SWI trade ideas

SolarWinds (NYSE: $SWI) Ready To Go Sonic Boom ✨SolarWinds Corporation provides information technology (IT) management software products in the United States and internationally. The company offers a portfolio of solutions to technology professionals for monitoring, managing, and optimizing networks, systems, desktops, applications, storage, databases, website infrastructures, and IT service desks. It provides a suite of network management software that offers real-time visibility into network utilization and bandwidth, as well as the ability to detect, diagnose, and resolve network performance problems; and a suite of infrastructure management products, which monitor and analyze the performance of applications and their supporting infrastructure, including websites, servers, physical, virtual and cloud infrastructure, storage, and databases. The company also provides a suite of application performance management software that enable visibility into log data, cloud infrastructure metrics, applications, tracing, and web performance management; and service management software that offers ITIL-compliant service desk solutions for various companies. It markets and sells its products directly to network and systems engineers, database administrators, storage administrators, DevOps, SecOps, and service desk professionals. The company was formerly known as SolarWinds Parent, Inc. and changed its name to SolarWinds Corporation in May 2018. SolarWinds Corporation was founded in 1999 and is headquartered in Austin, Texas.

SolarWinds (NYSE: $SWI) On Q4 Earnings and Revenues Beat! 💰SolarWinds Corporation provides information technology (IT) infrastructure management software products in the United States and internationally. It offers products to monitor and manage network, system, desktop, application, storage, database, and website infrastructures, whether on-premise, in the public or private cloud, or in a hybrid IT infrastructure. It provides a suite of network management software that provides real-time visibility into network utilization and bandwidth, as well as the ability to detect, diagnose, and resolve network performance problems; and a suite of infrastructure management products, which monitor and analyze the performance of applications and their supporting infrastructure. It also offers suite of application performance management software that enable visibility into log data, cloud infrastructure metrics, applications, tracing, and web performance management; and service management software. In addition, the company provides cloud-based software solutions to enable managed service providers (MSPs) to support digital transformation and growth in small and medium-sized enterprises; and service management software that provides ITIL-compliant service desk solutions for various companies. Further, it offers remote monitoring and management solutions for the performance of networks and devices, and automation of policies and workflows; security and data protection products for network and systems infrastructure, applications, and end user devices; and business management solutions for professional services automation, and password and documentation management. The company markets and sells its products directly to network and systems engineers, database administrators, storage administrators, DevOps professionals, and managed service providers. The company was formerly known as SolarWinds Parent, Inc. and changed its name to SolarWinds Corporation in May 2018. The company was founded in 1999 and is headquartered in Austin, Texas.

$SWI Solar winds infrastructure win..SolarWinds Corporation designs and develops information technology management software for infrastructure solutions. The Company offers solutions such as network performance monitoring, configuration, virtualization, database management, hosted logs, security, and configuration. SolarWinds serves customers in the United States.

JULY 20TH 2021

Red shake off of previous shareholders while taking in new inflow due to gap up.

On August 2nd 2021, a massive green candle has resulted in clear EMA Cross over of

all three minor EMA (20/50/100) over the

major EMA trend line(200) On August 3nd 2021.

This all indicates bullish up trend. If you refer to the last time this happened, on Jun 24th 2020,

and you bought on that day, the stock would have ran up roughly 25% till the 11th of december.

Where you can see a bearish down trend occurs, and the EMAS all dip under neath the 200 EMA.

This bearish downtrend has been confirmed dead on the 20th of july 2021.

I believe a new bull run has started.

Due to current Catalysts involving the Infrastructure 1 trillion plan, $1.5 Cash per share one time dividend annoucement, Morgan Stanely raised price target from 20-> 40, and Earnings suprise today of 60%. I believe this company will achieve even higher revenues and have another earnings beat in november. While also maintaining a bull run to 30-40 dollars.

Where is support?

Most likely at 22.86. (Refer to high on feb 04 2020, and August 07 2020.)

Thanks,

Ben

finance.yahoo.com(SWI)%20came%20out%20with,Estimate%20of%20%240.43%20per%20share.

www.businesswire.com

$SWI can rise in the next daysContextual immersion trading strategy idea.

SolarWinds Corporation provides information technology (IT) infrastructure management software products in the United States and internationally.

