TMHC – 30-Min Short Trade Setup!📉

🔹 Ticker: TMHC (NYSE)

🔹 Setup: Trendline Rejection + Resistance Hold

🔸 Rejection Zone: ~$59.44 (yellow zone + wedge top)

📊 Trade Plan (Short Bias)

✅ Entry Range: $59.30–$59.50

✅ Stop Loss (SL): Above $60.75 (red zone resistance)

✅ Profit Targets:

• TP1: $57.56 (blue support base)

• TP2: $56.16 (green minor support)

• TP3: $55.45 (orange zone - extended support)

📐 Risk-Reward Notes

• Bearish wick rejection at key trendline

• Price reacting to previous support flipped resistance

• Pattern shows signs of exhaustion at the top

🔍 Technical Highlights

• Lower highs + trendline pressure

• Bearish engulfing rejection candle

• Consolidation under resistance = short bias continuation

⚙️ Trade Management

• Move SL to breakeven after TP1

• Scale out partially near TP2

• Let remaining ride with trailing SL if momentum builds

⚠️ Invalidation Triggers

❌ Price breaks and holds above $60.75

❌ Strong bullish breakout candle

❌ Volume surge above trendline

TMHC trade ideas

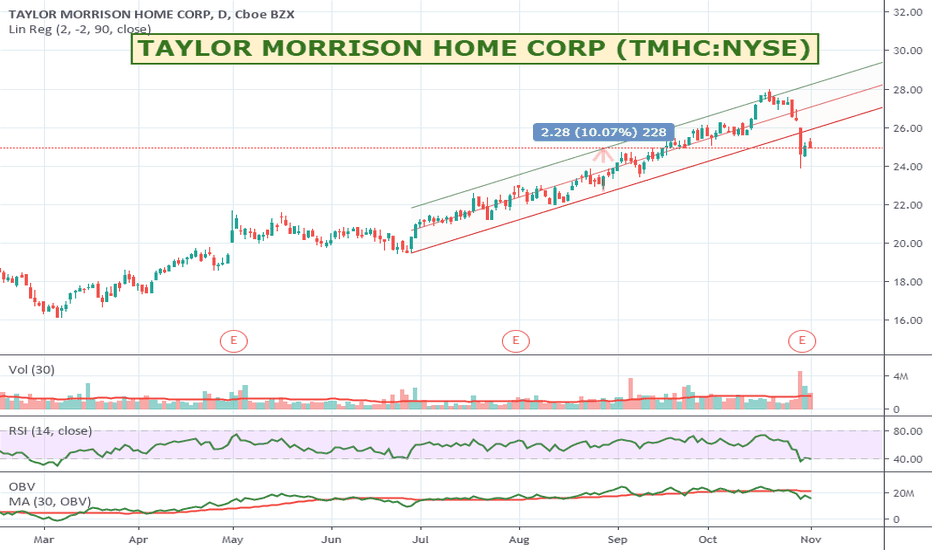

TMHC A Steady Gainer - worth the time?Stock has been on a steady rise since oct 22. Out of the 7 earnings it only missed one.

This leads me to believe were looking at a run up before their earnings call on July 23rd ( Right before market open ) & If it falls it continuosly bounces off the 100 EMA.

It already showed it has potential to touch 60 on jun 23rd.. Retest prior to earnings?

To be continued..

Momentum Stock: Taylor Morrison Home CorporationTaylor Morrison Home Corporation is a national homebuilder and land developer in the U.S., specializing in the construction and sale of single-family detached and attached homes. The company's investment appeal lies in its strategic expansion across desirable real estate markets, providing geographical diversification and resilience against localized market downturns. Further bolstering its attractiveness to investors, Taylor Morrison has a strong commitment to customer satisfaction and quality homes, alongside robust financial performance. Its emphasis on sustainable practices aligns with growing ESG investment trends, making it an intriguing choice for investors seeking stability, growth, and sustainability within a single investment.

In terms of any kind of short term entry, I would want to wait for a pullback with an indication of the uptrend continuing in order to get better value. The RSI and MACD are both pretty high at the moment which you would expect for a momentum stock, but you can see where they have dipped down to in the past and where better value for an entry might be found.

For risk management, a trailing stop loss of around 12% would have kept you in most of this trade. If it broke below that it could have been a good sign to exit and look for a new entry when the trend resumed.

As always how you interpret and decide to act on any results is up to you. This is just data not financial or trading advice and past performance is in no way any guarantee of future performance. Think of it as a way to spot stocks you might be interested in and can add to your watch list and perform further research on and or discuss with your broker.

