OPUSDT Update

Symbol: OP/USDT

Timeframe: Daily

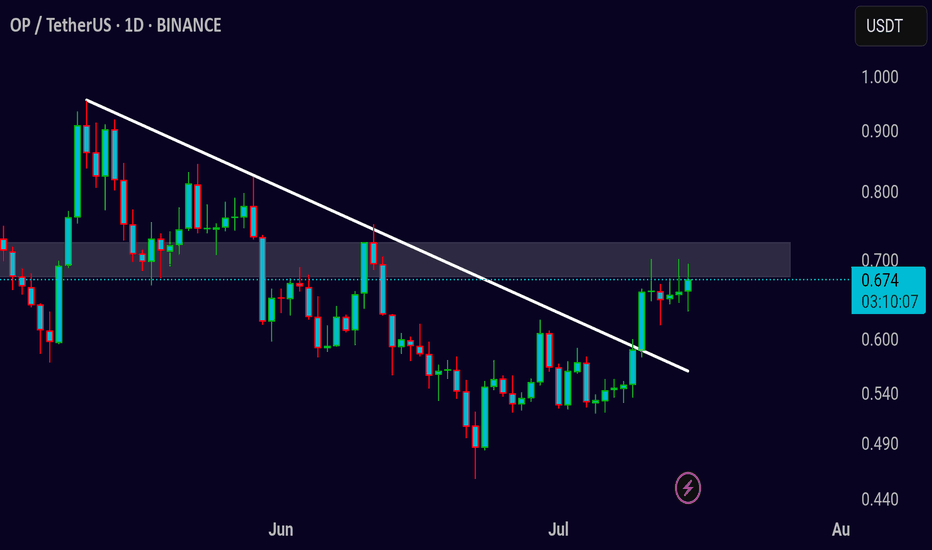

Chart Analysis:

The price is currently approaching a key resistance zone at around 0.673, as seen in the chart. A descending trendline from May to June has been acting as resistance. The price has recently made a strong move towards this resistance zone, showing a potential breakout pattern.

If the price successfully breaks above the 0.673 resistance, we could see a bullish continuation towards the next resistance levels, potentially up to 0.700 or higher. The breakout would suggest a reversal of the prior downtrend.

Key Levels:

* Resistance: 0.673 (current resistance zone)

* Support: 0.600 (lower support area)

Trade Strategy:

1. Long Entry: Consider entering a long position if the price breaks above the 0.673 resistance with strong volume.

2. Target: A reasonable target could be the 0.700 region. Keep an eye on price action as it approaches this level.

3. Stop Loss: Place a stop loss below the 0.600 support to manage risk in case of a failed breakout.

Risk-Reward: A potential reward-to-risk ratio of 2:1 or better, depending on entry and exit points.

Conclusion:

Monitor the price closely for a breakout above the 0.673 level. If it breaks and sustains, a bullish move could follow. Watch for volume confirmation and market momentum to gauge the strength of the breakout.

