NK2251! trade ideas

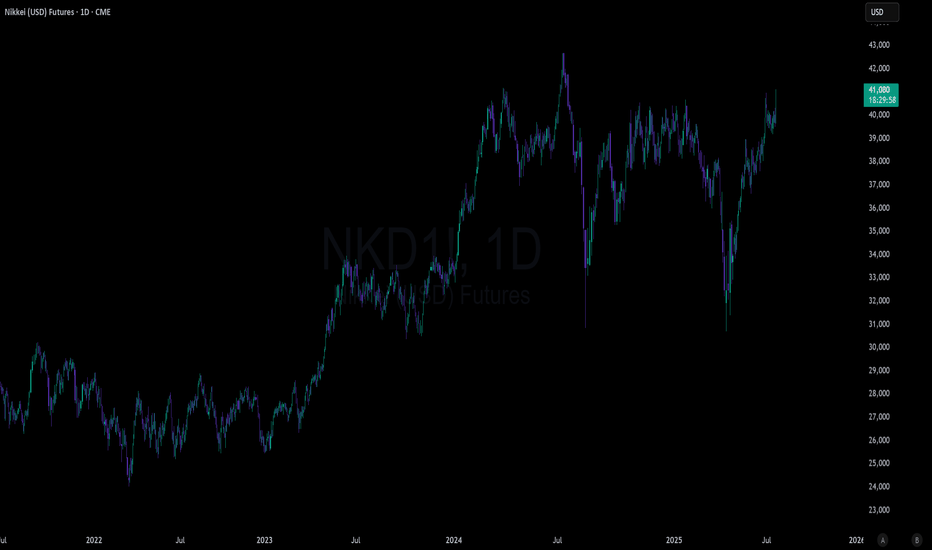

Japanese Yield Surged to Record High 3.2% - Nikkei OutlookAre Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major exporters (like Toyota, Sony, and Panasonic), as their overseas earnings convert into higher yen profits.

But what’s the downside? - Inflation

Yes, they wanted inflation, below 2% yoy will be ideal, but not at this rate of growth at 3.5%.

Another key reason for the stock rally starting in 2020 was that, just like the U.S., the Bank of Japan (BOJ) unleashed massive monetary stimulus, flooding markets with liquidity during the pandemic.

Although the yen has fallen sharply, it seems to have stalled since 2024, that was when the BOJ started raising interest rates from –0.1% to the current +0.5%.

With inflation continuing to rise, the BOJ will likely maintain a hawkish stance on interest rates.

This could cause the yen to strengthen or push USD/JPY lower.

I am also observing a potential head and shoulders formation on the USD/JPY. And if the yen strengthens, this may cause the Japanese stocks to meet its road block.

Nikkei 225 performance since the post WWII to its roaring 80s, to its collapsed, and now rebounded.

Even though prices have breached the 80s level in 2023, it could represent a false breakout, as prices continue to fall back below that historic resistance the last 2 years.

My assessment: The Japanese stocks are still testing their 80s high — a major psychological level.

With money printing, the yen weakened; and a weaker currency fueled inflation.

With inflation, yields and interest rates rise, borrowing costs are increasing across the different tenures — and that’s not good news for stocks.

The 30-year yield is now at around 3% — a level surpassing the deflationary years and that’s something most Japanese would not have imagined just a few years ago.

With a raising interest rate and a stronger yen, let’s see how this will impact the Nikkei 225.

Since the BOJ began raising interest rates at the beginning of 2024, the market has literally stalled within a wide 10,000-point range.

And there is a key support level at 30,000, we can see it was a resistance in the past.

Currently, the BOJ is trying their best in managing the yen and inflation very carefully, to maintain financial system stability. Based on this sentiment, I believe the market will likely continue moving within this wide range — though it may gradually narrow over time.

Make sure to keep monitoring the direction of the Japanese yen, yields, and inflation.

If the yen strengthens too quickly, or if yields and inflation rise too sharply, it could push the market to break below this range and start trending downward.

And if it is all well, market will likely to continue its upward momentum.

Another key factor I am watching closely is tariffs.

The direction of the Japanese stock markets will also be influence by the tariff agreements ultimately with US, and as well as how quickly they can forge potential trading partnerships and alliances — just like other nations, they are racing against time.

