NZDUSD trade ideas

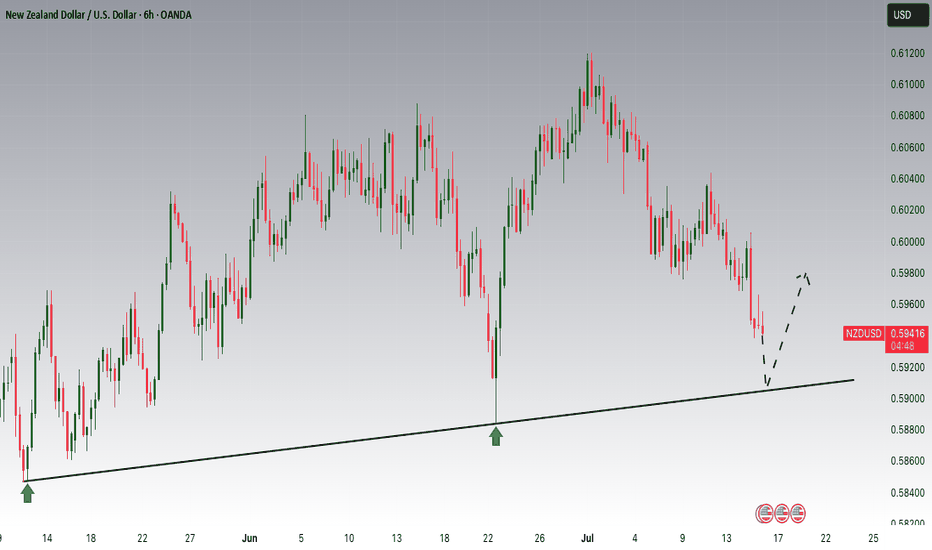

NZDUSD is Nearing an Important SupportHey Traders, in today's trading session we are monitoring NZDUSD for a buying opportunity around 0.59100 zone, NZDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.59100 support and resistance area.

Trade safe, Joe.

