NZDCAD trade ideas

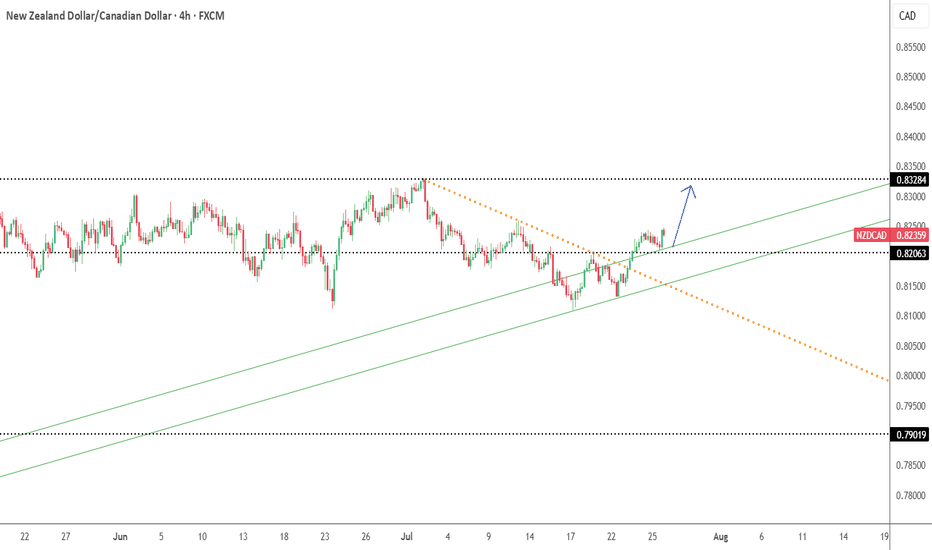

A Top Down Approach will help you spot quality tradesAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

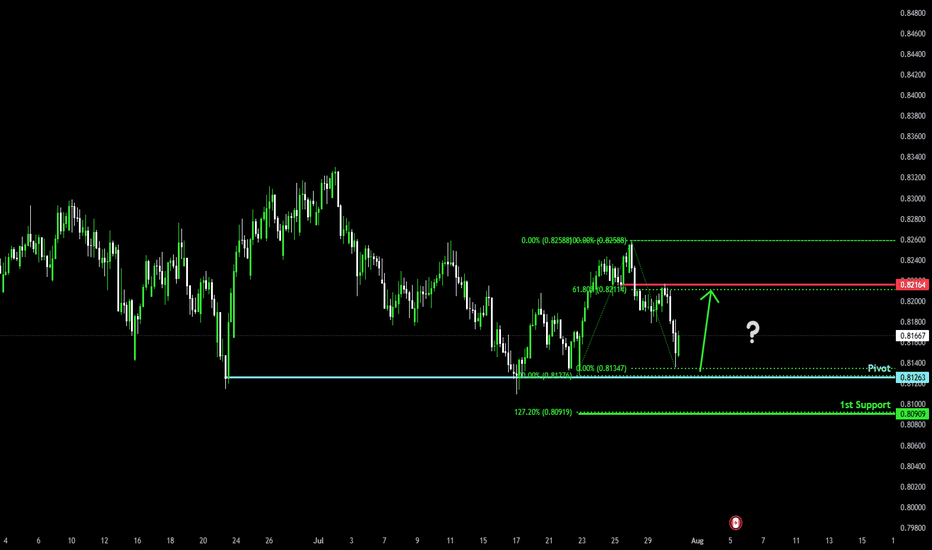

Bullish reversal?NZD/CAD is falling towards the pivot an could bounce to the 1st resistance.

