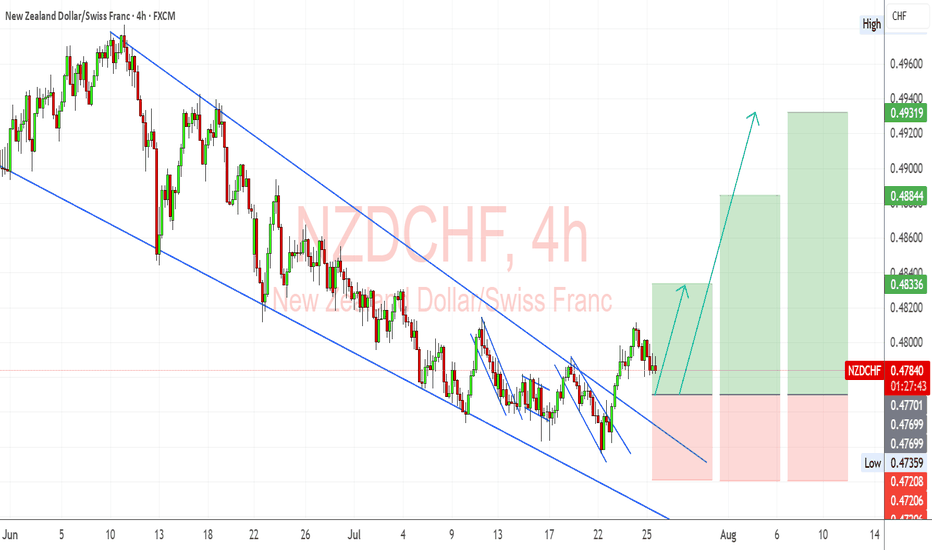

NZDCHF – Bullish Breakout Sets Stage for ReversalNZDCHF has broken decisively out of a long-term descending channel, signaling a potential trend reversal. Price action confirmed multiple bullish flags within the falling structure, followed by a clean breakout and higher low retest, supporting a bullish continuation bias.

Currently, the pair is st

Related currencies

NZDCHF Remains Heavily Influenced By The SNBNZDCHF Remains Heavily Influenced By The SNB

NZDCHF remains heavily influenced by the Swiss National Bank (SNB), which continues to control the value of several currencies.

Despite this, NZDCHF looks significantly oversold. All it may need is time before a bullish wave begins to unfold.

Meanwh

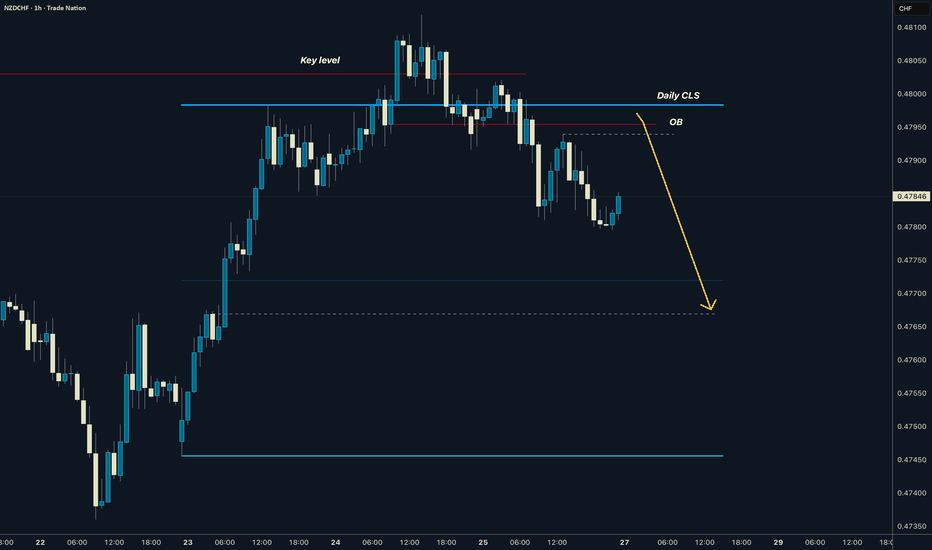

NZDCHF: Bearish Continuation from Re-Delivered Re-Balanced ArrayGreetings Traders,

In today’s analysis of NZDCHF, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities.

Key Observations on H4:

Bearish Market Structure S

NZD-CHF Risky Long! Buy!

Hello,Traders!

NZD-CHF keeps falling and

Will hit the horizontal support

Of 0.4738 on Monday from

Where we will be expecting

A local rebound and a

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Inf

NZDCHF I Daily CLS I Model 1 I Pullback entryYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The i

NZDCHF: Selling Within Bearish Order Flow & Order BlockGreetings Traders,

In today’s analysis of NZDCHF, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities.

🔍 Key Observations on H4:

Bearish Market Structure

NZDCHF POTENTIAL BULLISHWeekly chart shows NZDCHF has bounced off its minimum since 2004, with RSI showing just recovering from the OS area. Price has bounced back from the weekly resistance around 0.47400. This bounce has formed a bullish Gartley on the daily chart and another bullish Gartley on the H4 timeframe. It was s

Bearish drop?The NZD/CHF is rising towards the resistance level, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement. It could drop from this level to our take-profit.

Entry: 0.48256

Why we like it:

There is a pullback resistance that is slightly below the 61.8% Fibonacci retra

Bullish bounce?NZD/CHF is reacting off the pivot, which is a pullback support and could rise to the 1st resistance.

Pivot: 0.47867

1st Support: 0.47391

1st Resistance: 0.48695

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford t

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Te

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of NZDCHF is 0.47814 CHF — it has increased by 0.34% in the past 24 hours. See more of NZDCHF rate dynamics on the detailed chart.

The value of the NZDCHF pair is quoted as 1 NZD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 NZD.

The term volatility describes the risk related to the changes in an asset's value. NZDCHF has the volatility rating of 0.21%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The NZDCHF showed a −0.36% fall over the past week, the month change is a −0.72% fall, and over the last year it has decreased by −5.69%. Track live rate changes on the NZDCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

NZDCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade NZDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with NZDCHF technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the NZDCHF shows the sell signal, and 1 month rating is sell. See more of NZDCHF technicals for a more comprehensive analysis.