The demand for shares of the company looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $18.54;

stop-loss — $17.86.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Perfect entry for Solar Winds (SWI)Fundamental Analysis

1. Industry: Information technology (IT), infrastructure management software ++

2. Price: Very Cheap

3. Upward potential: 61%

4. Risk-Reward Ratio: 1:8

5. 5Y EPS Growth: 30%-50%

Technical Analysis

1. Volume is growing

2. Support of the MA9

3. Boilinger Percentage: 17% (high short-term potential)

4. Morningstar growth rate: B (91%)

5. Short-term target: 20

6. Long term target: 25

SolarWinds 50 products for specific IT tasks, but they are combined in a single interface, which SolarWinds calls the Orion platform.

"hackers funded by a foreign government broke into the computer networks of the american software manufacturer solarwinds and implemented a malicious update for its orion software in order to infect the networks of government and commercial organizations using it," fireeye reported on sunday, december 13 .

The damage can be much broader and risk factors for reputation, which can even become a death trap for the company.

However, let's look at it from the other side, many companies were attacked and only a few failed to get out , while out of 18 thousand organizations that downloaded malicious updates for SolarWinds Orion software, only forty (about 0.2%) were subjected to further cyber attacks through the installed backdoor. However, SolarWinds is unique in the ecosystem. Almost everything they provide can be replaced with other software, but it will take time to build, it will cost a lot of money, and it will not have the unified user interface that Orion offers. I think this is a sufficient reason to keep the company afloat . .

Following the news of the hack, the stock nearly halved from $ 24.20 to $ 14 . On the chart, we see the interest of large buyers at the level of 11.50 -12.20 . if the price breaks through the level of 12.00 and does not slip too far , then this formation will be ideal for entry and you can work out a false breakout. Take will be good ..

Share your opinion in the comments and support the idea with likes.

Thank you for your support!

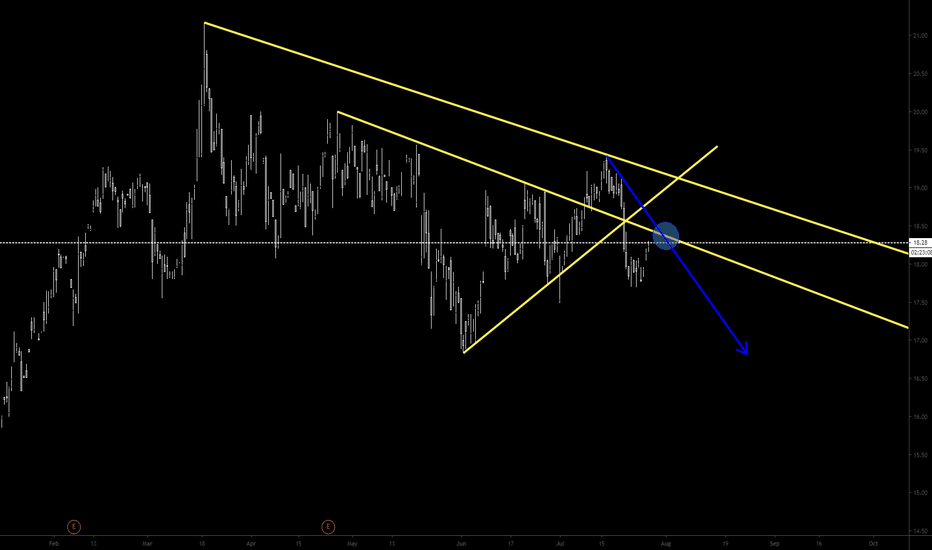

Solarwinds Corporation short after bounceback from resistanceHistorically, the price of the Solarwinds Corporation has been very steady, moving in its normal range between 16.76 and 19.40. Given no overbought signals, nor any divergence with the MACD, I expect the price to be pushed a little bit higher by the bulls, at least to 19.40, if not up to 20.41. But it will not break these resistance levels for long. When the bears take over, make sure to go short!

VF Investment can not be held responsible for any financial damages suffered from following our well-funded but personal opinions and trading ideas.

Please, maintain proper position sizing and risk management!

Solarwinds Technical Analysis: Throwback before Resumption!So far the latest decline was probably a retest to the broken resistance level, which is a usual phenomena in price action, as price retests broken resistance levels, which turn to support in most cases( I say in most cases cause there is always a percentage of failure)

Accordingly. the price is likely to remain supported in the near term target the top of the channel and possibly 60.95 major high. Note that a break below the rising trend line for the channel will probably reverse the bias to bearish.

------------------------------------------------------------------------------------------------------------------------------------------------------------

Be one of the first members of my new trading portal, check my new website thefxchannel.com , vote and subscribe. Thank you

Good luck, keep your stops tight..

twitter.com

www.facebook.com

plus.google.com

My best regards

Technician