Pivot: 0.81263

1st Support: 0.80909

1st Resistance: 0.82164

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

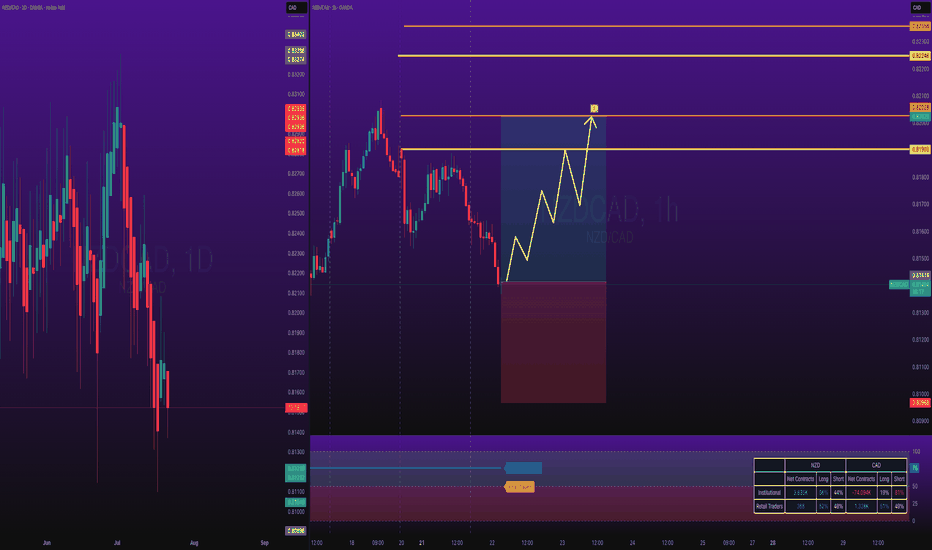

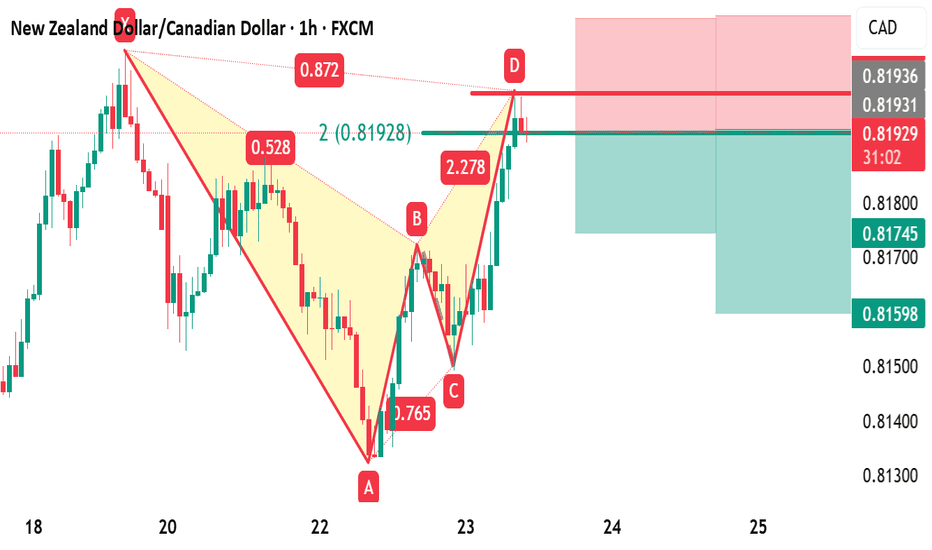

(art📊 Smart Money Concept Trade Setup (NZD/CAD – 30-Min Chart)

🧠 Market Structure Overview:

Price initially formed a Lower Low (left side of the chart).

Then, price made a clear Break of Structure (BOS) to the upside, creating a Higher High.

An IDM indicates price manipulation and confirms liquidity resting above the recent high (target).

🔍 Entry Plan:

📉 Price is currently dropping towards a marked 30-minute POI (Point of Interest) — a Demand Zone.

⏳ Once price enters this 30M POI zone, switch to the 5-minute or 1-minute timeframe for confirmation.

🔁 Look for a CHoCH (Change of Character) within the POI on the lower timeframe — this shows bullish intent and potential reversal.

📥 Enter a Buy trade right after CHoCH confirmation:

Stop Loss (SL): Just below the POI/Demand zone.

Take Profit (TP): At the Targeted High marked above (where external liquidity sits).

📐 Risk:Reward Details:

This setup offers a minimum 1:5 RR (Risk to Reward).

SL: Below the 30M POI.