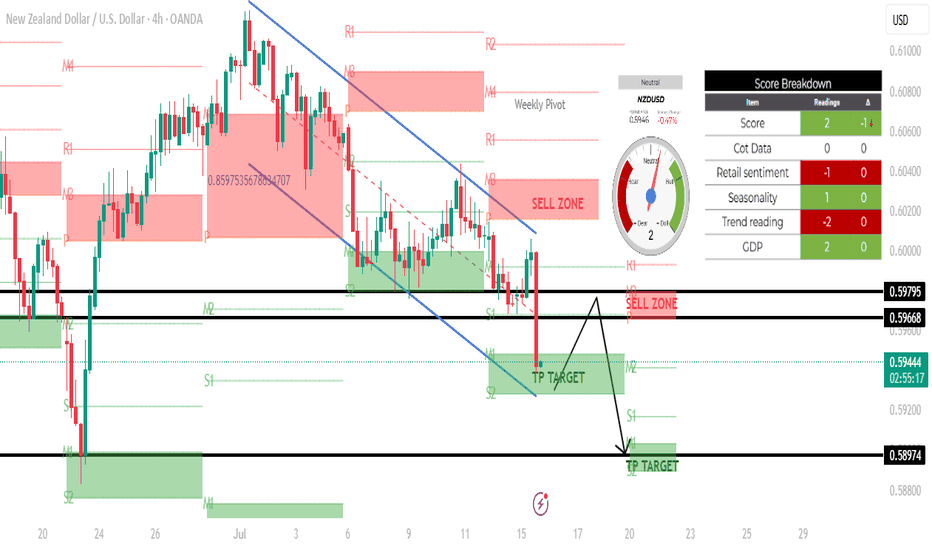

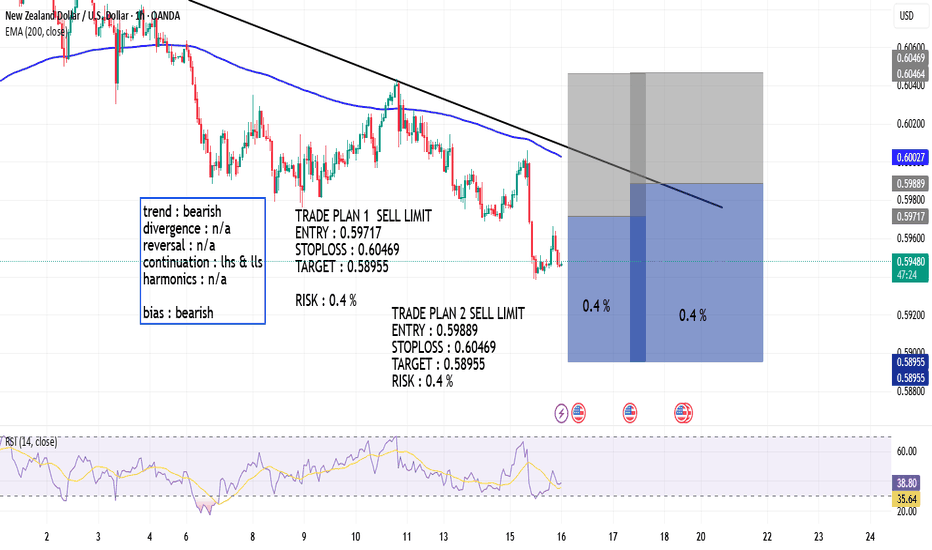

NZDUSD H4 SHORT SETUP: 15 JULY 2025Based on the 4-hour chart of NZD/USD, here's a technical analysis of the current setup:

\---

🕒 Timeframe: 4H

💱 Pair: NZD/USD

📉 Current Price: Around 0.59430

---

🔍 Chart Structure and Analysis:

🔻 Trend:

The market is in a clear downtrend, as indicated by the descending channel and the strong bearish candle that broke below the previous support zone.

Sellers are currently in control.

---

📍 Key Zones:

🔴 Sell Zones (Supply):

0.59668 – 0.59795: Marked as a supply/sell zone.

Price previously reacted here and dropped sharply. Expect selling pressure if price retests this zone.

---

🟢 Take Profit (TP) Targets / Demand Zones:

1. TP Target 1: Around 0.59430 – 0.59300 — Already hit; slight bounce seen.

2. TP Target 2: 0.58974 — This is the next key target/support zone, which aligns with a prior low.

---

🔁 Possible Scenarios:

✅ Scenario 1: Continuation Bearish

If price fails to break back above the 0.59668 resistance, it will likely:

Consolidate below,

Retest and reject again,

Then head lower toward 0.58974 (TP2).

⚠ Scenario 2: Short-Term Retracement

If there's a bounce (as seen by the current candle's wick), price may retest the sell zone at 0.59668–0.59795.

This could present another short entry opportunity with a target at 0.58974.

---

📊 Confluences:

Weekly Pivot + Structure Resistance near 0.59668: Strengthens the sell zone.

Strong Bearish Momentum Candle: Signals potential for continuation.

TP Zone overlaps with S2 level: Providing possible support/bounce area.

