X on its way to 100 dollars a share!The new updates on the website since 2021 has made the ability for someone to make money while posting, they have just added a Job board for people to seek employment. The X team also has one of the best Paid adertisements that are helpful for the viewer who is on the computer on their profile to help them and above all the website is full of very pretty girls to talk to. This makes tender look like its better for finding Boys / Girls, Its better for Finding jobs and above all its great for content and making money as a poster on X.

TWTR trade ideas

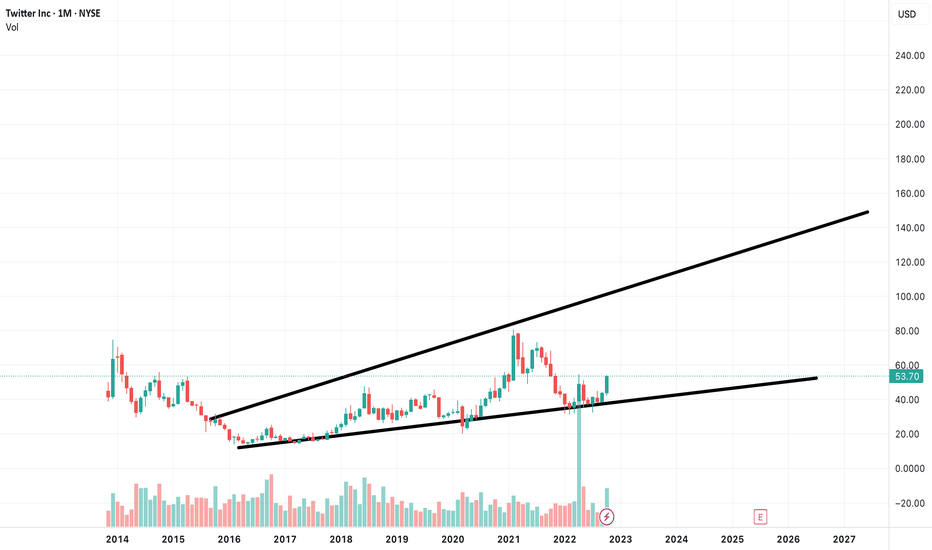

TwitterThe chart suggests a highly bullish projection for Twitter stock, with an anticipated rise from its current level around $53.70 to a target of $475, representing a potential massive surge. The long-term weekly chart highlights a breakout scenario that could send the stock "to Mars" with an implied exponential rally. This forecast assumes a strong upward momentum and market sentiment supporting Twitter's price growth

Twitter at resistanceTwitter stock had an amazing November but the stock price is at a break it or Dip it price. With advertisers pulling out of the platform, internal strife between the staff, and shrinking revenues, Twitter stock price has a probability to trade lower in the coming months unless it will ride the fed hype of the end of QT in 2024.

I am expecting disappointing Q4 earnings unless I am in for a surprise.

TWITTER: $32 | where deals are made on and off books organic and solid.. still undervalued relative to the rest

intentionally under dog to keep off secret billionaires taking over the board...

----

twtr... the app that gets the other apps to the moon

raw power sustainable over time across the space..

--

lines are key levels for new recruits to exit Jack's pals aka early investors...

$TWTR -'X' FLEX- NYSE:TWTR (X) occurred on a Monthly Resistance Trendline being broken-out TA speaking.

Well, fundamentally didn't go as well.

The recent name change wiped out a lofty 4$Billon Dollars and more the

size of it on Brand Value.

It's a mix in between TA and Fundementals from here.

Still sitting on the sidelines aiming for TP1 and more long term.

Buying shares(investing) or longing derivatives from here is quite Risky.

The confirmation of Resistance Trendline Breakout alone can be enough for someone.

However, entry here requires at least a Stop Loss of 10% ;

and that's only the recent Higher Low from the current uptrend break-out Market Structure.

More confirmations ahead to the *D (CHoCH) awaiting how price will perform.

Looking for Entry aiming at TP levels at Wave C correction from impulse(breakout uptrend)

Patience is Wealth.

TRADE SAFE !

*** Note that this is not Financial Advice.

Please do your own research and consult your own Financial Advisor

before considering partaking on any trading activity based solely on this Idea.

Elon's X.COM - a 'Bank, eXchange and more' = Trillions 💡🤖🚀💰💸💡Elon's concept for X.com in 1989 was this:

It would be a one-stop e-store for all financial needs: banking, everything digital, investments, insurance, credit cards, and loans.

Instant transactions, with no waiting for payments to clear. His insight was that money is simply an entry into a database, and he wanted to devise a way that all transactions were securely recorded in real time.

“If you fix all the reasons why a consumer would take money out of the system,” he says, “then it will be the place where all the money is, and that would make it a multitrillion-dollar company.” (from Walter Isaacson new book)

🤖🚀💼

Linda Yaccarino (Chief Executive Officer of Twitter):

It’s an exceptionally rare thing – in life or in business – that you get a second chance to make another big impression. Twitter made one massive impression and changed the way we communicate. Now, X will go further, transforming the global town square.

