Tronox Holdings (TROX) Long Thesis – Target Price: $20Investment Rationale: Tronox Holdings plc (NYSE: TROX) is a global leader in titanium dioxide (TiO₂) production, essential for paints, coatings, plastics, and other industrial applications. The company also mines and processes titanium-bearing minerals and zircon, making it a vertically integrated player with strong cost control advantages.

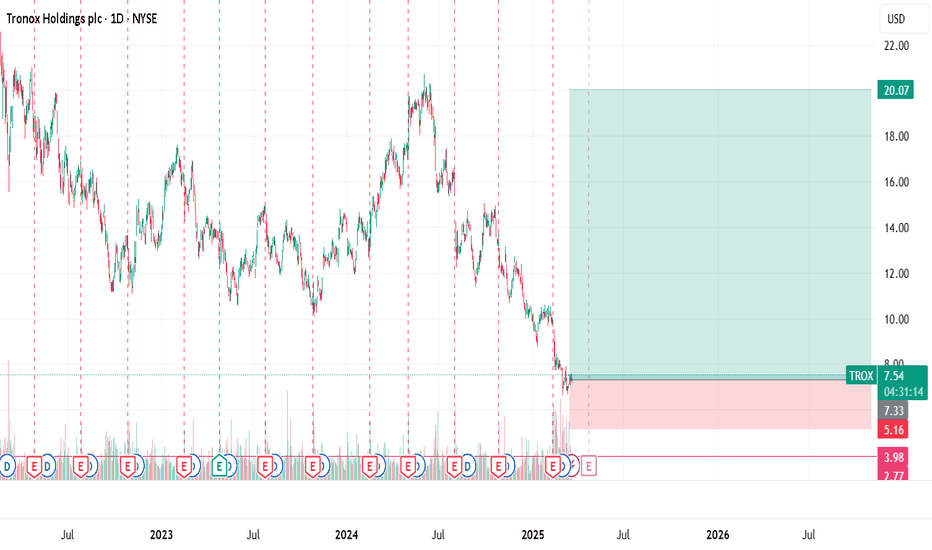

Despite short-term challenges, Tronox presents a compelling long-term investment opportunity with a target price of $20, representing a potential upside of over 170% from current levels ($7.29). This bullish outlook is supported by key fundamental catalysts:

1. Revenue Growth & Margin Expansion

Tronox has successfully navigated cyclical headwinds, and 2025 revenue is projected to reach $3.0–3.4 billion, reflecting a return to industry normalization.

Adjusted EBITDA guidance for 2025 is $525–625 million, with further cost-saving initiatives of $125–175 million by 2026.

The expected 12–16% increase in TiO₂ volumes indicates strengthening demand across industrial sectors, which should support revenue and margin growth.

2. Industry Recovery & Pricing Upside

The TiO₂ market has been in a down cycle, but industry-wide supply rationalization (including Tronox idling underperforming assets) is set to rebalance supply and demand.

Historical pricing trends suggest that once demand stabilizes, TiO₂ prices can surge rapidly, leading to significant operating leverage for Tronox.

Potential price increases for zircon, another high-margin product, provide an additional revenue boost.

3. Valuation Upside – Trading Below Book Value

Current P/B ratio is only 0.64, meaning the stock trades significantly below its intrinsic asset value.

P/S ratio of ~0.35 is well below historical norms, highlighting a substantial discount compared to peers like Kronos Worldwide (KRO) and Chemours (CC).

Forward P/E estimates of ~13-14 indicate a potential re-rating as profitability recovers.

4. Strong Dividend & Shareholder Returns

Tronox offers a high dividend yield of ~5%, which remains stable even during downturns.

Management is committed to returning capital to shareholders, reinforcing confidence in long-term cash flow stability.

5. Debt Management & Financial Stability

Although Tronox carries $2.9 billion in total debt, its liquidity position of $578 million and ongoing cost reductions should improve balance sheet health.

The company maintains a manageable interest coverage ratio, and deleveraging efforts could significantly enhance shareholder value.

