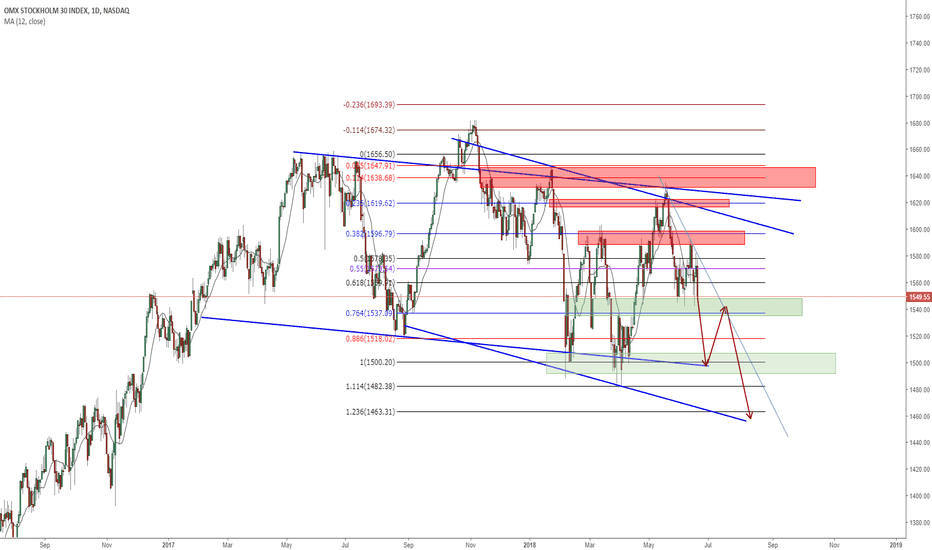

Sweden OMXS30 - a few zones of support leftAfter having broken down from a near 2 year consolidation pattern things have become a lot more volatile. As of last bounce from low we are looking at a 50% retrace. Not sure it will stop there with S&P and NDQ in hindsight.

My mid term view is that we will make a clear break of 1500 and remain below for quite some time. Bounces may occur from mid 1400 and definitely from low 1400.

/Cheers!

OMXS30 trade ideas

OMX30 Strong Bullish Divergence on D/H4 Nov 28 2018Clear, strong bullish divergence is visible on the daily and H4 timeframe, seen in two waves.

Price is in extended bearish territory with expanded bearish Kumo Clouds. Trend

followers will have to wait for entry until a buy signal appears by the Ichomku, while

traders using divergence has a golden opportunity to enter long, scale in or increase

periodical purchases right now.

Ideally, one would wait for a slight pull back from here, but for medium and longer term

holders, this wouldn't be needed.

OMXS30 Hit first support but will probably not hold for too longSwedish stock market seem to be correlated with the US stock market.

Neither of them seem to have any bullish momentum left while the dollar is getting stronger.

Also too much political uncertainty in Sweden can have impact.

Target: 1250

OMXS30 Monthly - Yet another scary looking chartBottoms show a resistance (blue, striped line).

Red shows a bearish triangle forming. If coming true, target would be around 840-850 around the year 2020/21.

Pink show's bearish target.

Current uptrend (monthly) shown with Inside Pitchfork (started in beginning of 2009). There is also a chance we continue going up, but remember: What goes up also comes down.

Orange striped line from peaks of both past financial crisis' show another resistance.

Stay safe, comments welcome :)

OMX-30 Liveupdate!Nice Buy-Signal#RideTheLastWaveHey tradomaniacs,

quick another update for OMX-30!

Trend seems to continue in order to finish the last and 5th-Wave of the impuls-phase!

Type: Swing-trade

Buy-Limit: 1.632 (conservative)

Buy-Stop: 1.650 (aggresive)

Stop-Loss: 1.607

Target 1: 1.680 (Double-Top-Potential)

Target 2: 1.721 (ATH)

Trend-following-Strategy: Don`t use Take-Profits

Peace and good trades

Irasor

Trading2ez

Wanna see more? Don`t forget to follow me.

Any questions? Need education or signals? PM me. :-)

OMX30 weekly analysis ***10.09.2018***Hey guys,

it seems like we crashed back into the recent range and bounce off of it.

The globale situation is pretty weird in terms of the differences and mood of investor world wide.

Fundamental facts:

1. S&P500 = 7% Plus since Years begin

2. Globale Stockmarket (measured on ETFs) = -7%

3. Chinas Stockmarket = -19%

Question: Does that make sense?

-----------------------------------------

- First time since 1987 - 2001 the S&P 500 showed 4 red days in a row

- Apple: falling since 4 days

- Nasdaq: Worst performance since march

Conclusion? Since July defensive sectors doing well.

- Export indexes like Dax suffer

- Techs like amazon seems to advoid the high-risk-aversion since Juni caused by the tradewar = Greatest potential for a corretive phase.

- US-techs compared to CH-techs like Tencent, Alibaba etc. = massive difference in performance and Sell-Off in Stockmarket & Techmarket

- Apple produces in China and Trump wants them to produce in the USA / Is he going to destroy the globale supply chain performance like in 1930?

- Apple = vulnerable company

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sweden`s new ATH coming soon? better don`t buy right now!Hey guys,

my friend erfrered wanted to see this chart, so I thought I might check OMX and share my idea. :-)

I usually don`t trade OMX and have no real fundamental information about it.

All I know is: THE US-MARKET is freaking dafuck out! And as long as the WORLDINDEX S&P500 creates ATH we can expect the european market to follow.

But how long will this take? The market is overheated and it`s time to see a recession.

Off-Topic. WE will what happens. :-)

Peace and good trades

Irasor

Trading2ez

Wanna see more? Don`t fprget to follow me.

Any questions? Need education or more signals? PM me! :-)

OMXS30, 4H - Potential Shark patternOMXS30 continues to be bullish and are looking to face two resistance levels ahead.

First one is at the level of "X" in the pattern, wich is strong nut we Do see some tests just above lining up with the top of the Sharks PRZ.

Expected reaction from the Shark is a 38.2% Fib, but often we can see a pullback down to 50% where w, in that case, have a 5-0 pattern comming up.

Interesting time ahead for the Swedish OMXS30.