NZDGBP trade ideas

gbpnzd sell signal

. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP_NZD GROWTH AHEAD|LONG|

✅GBP_NZD made a retest

Of the key horizontal level of 2.2600

Which is now a support after a powerful

Breakout so we are bullish biased

And we will be expecting a further

Bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD is in Selling DirectionHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on GBPNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP-NZD Free Signal! Buy!

Hello,Traders!

GBP-NZD is trading in an

Uptrend and the pair made

A bullish breakout of the

Key horizontal level of 2.2600

Which is now a support then

Made a retest and we are now

Seeing a bullish rebound

Already which reinforces our

Bullish bias on the pair and

Suggests that we enter

A long trade with the

Take Profit of 2.2715

And the Stop Loss of 2.2568

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the GBPNZD next move:

The instrument tests an important psychological level 2.2627

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.2500

My Stop Loss - 2.2695

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPNZD Will Move Lower! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2.263.

The above observations make me that the market will inevitably achieve 2.229 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD is ready to push againNo comment needed. All information is in the chart analysis.

Steps to follow:

Analyze yourself.

Take the position with SL and Take Profits.

Wait, it may take a couple of days, so take a break and step away from the screen from time to time, just like I do :)

Get the result.

I will update the trade every day.

Like, comment with your good mood or viewpoint, share with your circle. It’s together that we get stronger!

Good trades, Traders!

The golden bear

GBP-NZD Potential Short! Sell!

Hello,Traders!

GBP-NZD is making a local

Bullish move upwards and the

Pair will soon hit a horizontal

Resistance of 2.2620 and after

The retest a local bearish

Correction is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

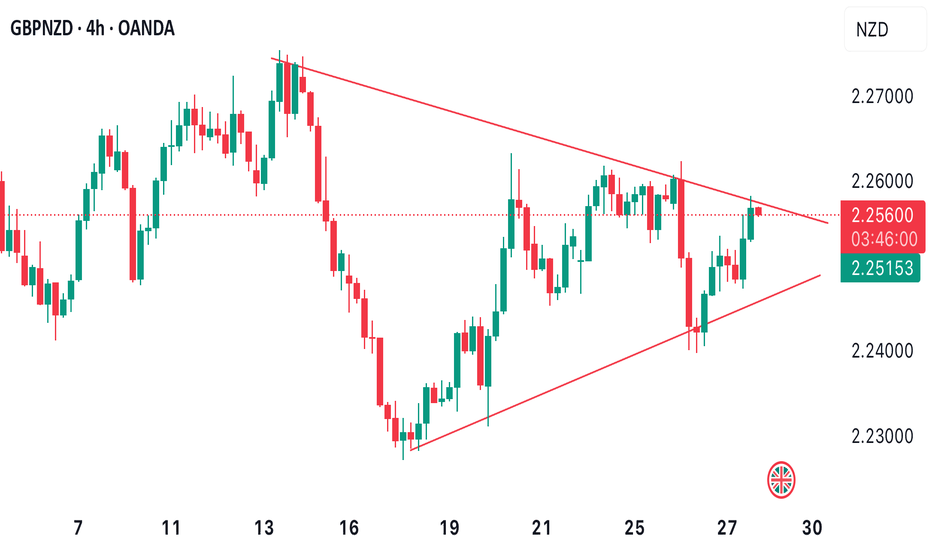

GBPNZD SOON TO EXPLODE!Price is currently forming a symmetrical triangle as we’ve seen both the presence of buyers & sellers for the last 3 weeks now. We’re looking forward to seeing price either breaking to the upside for further bullish price action or breaking to the downside for a potential correction of price.

Keep a close watch!

GBPNZD Sell Limit: Shorting from Key Resistance at 2.2590📉 GBPNZD: Sell Limit Trade Idea (Intraday)

Published: 27/03/2025 16:06 | Expires: 28/03/2025 15:00

Overview

Trading Bias: Mixed and volatile, with a preference to sell into rallies.

Market Context: GBPNZD has been showing short-term volatility, with the RSI trending higher, indicating potential for a temporary move upward before resuming the downtrend.

Trade Details

Entry (Sell Limit): 2.2590

Stop Loss: 2.2650 (-60 pips)

Take Profit: 2.2350 (+240 pips)

Risk/Reward Ratio: 4:1

Key Levels

Resistance Levels:

R1: 2.2590 (Bespoke resistance, preferred entry point)

R2: 2.2620

R3: 2.2680

Support Levels:

S1: 2.2450

S2: 2.2400

S3: 2.2330

Rationale

Preferred Setup: We expect a temporary rally into resistance at 2.2590, providing a favorable entry point to initiate short positions.

Momentum: While RSI indicates higher momentum in the short term, this aligns with a corrective rally rather than a sustained bullish move.

Volatility Risks: Key UK economic events (retail sales figures and national accounts) on 28/03/2025 at 07:00 GMT could trigger significant price swings. Traders should closely monitor these data points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Sell GBPNZD is showing a Change of Character (ChoCh) on the Daily, signaling a potential shift in market structure. This is further reinforced by a double top confirmation on the 4-hour timeframe, indicating strong resistance and potential exhaustion of buyers. With price rejecting key levels and bearish momentum building, this setup presents a high-probability sell opportunity, especially if we see a strong bearish break and retest.

GBPNZD is in Selling DirectionHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on GBPNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts