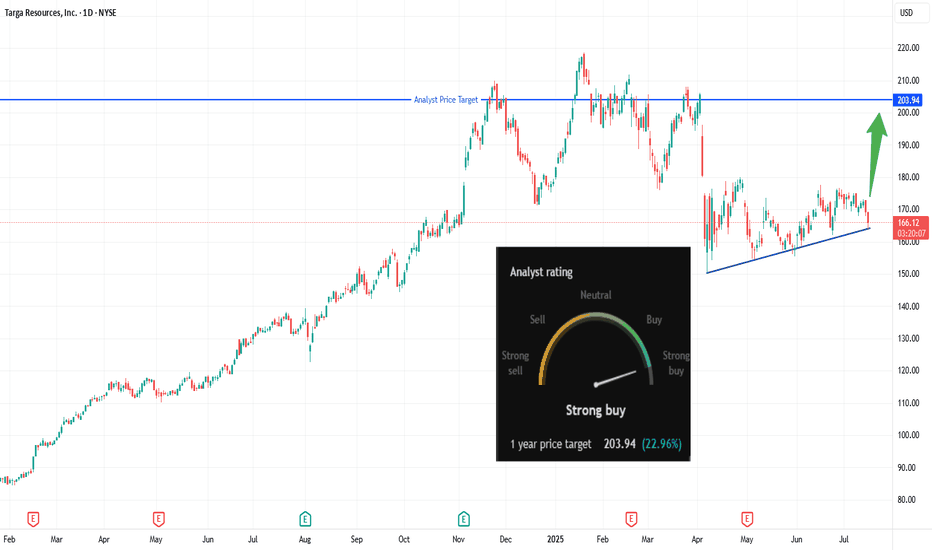

Breakout Brewing: Is TRGP About to Explode?🔹 Trade Summary

Setup:

Ascending triangle forming over several months

Price consolidating near major resistance

Strong analyst buy rating with 1-year target at $203.94

Entry:

Buy on daily close above $169.42 (breakout trigger)

Stop-loss:

Below $159 (invalidate the setup)

Tar

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.46 USD

1.27 B USD

16.63 B USD

213.36 M

About Targa Resources, Inc.

Sector

Industry

CEO

Matthew J. Meloy

Website

Headquarters

Houston

Founded

2005

FIGI

BBG0015XMW40

Targa Resources Corp. engages in the business of gathering, compressing, treating, processing, transporting, and purchasing and selling natural gas. It operates through the following segments: Gathering and Processing, and Logistics and Transportation, and Other. The Gathering and Processing segment includes assets used in the gathering, and purchase and sale of natural gas produced from oil and gas wells. The Logistics and Transportation segment refers to the activities and assets necessary to convert mixed natural gas liquids (NGLs) into NGL products. The Other contains the results of commodity derivative activity mark-to-market gains and losses related to derivative contracts. The company was founded on October 27, 2005 and is headquartered in Houston, TX.

Related stocks

Another Nat Gas Play Breaking Out! The US is going big into the LNG exporting business in the next few years, and any company that can move that along is going to make money.

The technicals still look strong to go higher, but right now the future fundamentals look even more compelling.

Targa Resources Corp. provides midstream natu

filing the gap at 77 before see reversal indicators curling upThe stochastics are at a low, and then you got MACD still forcing its way down some more; it should restore bullish with a reversal pattern, but do not see this at this level until it drops a few points; we can see there is a sentiment of a reversal, but we are waiting until we see an indicator, or

Targa Resources Corp. WCA - Ascending TriangleCompany: Targa Resources Corp.

Ticker: TRGP

Exchange: NYSE

Sector: Energy

Introduction:

In today's examination, we focus on Targa Resources Corp. (TRGP) listed on the NYSE, a key player in the energy sector. The weekly chart exhibits a bullish breakout from an Ascending Triangle pattern, which h

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

T

TRGP4940559

Targa Resources Partners LP 6.875% 15-JAN-2029Yield to maturity

6.19%

Maturity date

Jan 15, 2029

See all TRGP bonds

Curated watchlists where TRGP is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of TRGP is 162.92 USD — it has decreased by −0.57% in the past 24 hours. Watch Targa Resources, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Targa Resources, Inc. stocks are traded under the ticker TRGP.

TRGP stock has risen by 0.81% compared to the previous week, the month change is a −4.75% fall, over the last year Targa Resources, Inc. has showed a 20.37% increase.

We've gathered analysts' opinions on Targa Resources, Inc. future price: according to them, TRGP price has a max estimate of 240.00 USD and a min estimate of 188.00 USD. Watch TRGP chart and read a more detailed Targa Resources, Inc. stock forecast: see what analysts think of Targa Resources, Inc. and suggest that you do with its stocks.

TRGP reached its all-time high on Jan 22, 2025 with the price of 218.51 USD, and its all-time low was 3.66 USD and was reached on Mar 18, 2020. View more price dynamics on TRGP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TRGP stock is 3.63% volatile and has beta coefficient of 1.03. Track Targa Resources, Inc. stock price on the chart and check out the list of the most volatile stocks — is Targa Resources, Inc. there?

Today Targa Resources, Inc. has the market capitalization of 35.34 B, it has decreased by −2.78% over the last week.

Yes, you can track Targa Resources, Inc. financials in yearly and quarterly reports right on TradingView.

Targa Resources, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

TRGP earnings for the last quarter are 0.92 USD per share, whereas the estimation was 1.98 USD resulting in a −53.53% surprise. The estimated earnings for the next quarter are 1.86 USD per share. See more details about Targa Resources, Inc. earnings.

Targa Resources, Inc. revenue for the last quarter amounts to 4.56 B USD, despite the estimated figure of 4.90 B USD. In the next quarter, revenue is expected to reach 4.89 B USD.

TRGP net income for the last quarter is 198.80 M USD, while the quarter before that showed 315.90 M USD of net income which accounts for −37.07% change. Track more Targa Resources, Inc. financial stats to get the full picture.

Yes, TRGP dividends are paid quarterly. The last dividend per share was 1.00 USD. As of today, Dividend Yield (TTM)% is 2.15%. Tracking Targa Resources, Inc. dividends might help you take more informed decisions.

Targa Resources, Inc. dividend yield was 1.54% in 2024, and payout ratio reached 47.94%. The year before the numbers were 2.13% and 50.48% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 3.37 K employees. See our rating of the largest employees — is Targa Resources, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Targa Resources, Inc. EBITDA is 4.56 B USD, and current EBITDA margin is 26.33%. See more stats in Targa Resources, Inc. financial statements.

Like other stocks, TRGP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Targa Resources, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Targa Resources, Inc. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Targa Resources, Inc. stock shows the buy signal. See more of Targa Resources, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.