Micro Nikkei Futures

Ticker: MNI

Minimum fluctuation:

5.00 index points = ¥250

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

Japanese Markets: Still a Buy?Are Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major exporters, as their overseas earnings convert into higher yen profits.

But what’s the downside? Inflation. (expand)

Yes, they wanted inflation, below 2% yoy will be ideal, but not at this rate of growth at 3.5%.

Micro Nikkei Futures

Ticker: MNI

Minimum fluctuation:

5.00 index points = ¥250

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

Nikkei 225 Wave Analysis – 21 May 2025

- Nikkei 225 reversed from the resistance level 38280.00

- Likely to fall to support level 36000.00

Nikkei 225 index recently reversed down from the pivotal resistance level 38280.00 (former top of wave 4 from the start of this year).

The downward reversal from the resistance level 66.00 created the daily Japanese candlesticks reversal pattern, Shooting Star.

Given the strength of the resistance level 38280.00, Nikkei 225 index can be expected to fall to the next support level 36000.00.

Nikkei Futures (NKD/Nikkei 225) Inverse Cup and HandleNikkei futures have setup an inverse cup and handle on the daily. A somewhat rare pattern as most of them turn into double bottoms or sideways consolidation. Maximum downside target for the pattern is 21,000

- Global macro trends continue to worsen

- BOJ stuck between saving the Yen and helping the dollar

- Japan economic fundamentals may allow BOJ to allow inflation to run hot

- Possible US recession could spread around the world

- Yen carry trade still in play although most likely only blows up in catastrophic situation

- Japan has seen the benefit of US monetary and fiscal policy, Trump admin likely to try to pressure Japan into spending money on US goods such as food and weapons

Overall sentiment on NKD is that it has followed US markets especially the Nasdaq for some time. DXY moving up takes pressure off the Yen carry but could be a sign of now US firms taking profit on a very large run up in the past few weeks. Regardless of outcome, volatility is expected.

Nikkei 225 Bounce Zone Holds AgainTraders should pay close attention to Nikkei 225 futures if the price returns towards 30,400. We’ve now seen decent bounces from around that level five times, including earlier today upon the resumption of trade after the weekend.

While momentum signals are firmly bearish, with RSI (14) and MACD both trending lower, the former now sits at its most oversold level since the pandemic plunge in early 2020. That means the market may be vulnerable to even a minor shift in the prevailing bearish sentiment. For now, the preference remains to sell rallies over buying dips.

A clean break of 30,400 would open the door for a run towards 28,400 or 25,600 — the latter a key technical level given how often it thwarted bearish moves in 2022. On the topside, resistance may be encountered around 33,300, marking where the price rout stalled last Friday. A break of that would put 35,120 on the radar.

Good luck!

DS

The Nikkei (NKD) poised to continue its broader corrective trendThe Nikkei (NKD) has been trending lower since its peak on July 8, 2024. We indicate this decline follows a “double three” Elliott Wave pattern, characterized by a series of distinct movements. After reaching that high, the index fell to 30,720, rebounded to 40,675, and is now progressing downward in a zigzag formation as the internal within “wave y.” The index dropped to 36,275, rose to 38,029 with intermediate fluctuations, and has since resumed its downward trajectory.

This ongoing move lower has already reached 33,525, followed by a recovery to 34,975. We anticipate the index will extend further downward to complete this phase. Afterwards, a temporary rally is expected to provide a correction before the next decline resumes. We anticipate the index will extend further downward to complete this phase. Afterwards, a temporary rally is expected to provide a correction before the next decline resumes.

In the near term, as long as the high of 38,029 remains intact, any upward movements are likely to be limited, setting the stage for additional downside. Investors should monitor these developments closely as the Nikkei continues to navigate this pattern

Ascending Triangle in Nikkei/Yen Futures: A 2025 Bullish Setup?1. Introduction

The Nikkei/Yen Futures, a crucial instrument for traders aiming to capture movements in Japan’s equity index and its currency dynamics, presents an intriguing setup as we step into 2025. An ascending triangle pattern, a classic bullish formation, is emerging on the chart, signaling a potential breakout to the upside.