OPUSDT trade ideas

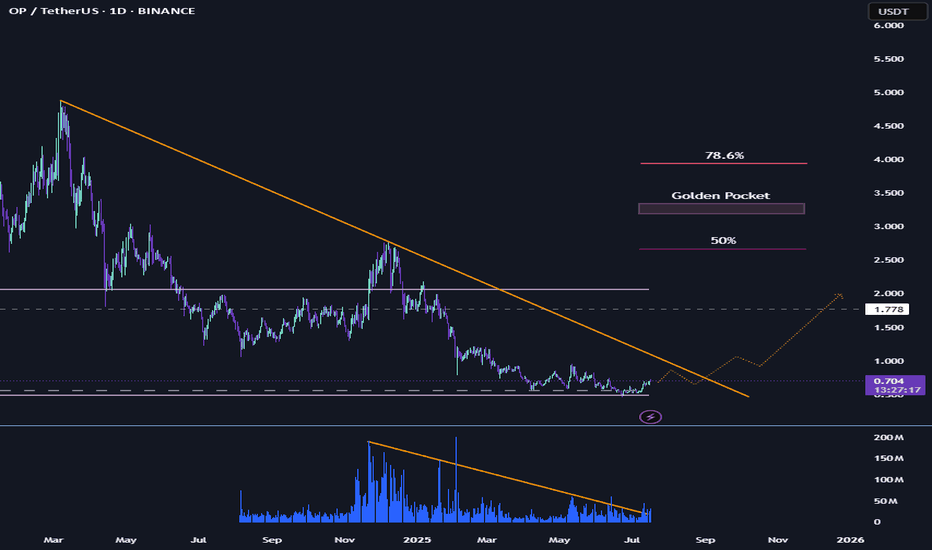

1d OP - Long setupToday I set up a low lev (2x) long with a 7:1 rr on BINANCE:OPUSDT

Reason being that it seems to have bottomed out. fairly close to the VAL and POC. both are at 50 cent and 55 cent respectively. I'd consider adding a little margin IF it comes close to that area. around 48/49 cents I'd consider myself out. my target is 4.50, possibly 78.6 fib at around 4 dollars I'll take some out, but the past ATH of 4.50 should be possible imho.

currently the marketcap is at roughly over 1 billion. to shoot it towards 10 billion is not a big stretch.

currently it followed a downtrend since the last ATH in march 24. possible reaction/rejection once more around that touchpoint. with enough volume and the correct sentiment in the market, I see it push through and retest before going towards VAH at 2.06 and the 50% fib at 2.66.

all things considered, I'll take the chance.

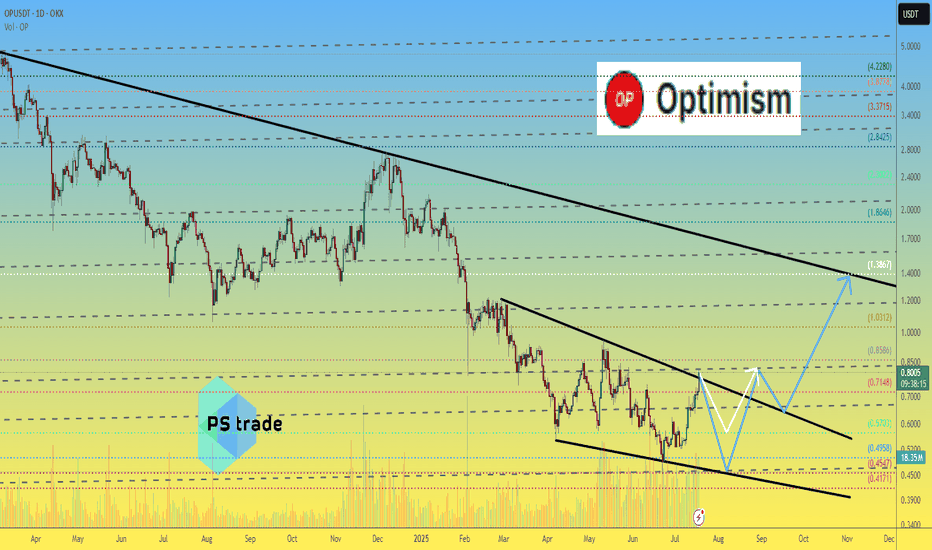

Optimism OP price analysisCurrently, the price of #OP does not look very optimistic (a little pun to start with )))

🟢 An optimistic forecast would be for the price of OKX:OPUSDT to rise to $1.40

🟡 But it looks like this growth will not happen now, but after a correction.

🔴 Correction: only to $0.57 or again to $0.45 — this is also an open question.

👌 Patience to holders and fans of the #Optimism project, the “microclimate” in the crypto market is improving — the time will come, and this coin will also be pumping...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

OPUSDT Forming Falling ChannelOPUSDT is currently exhibiting a promising setup that could lead to a significant bullish move. The chart shows that the price has broken out of a well-defined falling channel pattern, which often signals the end of a correction phase and the beginning of a potential uptrend. With the breakout confirmed and good volume supporting this move, there is a strong possibility of a 90% to 100% gain in the coming sessions, drawing the attention of traders looking for breakout plays.