TP: Just above the previous high (liquidity grab zone).

✅ Entry Checklist (English)

Entry Condition Status

Price entered 30M POI? ✅

CHoCH confirmed on 5M/1M? ✅

Bullish BOS or structure break visible? ✅

Risk:Reward at least 1:5? ✅

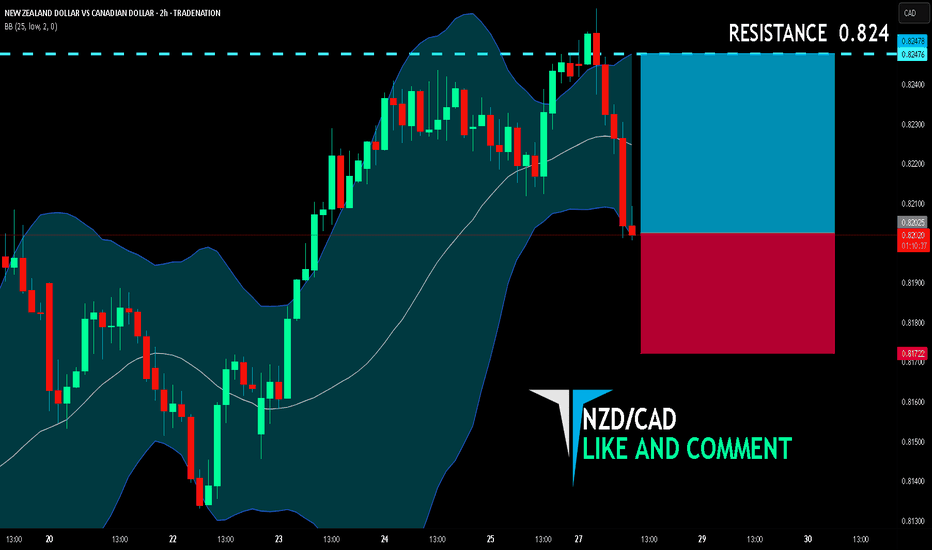

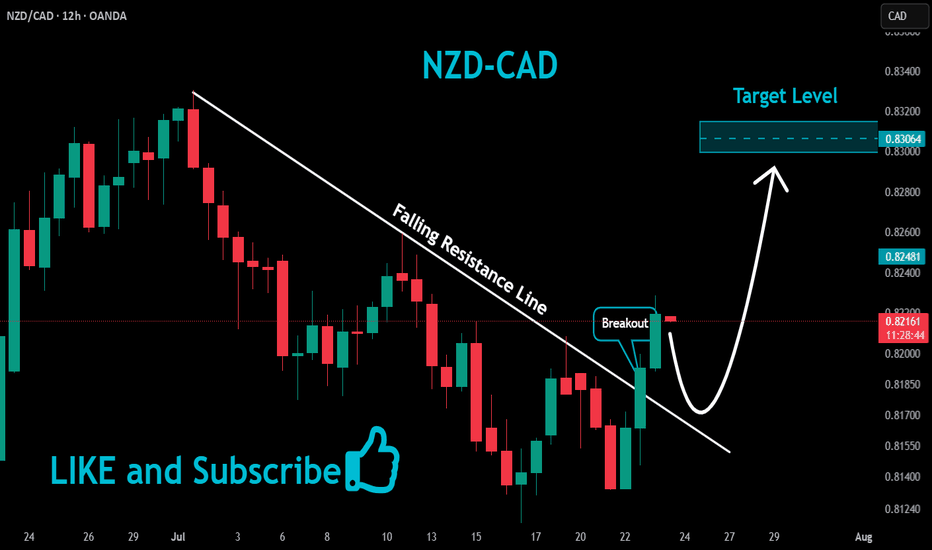

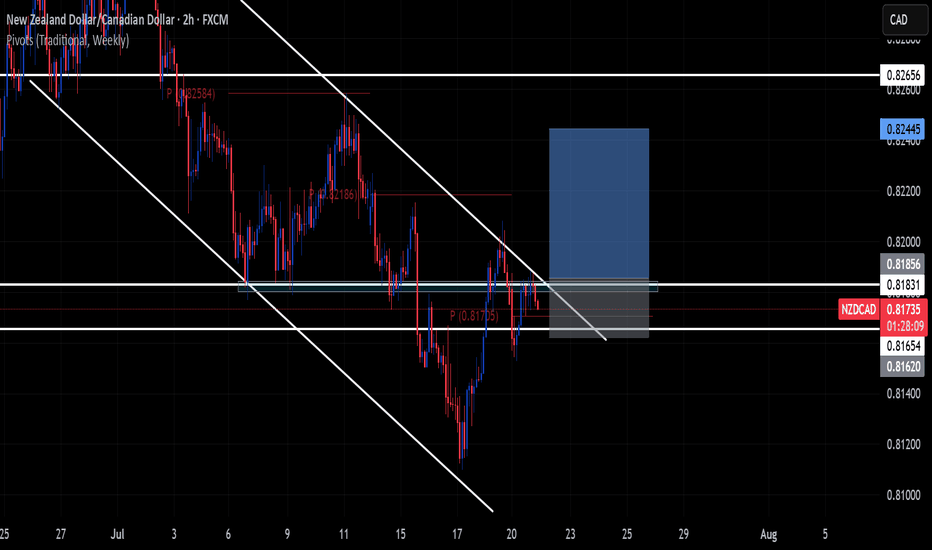

NZD/CAD BULLS ARE GAINING STRENGTH|LONG

NZD/CAD SIGNAL

Trade Direction: long

Entry Level: 0.820

Target Level: 0.824

Stop Loss: 0.817

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

