BRN Ready To Move?Looking at a simple Daily chart here shows a nice triangle forming from the ATH last year.

An argument could be made that the support is at 48.5 but I'm more comfortable placing it at 51.

Note: The Annual Report is due this week which will inevitably bring more volume either way. But i can't see it dropping below 48.5 due to the fundamentals.

(I'm currently holding from a lower level but might top up this afternoon in the low 50's)

BRCHF trade ideas

BRN time bbyBRN been consolidating for a while now in this triangle. Awaiting announcements regarding deals with customers, we may see a break up here, followed soon after by announcements. Some good announcements will see this one absolutely fly past previous highs very quickly. Please DYOR, very volatile stock this one. None of this is advice.

Short term target $0.78

Medium term $0.91

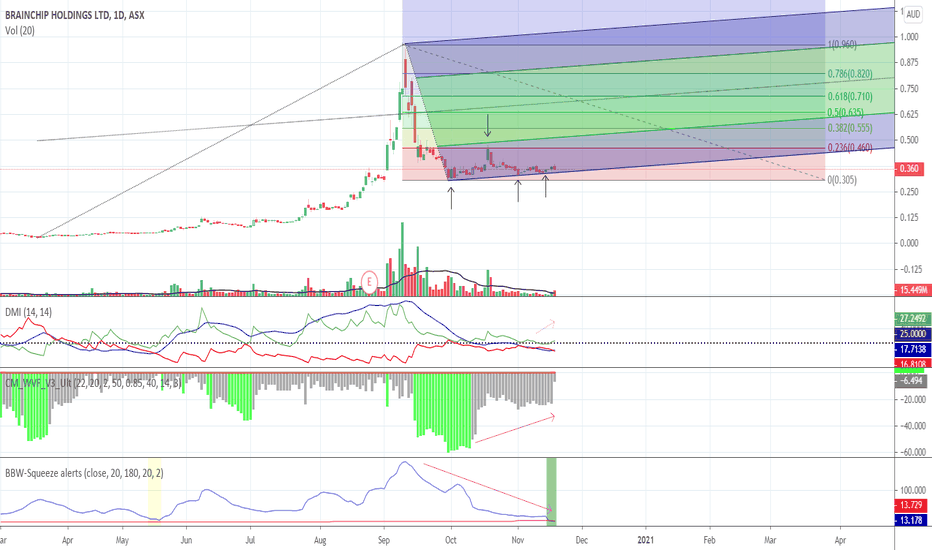

BRN consolidation over?Quick technical analysis of ASX:BRN following its rapid rise and subsequent consolidation over the past two months.

In summary:

Indicators are showing that support has been found at ~$0.31 and the .236 fib retracement level / -0.5 schiff resistance level has been tested.

As per BBW, volatility is decreasing which indicates that a breakout may be on the horizon. The BBW-squeeze also shows a potential alert for an entry point. This is supported by the Vix which hints that we have moved away from market bottoms.

Finally, DMI+ remains above ADX and has been toying with the 25 level. Movement above this level would further strengthen technical indicators for ASX:BRN .

The above indicate that BRN is in a favourable position for opting in. This would be further strengthened by positive news and / or increase in trading volume.

DYOR.

Bullish idea for BRNThe end of the current consolidation cycle into a new bullish move will be determined by an ascending triangle breakout.

RSI is approaching the reversal sweet spot and a reversal here would likely give us the breakout we need above 0.38-0.40.

OBV shows solid growth and CMF has formed a distinct pattern of higher lows and is spending less and less time in the negative zone, pattern suggests we will start seeing positive money flow soon.

50 day MA has just passed the 200 day MA, another great bullish signal.

This stock is very popular and has a decent amount of liquidity. Popular small cap tech stocks can be really great flips.

IMHO

Thanks!

Ascending Triangle into Dynamic Resistanc- Breakout possibility Ascending triangle

Momentum increasing on stochastic , RSI and MACD

MACD showing uptrend

Divergence at beginning of ascending triangle signalling loss of downward trend momentum.

Somewhat of a inverse head and shoulder pattern

Currently no sign of divergence to signal a reversal of immediate uptrend

Will need to breach both the 50 EMA, 200EMA and resistance level to breakout above

BrainChip Holdings (ASX:BRN) - What I see happening from hereLooking at the chart today from BrainChip ( ASX:BRN ) I can see they it has a couple of potential directions from here.

Over the last week or so, the stock has been retreating back from its highs of close to $1.00.

Overall though, I can see 2 possible scenarios.

Scenario A

Holding current levels (which look good considering the 61.8 fib line placement) here could see a price grab back up to above $0.50. Holding there would mean BrainChip is still maintaining an overall uptrend and also holding above the 50 fib line. Breaking through the next level of resistance at $0.64 is critical for recover efforts. A bullish scenario overall with some risk.

Scenario B

Failing to hold here would mean a fall back to previous support and older trend line around $0.34. A note here though that the old trend line has less touches, so holding it is yet to be determined. However, the fact that we have a trend line and a support line means we might see a bounce.

Options

If I was looking to gain entry, I can do so immediately, however I would be prepared for further volatility. A further fall back to $0.34 could mean a need to top up the position with more cash.

I can also choose to wait for one of the following scenarios:

- A clean break up and out of $0.64, signalling a much stronger bullish case.

- A break down and a hold at $0.34, signalling a position of relative safety to begin investment.

Risk Management

I can deploy risk management techniques including limiting the percentage exposure to this stock, applying a stop loss if it falls too far or reserving cash to purchase lower entries and reduce my average, should I want a long term position.

Hope this analysis helps!

Note - this is a record of my thoughts for personal use only. Nothing here should be taken as financial advice. Investors and traders should always do their own research before buying or selling assets.

BRN:ASX - BRAINCHIP - AI / Machine Learning stock running hardBig up day today on news of a collaboration agreement with Vorago Tech (privately listed). It is a stock I have been in and out of a few times over the last month as I didnt want to keep my stops so wide. Caught most of todays move thankfully. I like the sound of what they do. The whole BRN is "a leading provider of ultra-low power high performance AI technology" sounds good to me long term. One to watch perhaps after a more significant pullback.