain.

Many will remind you that current earnings growth rate which outpaced its revenue growth, will not last that long or if you run SWOT analyses you may see that trend as unsustainable, but its. Operating Profit Margin, the company converts an above median percentage of its revenues to profits compared to other companies in the Multi-Utilities industry.

From technical point, the stock broke out well watched over head resistance previous pivot high or June high with a OK volume. This may encourage breakout buyers to believe 127% level is achievable as long the current crises in Ukrain goes on. If you decide to take a long position make your stop loss at recent swing low at and around 103.85 area. If you want to get a real-time alerts try us www.2waytrading.com