Again. Not trading advice . Industries and companies change. Trends can end. Do your own research / discuss it with your advisor, but might be one to watch.

TMHC - Summer '23 Real Estate Apocalypse? (Short)Redmane: They are over extended on homes built and going to be forced to sell at a loss with rates climbing and people's buying power dropping.

Dawson's notes:

1) Zoom out we're in a large channel with good support at $27 (yellow)

2) The 21 day ATR is between $40 and $33.

3) Price is right against resistance at the $38 double top, which is also the midpoint of the channel (thin dashed lines)). So if we get a bull move, there's not a lot of resistance between $38 and the top of the channel at $50. If we get a bear move, I wouldn't expect to break below $27.

Conclusion:

We're eying a 2.29 to 1 short through the summer.

NOTE: We have a lot of chop and pivot support and an old gap(!) at $28.30 so a TP just above it at $28.57? If i was scalping or looking to take a partial profit, I'd sell a little at $34/33ish (thin green line).

These are just some thoughts to consider. Housing is in a very precarious spot due to the combination of high home prices and high mortgage rates.

Mid-term buying opportuninty for TMHCHey there!

Let's take a look at technical picture for Taylor Morrison Home Corp NYSE:TMHC .

We have just bounced from the bottom line of clearly defined channel that has been started almost a year ago (from 26th June 2020).

So we can expect an upward direction in this stock's price.

From the Elliot Wave Theory there is also a bullish set up for this stock.

This stock has started the first wave like many other stocks in the end of march 2020 and ended a first wave on 20th October 2020. Afterwards we have a sharp zig-zag correction to the bottom line of the previously defined channel and the wave 3 started in November 2020. The nice leading diagonal pattern shows us that there should be more impulse move upwards. So the closest target price for the current wave should be at least at 34 usd per share. That corresponds 1.618 fibonacci level.

And as the last point we've just bounced from the old resistance level at 28.21 us per share that was holding this stock since 2018.

Summary:

There could be a good long position with an 20% upside potential and take profit at 34.5 usd per share and tight stop loss of about 4% at 27.75 level.

$TMHCEntry price : 24.81

Fundamentals :

- Sector: Building - Residential

- EPS % Chg (Last Qtr): 39%

- EPS % Chg (Previous Qtr): -34%

- 3 Year EPS Growth Rate: 22%

- EPS Est % Chg (Current Yr): -33%

- Sales % Chg (Last Qtr): 54%

- Sales % Chg (Previous Qtr): 21%

- 3-Year Sales Growth Rate: 16%

- Annual Pre -Tax Margin: 8.6%

TMHCYesterday, #TMHC, which has a business similar to #EXPI (Home builder), reached a new all-time high (ATH). There was a breakdown of a large resistance level, and now the security will be fixed at the top, from there in growth, it is expected that 2 growth targets will be achieved - prices 41.12 and 49.12 (in total + 75%). It makes sense to leave this security for the medium term after reaching the goals of the trade.

BIG Potential for TAYLOR MORISSON HOME CORPHey investors, TAYLOR MORISSON HOME CORP is in a zone of compression which it seeks to break upwards, high volume of sales on the last session. false bearish signal it goes towards its last previous low to turn around and go upwards we can reach the decision area if the buyers coordinate on a price.

Please LIKE & FOLLOW, thank you!

TMHC LONG OPPORTUNİTYThe homebuilder has healthy books and took a large hit from the coronavirus. The company has taken a freefall from $28 a share to $6 a share, where we saw a bottom. The long play here relies heavily on the scale the company has in the U.S consumer durables segment. The company is trading at a discount when compared with peers, and still has double-digit earnings growth. and current levels indicate oversold territory.

$TMHC:NYSE - TAYOR MORRISSON - Possibly oversold.Might be a value opportunity for those who like this kind of trade where it has probably oversold on earnings announcement.

Taylor Morrison Home Corporation (Taylor Morrison) is a home building and land developing company. It builds and sells single-family detached and attached homes. It operates under the Taylor Morrison and Darling Homes brand names. It also provides financial services to customers through its mortgage subsidiary, Taylor Morrison Home Funding, LLC (TMHF), and title insurance and closing settlement services through its title company, Inspired Title Services, LLC. Its business is organized into multiple homebuilding operating divisions and a mortgage and title services division, which are managed as multiple reportable segments like: East Central and West Mortgage Operation. Its East Central segment includes Atlanta, Charlotte, Chicago, Orlando, Raleigh, Southwest Florida and Tampa Austin, Dallas, Houston and Denver. Its West Mortgage Operation includes Bay Area, Phoenix, Sacramento and Southern California, Taylor Morrison Home Funding (TMHF) and Inspired Title Services