Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.27 USD

69.67 M USD

3.05 B USD

44.02 M

About Teleflex Incorporated

Sector

Industry

CEO

Liam J. Kelly

Website

Headquarters

Wayne

Founded

1943

FIGI

BBG000BV59Y6

Teleflex, Inc. engages in the provision of medical technology products. It operates through the following business segments: Americas, EMEA (Europe, the Middle East and Africa), Asia, and Original Equipment Manufacturer and Development Services (OEM). The Americas, EMEA, and Asia segments are involved in the design, manufacture, and distribution of medical devices primarily used in critical care and surgical applications and generally serve two end-markets: hospitals and healthcare providers, and home health. The OEM segment refers to the design, manufacture, and supply of devices and instruments for other medical device manufacturers. The company was founded in 1943 and is headquartered in Wayne, PA.

Related stocks

Teleflex Incorporated

There was a recent minor pullback, but the price is attempting to resume the uptrend as it has bounced back to the upper side of the Bollinger Bands.

Middle Line (SMA): This line is being used as support, and the price bouncing off this level further supports the uptrend.

In the most recent da

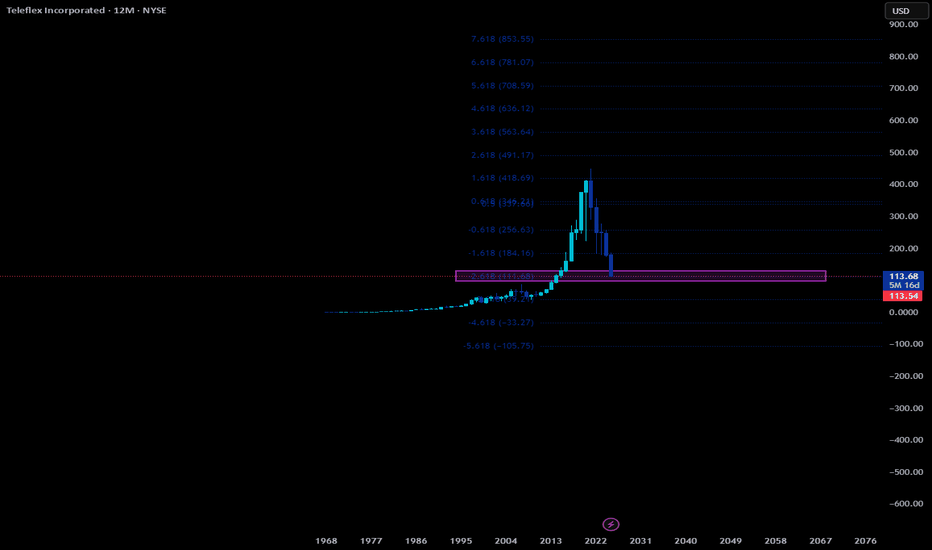

TFX Coin Weekly OutlookOn Weekly Chart of TFX

- Head & Shoulder Pattern showed up from Nov 2020 and breaking the 'neck' on Nov 2021.

- Price keep making breaking of structure (BOS)

- Price moving towards closest support at the price of 182.93

Key Point?

1) If Break 182.93, price contiue bearish to the next support at 140

the b[AI]te's weekly insights -- TFX 2021-03-08center stage image

stock

our system found that TFX received the best image over the course of last week.

comment image

we see a moderate negative correlation with our image indicator. We therefore assume that prices are driven partial emotionally as there is probably some other catalyst wit

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TFX4991347

Teleflex Incorporated 4.25% 01-JUN-2028Yield to maturity

5.45%

Maturity date

Jun 1, 2028

TFX4566956

Teleflex Incorporated 4.625% 15-NOV-2027Yield to maturity

5.37%

Maturity date

Nov 15, 2027

See all TFX bonds

Frequently Asked Questions

The current price of TFX is 115.89 USD — it has decreased by −3.02% in the past 24 hours. Watch Teleflex Incorporated stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Teleflex Incorporated stocks are traded under the ticker TFX.

TFX stock has fallen by −0.24% compared to the previous week, the month change is a −5.26% fall, over the last year Teleflex Incorporated has showed a −48.89% decrease.

We've gathered analysts' opinions on Teleflex Incorporated future price: according to them, TFX price has a max estimate of 159.00 USD and a min estimate of 120.00 USD. Watch TFX chart and read a more detailed Teleflex Incorporated stock forecast: see what analysts think of Teleflex Incorporated and suggest that you do with its stocks.

TFX stock is 5.56% volatile and has beta coefficient of 0.33. Track Teleflex Incorporated stock price on the chart and check out the list of the most volatile stocks — is Teleflex Incorporated there?

Today Teleflex Incorporated has the market capitalization of 5.12 B, it has decreased by −5.52% over the last week.

Yes, you can track Teleflex Incorporated financials in yearly and quarterly reports right on TradingView.

Teleflex Incorporated is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

TFX earnings for the last quarter are 3.73 USD per share, whereas the estimation was 3.36 USD resulting in a 10.93% surprise. The estimated earnings for the next quarter are 3.41 USD per share. See more details about Teleflex Incorporated earnings.

Teleflex Incorporated revenue for the last quarter amounts to 780.90 M USD, despite the estimated figure of 771.55 M USD. In the next quarter, revenue is expected to reach 874.48 M USD.

TFX net income for the last quarter is 122.58 M USD, while the quarter before that showed 95.00 M USD of net income which accounts for 29.03% change. Track more Teleflex Incorporated financial stats to get the full picture.

Yes, TFX dividends are paid quarterly. The last dividend per share was 0.34 USD. As of today, Dividend Yield (TTM)% is 1.17%. Tracking Teleflex Incorporated dividends might help you take more informed decisions.

Teleflex Incorporated dividend yield was 0.76% in 2024, and payout ratio reached 91.92%. The year before the numbers were 0.55% and 18.05% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 14.1 K employees. See our rating of the largest employees — is Teleflex Incorporated on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Teleflex Incorporated EBITDA is 871.85 M USD, and current EBITDA margin is 27.52%. See more stats in Teleflex Incorporated financial statements.

Like other stocks, TFX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Teleflex Incorporated stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Teleflex Incorporated technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Teleflex Incorporated stock shows the sell signal. See more of Teleflex Incorporated technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.