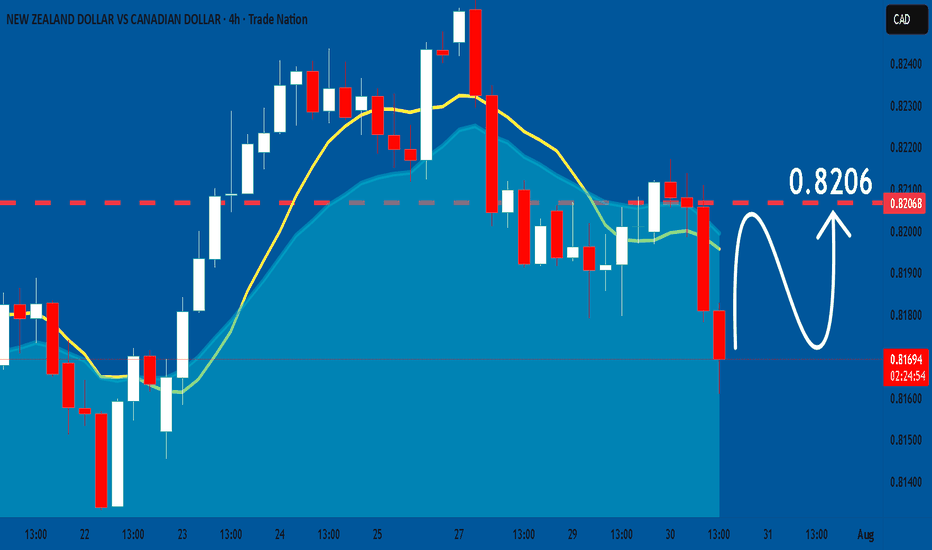

NZDCAD: Bullish Continuation is Expected! Here is Why:

The analysis of the NZDCAD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDCAD SHORT Market structure bearish on HTFs DW

Entry at both weekly and daily

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.82000

H4 Candlestick rejection

Levels 3.23

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDCAD Long Trade Risking 1% to make 1.37%OANDA:NZDCAD Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