Optimism (OP) has been a hot topic within the crypto community due to its role in scaling Ethereum through its layer 2 solution. The consistent development and growing adoption of the Optimism network have sparked investor interest, providing a fundamental backdrop that complements the bullish technical signals. Many traders see this breakout as an opportunity to get in early on a potential recovery rally.

The current price action suggests that OPUSDT may continue its upward trajectory if buying pressure remains strong and key resistance levels are cleared convincingly. Traders should watch for sustained volume spikes and possible retests of the breakout level, which can offer more confidence in the continuation of the bullish momentum. As always, risk management is essential when navigating such moves.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Optimism Extreme BUY: Easy 1277% Profits Potential—Can Go HigherOptimism is now moving within a "extreme BUY" zone. This is a price zone that was active only once between June and July 2022, one month only and then OPUSDT went on a massive rally. Total growth amounting to more than 1,111% from bottom to top.

This zone has been activated again for a little over one month and I believe it won't remain valid much longer. There is room for a new wave of growth but this time much more than 1,111%.

The target shown on the chart is a good one but I believe this trading pair/Cryptocurrency project can go higher when all is said and done.

Technical analysis —Bullish based on price action

On the 16-June week, 22-June specifically, Optimism (OPUSDT) hit its lowest price yet. 0.457. This is just a bit higher compared to the all-time low June 2022 at 0.396. We can easily say the bottom is in as this week the action is back above its 7-April 2025 low.

Higher targets

The next high target sits at $12, giving us a 2,078% potential for profits from current price. 0.551 at the time of writing.

Previous cycle vs current cycle

Optimism's first bullish cycle lasted 630 days. The next cycle, the one that is about to start now, can last an entire year, eight months... We are entering uncharted territory so it is hard to say.

One thing I can say based on TA is that this new wave will be much more steep compared to the last one. The climb will be really fast, it will be hard to adapt.

How to trade to maximize profits

The best way to approach this pair for sure success is by buying when prices are low, now. This would secure a smooth ride and happy profits on the way up.

If you are reading this now, your timing is awesome because we are looking at a bottom catch, this type of opportunity is only seen once every several years. For example, the last time OPUSDT traded this low was in mid-2022, three years ago. Once the bullish wave takes off, there is no going back. Once the bulls are in, low prices will be forever gone.

Thanks a lot for your continued support.

Namaste.

OPUSDT 1D#OP is on the verge of breaking out above the descending resistance and the SMA50 on the daily chart. The setup looks promising — keep a close eye on it.

In case of a breakout, the targets are:

🎯 $0.647

🎯 $0.706

🎯 $0.764

🎯 $0.848

🎯 $0.954

⚠️ As always, use a tight stop-loss and apply proper risk management.

OPUSDT: Buyers try to regain control inside the rangeHi traders and investors!

On the daily timeframe, OPUSDT is trading in a sideways range. The price has repeatedly dipped below the lower boundary at 0.545, but each time, buyers managed to bring it back.

Now, we’re seeing another attempt to return into the consolidation zone — a possible sign of renewed buyer initiative.

If the price secures above 0.545, the path opens toward the next targets at 0.844 and 0.954. However, a short-term dip below 0.52 may occur within this bullish scenario.

Therefore, buying becomes a priority once the price is firmly back above 0.545.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

OP 5$ SOONOptimism

Optimism is an EVM-compatible optimistic rollup blockchain platform built on top of Ethereum.

We note that the currency has been undergoing a deep correction for a long time due to the ongoing downward pressure and market negativity.

Note that the currency made a strong rebound after a false break on the RSI.

I expect this currency to achieve a historic high once the currency season begins.

This analysis fails to break the historic low and trade below it.

I wish everyone abundant profits.

Like and follow

for more.

OPUSDT Maintains Bearish MomentumOPUSDT continues its decline following the breakdown from a massive rising wedge. After a clean corrective pullback, price formed a bearish continuation structure, which has now broken into a descending channel guiding the current move.

The chart suggests further downside toward the projected drop target, which aligns with a potential re-accumulation zone for long-term positioning.

Keep an eye on price behavior as it approaches this level for possible reversal signals.

