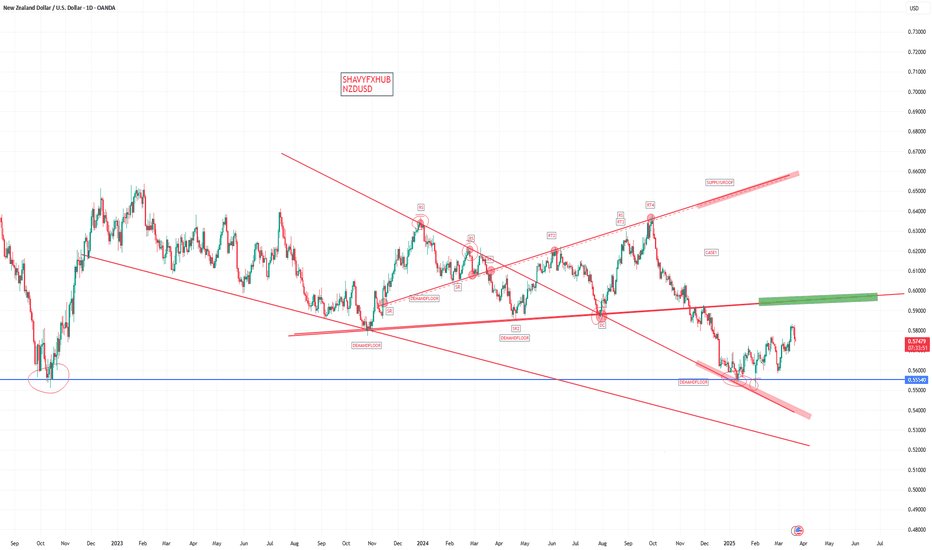

NZDUSD trade ideas

NZDUSD Potential Bullish Bat PatternOn the 4-hour chart, NZDUSD is currently fluctuating and falling. In the short term, you can pay attention to the area below 0.5698, which is a potential buying position for a bullish bat pattern. At the same time, this position is within the previous demand area.

NZD/USD "The Kiwi" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.57500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (0.56800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

✂Primary Target - 0.58350 (or) Escape Before the Target

✂Secondary Target - 0.59600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

NZD/USD "The Kiwi" Forex market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

🟡Fundamental Analysis

- Economic Indicators: New Zealand's GDP growth rate is 2.5%, inflation rate is 2.3%, and unemployment rate is 3.7%.

- Monetary Policy: The Reserve Bank of New Zealand's official cash rate is 3.25%.

- Fiscal Policy: The New Zealand government's budget deficit is 1.2% of GDP.

⚫Macroeconomic Factors

- Inflation Rate: The inflation rate in New Zealand is 2.3%, which is within the Reserve Bank's target range of 1-3%.

- Interest Rates: The Reserve Bank of New Zealand's official cash rate is 3.25%, which is relatively high compared to other developed economies.

- GDP Growth Rate: New Zealand's GDP growth rate is 2.5%, which is moderate compared to other developed economies.

- Trade Balance: New Zealand's trade balance is improving, with exports increasing.

🟠Global Market Analysis

- US Economic Indicators: The US GDP growth rate is 2.2%, inflation rate is 2.2%, and unemployment rate is 3.5%.

- Commodity Prices: The price of gold is $1,700 per ounce, and the price of oil is $65 per barrel.

- Global Economic Growth: The global economic growth rate is 3.5%, which is moderate.

🔴COT Data

- Non-Commercial Traders: Non-commercial traders, such as hedge funds and speculators, have been net long on the NZD, with 30,000 contracts.

- Commercial Traders: Commercial traders, such as banks and institutions, have been net short on the NZD, with 20,000 contracts.

- Open Interest: The total number of outstanding contracts in the futures market is 120,000.

🟣Intermarket Analysis

- Correlation with AUD/USD: The NZD/USD exchange rate has a strong positive correlation with the AUD/USD exchange rate, with a correlation coefficient of 0.8.

- Correlation with Gold: The NZD/USD exchange rate has a moderate positive correlation with gold prices, with a correlation coefficient of 0.5.

🟤Quantitative Analysis

- Moving Averages: The 50-day moving average is 0.5820, and the 200-day moving average is 0.5750.

- Relative Strength Index (RSI): The RSI is currently at 60, indicating bullish conditions.

- Bollinger Bands: The NZD/USD exchange rate is currently trading above its Bollinger Bands, indicating a strong uptrend.

🔵Market Sentimental Analysis

- Bullish Sentiment: 60% of market participants are bullish on the NZD/USD exchange rate.

- Bearish Sentiment: 40% of market participants are bearish on the NZD/USD exchange rate.

- Fear and Greed Index: The fear and greed index is currently at 70, indicating greed.

🟢Positioning

- Short-Term: Long NZD/USD, targeting 0.59000.

- Long-Term: Long NZD/USD, targeting 0.62000.

⚪Next Trend Move

- Upward: The NZD/USD exchange rate is expected to move upward in the short term.

🟡Overall Summary Outlook

- Bullish: The NZD/USD exchange rate is expected to move upward in the short term, driven by macroeconomic factors, global market analysis, and quantitative analysis.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Mon 24th Mar 2025 NZD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a NZD/USD Sell. Enjoy the day all. Cheers. Jim

Bullish bounce?The Kiwi (NZD/USD) is falling towards the pivot which is a pullback support and could bounce to the 1st resistance which acts as an overlap resistance.