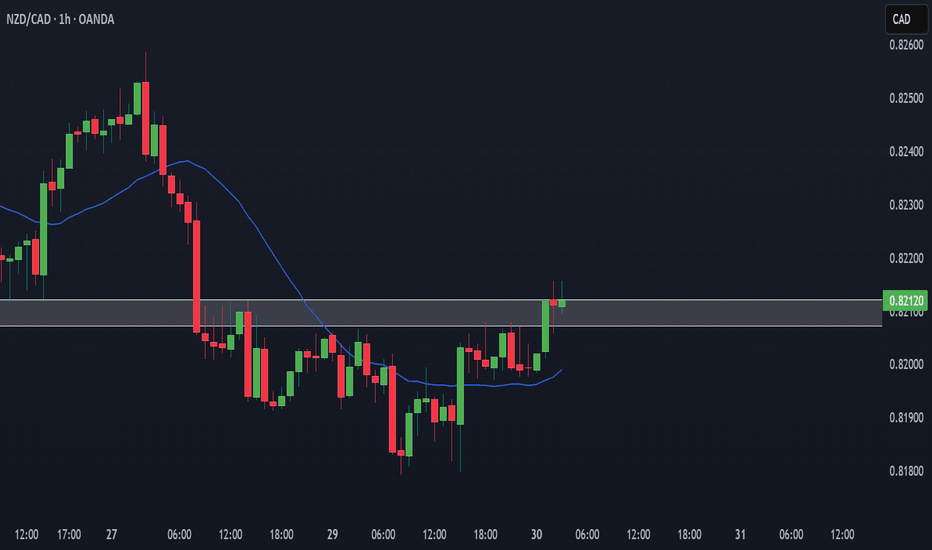

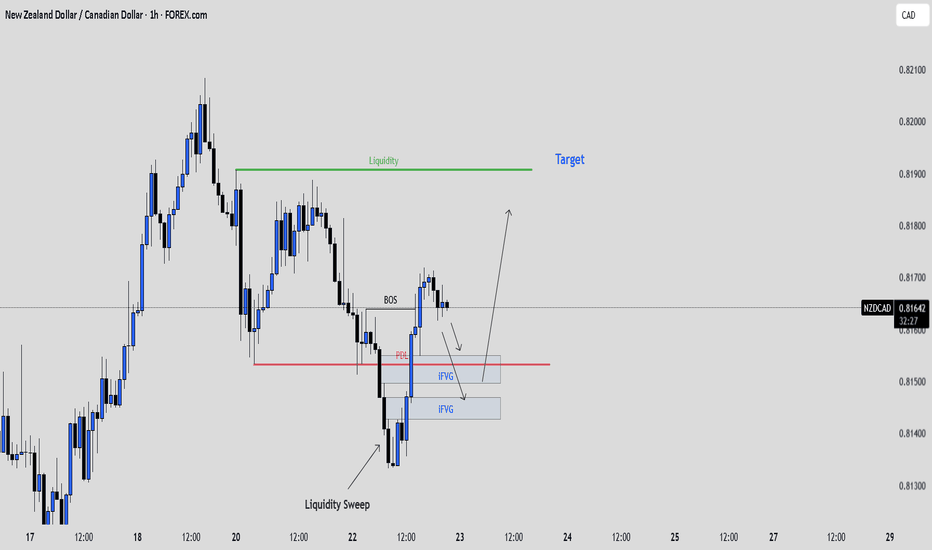

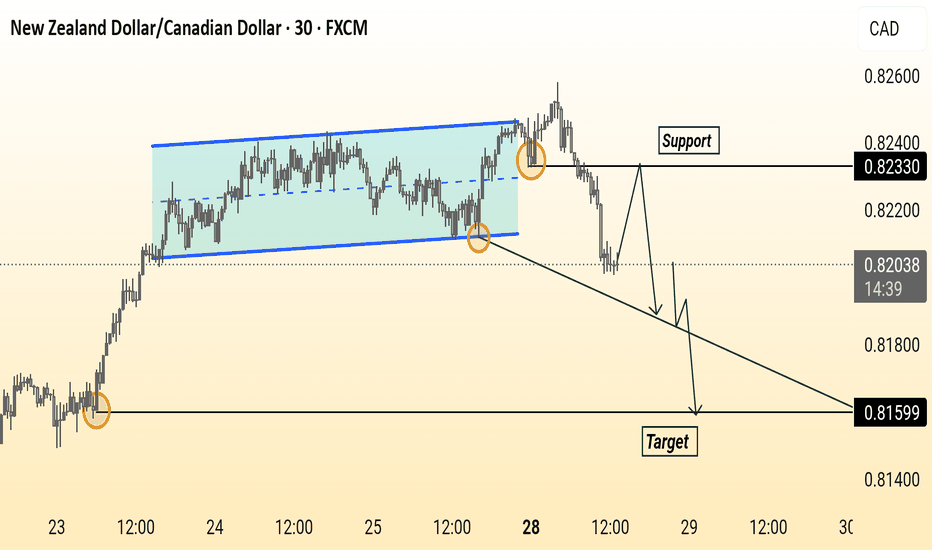

NZDCAD: Patience Before the PushNZDCAD on the 1H chart just completed a clean liquidity sweep below the previous day’s low. That long wick aggressively took out resting sell stops before price sharply reversed.

We’ve now seen a break of structure to the upside, showing a possible shift in market direction. Price is currently pulling back toward two visible imbalance zones (iFVGs), both sitting just below the previous day’s low.

If price trades into these iFVGs and gives us a clear bullish confirmation like a bullish engulfing candle, a rejection wick, or a strong break of structure on lower timeframes, we could look for continuation toward the liquidity above the highs.

📌 Key Levels

• Liquidity sweep below PDL