Adding to the technical allure is the depletion of sell unfilled orders (UFOs) within a significant price zone between 40,420 and 39,685. This critical area, revisited six times since late July 2024, has seen a steady reduction of unfilled sell orders, opening the possibility for bullish momentum to dominate. With the price currently hovering near the 39,685 level, the stage appears set for a breakout opportunity.

2. The Technical Setup

The ascending triangle, characterized by a series of higher lows converging toward a horizontal resistance level, often signifies bullish pressure. In the case of the Nikkei/Yen Futures, the horizontal resistance resides near 39,685, the lower boundary of a key sell UFO zone.

This resistance has been tested repeatedly since July 2024, with each revisit chipping away at the sell orders within the zone. Such behavior suggests diminishing selling pressure, setting the foundation for a breakout. The anticipated target for this breakout, calculated using Fibonacci projection, is set at 41,380—aligning with historical price action and technical projections.

Key Contract Specifications:

o Regular Nikkei/Yen Futures (NIY1!)

Contract Size: ¥500 x Nikkei 225 index

Tick Size: ¥5

Point Value: ¥2,500

Margin Requirement: Approx. $ 1,500,000 JPY

o Micro Nikkei/Yen Futures (MNI)

Contract Size: ¥50 x Nikkei 225 index

Tick Size: ¥5

Point Value: ¥250

Margin Requirement: Approx. $ 150,000 JPY

These details ensure accessibility for both institutional and retail traders, with the micro contract enabling smaller capital commitments while maintaining exposure to the same underlying asset.

3. Forward-Looking Trade Plan

The technical evidence supports a bullish trade plan for Nikkei/Yen Futures:

Trade Direction: Long

Entry Price: Above 39,685, confirming a breakout from the resistance level.

Target Price: 41,380, based on Fibonacci projections.

Stop Loss: 39,120, targeting a 3:1 reward-to-risk ratio to manage risk effectively.

Reward-to-Risk Ratio: 3:1 (Calculated: 41,380 - 39,685 = 1,695 reward; 39,685 - 39,120 = 565 risk).

The trade parameters apply to both the standard and micro contracts, offering flexibility in position sizing. Traders with smaller accounts may opt for the micro contract to manage margin requirements while engaging in this high-potential setup.

4. Importance of Risk Management

Risk management remains the cornerstone of any successful trading strategy, particularly when trading leveraged instruments like futures. Here are key considerations for managing risk in the Nikkei/Yen Futures trade setup:

Stop-Loss Orders: Placing a stop-loss at 39,120 ensures a predefined risk level, protecting traders from unexpected market reversals. It’s vital to adhere to this level to maintain discipline and avoid emotional decision-making.

Position Sizing: The availability of micro contracts (MNIY1!) allows traders to tailor their position size according to their account size and risk tolerance. For example, trading one micro contract involves a significantly smaller margin commitment compared to the regular contract, making it suitable for retail traders.

Defined Risk Exposure: Leveraged products like futures can lead to substantial losses if risk is not clearly defined. Using stop-loss orders and trading within calculated risk parameters prevents the potential for undefined losses.

Precise Entries and Exits: Setting the entry above 39,685 ensures a systematic approach to triggering the trade based on the expected breakout. Similarly, targeting 41,380 using Fibonacci projections ensures that profit objectives align with technical analysis rather than arbitrary levels.

By prioritizing these aspects, traders can mitigate risks while maximizing the potential reward from this bullish setup.

5. Closing Remarks

The Nikkei/Yen Futures seem to be poised for a potential breakout as we enter 2025, driven by a combination of technical factors and diminishing sell-side unfilled orders. The ascending triangle formation strengthens the bullish bias, with the calculated Fibonacci projection of 41,380 offering an attractive target.

Both the standard and micro contracts cater to different trader profiles, allowing participation regardless of account size. As the price approaches the critical 39,685 level, traders are encouraged to stay vigilant, using real-time CME data to track developments and validate entry triggers.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Japan Stocks: A Bullish Outlook Overlooked by ManyCheck out XETR:DBXJ - draw the same lines you see here. The outlook is clear: once the market breaks out of the rectangle upwards, it's a bullish entry signal. But that's not the whole story! If CME:NKD1! climbs higher, we're looking at all-time highs, surpassing 1989 levels. After that? The sky's the limit!

Japanese Equities Rebound Post Election ShocksJapan’s October 28 elections delivered a surprise to the market with the ruling Liberal Democratic Party (LDP)’s loss of the majority in the parliament. Prime Minister Shigeru Ishiba now faces the challenge of securing a majority in the 465-member Diet, Japan’s national legislature, in the coming weeks.

This political uncertainty has impacted the outlook for Japanese equities. Typically, such instability would weaken the equity market; however, a combination of a depreciating Yen and a "buy the news" rebound after two weeks of decline has led to a market recovery, with the Nikkei-225 rising 3.7% since the election results were announced.

This environment presents tactical opportunities for savvy investors, such as leveraging spreads between the concentrated large-cap stocks in the Nikkei-225 and the broader Japanese equity market through the AMEX:DFJ ETF.

Political Uncertainty a Concern for the Nikkei-225

Japan's October 28 election resulted in no party securing a majority, with the LDP and Komeito losing 64 seats, leading to a hung parliament. This uncertainty has raised concerns over the Nikkei-225, as the lack of a stable government could hinder decisive economic policy.

Historically, political instability tends to undermine investor confidence in Japanese equities, and analysts are now concerned about the ability of a weakened government to implement coherent economic policy.

Following the result, the Yen dropped to a three-month low of 153.88 per dollar, reflecting investor nervousness.

The Nikkei-225 rallied 3.7%, driven by a weaker Yen benefiting exporters like Toyota and Nissan. Analysts expect continued market volatility until a stable coalition is formed, with specific concerns around delayed fiscal measures and economic reforms that could weigh on investor confidence.

PM Ishiba’s Hawkish Tone Likely to be Tempered Even in Case of Victory

Shigeru Ishiba, recently appointed as Prime Minister, has expressed his intention to remain in office, despite facing a challenging re-election campaign after the disappointing outcome of his snap election. Analysts like David Roche from Quantum Strategy and Masahika Loo from State Street suggest his re-election prospects are slim.

PM Ishiba has historically supported the Bank of Japan's rate hike strategy and voiced concerns over yen depreciation. However, in light of the election results, his party may need to adopt a more populist stance to retain support, embracing dovish monetary policies and increased social spending.

Additionally, PM Ishiba has pledged to introduce a larger stimulus plan in response to the election outcome. This expanded stimulus could conflict with the BoJ’s monetary policy goals, likely prolonging yen weakness.

Weaker Yen Supports Nikkei-225

The weaker yen has been a key driver in Nikkei-225's recent stellar performance. A depreciating yen makes Japanese exports more competitive, directly benefiting major exporters such as Toyota and Nissan, which saw gains of over 4% on 28/Oct (Mon).

Mint Finance previously highlighted the inverse relationship between the Yen and the Nikkei-225.

Recently, however, this correlation has broken, with both the Nikkei-225 and the Yen declining over the past two weeks. Although post-election performance has brought a modest recovery in this relationship, fundamental concerns persist. With the Bank of Japan holding rates steady, the Yen is expected to weaken further. The outlook for the Nikkei-225 is less clear, as it benefits from a weaker Yen yet faces pressures from ongoing political uncertainty.

Key Technical Levels

Nikkei-225 is trading just above its long-term moving averages which have acted as support after being tested multiple times over the past few months. With the Nikkei-225 in a rising channel and above a support level, price may have some upside. However, the R1 pivot level at 40,525 may act as resistance as it previously has.

Nikkei-225 is currently in a price range dominated by buyers over the past month. Overall volume activity shows buyers have remained dominant according to the accumulation/distribution indicator. In case Nikkei-225 breaks out from this range, it is likely to see increased selling. This could lead to a period of consolidation at present levels, especially given the political uncertainty.

Hypothetical Trade Setup

Tailwinds from the weakening Yen intertwine with headwinds from the political uncertainty for Nikkei-225. Until clarity on economic outlook arises, the Nikkei-225 is likely to remain volatile. Due to the recent diverging performance, the effectiveness of a Yen hedge on the Nikkei-225 has decreased. While the Yen may continue to weaken, it is not likely to have a proportional impact on strengthening the Nikkei-225.