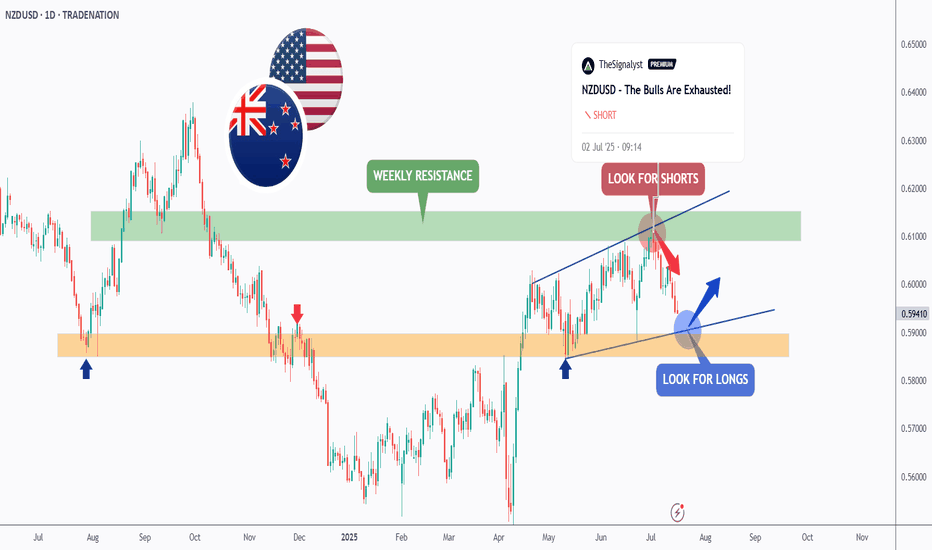

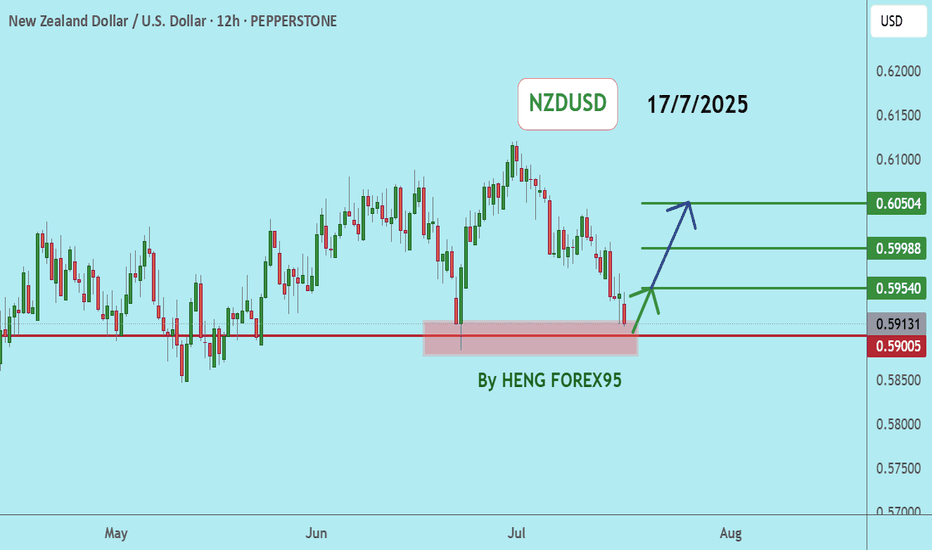

NZDUSD - It is Time!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last NZDUSD analysis, attached on the chart, it rejected the upper bound of the blue wedge pattern and traded lower.

📈This week, NZDUSD is retesting the lower bound of the wedge.

Moreover, the orange zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and orange support.

📚 As per my trading style:

As #NZDUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

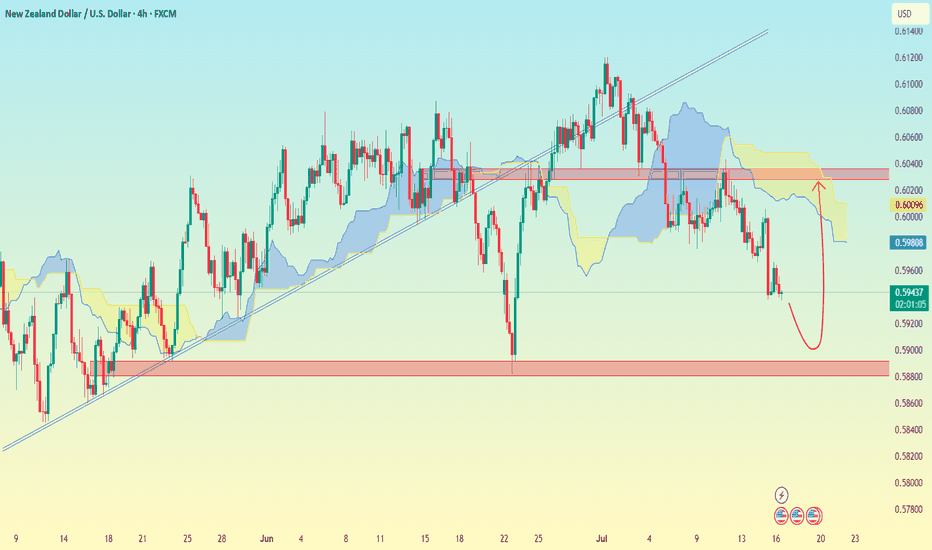

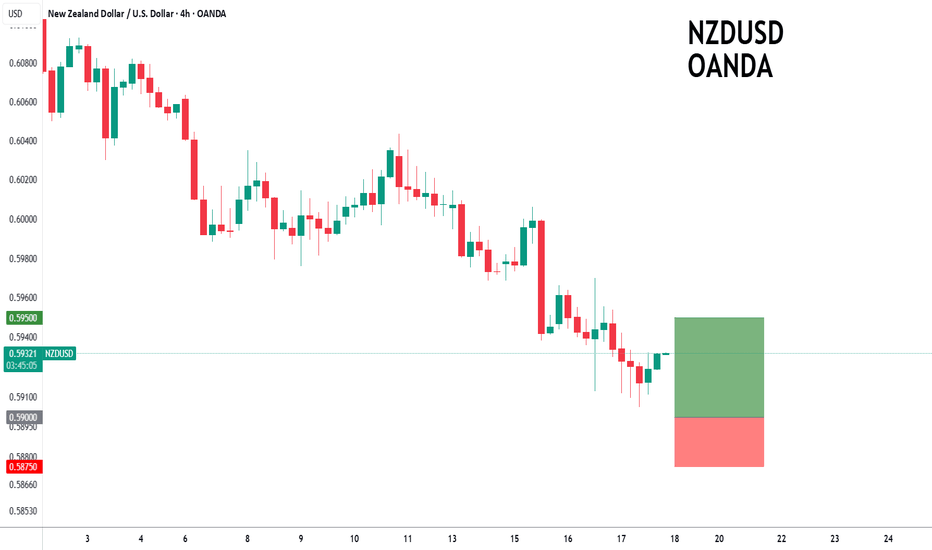

NZD/USD (4H time frame)..NZD/USD (4H time frame), here's the analysis:

---

📉 Chart Analysis Summary:

Price has broken below the trendline and is currently below the Ichimoku cloud, indicating bearish momentum.

A bearish move is likely continuing toward a strong support zone.

A rebound is drawn on my analysis suggesting a possible bounce after reaching a key demand zone.

---

🎯 Target Levels:

🔻 Bearish Move (Primary Setup):

Sell from: Current zone around 0.59400

Target 1: 0.59000

Target 2 (Main Support Zone): 0.58600

Stop Loss: Above the red horizontal resistance — around 0.60000

---

🔁 Possible Bounce Scenario (Secondary Setup):

If price hits the 0.58600 zone and shows reversal signs:

Buy from: 0.58600 – 0.58800

Target: 0.59800 – 0.60000

---

⚠ Key Zones:

🔴 Resistance: 0.60000 – 0.60200

🟢 Support: 0.58600 – 0.58800

NZD/USD H&S Reversal Pattern Clear,Short Setup To Get 150 Pips !Here is my opinion On NZD/USD On 4H T.F , If we checked the chart we will see that we have a very strong Historical res that forced the price many times to respect it and stay below it and now we have another good confirmation , we have a perfect reversal pattern and we have a clear closure below our neckline so the pattern already confirmed , i`m waiting the price to go up a little to retest my broken neckline and then we can enter a sell trade . only 1 case i will avoid this idea , if we have a daily closure agin above my res with clear closure .

NZDUSD Pullback in Play – Head & Shoulders Signals More DownsideNZDUSD ( OANDA:NZDUSD ) is currently trading near the Resistance zone($0.612-$0.605) and has also managed to break the Support zone($0.604-$0.602) . We consider the Support zone as the neckline of the Head and Shoulders Pattern .

In terms of classic technical analysis , NZDUSD has managed to form a Head and Shoulders Pattern .

I expect NZDUSD to decline towards the Support zone($0.5968-$0.5946) after completing the pullback .

Note: Stop Loss(SL): $0.6062

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ U.S. Dollar Analyze (NZDUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

IS USD STRENGTH BACK? or IS IT JUST A PULLBACK?All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

NZD/USD "KIWI HEIST" – BEARISH BANK ROBBERY!🦹♂️ NZD/USD "THE KIWI HEIST" – BEARISH BANK ROBBERY PLAN! 🚨💰

(Thief Trading Style – Short Entry Strategy for Maximum Loot!)

