NZDGBP trade ideas

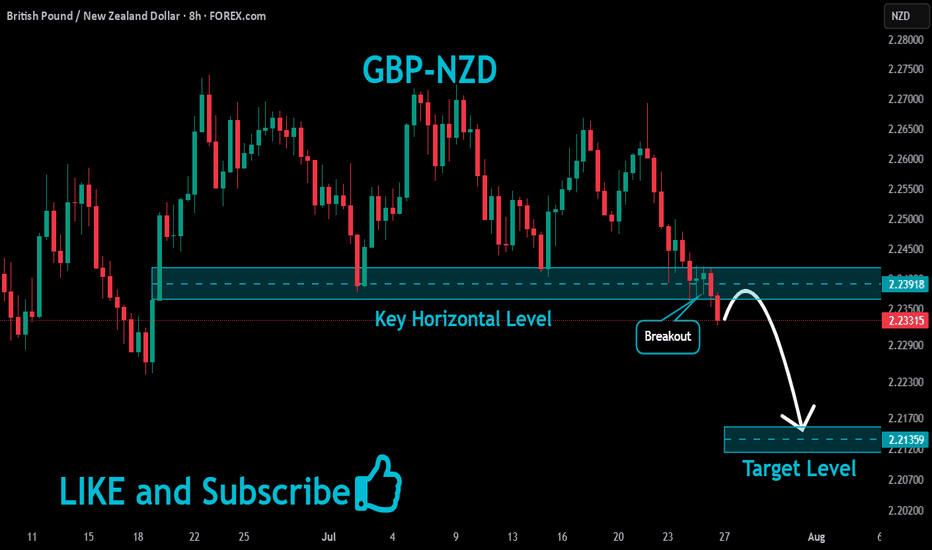

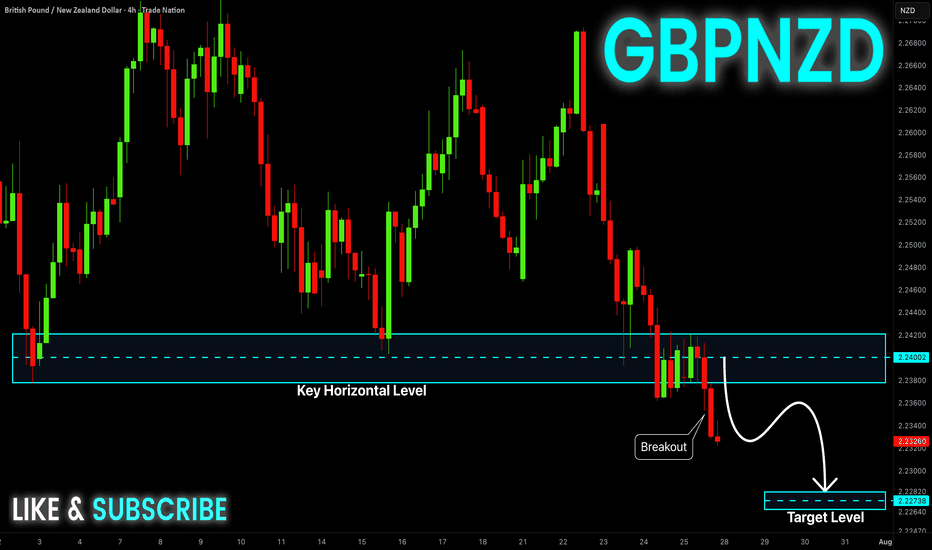

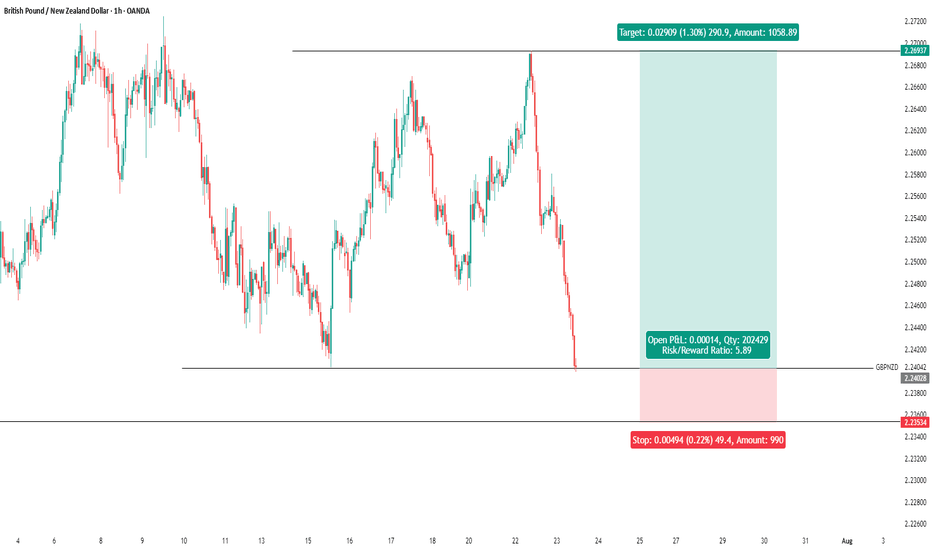

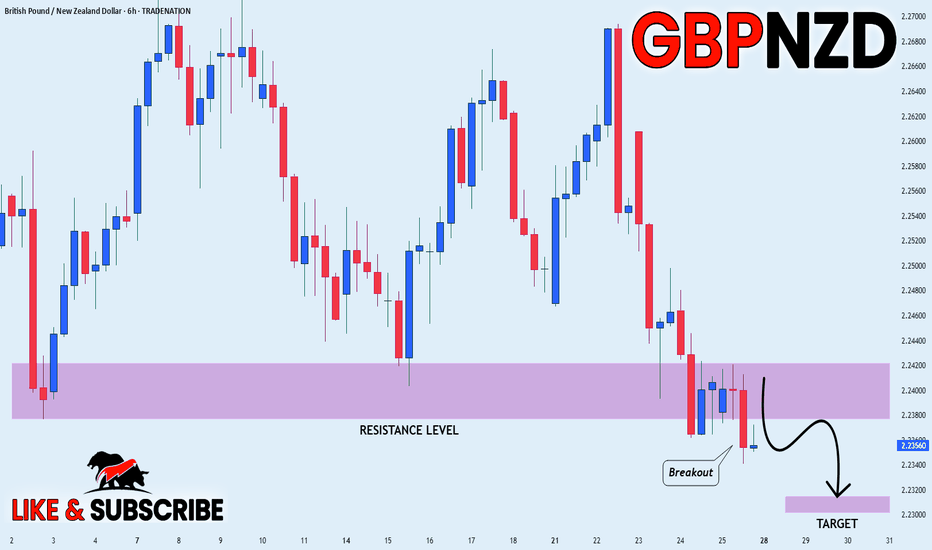

GBP-NZD Will Keep Falling! Sell!

Hello,Traders!