However, a weakening Yen also favours large cap stocks that comprise the Nikkei-225 relative to smaller companies such as those comprising the WisdomTree Japan Smallcap Fund ETF (DFJ), which provides broad exposure to Japan equities. DFJ is geared towards small cap firms and excludes the 300 largest companies by market cap. It also caps the maximum weightage of any single sector to 25% ensuring that the index is not impacted by any single sector.

By comparison, the Nikkei-225 index is a price weighted index which tilts its exposure towards expensive stocks, especially those from large companies. It also provides exposure to the technology sector in Japan which has outperformed recently due to the burgeoning chip industry. Mint Finance covered the breakdown of the index in a previous paper .

The spread between the Nikkei-225 and DFJ ETF has continued to rise over the past two years alongside the Japanese equity rally, though there have been periods of consolidation in between which small caps have managed to to catch up. The peaks in the ratio have been at times when the Nikkei-225 reached a new all-time-high while periods of consolidation following the peak have favoured the small cap equities.

This view benefits investors in case the Nikkei-225 retests its all-time-high in the near future. It also benefits from the fundamental drivers that favour the firms comprising the Nikkei-225 compared to the ETF.

Investors can express a view by buiding a long position in Nikkei-225 using CME Group futures and a short position in DFJ ETF. Nikkei-225 Futures on CME are available in a dollar denominated form, which negates currency impact from the weakening Yen.

For example, a long position in CME Group Nikkei-225 futures provides exposure to a notional value of USD 197,900 (USD 5 x 39,580 index price as of 30/Oct). This would require an extremely large position on the ETF leg to balance out the notional. Alternatively, investors can utilize the newly launched Micro Nikkei (USD) futures which are 1/10th the size of the standard Nikkei 225 futures contract with a notional value of USD 19,790 (USD 0.5 x 39,580).

Micro Nikkei (USD) futures are geared towards smaller notional sizes which allows for granular hedging and spreads as well as enhanced capital efficiency.

Since their launch on October 28, the contracts have experienced rapid growth and adoption. Over the past two days, 1,370 Micro Nikkei (USD) contracts and 4,141 Micro Nikkei (JPY) contracts have been traded. The contracts also shows a tight bid-ask spread and a liquid market, supporting capital-efficient trading.

The following hypothetical trade setup consists of long 1 x Micro Nikkei (USD) futures expiring in December and short 265 shares of WisdomTree Japan SmallCap Fund with a reward to risk ratio of 1.33x.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

NKD: Japan Beyond Carry TradeCME: Nikkei 225 USD Futures ( CME:NKD1! )

Tokyo: The Ministry of Internal Affairs reported last Friday that the Consumer Price Index (CPI) in Japan increased 2.5% in September year-on-year, down from 3.0% in August. The CPI excluding fresh food rose 2.4%, down from 2.8%, during the same period.

The core inflation measure, which excludes both fresh food and energy costs, rose slightly to 2.1% in September from 2.0% in August. Service prices, considered a crucial indicator by the Bank of Japan (BOJ), gained 1.3% year-on-year, slowing from 1.4% in August.

To counter the recent economic slowdown, the Japanese Government rolled out subsidies on electricity and gas prices. These fiscal measures were a major contributor to the cooling inflation, estimated to have shaved 0.55% off the annual inflation rate.

The BOJ is widely anticipated to maintain its interest rate at 0.25% during its upcoming policy meeting on October 31st.

Despite the dip in inflation, BOJ has signaled that further rate hikes may still be on the table if inflation continues to align with its projections. However, policymakers are cautious following criticism of their July rate hike, which triggered a market downturn.

As the US Federal Reserve will have its rate-setting FOMC meeting on November 7th, the all-important interest rate spread between the US and Japan could continue to narrow:

• With the Fed Funds at 4.75%-5.00% and the Japanese Interest Rate at 0.25%, the US-Japan interest rate spread is currently at 450 basis points (our calculation takes the lower bound from the US policy rate range)

• According to CME Group FedWatch Tool, as of October 20th, the futures market expects a 99.3% chance that the Fed will cut 25 basis points in November. If that happens and the BOJ maintains its current rate, the spread will narrow to 425 bps

• If the Fed pushes for a supersized 50bp cut again, same as they did in the last meeting, the interest rate spread could further shrink to 400 bps

• Over the course of the next 2-3 years, I expect the Fed to normalize interest rates to 3% or below, to a level not restrictive to economic activity. Meanwhile, the BOJ could maintain the 0.25% rate throughout this period. If that is the case, the US-Japan rate differential could further move towards the 200-250bp range, in my opinion

Carry Trade May be a thing of the Past

Two years ago, I published a market commentary, “Land of Rising Sun and Falling Yen” on November 7, 2022, and received TradingView Editors’ Picks.