OPUSDT Forming Descending ChannelOPUSDT is showing an impressive technical setup that has caught the attention of many crypto traders recently. The chart reflects a well-formed descending channel, which is a classic bullish reversal pattern when broken to the upside. Currently, the price action is testing the upper boundary of this channel with increasing buying pressure, signaling that a potential breakout could be on the horizon. A successful breakout here, supported by good volume, could trigger a strong rally in the coming sessions.

The volume profile for OPUSDT is encouraging, as it suggests that more investors are accumulating positions in anticipation of this move. This aligns with the optimistic sentiment in the broader crypto market, where traders are actively seeking altcoins with high potential upside. With an expected gain of around 80% to 90%+, OPUSDT offers an attractive risk-to-reward ratio, especially for those who prefer swing trades and short-term position trades in trending altcoins.

One key factor to watch is whether OPUSDT can sustain momentum above the descending channel’s resistance line. If volume remains strong and the breakout confirms on higher timeframes like the daily or weekly chart, this could attract further interest from both retail and institutional traders. Such a move often sparks a chain reaction of buying, as traders look to ride the trend to its projected target zone.

Overall, the combination of a textbook pattern, healthy volume, and increasing investor interest makes OPUSDT one to watch closely. Keep it on your radar for a possible breakout play with significant upside potential. As always, manage your risk properly and wait for a confirmed breakout before entering any position.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

OP/USDT Weekly Reversal Zone: Strong Bounce ExpectedThe OP/USDT pair is currently showing strong signs of a potential trend reversal from a major long-term demand zone.

📊 Timeframe: 1W (Weekly)

🟨 Key Support Zone: 0.396 – 0.542 USDT

The price has revisited a historically strong support area that previously served as an accumulation zone since mid-2022. The recent bounce from this level reinforces the likelihood of a bullish reversal.

📈 Upside Targets (Resistance Levels):

1. Minor Resistances:

0.699

0.844

2. Mid-Term Target:

1.190 (key breakout confirmation level)

3. Long-Term Bullish Targets:

2.168

2.400

2.700

2.991

3.725

4.020

4.538

4.865 (Previous major high)

🛡️ Critical Demand Zone:

As long as price holds above the 0.396–0.542 range, bullish structure remains intact. A breakdown below this range could invalidate the setup.

🔄 Outlook:

The chart pattern suggests the formation of a higher low and a potential breakout in stages, supported by volume and positive sentiment. Watch the 0.699 and 0.844 levels for initial confirmation of buyer strength.

📌 Note:

This setup offers an attractive risk-reward ratio for mid to long-term traders watching for a trend reversal.

OP Roadmap (3D)The OP token has entered a bearish phase after completing a triangle pattern. We are currently in this bearish phase.

Such large bearish phases typically require a sweep of liquidity from key levels before ending. It appears that OP, after sweeping the liquidity below support levels, may reverse and enter a bullish phase.

The targets have been marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

OP TARGETS FOR Q2 2025🔥 NASDAQ:OP long setup (1D) 🚀

✅ Entry Zone: $0.46 – $0.506 (descending-channel base)

🎯 Targets

• TP-1: $1.55 (Nov-23 supply flip)

• TP-2: $1.80 (201-day breakdown block)

⛔ Stop-Loss

Daily close < $0.42

📊 Thesis

• Superchain mainnet ties OP, Base, Mode & Fraxtal together Q4-25

• Bedrock upgrade already cut L2 gas ~40 % & sped deposits 9×

• Worldcoin + 30 M wallets moved to OP Mainnet

• Retro Funding 5 injects $100 M into OP-Stack builders

• Emission schedule halves in Aug-25; float tightens each month after

• Sequencer-revenue share & Superchain fees stream back to stakers

• Mode, Fraxtal & dozens of L3s funnel new users into the OP economy

OP / USDT 4hr PUMP INCOMING? OP/USDT – 4H Chart Summary

Market Structure:

4H Timeframe:

- Price consolidating within a descending triangle/wedge pattern, indicating potential buildup before a breakout.

- Lower Timeframes (1H and below): Bearish trend structure with lower highs and lows.