GBP-NZD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 2.2400

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

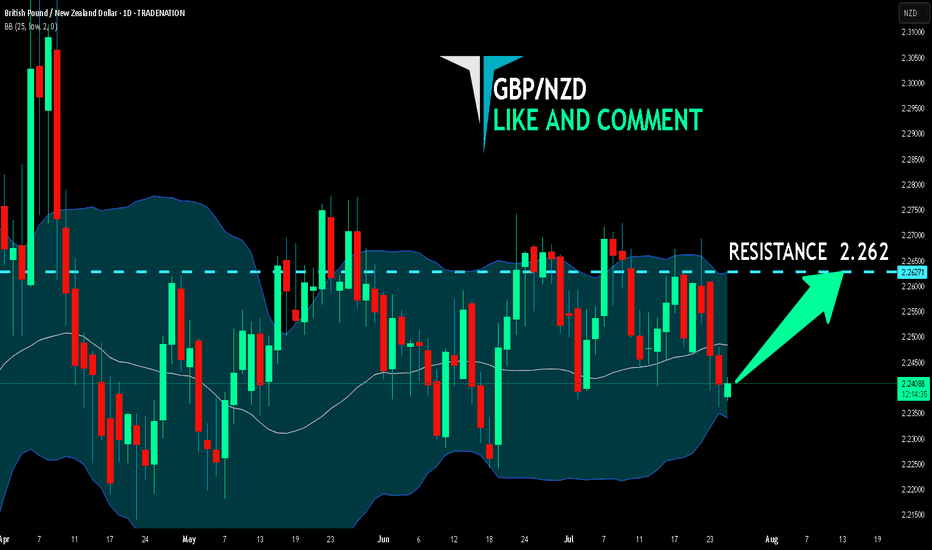

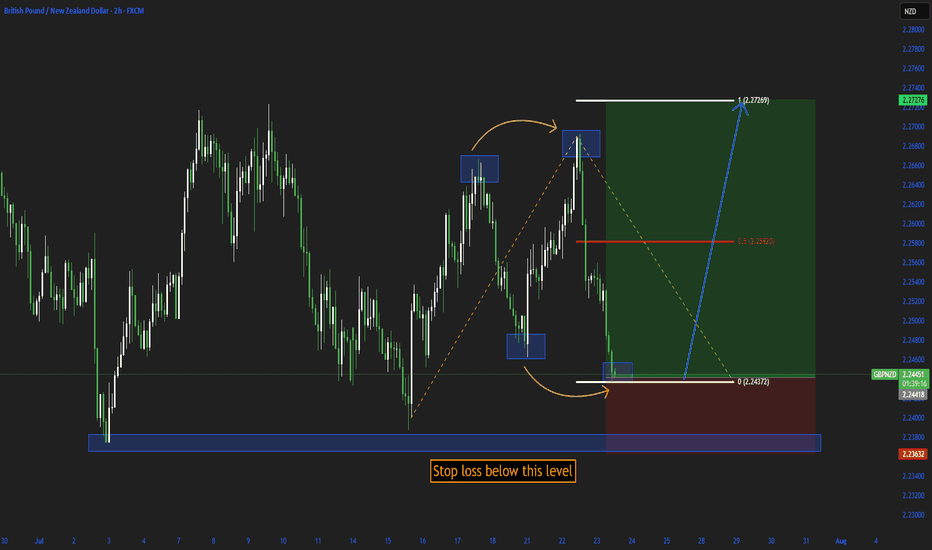

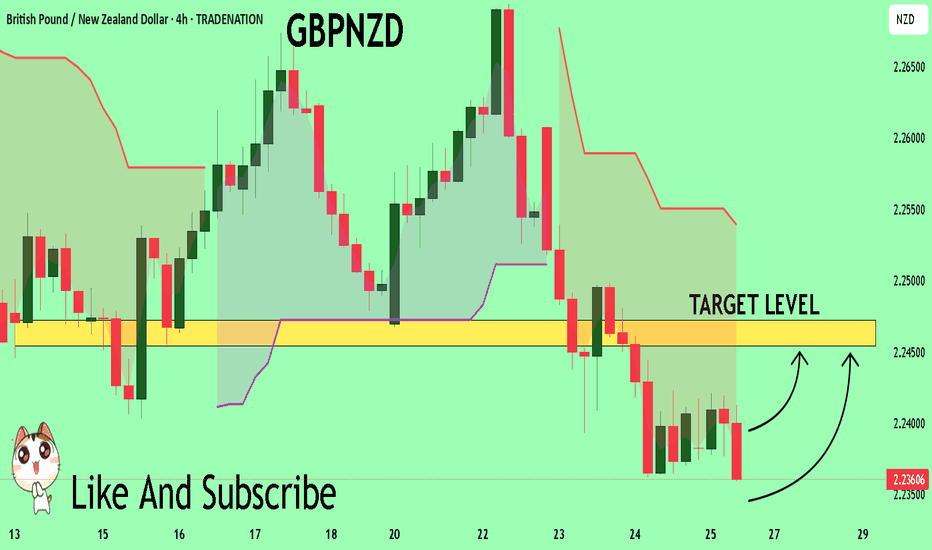

GBP/NZD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are going long on the GBP/NZD with the target of 2.262 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