🎯 MASTER TRADING HEIST BLUEPRINT

🔥 Thief’s Technical & Fundamental Analysis Confirms:

NZD/USD is OVERBOUGHT + TREND REVERSAL!

Police (Bulls) set a TRAP near the Red Zone (Support) – Time to ESCAPE with profits before they catch us!

✔ Entry Point (Bearish Loot Grab):

*"The vault is UNLOCKED! Swipe SHORT anywhere – but for SAFER HEIST, use Sell Limit orders (15m/30m pullbacks). Pro Thieves use DCA/Layering for max gains!"*

✔ Stop Loss (Escape Route):

"SL at nearest 4H Swing High (0.60400). Adjust based on YOUR risk tolerance & loot size!"

✔ Target 🎯 (Profit Escape):

0.58900 (or exit earlier if cops (bulls) show up!)

⚠️ THIEF’S WARNING – NEWS & RISK MANAGEMENT

📢 High-Impact News = VOLATILITY TRAP!

Avoid new trades during news releases.

Trailing SL = Lock profits & evade market cops!

💥 SCALPERS & SWING THIEVES – QUICK NOTES:

Scalpers: Only quick LONG scalp plays (use Trailing SL!).

Swing Thieves: Hold for the BIG BEARISH LOOT! 🏦

📉 WHY NZD/USD IS BEARISH? (Thief’s Intel Report)

Overbought + Trend Reversal Signals!

Bulls (Police) losing strength at Resistance!

For FULL Intel (Fundamentals, COT Report, Sentiment, etc.) – Klickk 🔗!

🚀 BOOST THIS HEIST! (Like & Share for More Loot Plans!)

💖 "Hit 👍 BOOST to strengthen our THIEF SQUAD! More heists = More profits!"

📌 DISCLAIMER (Stay Safe, Thieves!):

This is NOT financial advice. Trade at your own risk & manage positions wisely!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🎭

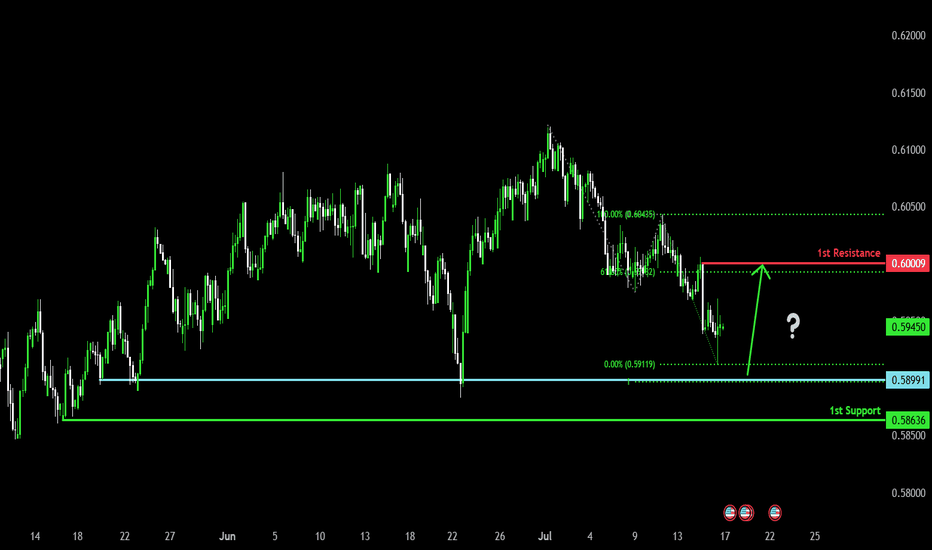

Bullish bounce?The Kiwi (NZD/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.5899

1st Support: 0.5863

1st Resistance: 0.6000

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?The Kiwi (NZD/USD) is reacting off the pivot and could drop to the 1st support which is a pullback support.

Pivot: 0.6007

1st Support: 0.5946

1st Resistance: 0.6037

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDUSD to turnaround?NZDUSD - 24h expiry

The correction lower is assessed as being complete.

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5925 will confirm the bullish momentum.

The measured move target is 0.5975.