- OBV (On-Balance Volume): Forming a wedge—suggesting accumulation or distribution phase nearing a breakout.

Key Zones:

Demand Zone (Support):

- 0.5483 – 0.6351

This area has provided strong support historically. A clean break below could signal continuation of the larger downtrend.

Supply Zone (Resistance):

- 0.9068 – 1.0414

-Historically rejected price; high probability of reversal or consolidation if revisited.

Fair Value Gaps (FVG):

- FVG 1: 0.6659 – 0.6838

- FVG 2: 0.7024 – 0.7308

These inefficiency zones are likely to attract price if bullish momentum builds. Watch for potential short-term rejection or continuation setups here.

Volume Profile:

Strongest volume node (high liquidity zone) sits between 0.7470 – 0.8000

Suggests this area has been heavily traded and may act as magnet/resistance if approached again.

Fibonacci Confluence:

Previous swing high at 0.8232 aligns with the 0.618–0.65 golden pocket

A critical zone for potential take-profit or trend reversal on a breakout.

Scenarios:

Bullish Case:

If price holds above 0.6351 and bounces, look for:

- Retest of FVG 1, followed by FVG 2.

- Breakthrough of 0.7308 could target the golden pocket and swing high at 0.8232.

- Sustained bullish move may reach the supply zone above 0.9068.

Bearish Case:

- Breakdown below 0.6351 and especially below 0.5483 would:

- Invalidate the wedge support.

- Confirm continuation of the macro downtrend.

-Open room for new lows and bearish expansion.

Conclusion:

Price is at a key decision point inside a wedge.

Reaction at 0.6351 is critical—support bounce targets higher inefficiencies; breakdown signals deeper bearish continuation.

OBV and volume structure suggest an imminent volatility spike—prepare for a breakout.

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.544.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.564

First target: 0.581

Second target: 0.602

Third target: 0.626

Everyone saw the drop. I saw the gapPrice nuked — but it didn’t break structure. It filled imbalance, paused, and now it's reloading beneath a stack of untouched FVGs. This isn't capitulation. It's orchestration.

The setup:

We’ve got layered 60-minute FVGs stacked from 0.61 to 0.66. That’s the destination — not the mystery. What matters is the origin. The rejection block around 0.58–0.59 has held clean, and we now have two bullish rejection wicks off that base.

Volume surged during the sweep — and fell on the retrace. That’s not distribution. That’s Smart Money filling.

Two entries — one outcome:

Entry 1: Tap into the red demand zone, wick the 0.58–0.579 region

Entry 2: Break and retest above minor FVG (0.60 reclaim confirmation)

Either way, the draw is the inefficiency stack above.

Execution Map:

Long from 0.579–0.583

SL: Below the base at 0.574

TP1: 0.615 (lower FVG)

TP2: 0.645 (full sweep)

Final: 0.660 liquidity run

Don’t fear the compression. That’s where the trap is set.

Final thought:

“Most traders fear price going sideways. I see it as silence before the algorithm speaks.”

OP BullishA potential long entry could be around the current price range of 0.5864 to 0.5814 USDT, as the price seems to be bouncing off a recent support level near 0.5585. Before entering, it's important to confirm the move with a bullish candlestick pattern like a hammer or engulfing candle, check for a bullish MACD crossover, and ensure the RSI is trending upward but not yet overbought. For risk management, a stop-loss can be placed just below the recent support at around 0.5585 USDT, while the take-profit target could be set near a previous resistance zone, around 0.6276 to 0.6600 USDT, aiming for a favorable risk-reward ratio

$OP Building a Strong Base! Breakout Loading?NASDAQ:OP is showing a strong base here around the $0.59–$0.62 zone, holding support perfectly!

A clear breakout above this falling trendline could open the door for a big move → $0.82, $1.08, and even higher toward $1.38+ if momentum builds. 🚀

Structure looks solid, bulls are stepping in again.

Now just need to watch for breakout confirmation.

Stay ready, the next big move may be coming! 👀

DYOR, NFA

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.600, acting as strong support from which the price can rebound.

Entry price: 0.616

First target: 0.630

Second target: 0.641

Third target: 0.658