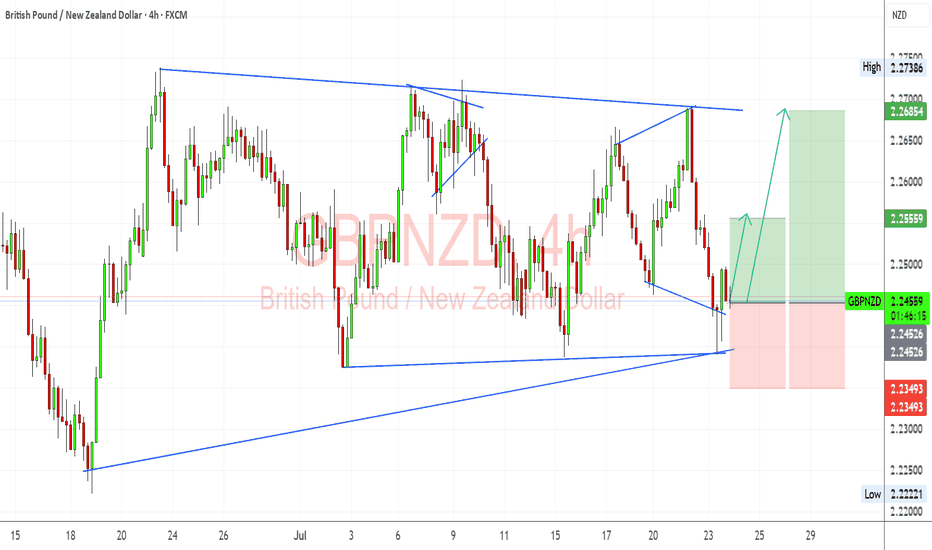

GBPNZD Analysis — 4H Chart ReviewI’m watching GBPNZD for a potential bullish continuation after a successful retest of the long-term ascending trendline. Price rejected near the lower boundary of the symmetrical triangle and showed bullish momentum right off that support. My structure suggests potential upside targets at 2.25559 (minor resistance) and 2.26854 (upper triangle boundary/major resistance zone).