• Bullish break of structure

• iFVGs aligning as potential entry zones

• Final target: liquidity resting near 0.81900

🧠 Psychology Tip

The best trades don’t need to be forced. Wait for confirmation. A setup without a signal is just a theory. Protect your capital, trade your plan, and trust the process.

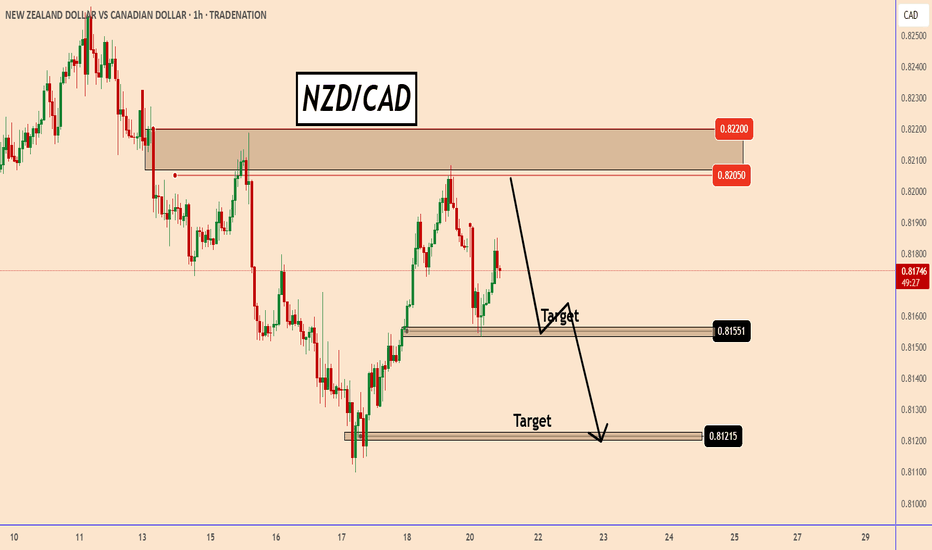

NZDCAD: A Short Term Bearish Perspective NZDCAD: A Short Term Bearish Perspective

NZDCAD reached a strong zone near 0.8205 and reached

Given that the trend is still bearish and Canada continues to print strong data the chances are that it can drop further in the short term.

The chances are that it can drop further during the U.S trading session given that the economic calendar is very poor today.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Will Go UP! Buy!

Hello,Traders!