In that writing, I discussed Carry Trade, a wildly popular FX strategy. In a nutshell, a trader would borrow Japanese Yen with ultra-low interest rate, exchange the fund into Australian Dollar or US Dollar and earn a higher return. At the end of the investment horizon, the trade would exchange the proceed back to Yen and pay back the loan. The differential between the investing interest rate and loan rate would be the return from this strategy. With 50x to 100x leverage common in FX trade, carry trade could be hugely profitable.

Carry trade carries two significant risks. The first is the appreciating yen. The trader may need more dollars to exchange back to yen and pay back the loan. The loss from exchange rate changes could eat up all the interest earning profit.

In the last writing, I commented that Yen at 150 may have bottomed out, and explored the idea to take cover for carry trade. Over the following two months, the Yen sharply rose 15% to 127. A trade that earned 3% in interest would have been wiped out completely and may incur huge losses if executed with high leverage.

In the present time, we are observing the second risk, a shrinking interest rate spread. Carry trades may have 400-bp interest spread in 2023 and could see the spread narrowing to 200 bps in the next two years.

With central banks around the world cutting interest rates, and volatility of exchange rates on the rise, this is probably not a good time for carry trade.

The Japanese Stock Market on Focus

While the currency play may be out, the Japanese stock market could offer both a good return and diversification for an investor’s portfolio.

The Nikkei 225 index is the main stock market index for Japan. At 39,290, its year-to-date return is 17.9% as of last Friday. It is lower than the 22.7% YTD return for S&P 500. However, Nikkei was initially up 27.6% in July. When the BOJ raised rates, the Japanese stock market entered a huge correction, wiping out all the gain. Since then, the Nikkei popped up about 17% in the past six weeks.

Japan is the world’s third largest economy with GDP of $4.2 trillion in 2023. Comparing to the other large nations, Japan is more intertwined with the rest of the world. We would explore two trading strategies based on Japan’s unique economic fundamentals.

The first aspect: Japan has an export-oriented economy. Its top 3 trading partners are

• China: exports were $153 billion in 2021, accounting for 21% of the total ($728 billion)

• United States: $137 billion, 19% of the total

• The European Union: $97 billion, a 13% share

These top 3 partners contribute to 53% of Japan’s exports of goods and services. In essence, economic growth in its trading partners will result in more demand for “Made-in-Japan”, while economic slowdown could spill over to Japan.

In my opinion, there is more tail wind than head wind on the way. The US is already in a rate-cutting cycle. Its economy has been resilient during the high-rate environment. The economic health would continue to improve with lower cost of capital.

I would also point out that Japan’s export data did not tell the whole story. Most Japanese cars are now made in the US. The data does not show up on Japan’s GDP, but is included in the profit of Toyota, Honda and Nissan. Many of the Japanese car makers are component companies in the Nikkei 225 index.

China is implementing massive economic stimulus. Hundreds of business-supportive new rules and trillions of yuan are putting in the economy. I expect China to revive in Q4 and in 2025, which would lead to higher demand for Japanese goods.

To summarize, I consider the Nikkei 225 has room to grow. A long position in CME Group’s Nikkei 225 Futures could be deployed to express this view.

The second aspect: Japan is a net importer of natural resources

• Japan, ranked fifth-highest consumer of oil in the world, relied on imports to meet 97% of its demand in 2022. Japan imports crude oil primarily from Saudi Arabia, United Arab Emirates, Kuwait, Qatar, and Russia. In 2022, Japan’s crude oil imports increased to 2.5 million barrels per day, up from 2.3 million b/d in 2021.

Not only does Japan depend on foreign oil, but it also sources crude oil from regions with heightened geopolitical tensions. If the conflicts in the Middle East escalate further, crude oil production and/or shipping routes could be interrupted.