🔍 Fundamental Context:

🇬🇧 GBP Fundamentals:

UK CPI came in softer than expected, and BoE rate cuts are slowly being priced in for late 2025.

However, BoE still sounds relatively hawkish compared to RBNZ due to inflation persistence in services.

Strong UK wage growth and sticky inflation give GBP some near-term yield support.

🇳🇿 NZD Fundamentals:

RBNZ remains on hold, but dovish tilt noted in recent communications.

NZD under pressure from falling dairy prices and weak global growth sentiment (especially China).

Risk-off flows and Fed hawkishness keep NZD vulnerable as a high-beta currency.

⚠️ Risks to the Setup:

A surprise hawkish turn from RBNZ or better-than-expected NZ data could boost NZD.

Renewed UK political instability or weak retail sales data may pressure GBP.

Broader market risk sentiment — NZD may strengthen if risk-on returns and US yields drop.

🗓️ Key News/Events to Monitor:

UK Retail Sales (July 25)

RBNZ Governor Orr Speech (if scheduled)

US PCE (for global risk impact)

Chinese macro data (indirect NZD driver)

🔁 Leader/Lagger Perspective:

GBPNZD often leads EURNZD during GBP-specific catalysts (BoE speeches, UK CPI).

It lags NZDUSD and NZDCAD when risk sentiment or commodity cycles dominate.

📌 Summary: Bias and Watchpoints

I'm bullish on GBPNZD in the short term, especially after a strong trendline retest and recovery off the 2.2450 zone. Fundamentals support GBP resilience over NZD due to relatively hawkish BoE stance and weaker New Zealand data. The main risk to this setup would be a dovish BoE surprise or strong NZ commodity-led rebound. I'll be watching UK Retail Sales and general risk sentiment closely. This pair can act as a leader during UK-specific news but becomes a lagger when risk flows dominate broader NZD direction.

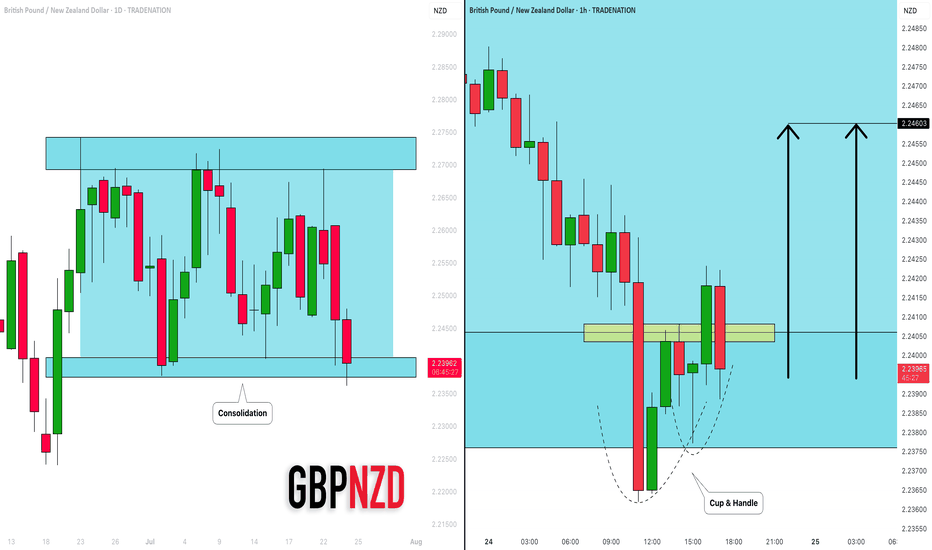

GBPNZD: Bullish Move in a Channel 🇬🇧🇳🇿

I see a horizontal parallel channel on GBPNZD on a daily.

The price is currently testing its support.

On an hourly time frame, a cup & handle pattern was formed on that.

Its neckline was violated with the today's high impact news.