6. Wall Street Sentiment & Price Target Consensus

Analyst price targets range between $11–$26, with an average target of $14.02 (indicating ~90% upside).

Some institutions, including Truist Securities and UBS, have upgraded their recommendations, highlighting deep value and a strong potential for rebound.

Conclusion: A Deep Value Play with High Upside

Tronox Holdings is severely undervalued given its improving fundamentals, industry recovery potential, and long-term strategic positioning. With a $20 target, this stock represents a strong asymmetric risk-reward opportunity for long-term investors. As TiO₂ demand stabilizes and cost-cutting measures take effect, Tronox could generate over $1 billion in EBITDA in an upcycle, driving substantial price appreciation.

Investment Rating: STRONG BUY

Timeframe: 12–24 months

Upside Potential: +170%

TROX trade ideas

TROX: I see potential. Take a look and process your way.The action since 2017 could be seen as a cup with handle pattern. The action since 2012 looks like a large "W" pattern. There is overhead resistance. I think intermediate term 34-35 is possible. Up about 13% so far today.

Process you r way.

From Zack: " Tronox Holdings plc is a vertically integrated mining and inorganic chemical business. The company mines and processes titanium ore, zircon and other minerals and manufactures titanium dioxide pigments to paints, plastics, paper and other everyday products. It operates primarily in South Africa, Australia, United States, the Netherlands and Australia. Tronox Holdings plc, formerly known as Tronox Limited, is based in London, United Kingdom."

TROX idea after good earnings- disclaimer: amateur swing traderTROX seems to be bouncing off the 200MA. Just came off good earnings and an increased dividend. Seems to have strong fundamentals. Targets set for previous high, and 127 and 168 fib extension levels (which are also previous levels of resistance).

Target 3 = 30.50 RR: 1.66

Target 2 = 27.30 RR: 2.37

Target 1 = 24.51 RR: 3.13

Close below $15 and I'd get out.

Let me know your thoughts on this analysis as I'm still learning and appreciate the feedback.

TRONOX HOLDING PLC Idea DailyHey my friends, TRONOX HOLDING PLC is in a bullish continuation of large buying volume, on TIMEFRAME 4H we see an aborted attempt by sellers. Strong potential to go into the bullish gap to seek the bearish point of the fall, to fill the catch-up and with the quantity of purchase volume may be relapsed thereafter.

Please LIKE & FOLLOW, thank you!

Prepare to short this market!I am not to sure about this channel, but still we can see a nice repetitive pattern, as the price bounces between top and bottom.

BUT as we are in an uptrend (daily chart) I will watch this one for now, or wait for a strong bearish candle before I enter it. For now, this is only educational for me.

We could see a breakout on the same time, since the price has quite a bit of a sideway move for a couple days now.

Only trade this one if your opinion is strong about it! And if so, let me know why =)

Good trades for this week!

Breakout ahead? We are at a crucial level againHey folks!

I found a good opportunity for a nice swing trade again.

As we can see, the top of the cannel is reached, and now what will happen?

I see two things right now.

1) A breakout with a pullback, that would be my entry trigger.

2) A double top formation, and of course the price will fall then. So we have a short position. I will wait a few hours, maybe one day to make sure I am not running into a trap. And if you see the main trend, it goes up right now. So shorting would go against the trend, and I am careful with that...

TROX going for another upswing ?Looking into 30 mins charts where the RSI has been falling substantially vs price action... which makes a way for another upswing ... Also looking at a 2hrs charts it appears to be a bull flag

Also got multiple of my bullish indicator on 30mins charts which is again very bullish... I will expect the price action to break 8$ mark very soon

Strong Short, Tronox Ltd.Very good short play on Tronox Ltd. This stock has broken its upwards trend posting a lower high after 4 higher highs in a row and it is at the top of the linear regression channel. TROX has bounced off of a resistance line and is experiencing decrease in volume. The MACD is also about to crossover to a sell signal and the Directional Movement Index is showing a downwards trend. Also, the stock is in oversold territory showing at 65 and is about to cross under the 9 Day MA.