The chart below shows an inverted relationship between Nikkei 225 and WTI crude oil price trends. This suggests that a spread trade could be constructed. For most of 2024, Nikkei moved up as crude oil trended down, except for the BOJ rate hike disrupting the trend. If geopolitical crisis escalated, oil prices could soar while the Nikkei would tank. For someone holding this view, a long position on WTI Crude Oil futures ( NYSE:CL ) and a short position on CME Nikkei futures ($NKD) could be deployed to express such a view.

Introducing CME Micro Nikkei USD Futures

On October 28th, CME Group will be launching a USD-denominated and Yen-denominated Micro Nikkei futures. The new contract has a notional value of $0.50 times the Nikkei index. At Friday closing price of 39,150, each contract would be worth $19,575.

The Micro contract is 1/10th the size of the standard Nikkei futures ($NKD). It will provide a new way to access broad-market Japanese index exposure with greater trading precision and lower capital commitment required.

The timing of the new contract launch is critical. It is a week before the US presidential election (November 5th) and ten days before the next FOMC meeting (November 7th). Let’s watch this space to explore the trading opportunities presented by the standard Nikkei futures and Micro Nikkei futures.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Breakout Watch: Trading Nikkei Futures Ahead of Its Micro Launch1. Introduction: Nikkei Futures and Current Market Setup

Nikkei Futures (NIY1!) remain a cornerstone of Japan's equity market exposure for traders globally, offering insights and trading opportunities tied to the performance of Japan’s stock market. In recent days, the Nikkei Futures market has entered a phase of tight consolidation, with the trading range narrowing between 39515 and 38785. This setup presents a classic breakout opportunity, with price poised to either break above the upper boundary or fall below the bottom one. Traders should remain vigilant, as a breakout could lead to a market movement in either direction.

2. Contract Specifications: Nikkei Futures vs. Micro Nikkei Futures

Nikkei Futures (NIY1!) are a valuable tool for traders seeking exposure to Japan’s economy. The contract size is tied to the Nikkei 225 index, with each tick movement having substantial financial implications for the trader. Here’s a breakdown of the key specifications:

o Nikkei Futures (NIY1!):

Tick Size: 5 points.

Tick Value: 2,500 JPY per tick.

Margin: 1,500,000 JPY (varies as market conditions change)

Starting October 28, 2024, CME Group will introduce Micro Nikkei Futures, which will provide a more accessible option for retail traders by offering a smaller contract size and lower margin requirements. The Micro Nikkei contracts will allow traders to take advantage of the same market exposure with greater flexibility and reduced capital risk:

o Micro Nikkei Futures:

Tick Size: 5 points.

Tick Value: 250 JPY per tick.

Margin: 150,000 JPY (varies as market conditions change)

This introduction opens up new opportunities for traders looking to manage risk more effectively or for those who prefer to trade with smaller position sizes.

3. Breakout Trade Setup for Nikkei Futures

Currently, Nikkei Futures are stuck in a range-bound market, oscillating between 39515 and 38785. A potential breakout beyond these levels is potentially imminent, and traders can prepare to capture the momentum once it occurs.

The key to this setup is patience: wait for the price to either break above or fall below before entering any trades. Here’s the breakout strategy we’ll be focusing on:

Breakout to the Upside: Enter a buy trade if price breaks above 39515.

Breakout to the Downside: Enter a sell trade if price falls below 38785.

By leveraging this breakout strategy, traders can capture the volatility that usually follows a breakout from a tightly held range.

4. Breakout to the Upside: Trade Idea

In the event of an upside breakout, we anticipate that the price will rally after breaking through the 39515 level. Here’s the breakdown for this trade setup:

Entry: Buy at 39515, the upper boundary of the current range.

Target: The target is set at 40285, where there is a significant UFO resistance and a technical resistance level. This level marks a strong area where sellers may come in, making it a logical point to exit the trade and secure profits.

Stop Loss: To manage risk, place the stop loss a third of the profit zone below the entry price. In this case, the stop would be at 39258, minimizing downside exposure while allowing the trade to develop.

o Risk/Reward Calculation:

Profit zone: 40285 - 39515 = 770 points.

Risk (1/3 of the profit zone): 770 / 3 = 257 points.

Stop loss: 39515 - 257 = 39258.