X is the future state of unlimited interactivity – centered in audio, video, messaging, payments/banking – creating a global marketplace for ideas, goods, services, and opportunities. Powered by AI, X will connect us all in ways we’re just beginning to imagine.

💲💰💲

Elon bought Twitter to accelerate his plans for a multi-Trillion dollar X empire.... not sure how connected you feel to this but for the time being i feel a bit 'disconnected'. He will need to do a LOT of improvements as Twitter has been disappointing me in many ways lately...

Twitter goes Dodo (eXtinct🦤), X.com comes (back) to Life.

ps. I had told you so back in April : (watch from 1:20 to 3:00)

Just one question:

What will tweeting be called?

One Love,

The FXPROFESSOR 🌍💚🕊️

Twitter goes e' X 'tinct like Dodo, the flightless bird of Mauritious. Money is good, Ai can be good, Elon's BS can be good but we really need to take care of the environment. Many fires in my area and pollution is not reduced.. we need to save this planet people 🌍💚🕊️🌳🐦

It's also interesting to note that Musk's other ventures, like Tesla and SpaceX, do have significant environmental implications - Tesla with its focus on electric cars and renewable energy, and SpaceX with its potential for reducing the cost of access to space.

en.wikipedia.org

European Union threatens Elon Musk with Twitter BanLarge volumes came after the break out.

Fundamentals are showing an imbalance in supply/demand

Technicals look to be overvalued and in resistance

The market tone just became even more negative with E.U. threatening Musk

This is for personal recording only

Financial Wave. TWTRTWTR - Twitter

Musk's purchase of Twitter caught the world's attention, and we can't ignore it either.

Our priority scenario looks very optimistic for TWTR. Growth in wave (3) may bring TWTR prices to new highs: the first intermediate target is $100. We believe that the key levels are $57.40 and $68, and breaking these marks will confirm our view that TWTR. A price drop below $32.30 cancels the upside scenario.

Twitter Goes Bullish (Can It Hit Above $120?)Twitter (TWTR) has been on the headlines lately with Mr. Musks stealing the show...

Is he doing a good job?

Let's ask the chart.

We can see a low hit March 2020.

We have a long-term higher low hit February 2022.

The peak happened February 2021 followed by a year long correction.

After this correction, bullish signals are starting to show up.

First, we have a rejection April/May this year around EMA50.

Another rejection at EMA50 in August followed by only 3 weeks red.

Now, the Twitter (TWTR) stock managed to conquer this level late September early October 2022 and the ball changes hands towards the bulls.

We had a volume breakout three weeks ago after TWTR conquered EMA50, which supports this move as real and strong.

This week is also full green and you see on the news what has been going on.

Based on Fib. projections and the chart structure as a whole; This is the weekly timeframe... Twitter is getting ready to grow.

CHANGE

Short-term a breakdown and close below $44.44 would send a negative signal but the chart would still be leaning bullish.

A break below the down-trendline or the July low would be much worse and the analysis would be invalidated as the bears would gain control.

CONCLUSION

Twitter can move above $100 but we have to see how $68 is handled on the next bullish jump.

Thank you for reading and for your continued support.

Namaste.

What Kind of Person You Need to Become to Be ProfitableHello traders,

All the below are based on my preferences, I don't give any financial recommendations and I have nothing to sell you with this article.

I'm sharing content because I see a lot of traders being/becoming broke and I don't want you to be one of them.

Why have I been sharing so many articles so far?

I’ve shared one educational post a day because being a trader is a job.

And a job is the sum of many skills to acquire.

Each skill taken individually won’t make you a profitable trader.

Talking about me and the guys from my trading community, only all those skills applied altogether give us a shot at making money.

Trading is one of the most challenging and one of the most monetary rewarding activity.

Work on yourself first

Your trading profitability is a direct reflection of who you are as an individual.

It’s just is.

If you’re not profitable, it’s because you made some mistakes.

And if you made them, it’s because you didn’t work enough on yourself yet.

Having great trading signals is indeed an essential tool among the stack of tools to have but… this is not enough.

And I’m saying this as someone selling trading signals (and a trading course).

In a past life, when I worked as a back office Quant, we were strongly encouraged to workout, meditate, eat healthy, sleep 7+ hours, having some social life, etc…

Being a trader is first being a human with great habits leading him/her towards nothing else but excellence.

How can someone expects to perform well at such a tough job while being fat and/or sleeping 4 hours a night and/or not controlling his mind/emotions,…

YOU JUST CAN’T.

Trading is hard enough already and the market knows damn well how to take the hard-earned money from people who didn’t work on themselves enough.

Your skills stack

As an entrepreneur owning online businesses, I had to learn about sales, marketing, negotiation, copywriting, accounting, taxes optimisation, coding, hiring, building a company culture, …

Each skill taken separately isn’t enough to bootstrap a business.

All of them used together gave me a shot at succeeding

The same goes with trading.

The reason any very profitable trader I know became profitable after some serious time is because the stack of skills to acquire is consequential.

And I’m not talking about skills we can learn in a short timeframe.