We look to Buy at 0.5900 (stop at 0.5875)

Our profit targets will be 0.5950 and 0.5975

Resistance: 0.5925 / 0.5950 / 0.5975

Support: 0.5900 / 0.5875 / 0.5850

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSDNZDUSD price is near the support zone 0.59197-0.58790. If the price cannot break through the 0.58790 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

NZD/USD showing a potential bullish setupNZDUSD 4H Trade Breakdown – Bullish Reversal in Play 🔥📈

This setup is a textbook example of a smart money reversal backed by structure, market psychology, and clear technicals.

1. Change of Character (CHoCH):

- The market was previously in a downtrend.

- Price broke above the last lower high, signaling a CHoCH – the first sign that buyers are gaining control.

- This is a key point where many smart traders start paying attention.

2. Trendline & Channel Respect:

- Price tapped perfectly off the ascending trendline, confirming the long-term bullish channel.

- This adds confluence (multiple confirmations) to the bullish bias.

3. Market Structure Shift:

- After the CHoCH, price formed a higher low and started pushing up.

- This shows a shift to bullish structure (higher highs and higher lows).

4. Projected Move:

- The blue arrow shows a likely path: a bullish break, possible pullback to retest the broken structure, then continuation up.

- Targeting above 0.61200, with potential for further highs.

Why this trade stands out:

✅ Structure break (CHoCH)

✅ Strong support off trendline

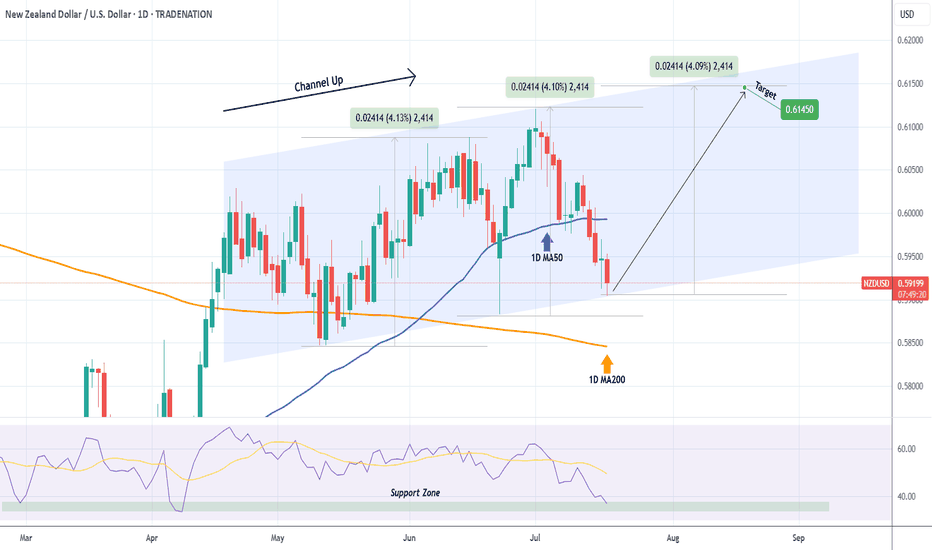

NZDUSD Excellent buy opportunity on the Channel Up bottom.Last time we looked at the NDUSD pair (May 27, see chart below), we gave a buy signal that in a few days hit our 0.60900 Target:

This time the price is trading exactly at the bottom of a 3-month Channel Up, with the 1D RSI entering its Support Zone. The true Support might be a little lower on the 1D MA200 (orange trend-line) and as long as it holds, the trend will remain bullish, but this is the first strong buy signal of the chart.

Our Target is 0.61450, which will be a +4.10% rise, exactly the same as both previous Bullish Legs.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDUSD M15 I Bullish Bounce Off Based on the M15 chart analysis, the price is approaching our buy entry level at 0.6014, a pullback support.

Our take profit is set at 0.6053, a pullback resistance that aligns with the 100% Fib projection.

The stop loss is placed at 0.5975, a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Potential bullish rise?The Kiwi (NZD/USD) is reacting off the pivot and could rise from this level to the 1st resistance.

Pivot: 0.6018

1st Support: 0.5990

1st Resistance: 0.6061

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.