For standard Nikkei Futures, each point is worth 500 JPY, so:

Potential profit: 770 points × 500 JPY = 385,000 JPY (approx. USD 2,580).

Risk: 257 points × 500 JPY = 128,500 JPY (approx. USD 860).

For the Micro Nikkei Futures, everything would be reduced x10 (approx. USD 258 and USD 86).

5. Breakout to the Downside: Trade Idea

In the case of a downside breakout, we expect a decline once the 38785 level is breached. Here’s how the trade setup would work:

Entry: Sell at 38785, the lower boundary of the current range.

Target: Set the target at 37920, a level supported by a UFO support, a technical support, and two nested Fibonacci retracement levels (23.6% and 61.8%).

Stop Loss: The stop loss is set at a third of the profit zone above the entry price. This protects against excessive losses if the market moves against the trade. The stop would be at 39073.

For standard Nikkei Futures:

Potential profit: 865 points × 500 JPY = 432,500 JPY (approx. USD 2,910).

Risk: 288 points × 500 JPY = 144,000 JPY (approx. USD 970).

For the Micro Nikkei Futures, everything would be reduced x10 (approx. USD 291 and USD 97).

6. Risk Management

Effective risk management is key to long-term success in trading. In both breakout scenarios, the use of stop-loss orders ensures that traders can limit their losses if the market moves against them. Additionally, setting precise entry and exit points reduces the likelihood of emotional decision-making, allowing for more disciplined trading.

The upcoming launch of Micro Nikkei Futures offers traders enhanced control over their position sizing and risk exposure. With smaller contracts, traders can engage in these setups with a fraction of the capital required for standard futures contracts. This flexibility is particularly beneficial for retail traders looking to manage risk effectively while still capitalizing on market opportunities.

Whether you are a seasoned futures trader or new to the Nikkei market, these breakout setups provide a solid foundation for capturing momentum. As always, risk management should remain at the forefront of your strategy, ensuring you protect your capital while pursuing profits.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Japanese Stocks Have Room for More Upside?Do Japanese stocks have room for move upside? It has been one of the best-performing markets since COVID.

And what is the key reason for this rally? A falling Yen.

Where is the Yen heading and do the Japanese stocks have room for more upside?

Nikkei (JPY) Futures

Ticker: NIY

Minimum fluctuation:

5.00 index points = ¥2500

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Hidden Link Between Hedge Funds’ Yen Positions & Nikkei225 TrendBy Eric Lee , Sales Director of Phillip Nova

Tracking the GBP/JPY and Nikkei 225 Relationship for Futures Trading

In my previous analysis of the Nikkei 225, I pointed out its strong correlation with the GBP/JPY currency pair, highlighting it as a key factor for traders to watch when trading Nikkei 225 futures. The Japanese yen’s strength is largely shaped by the monetary policies of the Bank of Japan (BOJ). While these policies can be complex and challenging for everyday investors to grasp, hedge funds, armed with advanced models and PhD-level experts, have a clearer understanding. But what if you could gain insight into the bets hedge funds are making on the Japanese yen? Wouldn’t that be a game changer?

Understanding Hedge Fund Insights on Japanese Yen Through CFTC Reports

Here’s how you can: The Commodity Futures Trading Commission (CFTC), a U.S. regulatory agency overseeing futures markets, mandates that all financial institutions= report their futures positions every Friday. This means hedge funds trading Japanese yen futures on the CME must disclose their positions weekly.

Using Hedge Fund Trends to Anticipate Nikkei 225 and GBP/JPY Movements

Take a look at the COT (Commitment of Traders) chart of CME Japanese yen futures. I’ve highlighted the key trend in purple. This shows the aggregate positions that leveraged funds, or hedge funds, are taking on yen futures. Notice how hedge funds began accumulating yen positions in July, and as of the most recent data, they’re more bullish on the yen than they’ve been in the past three years.

Every Friday, traders should pay attention to the updated COT chart. If hedge funds continue to build long positions in the yen, it’s a strong sign that GBP/JPY may weaken, pushing the Nikkei 225 lower. Conversely, if hedge funds shift toward short positions, GBP/JPY could rise, causing the Nikkei 225 to move higher.

Trade the smallest Nikkei Futures from $400 with Phillip Nova today