I had to learn how to: (non-exhaustive list)

- Meditate

- Refrain myself from trading when I’m tired or sick or frustrated

- Put my ego side and time to time get back to trading with smaller position size

- Take my profit for the day and get out of my place and go outside

- Eat/sleep properly

- Relax and breath and do some NSDR (Non-Sleep Deep Rest)

- Working out properly and building muscles -> I’m so sure there is a direct correlation for men between our Testosterone level and the courage to enter and manage difficult trades.

- Not be greedy -> One needs to get slapped hard in the face a few times to understand that

- Never anticipate -> many times I cut a trade before the stop-loss or I entered too early front-running some signal(s) - in retrospect, was really a stupid behaviour

- Psychology and Game Theory

- Code trading scripts and trading bots in multiple programming languages

- Listen to the right mentors aka traders way ahead of me in term of net worth

- …

Those skills used altogether compound and made me a very disciplined person - those are my daily non-negotiable behaviours.

If you’re not profitable yet, it isn’t necessarily because the signals you have are bad.

And to figure out if they’re bad or not, you need some trading experience… which comes from….. taking a huge amount of trades for an extended period of time.

Your lack of profitability, comes for most of you from some work you still need to do.

And by the way, each trade you take works on you.

Your trades work on you more than you work on them.

What I mean by that, the more trades you take, the more skilled you get as you keep learning about yourself.

A virtuous feedback loop.

Many traders who lost everything due to a big mistake knew how to make it all back and beyond because…. they already had the required skills.

Conclusion

A red-pilled trader could decide to put his/her money into a 100% trading bot because… learning all those skills is time-consuming.

My advice to that person is…. “Good luck with your endeavour, you’ll likely wreck yourself”

If you don’t trust me… well… I worked as a back office Quant coding trading bots for about 5 years in NYC.

I tested and built more bots than 99.99% of people.

Retail trading bots sellers are selling a concept, a dream which by definition doesn’t reflect the reality.

Regardless of the strategy, it’s unlikely a 100% automated bot performs well overtime as market conditions keep changing.

We’re now in uncharted territory with a very high inflation rate, extreme tensions between countries, an extreme defiance of people of their governments, the WEF, WHO, … (and how could we not blame them seeing what they did to us those past 2 years)

Anyway, what I’m strongly recommending as someone who built non-retail trading bots for a living: learn to trade manually first and then learn how to pilot a bot.

Quotes of the day

- “Never chase opportunities. Let it come to you by creating value and building rare skillsets.” ― Johannes Larsson

- “The ability to make wise choices is the most valuable skill a person can develop.” ― Abhishek Ratna

“Skills don’t die; only people do.” ― Anas Hamshari

“A good trader converts his skills to cash.” ― Michael Bassey Johnson

I'll keep bringing a few articles like this every week because it helps me clarifying my thoughts AND giving back to the community makes me feel good about myself somehow :)

Thank you for reading

Dave

TWITTER: Musk announced permanent bansElon Musk said yesterday that Twitter users who have created fictitious profiles impersonating other users without labeling them as “parodies” will be permanently banned from the said social networking platform without warning.

In a separate post on Twitter, Musk said that in the past, the platform would issue a warning before suspending a profile, but as Twitter evolves a broad user verification process, there will be no such warning. Also, there will be no “exceptions”. This will be a condition for signing up for Twitter Blue, adding that any name change would cause the user to lose their identity verification token. They will not be allowed back on Twitter until the said social networking platform has “a clear process for doing so”.

Organizing such a process will take at least a few weeks, clarifying the timing of the possible return of Twitter’s most famous user, former President Donald Trump, who has been banned. The new timeline suggests Trump won’t be back before midterm congressional elections on November 08.

Twitter had a huge drop in revenue due to activist groups pressuring advertisers, even though nothing changed in terms of content moderation and everything was done to appease activists.

Musk’s fortune has shrunk by about 35%, to $209.4 billion since its peak on Nov. 4, 2021, from $320.3 billion, and the almost-sole reason for this decline is the decline in Tesla stock. Over the past year, Musk has sold $31 billion worth of Tesla stock to finance his takeover of Twitter and take it private. Since the deal has not been finalized, Forbes calculates the value of the cash (minus taxes) earned from these sales at their net worth. But the row over the Musk-Twitter deal has alienated investors, who believe Musk will pay an exorbitant amount to acquire the social networking platform and that he is recklessly selling Tesla stock to finance the deal.

From Elliott wave perspective, on the weekly chart we see Twitter trading in big bullish sideways running triangle pattern that can take some time before we will see a bullish break-out, as final wave E can be still missing. On a daily chart we are tracking a three-wave (A)-(B)-(C) rally within wave D that can find the resistance around 60 level and from where we should be aware of another slow down within wave E that can retest 40-30 support zone before it takes-off.

TWTRThis is the all time weekly chart of twitter usd. The concept is simple and clear for you all in the chart. I mean whether the yellow circle dots mean, the confirmation of the breakout for long and short.

Now the current scenario is, if we close above the 56 level on weekly timeframe. Then the possibility is, that there will be a new all time high coming for the twiterusd token.

And secondly if the the breakout fail, then we can buy at 46 level and open for long term holding target for twitter usd token.

Manage your own risk accordingly with that