I think that the price may bounce at least to 2.246 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

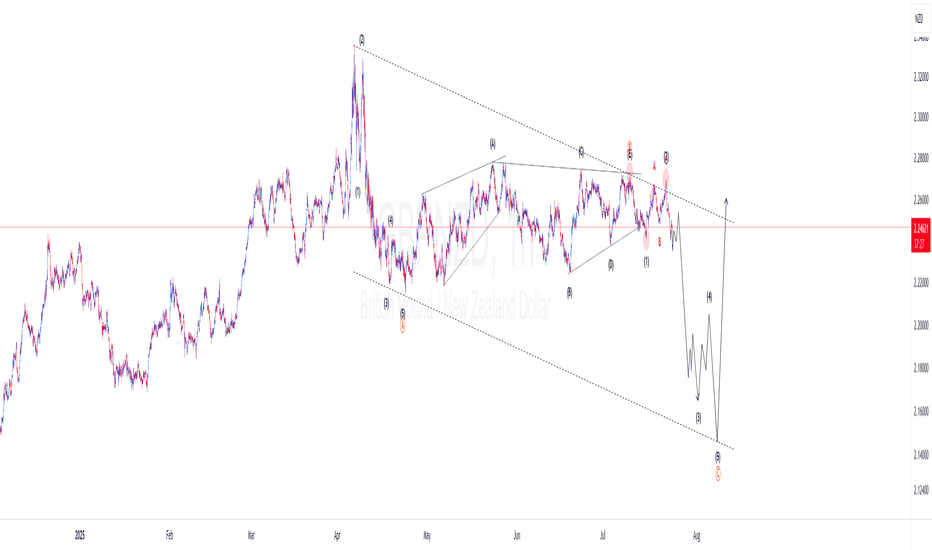

GBPNZD Elliotwaves updatePrice completed first wave of higher degree wave C. Currently price is on the lower degree wave 3. We should expect price to gain momentum to the downside creating lower lows to complete higher degree wave C. To take advantage of this short term bearish bias, one should find confluences that support a short trade.

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD MARKET ANALYSIS AND PRICE PREDICTIONGBPNZD, has experienced a massive Bullish rejection, this rejection has produced Bearish orders for three times, meaning there is a confirmed Bearish Trend. Price Has retested the order block and there is a successful Liquidity Hunt for the Bearish Trend Continuation. The targets are the two unmitigated order block, Entry is now.

Entry. Stop loss And Take Profits are clearly stated on the chat.

GOOD LUCK GUYS!

DISCLAIMER

Any analysis can fail due to markets uncertainties. take full responsibility of your capital and manage your risk!

3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy 🚀 3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy Ignites!

Pair: GBP/NZD

Timeframe:

Bias: Bullish Reversal Setup

Strategy: Rocket Booster Strategy

Signal Strength: ✅✅✅

🔍 Breakdown of the 3 Signals:

1️⃣ Volume Oscillator – Reversal Underway

Buy-side volume is increasing after a dry spell, suggesting a potential trend reversal and accumulation phase.

2️⃣ MACD – Bullish Cross Below Zero Line

Early momentum shift detected — this is where smart entries begin before full confirmation.

3️⃣ ADX + DI+ – Buyers Taking Control

ADX rising above 20 → Strengthening trend

DI+ crossing up → Buyers are clearly stepping in

🔧 Rocket Booster Strategy Criteria Met:

✅ Price is above EMA 50 and EMA 200

✅ Momentum, volume, and trend all aligned

✅ Ideal launch conditions for a bullish continuation

💡 Trade Idea (Example Only):

Entry: Market or pullback

Stop-Loss: Below swing low / EMA 50

TP1: Previous high

TP2: 2R+ extension

Optional: Use a trailing stop for scaling out

⚠️ Disclaimer:

This is not financial advice. Use a simulation account to test this strategy first.

Always apply risk management and have a clear profit-taking plan.

Never risk more than you can afford to lose.

🔚 Final Thought:

When volume, momentum, and trend align — it’s time to pay attention.

This is a textbook Rocket Booster setup: clean, powerful, and primed for upside.

Rocket Boost This Content To Learn More

GBPNZD 15m buyHello friends. The price of the GBPNZD symbol in the 15-minute time frame after hitting the FVG high time frame is now bullish. You can see that it also happened in the choch direction. If it returns to the FVG 15m area, it can be entered for buy. Friends, please note that this is just a theory.

GBP/ NZD Ready Read The Captions This 1-hour chart analysis of GBP/NZD highlights key trading zones:

Support level: 2.23949

Demand zone: 2.25236

Target zone: 2.26073

The price is currently rising from support and approaching the demand zone. Two possible scenarios are shown: a breakout toward the target zone or a pullback to the support before a new upward attempt.

GBP_NZD BEARISH BREAKOUT|SHORT|

✅GBP_NZD is going down currently

As the pair broke the key structure level of 2.2400

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK