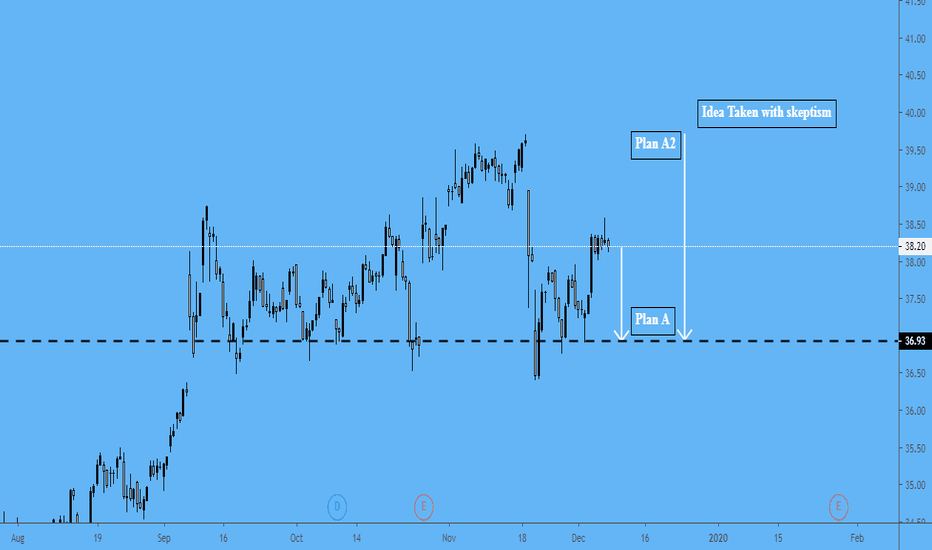

Melt-up @ workIn this market At&t is a golden goose with a healthy dividend and they're on the forefront of large-scale implementation of 5G. Although headwinds are strong (debt/ etc) , the bull market we're in and the future growth potential outweight the negatives at this point in time, especially since it still has a sane P/E. Go long, Q2 price target $42 + dividend along the way

Sell at 2nd support, if that is lost expect a rapid descent

Commentary, opinions, thoughts welcome

Some Articles:

www.cnet.com

www.fool.com

www.barrons.com

oppisite take on earnings -

T trade ideas

AT&T Vulnerable: Debt & Cash Flow LeaksT is highly leveraged on debt after acquisitions. There has been an expressed effort to pay down this debt and improve the debt to earnings ratio, but there is still a lot there. This makes T vulnerable to economic factors turning against them. Interest rate hikes would hurt them a lot (These seem unlikely), and a drop in the economy troubling earnings can sting them hard.

Alongside it's debt pile, T has various cash flow obligations. Paying a high dividend seeps money out of the company and upgrades to take advantage of 5G technology will be expensive. It's a delicate balancing act. Walking of a tightrope, and this will not stand up too well if it starts to get windy in the markets.

From a technical viewpoint, T is already weak and has been in a range for a while. This looks more like it has been a consolidation pattern than the start of a recover. Another leg breaking the low seems more probable than it continuing much higher than the established range. If this breakout happens, we should watch for a butterfly pattern to give signs to take profit and consider long positions.

Swing Trade : Sell T 38.30. Stop Loss 44. Target 10.

If this move starts to happen, I will post additional short term trades to follow the momentum through days/weeks

AT&T CFO signals reiterates strong guidanceAs AT&T's stock dips on the ex-dividend date today, traders may want to take advantage of the buying opportunity. Communications services are likely to be a solid sector this year with the 5g revolution coming, and comments by AT&T's CFO indicate that the company has strong execution right now.

The CFO reiterated the company's EPS guidance of 3.60-3.70, above the Street view of 3.58. He also said that AT&T is buying back more shares than expected, and that it also has exceeded its target for cost-cutting this year.

AT&T is a great stock for both growth and income, with a P/E of about 11 and a dividend yield above 5%.

How to trade in range/consolidation periodA lot of people asked me what to do in the case when the price is stuck in consolidation.

You can use Fibonacci retracement and create a range (0, 0.25, 0.5, 0.75, 1) and put it from swing low up to swing high. By that, you will create key points where the price will react on during consolidation time.

You can use it on all Timeframes and it does not matter if it is Monthly, Weekly, Daily or minute chart.

As you can see here, price very nicely reacts to each of our levels which we have set up once the range has been established. Also, when the price is stuck in consolidation range you do not want to trade it. Avoid it. You will make many mistakes, rather you should focus on a clear bullish/bearish trend.

Atnt- T - Long - bullish trend in MAs looking +10% safe in 2020Looking at the 20, 50 and 200 moving day crosses and relations back to 2009 seem to indicate T will test the recent 52-week highs break through and consolidate before boosting up on 5g cycle follow-through. T is trending to be a $50 dollar stock by the end of 2022

Watch for the cross of Moving averages in the weeks to come to confirm a long trade or even a multi-year investment (5% div)

I am long T

AT&T Symmetrical triangleAT&T has formed a symmetrical triangle, which will lead to a bullish breakout. The prior uptrend can be observed as being very bullish, which led to the peak at (1) and bearish reversal at (7) . Have also included a symmetrical triangle diagram for anyone interested in learning chart patterns.

$T Thursday trade setup in AT&TEntry level $38.83 = Target price $39.64

P/E ratio 17.32

Yield 5.7%

AT&T, Inc. is a holding company, which engages in the provision of telecommunications media and technology service. It operates through the following four segments: Communications, Warner Media, Latin America and Xandar. The Communications segment provides services to businesses and consumers located in the U.S., or in U.S. territories, and businesses globally. The Warner Media segment develops, produces and distributes feature films, television, gaming and other content over various physical and digital formats. The Latin America segment provides entertainment and wireless services outside of the U.S. The Xandar segment provides advertising services. The company was founded in 1983 and is headquartered in Dallas, TX.

AT&T rising wedgeAT&T's valuation looks pretty good today, with a 57/100 valuation score from S&P Global Intelligence. Dividend yield currently stands at 5.5%, making this a solid stock for recession protection and a steady cash return. Analyst summary score is 8.9/10, and options activity is bullish. AT&T is in the middle of a rising wedge; buy here or pick up any dip to the bottom of the wedge. There's a fair amount of volume support below the current price, with particularly strong support around $38 per share.

T Round UpT has closed over its 50 day moving average on increasing volume. The 9,20 and 50 day moving averages are all converging underneath the price action as support for a round up towards resistance at the $39.75 level, for a 4.5% move. The price has rebased around support levels over the past several days and is showing bullish candlesticks to retest resistance.

$T its long opportinity but entry should be between 34-35 After recent drop all indicators made corrections also candlesticks pattern showing possible bounce from current levels at 37.37 but it tested broken trend on Friday then drop back prior closing .. looking to channel bottom between 34-35 then it will be perfect LONG opportunity targeting 40s on long term or at least targeting 37s again which around 10% from entry . Note:also its risky to short it from current levels as i said most of indicators are oversold. so best ideas with it is to wait for price drop then get in .. or can get put options with stop limits at 38 but it will be risky

A long-term investment are my asset hold forever! Div growth! I believe in American Telephone And Telegraph that will bring our shares and dividend growth after 2022! I keep buying shares until I reach a total of 5,882 shares.

about.att.com

This stock has dividends every 3 months. AT&T offers to pay $0.51 per a share.

T - DAILY CHARTHi, today we are going to talk about AT&T Inc and its current landscape.

The AT&T Inc today it's stepping in the spotlight since the Walt Disney Co. debuted today it's streaming service that it's determined to face HBO max and other streaming services. With a basic subscription cost of $7 versus the $15 charged by HBO max and an arsenal of content loaded with Marvel, Pixar, and Star Wars Universes, plus more than 400 movies and other types of content including all seasons of "The Simpsons." Disney, it's also heavily producing and investing in new exclusive content, which makes the entering of Disney in the streaming war a frightening one for its adversaries. The Walt Disney Company CEO Robert Iger it's willing to play heavy on this showdown and has enough resources and experience to at least reshape the streaming market once for all. Those are exciting news to consumers of this type of service, that can be benefited from this competition but an unpleasant one for investors, since during this type of dispute the balance usually take the hit of a producing or price war.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.