NZD-CAD made a retest

Of the horizontal support level

Of 0.8125 from where we

Are already seeing a nice

Bullish rebound so we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of NZDCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

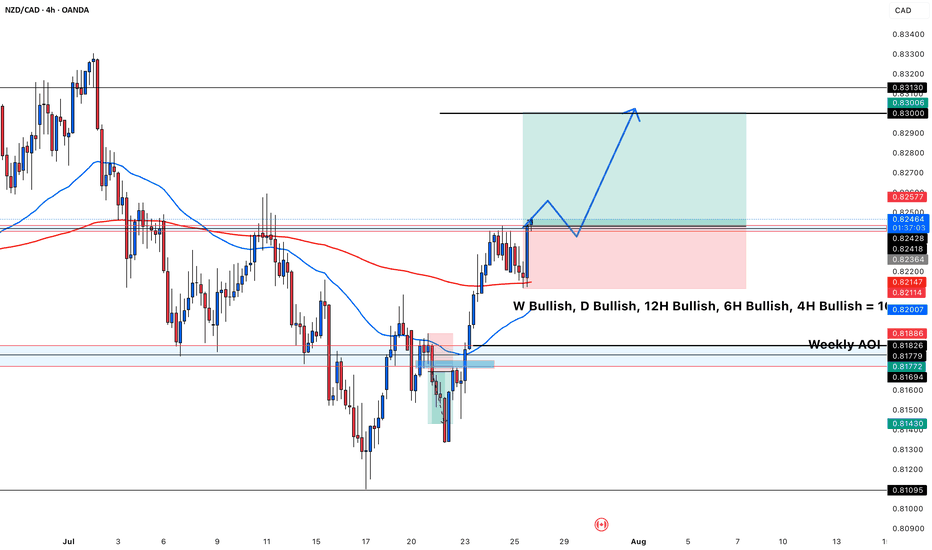

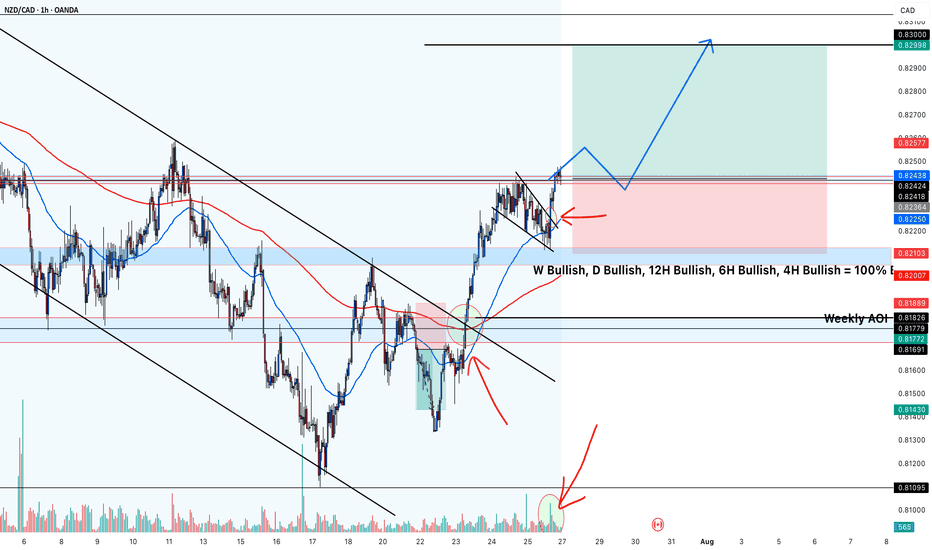

NZDCAD Long Now!📌 Instrument & Timeframe

NZD/CAD – 4H timeframe

Overall trend across multiple timeframes is noted as bullish (W, D, 12H, 6H, 4H all bullish).

📈 Market Structure

Price previously moved within a descending channel (drawn by two black trendlines) but has broken out to the upside.

After the breakout, price retraced back near a key area (just above the 200 EMA / red line) and is forming a smaller bull flag or descending wedge, indicating a potential continuation.

🔥 Area of Interest

Weekly AOI (Area of Interest) marked around 0.8180 – 0.8200 zone has acted as strong support.

Price reacted bullishly from that AOI, confirming buyers stepped in.

✅ Trade Bias

All higher timeframes (W, D, 12H, 6H, 4H) are bullish, so the bias is long.