Pivot: 0.5692

1st Support: 0.5596

1st Resistance: 0.5836

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZD-USD Free Signal! Sell!

Hello,Traders!

NZD-USD made a bearish

Breakout of the key horizontal

Level of 0.5755 so we are

Bearish biased and we can

Enter a short trade with the

Target Level of 0.5695 and

The Stop Loss of 0.5775

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish bounce off overlap support?NZD/USD is falling towards the support level which is an overlap support that lines up with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.5695

Why we like it:

There is an overlap support level that lines up with the the 50% Fibonacci retracement.

Stop loss: 0.5638

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 0.5764

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDUSD BULLISH BREAKOUT AHEAD?! *NZD/USD: Bullish Breakout Ahead?*

A potential buying opportunity has emerged in the NZD/USD pair, with a key resistance level in focus.

*Trade Idea:*

The NZD/USD pair is poised to fly to 0.6000 from its current price, driven by:

1. *Bullish Technicals*: Technical indicators are flashing bullish signals, hinting at a potential upswing.

2. *RBNZ's Monetary Policy*: The Reserve Bank of New Zealand's decision to maintain its monetary policy stance may support the Kiwi Dollar.

3. *US Dollar Weakness*: A weakening US Dollar, driven by concerns over the US economy and monetary policy, may boost the NZD/USD pair.

*Trade Specifications:*

- *Buy Entry:* Current price (around 0.5850)

- *Target Level:* 0.6000 (150 pips above entry)

- *Stop-Loss:* 0.5750 (100 pips below entry)

*Market Outlook:*

The NZD/USD pair is experiencing a consolidation phase, with market participants awaiting key economic data releases and central bank decisions. A break above the 0.5900 resistance level could trigger a sharp rally.

*Trading Strategy:*

Buy NZD/USD at current price, with a stop-loss at 0.5750. Use the target level to take profits or adjust the stop-loss to break even.

*Risk Management:*

- *Risk-Reward Ratio:* 1:1.5

- *Position Sizing:* 2-3% of trading capital

*Your Feedback Matters:*

If this trade idea and analysis helped you, please:

- *Like* to show appreciation

- *Share* your opinions and feedback

- *Follow* for more trade ideas and market analysis

Keep share your valuable ideas to the Travis 💯

NZD/USD 4H Analysis – Smart Money Perspective🔍 NZD/USD – 4H Smart Money Concept Analysis by "Asif Brain Wave"

Key Zones Marked:

🔴 Weekly Fair Value Gap (FVG) and Order Block (OB) marked as strong resistance zones.

🟢 Two Bullish Order Blocks (+OB) highlighted below – potential areas for retracement or reaction.

🔵 +FVG (H4) near the Monthly Target, indicating a possible price magnet.

Market Structure & Expectation:

A clear CISD (Change in Structure Direction) indicates bearish market behavior.

The red path projection shows:

A potential short-term retracement into the upper OB area.

Followed by a sharp bearish drop toward the monthly target.

💘 Final target near 0.55154, marked with a heart symbol as a visual touch – representing your target zone with a personal flair.

Highlighted Price Levels:

High: 0.58305

Current Price: 0.57272

Projected Target (Low): 0.55154

NZDUSDProjected Price Path: The white-drawn path on the chart suggests a small pullback followed by a potential drop.

Probabilities:

Bearish Probability: Around 60-70%, due to the price being at the channel’s resistance and reacting to a strong resistance zone.

Bullish Probability: Around 30-40%, if the price successfully breaks and holds above the 0.5800 level.

NZD/USD 1H Analysis & Trade Setup – 21-01-2025📊 NZD/USD 1H Analysis & Trade Setup – 21-01-2025

📉 Current Price: 0.57479

🔴 Supply Zones (Resistance):

✔ 0.57759

✔ 0.58188

🟢 Demand Zones (Support):

✔ 0.57231

✔ 0.56776

📌 Market Outlook:

Bearish Trend: Price is moving downward after hitting resistance.

If price retests the 0.57759 - 0.58188 supply zone and rejects, further downside expected.

Next Support: 0.57231, if broken, could fall to 0.56776.

⚡ Trade Setup:

🔻 Sell Near: 0.57759 - 0.58188

🎯 TP1: 0.57231

🎯 TP2: 0.56776

🛑 SL: Above 0.58350

#NZDUSD #ForexTrading #PriceAction #SmartMoney #TradingAnalysis 🚀📊

NZD/USD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

Could the Kiwi drop from here?The price is rising towards the resistance level which is a pullback resistance that lines up with the 50% Fibonacci retracement and could drop from this level to our take profit.

Entry: 0.5801

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 0.5830

Why we like it:

There is a pullback resistance level.

Take profit: 0.5760

Why we like it:

There is a pullback support level that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD_USD LONG SIGNAL|

✅NZD_USD will soon retest a key support level of 0.5770

So I think that the pair will make a rebound

And go up to retest the supply level above

So we can enter a long trade with

The Take Profit of 0.5806

And Stop Loss of 0.5752

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.