TWLO trade ideas

TWLO Head and ShouldersTWLO has formed a head and shoulders pattern, where the neckline breakout level is at $149. Playing the trend up into the neckline for the breakout to $155 which would be a $6 range breakout which is the full range of the shoulders and 1/3 the range of the head, which is typically the proportions I aim for. This will also be a breakout into all time highs which can carry momentum. From the point of entry this potential profit is 6%. Also earnings comes out on July 31st which will want to sell before then.

Daily TWLO stock forecast trend analysis 10-JUL

Price trend forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position: In Rising section of high profit & low risk

S&D strength Trend: About to begin an adjustment trend as a upward trend gradually gives way to a slowdown in rises and falling fluctuations

Today's S&D strength Flow: Supply-Demand strength has changed to a strengthening buying flow when stock market opening.

READ MORE: www.pretiming.com

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 2.1% (HIGH) ~ 0.3% (LOW), 1.9% (CLOSE)

%AVG in case of rising: 3.0% (HIGH) ~ -1.1% (LOW), 2.1% (CLOSE)

%AVG in case of falling: 1.5% (HIGH) ~ -3.1% (LOW), -1.5% (CLOSE)

$TWLO Just to hot coming into earnings. Evening Star forming.Twilio has really out performed in the last year with very few pullbacks. It is a fantastic company but is now getting just a bit to risky for traders to be holding into earnings. Earnings are expected to be good but after such a surge in the stock it better be a blowout. Late FOMO money has kept the rally going but will be quick to abandon ship on any sign of weakness. The entire market is due a pullback and Googles sell off may have quite a negative impact in the coming days, and give the BEARS the opportunity to pounce.

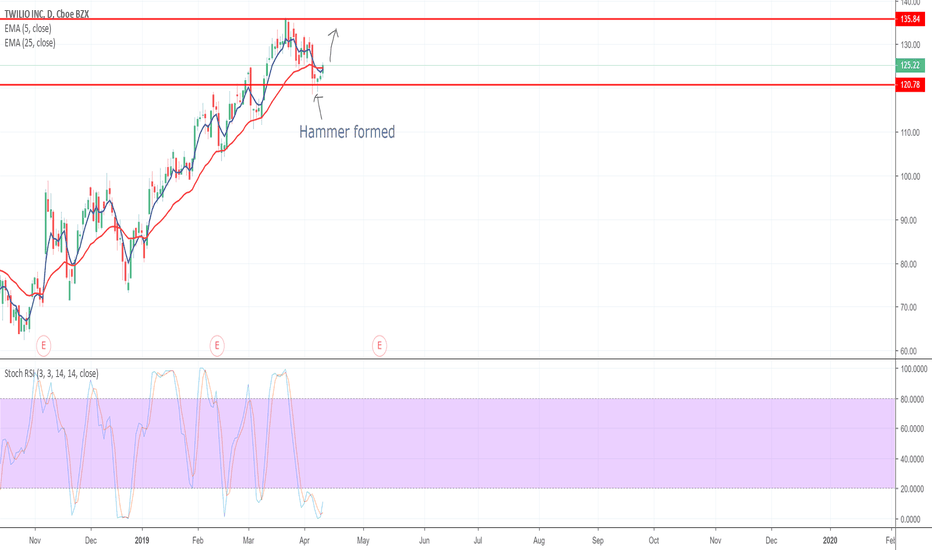

TWLO 12.04.19 ShortAsset and Time frame - 4 H, TWLO

Entry Price -125.70

Exit(Stop loss) -129.06

Exit(Take Profit) - 107.05

Range between SL and entry -3.36$

Technical Analysis -After a bearish engulfing candle broke the 0.618 Fibonacci daily level, the price started correcting with small and weak candles, and now the price has reached the C point to return the downtrend,also we have a confirmed resistance trend line from the last high at 136.

Why not enter the trade - The 100&200 SMA are in the way.

What can be improved -

Conclusion & End of Trade -

$TWLO LOOKING FOR A LONG, LONGTERMTwilio finally showed some weakness and the selling was quite intense. we will be looking for along in the stock if things become more positive but will be aware $115 could be the buy level. Fundamentally the company is still in extreme growth and still has a relatively low market cap making it appealing for as a takeover target.