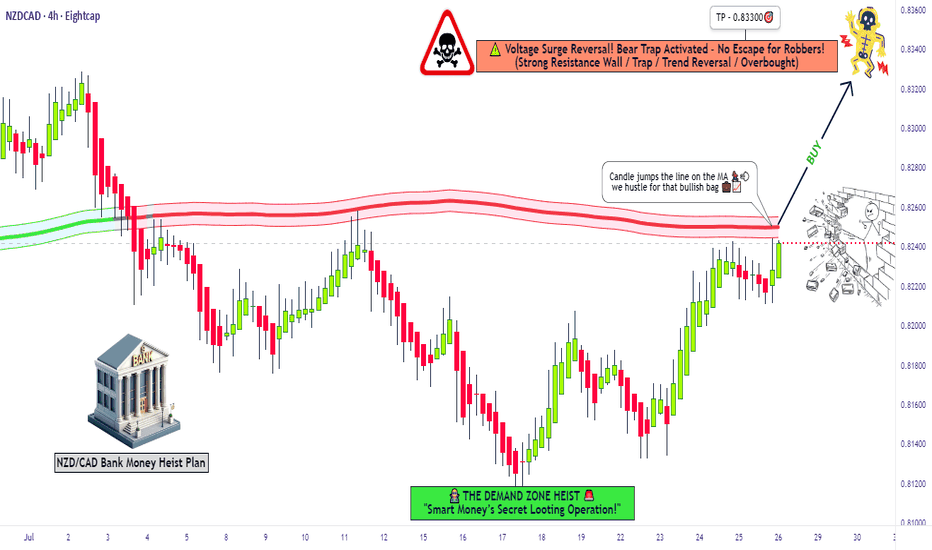

"NZD/CAD Reversal Play – Ride the Bullish Wave!🦹♂️💰 "THE KIWI-LOONIE HEIST: High-Voltage Forex Robbery Plan (NZD/CAD)" 💰🦹♂️

🌍 Attention all Market Pirates, Thieves & Profit Bandits! 🌍

🔥 Thief Trading Alert – NZD/CAD Bullish Heist Setup! 🔥

The "Kiwi vs Loonie" is setting up for a high-risk, high-reward robbery—and we’re locking in the master plan. Long entry is the play, but this ain’t for the weak hands. Overbought? Consolidation? Reversal trap? Perfect. That’s where we strike.

🎯 THE HEIST BLUEPRINT

🔑 ENTRY ZONE (Breakout & Retest Strategy)

"Wait for the 4H candle to CLOSE ABOVE 0.82600 (MA Breakout + Retest)."

Option 1: Place a BUY STOP above the MA (momentum confirmation).

Option 2: BUY LIMIT near recent swing lows (15M/30M precision).

🚨 Set an ALERT! Don’t miss the breakout—timing is everything.

🛑 STOP LOSS (Escape Route)

SL at 0.82000 (near swing low wick on 4H).

⚠️ Golden Rule: NO ORDERS BEFORE BREAKOUT! Wait for confirmation.

Adjust SL based on your risk, lot size, and multi-order strategy.

🎯 TARGETS (Profit Escape Plan)

Take Profit 1: 0.83300 (First resistance).

Or… Exit Early if the market turns shaky.

Scalpers: Long-only scalp plays! Use trailing SL to lock in gains.

⚡ THIEF TRADER PRO TIPS

✅ Fundamental Backing: Check COT reports, macro trends, intermarket signals.

✅ News Alert: Avoid new trades during high-impact news—protect open positions with trailing stops.

✅ Risk Management: Small lots, multiple entries = smarter heist.

💥 BOOST THE HEIST! (Let’s Get Rich Together) 💥

👉 Smash that 👍 LIKE button to fuel our next robbery plan!

👉 Follow for daily high-voltage setups.

👉 Comment "🚀" if you’re joining the heist!

🤑 NEXT HEIST COMING SOON… STAY TUNED, BANDITS! 🤑

🔥 WHY THIS TRADE? (Thief’s Edge)

Bullish momentum but trapped bears = perfect robbery setup.

Institutional levels + retail traps = our opportunity.

Not financial advice—just a well-planned theft. 😉

⚠️ Warning: Trading = Risk. Only play with funds you can afford to lose.