Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.28 USD

−69.77 M USD

1.01 B USD

186.30 M

About Zeta Global Holdings Corp.

Sector

Industry

CEO

David Adam Steinberg

Website

Headquarters

New York

Founded

2012

FIGI

BBG010FXVQ98

Zeta Global Holdings Corp. operates as a marketing technology software company, which engages in the provision of enterprises with consumer intelligence and marketing automation software. It enables its customers to target, connect and engage consumers through software that delivers marketing across all addressable channels, including email, social media, web chat, connected TV and video among others. The company was founded by David A. Steinberg and John Sculley on May 9, 2012 and is headquartered in New York, NY.

Related stocks

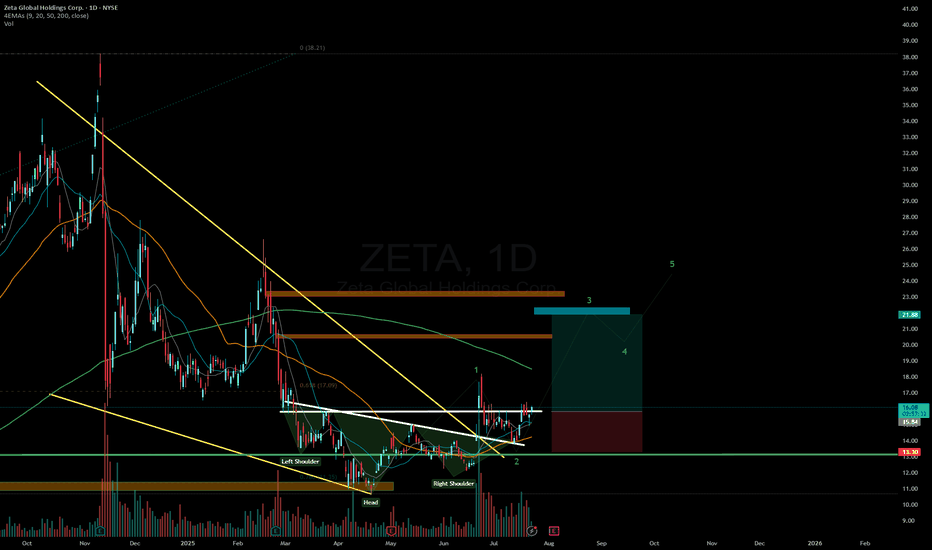

ZETA wave 5?Zeta appears to be forming the structure for a final Wave 5 (Elliott Wave Theory). Why? Let's analyze: Wave 2 showed only a shallow retracement, falling between 38–50%. However, Wave 3 extended to 1.618, indicating strong momentum. The Wave 4 pullback did not invalidate Wave 1 (as confirmed on the l

ZETA: when a wedge isn’t just a wedge — it’s a launchpadTechnically, this setup is textbook clean. Price completed the fifth wave within a falling wedge and instantly reacted with a bullish breakout. The expected breakdown didn’t happen — instead, buyers stepped in, confirmed by rising volume. All EMAs are compressed at the bottom of the structure, signa

ZETAZETA

Description:

- Marketcap: 2.5B

- Float: 184M (medium)

- ATR 52W: 27%, 24M: 45%, 12Q: 60%

- Correlation with SP500: 83.34% (200D)

- Betta: 1.42 (200D)

- Relative Strength: 2.24 (200D)

Fundamental picture

- Revenue: Growing with increasing rate

- EPS: Negative but becoming better

- Stock was p

$ZETA will continue to climb up > $30 - Ignore FUD, accumulate like the whales 🐋

- Zeta Global Holdings Corp. (NYSE: ZETA) reported robust financial performance in the third quarter of 2024, with revenue reaching $268 million—a 42% year-over-year increase.

STOCK TARGET ADVISOR

- This growth underscores the company's strong market pos

2/25/25 - $zeta - a lil EPS bingo2/25/25 :: VROCKSTAR :: NYSE:ZETA

a lil EPS bingo

- i'm aware of the bear/ culper write up and tend to believe it

- i also witnessed NASDAQ:APP go bananas (and that one is a total banana fr4ud too)

- nevermind a ton of NYSE:ZETA stuff is email related, and we saw $kyvo post good results

- all

ZETA reversal ZETA recently suffered a short attack on its earnings which were amazing

The short attack made Zeta dropped a lot making it a very cheap stock to own.

After the short attack was over and the cloud was cleared Zeta is now moving very quickly towards its ATH .

Zeta has bounced off really nicely

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ZETA is 15.08 USD — it has decreased by −3.64% in the past 24 hours. Watch Zeta Global Holdings Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Zeta Global Holdings Corp. stocks are traded under the ticker ZETA.

ZETA stock has fallen by −4.31% compared to the previous week, the month change is a 0.53% rise, over the last year Zeta Global Holdings Corp. has showed a −35.36% decrease.

We've gathered analysts' opinions on Zeta Global Holdings Corp. future price: according to them, ZETA price has a max estimate of 44.00 USD and a min estimate of 15.00 USD. Watch ZETA chart and read a more detailed Zeta Global Holdings Corp. stock forecast: see what analysts think of Zeta Global Holdings Corp. and suggest that you do with its stocks.

ZETA reached its all-time high on Nov 11, 2024 with the price of 38.20 USD, and its all-time low was 4.09 USD and was reached on Jul 5, 2022. View more price dynamics on ZETA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ZETA stock is 7.56% volatile and has beta coefficient of 2.41. Track Zeta Global Holdings Corp. stock price on the chart and check out the list of the most volatile stocks — is Zeta Global Holdings Corp. there?

Today Zeta Global Holdings Corp. has the market capitalization of 3.55 B, it has increased by 0.20% over the last week.

Yes, you can track Zeta Global Holdings Corp. financials in yearly and quarterly reports right on TradingView.

Zeta Global Holdings Corp. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

ZETA earnings for the last quarter are 0.10 USD per share, whereas the estimation was 0.11 USD resulting in a −13.03% surprise. The estimated earnings for the next quarter are 0.12 USD per share. See more details about Zeta Global Holdings Corp. earnings.

Zeta Global Holdings Corp. revenue for the last quarter amounts to 264.42 M USD, despite the estimated figure of 254.19 M USD. In the next quarter, revenue is expected to reach 296.69 M USD.

ZETA net income for the last quarter is −21.60 M USD, while the quarter before that showed 15.24 M USD of net income which accounts for −241.77% change. Track more Zeta Global Holdings Corp. financial stats to get the full picture.

No, ZETA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 2.19 K employees. See our rating of the largest employees — is Zeta Global Holdings Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Zeta Global Holdings Corp. EBITDA is 23.27 M USD, and current EBITDA margin is −0.36%. See more stats in Zeta Global Holdings Corp. financial statements.

Like other stocks, ZETA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Zeta Global Holdings Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Zeta Global Holdings Corp. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Zeta Global Holdings Corp. stock shows the neutral signal. See more of Zeta Global Holdings Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.