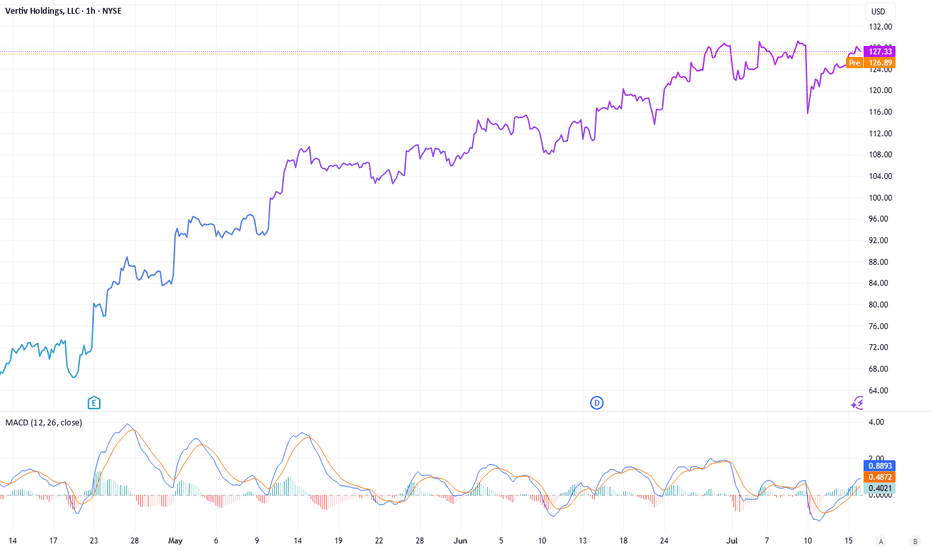

VRT : Long Position Vertiv Holdings is trading above the 50 and 200-period moving averages.

It has overcome the resistances one by one without being exposed to a very high IV.

It has started to draw a cup.

However, it is much better to focus on the big gap rather than the cup formation because with good chances it c

Key facts today

UBS has increased the price target for Vertiv Holdings LLC (VRT) to $173.00 per share, up from the previous target of $135.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.14 USD

495.80 M USD

8.01 B USD

374.52 M

About Vertiv Holdings, LLC

Sector

Industry

CEO

Giordano Albertazzi

Website

Headquarters

Westerville

Founded

1946

FIGI

BBG00L2B8KW8

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology for data centers, communication networks, and commercial and industrial environments. It also offers power management products, switchgear and busbar products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure. It operates through the following geographical segments: Americas, Asia Pacific, and Europe, Middle East, and Africa (EMEA). The Americas segment offers products and services sold for applications within the data center, communication networks, and commercial and industrial markets in North America and Latin America. The Asia Pacific segment includes products and services sold for applications within the data center, communication networks, and commercial or industrial markets throughout Greater China, Australia and New Zealand, Southeast Asia, and India. The EMEA segment focuses on products and services sold for applications within the data center, communication networks, and commercial and industrial markets in Europe, Middle East, and Africa. The company was founded in 1946 and is headquartered in Columbus, OH.

Related stocks

Vertiv Holdings: Powering the AI ProgressionNYSE:VRT NASDAQ:NVDA NASDAQ:META NYSE:ETN NASDAQ:CEG

While investors are engaged in a race “identify the next major microchip manufacturer”, a quieter opportunity is emerging at the crossroads of artificial intelligence (AI), infrastructure, and long-term demand. Vertiv Holdings (VRT), a c

The Picks and Shovels of The AI Boom1. Six-Month Price Trend

Long-term uptrend: Over the past 6 months, VRT has climbed from ~ $54 to a recent high around $155—deep into a clear bullish channel

Pullbacks vs higher lows: Corrections have consistently bounced off rising trend-lines and key moving averages (50 & 200-day), reinforcing t

Is VRT (they make cooling systems for data centers) a buy ?Vertiv Holdings Co. (NYSE: VRT) is a leading provider of critical digital infrastructure and continuity solutions, particularly for data centers. Here's an overview of its recent performance, valuation, and potential challenges:

Financial Performance

Q1 2025 Highlights:

-Revenue: $2.04 billion

$NYSE:VRT (Vertiv Holdings, LLC) Bullish Outlook NYSE:VRT

Company Overview:

Cooling for Data Centers. One of the very few.

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology that powers, cools, deploys, secures and maintains electronics that process, store and transmit data. It

2/20/25 - $vrt - lil ST punt only2/20/25 :: VROCKSTAR :: NYSE:VRT

lil ST punt only

- not cheap, not expensive, but reasonable

- dr. warren says... better to pay reasonable px for great asset than great px for mediocre asset

- nvda results r on deck and mkt probably remains choppy until then, but my industry sources confirming th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of VRT is 141.59 USD — it has decreased by −2.75% in the past 24 hours. Watch Vertiv Holdings, LLC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Vertiv Holdings, LLC stocks are traded under the ticker VRT.

VRT stock has risen by 7.16% compared to the previous week, the month change is a 14.08% rise, over the last year Vertiv Holdings, LLC has showed a 77.54% increase.

We've gathered analysts' opinions on Vertiv Holdings, LLC future price: according to them, VRT price has a max estimate of 173.00 USD and a min estimate of 115.70 USD. Watch VRT chart and read a more detailed Vertiv Holdings, LLC stock forecast: see what analysts think of Vertiv Holdings, LLC and suggest that you do with its stocks.

VRT stock is 7.06% volatile and has beta coefficient of 2.70. Track Vertiv Holdings, LLC stock price on the chart and check out the list of the most volatile stocks — is Vertiv Holdings, LLC there?

Today Vertiv Holdings, LLC has the market capitalization of 54.07 B, it has increased by 3.88% over the last week.

Yes, you can track Vertiv Holdings, LLC financials in yearly and quarterly reports right on TradingView.

Vertiv Holdings, LLC is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

VRT earnings for the last quarter are 0.95 USD per share, whereas the estimation was 0.83 USD resulting in a 14.16% surprise. The estimated earnings for the next quarter are 0.98 USD per share. See more details about Vertiv Holdings, LLC earnings.

Vertiv Holdings, LLC revenue for the last quarter amounts to 2.64 B USD, despite the estimated figure of 2.35 B USD. In the next quarter, revenue is expected to reach 2.56 B USD.

VRT net income for the last quarter is 324.20 M USD, while the quarter before that showed 164.50 M USD of net income which accounts for 97.08% change. Track more Vertiv Holdings, LLC financial stats to get the full picture.

Yes, VRT dividends are paid quarterly. The last dividend per share was 0.04 USD. As of today, Dividend Yield (TTM)% is 0.10%. Tracking Vertiv Holdings, LLC dividends might help you take more informed decisions.

Vertiv Holdings, LLC dividend yield was 0.10% in 2024, and payout ratio reached 8.77%. The year before the numbers were 0.05% and 2.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 31 K employees. See our rating of the largest employees — is Vertiv Holdings, LLC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Vertiv Holdings, LLC EBITDA is 1.87 B USD, and current EBITDA margin is 20.67%. See more stats in Vertiv Holdings, LLC financial statements.

Like other stocks, VRT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Vertiv Holdings, LLC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Vertiv Holdings, LLC technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Vertiv Holdings, LLC stock shows the buy signal. See more of Vertiv Holdings, LLC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.